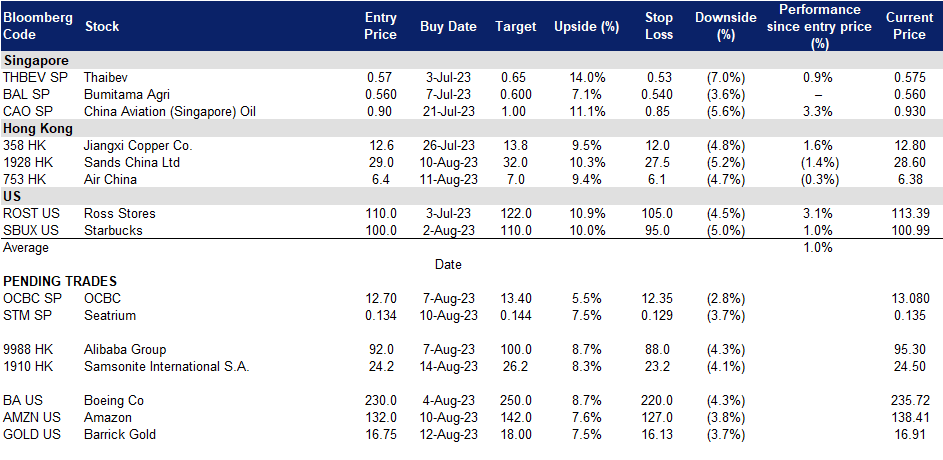

14 August 2023: Seatrium Limited (STM SP), Samsonite International S.A. (1920 HK), Barrick Gold Corporation (GOLD US)

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

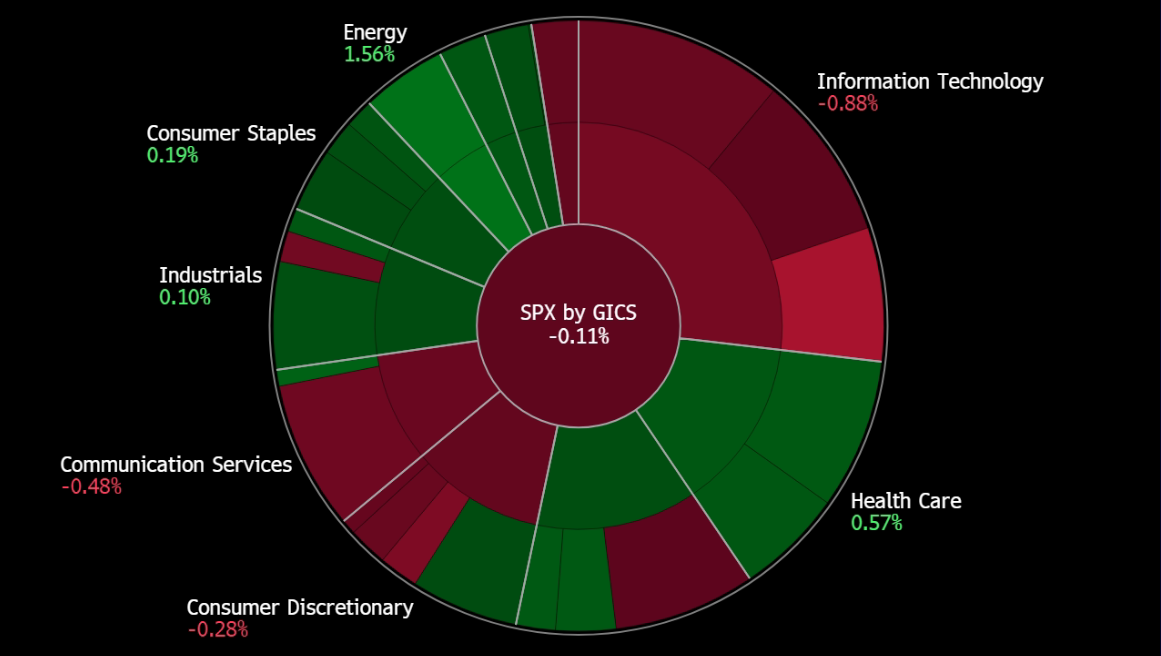

United States

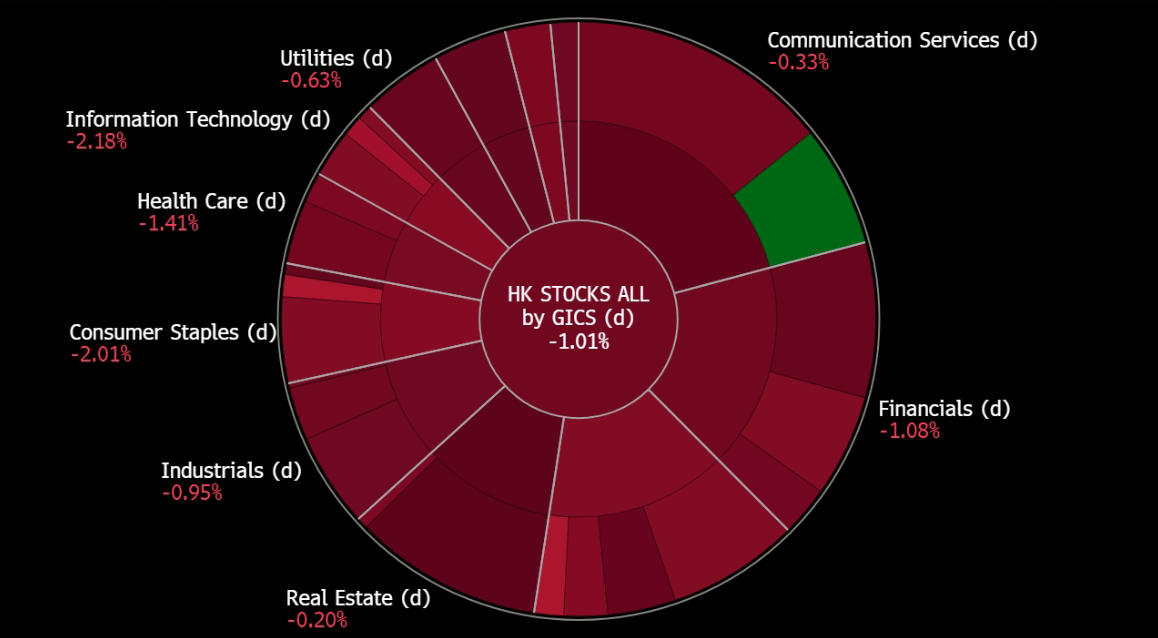

Hong Kong

Seatrium Limited (STM SP): Oil recovers

- RE-ITERATE BUY Entry 0.134 – Target – 0.144 Stop Loss – 0.129

- Seatrium Limited provides offshore and marine engineering solutions. It operates through two segments: Rigs & Floaters, Repairs & Upgrades, Offshore Platforms, and Specialised Shipbuilding; and Ship Chartering.

- Order book remains strong. It secured new contract wins of S$4.3bn ytd with solid orders pipeline. It’s net order book of S$19.7bn with projects lined up to 2030, comprising 40% renewables and cleaner/green solutions. Additionally it showed strong operational performance with track record of projects delivered.

- Share buyback. Seatrium bought back shares for the second time. The company bought back 20mn shares on August 4 for 13.4 SG cents each. This follows its first buyback on June 12, when it bought 1.2mn shares for 12.4 SG cents each.

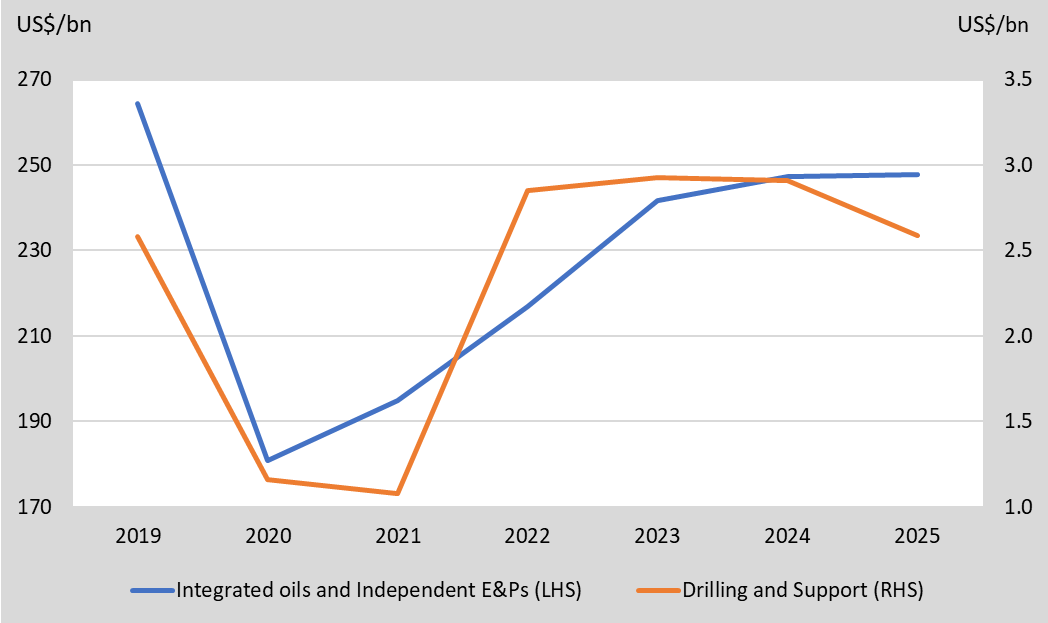

- Offshore market expected to strengthen. Seatrium is expected to benefit from the strengthening offshore market. The industry estimates that offshore oil and gas capital expenditure will continue to grow in 2023 and 2024, supported by data showing that day rates for latest generation drillships are now over $500,000 per day, and the number of active offshore rigs has increased by 8% YoY. The company has a strong order book, access to new markets, and the capacity to accept more projects and is looking to fill its 2028/29 production schedule. Furthermore, the normalisation of economic activity should also result in a greater volume of shipping activities, which will positively impact Seatrium’s repair/upgrade segment. These factors will help to drive Seatrium’s growth and share price in the future.

- Expecting mild growth in the upstream oil and gas capex. Oil prices have been showing signs of resilience despite a weakening economy, contribution by deflation in China. Yet, these concerns are offset by a steep drawdown in U.S. fuel stockpiles and Saudi and Russian output cuts, sending oil prices to a high since January 2023. The oil and gas upstream spending also continues. Oil majors accelerated to explore and develop oil resources outside Russia after the sanction. Hence, there still be mild growth in the upstream capex during 2023/2024.

Global upstream oil and gas capex

(Source: Bloomberg)

(Source: Bloomberg)

- 1H23 results review. Revenue rose 164% YoY to S$2.9bn from S$1.1bn the prior year. Net loss amounted to -S$264mn due to provision for contracts and merger expenses. The Group’s EBITDA of S$27mn in 1H2023 was higher than the negative S$19mn in the same period last year. EBITDA before provision for contracts and merger expenses amounted to a creditable S$258mn.

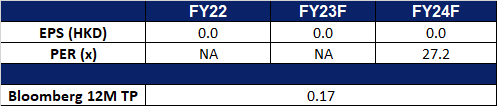

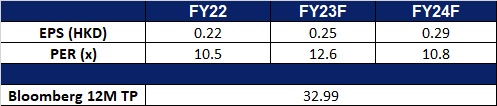

- Market consensus.

(Source: Bloomberg)

Oversea-Chinese Banking Corp Ltd (OCBC SP): Stellar results

- RE-ITERATE BUY Entry 12.90 – Target – 13.50 Stop Loss – 12.6

- Oversea-Chinese Banking Corporation Limited offers a comprehensive range of financial services. The Company’s services include deposit-taking, corporate, enterprise and personal lending, international trade financing, investment banking, private banking, treasury, stockbroking, insurance, credit cards, cash management, asset management and other financial and related services.

- Benefit from rate cut expectations. Even though it is uncertain when rates will start to decline, Singapore banks will continue to thrive in this volatile environment as our local banking system is heavily regulated and conditioned under various stresses by the Monetary Authority of Singapore (MAS). MAS has also expressed its readiness to provide liquidity to maintain financial stability and orderly market functions. The overall market believes that the Feds will start cutting rates in 2024, with interest rates expected to peak at 5.25% to 5.5%. The expected decrease in interest rates could result in borrowers refinancing their loans, which were granted at higher rates.

- Growing wealth segment. Singapore is seeing an influx of wealthy individuals and family offices, which has led to a rise in assets under management at the country’s banks. The Monetary Authority of Singapore estimated there were about 700 family offices in 2021, but the current estimate is around 1,400, with mainland Chinese being the biggest drivers of growth. Although the family offices generate jobs indirectly through external finance, tax, and legal professionals, little of the money is being invested in funds or private equity firms. Despite this, the influx of wealth will still benefit banks in Singapore, particularly with the tax exemption programs for family offices, which have led to higher assets under management at banks in the country. Furthermore, with fear brewing due to the deteriorating US-China ties, the ultra-rich in Taiwan are considering setting up family offices in Singapore to protect their wealth. BDO Tax Advisory has reported an increase in inquiries from the ultra-rich in Taiwan. OCBC’s wealth management income contributed 36.6% to the Group’s total income in 1H23. The group wealth management AUM was S$274bn as of 1H23, driven by continued growth in net new money inflows which offset negative market valuation. As Singapore continues to attract a growing number of wealthy individuals, the country’s banks are expected to receive a boost in assets and deposits.

- Dividend yield. The bank declared an interim dividend of S$0.4, and the ex-dividend date is 14th August. OCBC’s FY23F/24F dividend yield is 6.13%/6.29%.

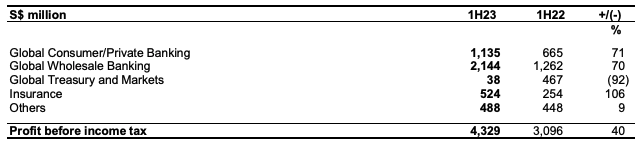

- 1H23 results review. PATMI jumped by 38.5% YoY to S$3.59bn. Net interest income surged by 47.6% YoY to S$4.73bn.

PBT by segment

(Source: Company)

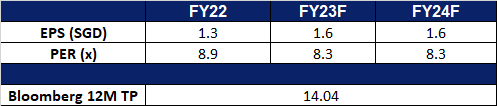

(Source: Company)

- Market consensus.

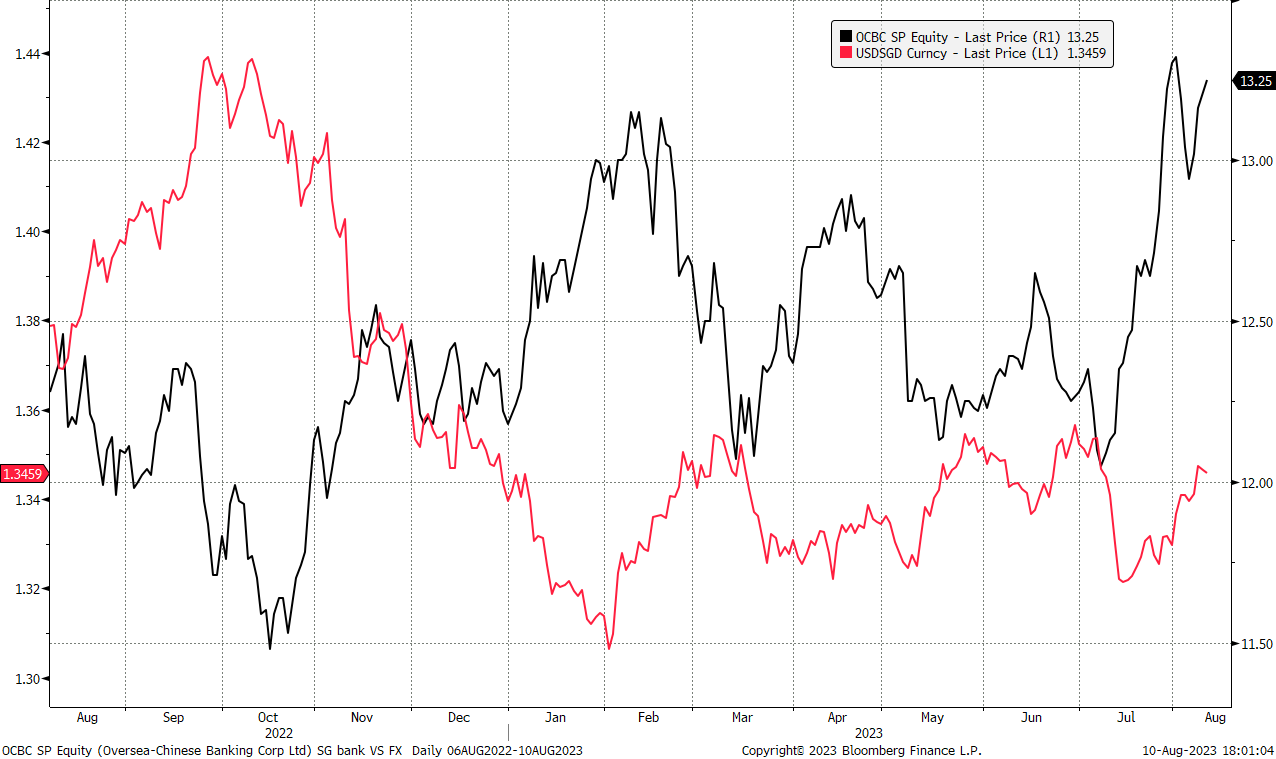

OCBC share price and USD/SGD comparison

(Source: Bloomberg)

(Source: Bloomberg)

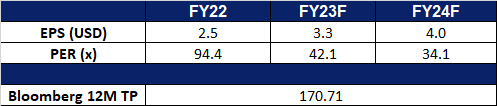

Samsonite International S.A. (1920 HK): Flying with style

- BUY Entry – 24.2 Target – 26.2 Stop Loss – 23.2

- Samsonite International S.A. is a Hong Kong-based company principally engaged in the design, manufacture, sourcing and distribution of luggages, business and computer bags, outdoor and casual bags, travel accessories and slim protective cases for personal electronic devices. The Company operates its business through three segments. The Travel Bag segment is engaged in travel products with suitcases and carry-ons of three main categories, including hard-side, soft-side and hybrid luggages. The Casual Bags segment is engaged in daily use, including different types of backpacks, female and male shoulder bags and wheeled duffel bags. The Business Bags segment is engaged in business use, including rolling mobile office bags, briefcases and computer bags.

- Travel bans lifted. China recently announced that it lifted pandemic-era restrictions on group tours for more countries, including key markets such as the United States, Japan, South Korea and Australia in a potential boon for their tourism industries. This is the third list of countries to receive approvals, coming after 2 lists of around 60 countries. With Korea and Japan being the more popular destinations amongst China tourists, the lifting of travel bans in these markets is likely to drive outbound tourism in China even more than its current level, as a result driving the demand for travel accessories like luggage up as well.

- Quality products with good marketing and collaborations. Samsonite consistently upholds its reputation as a premium brand celebrated for its unparalleled quality and enduring durability. The company has actively engaged in partnerships with third parties to create contemporary luggage designs, captivating a vast audience of interested consumers. Concurrently, the brand remains committed to upholding the high standards of quality in these luggage offerings. Notably, Samsonite has successfully collaborated with renowned entities like New Balance and even integrated elements from the hit BTS soundtrack “Butter,” yielding limited-edition, trend-setting products.

- Plans for expansion. The brand is extending its sales locations in the country using an innovative format already successful in Asia and Europe. This fresh brand concept arrives in Peru, situated within Mall de Salaverry. This year, the company aims to remodel its flagship store at Jockey Plaza, which houses multiple brands. Plans also include launching new stores in Lima and provinces next year, with a target of achieving 25% growth compared to the prior year and 30% growth relative to pre-pandemic 2019.

- 1Q23 results. Net sales improved to US$852.1mn, up 48.5% YoY. Net profit rose to US$73.8mn in 1Q23, up 348.4% YoY. Basic and diluted EPS were US 5.1 cents.

- Market Consensus.

(Source: Bloomberg)

Air China Ltd. (753 HK): Time to fly

Air China Ltd. (753 HK): Time to fly

- RE-ITERATE BUY Entry – 6.40 Target – 7.00 Stop Loss – 6.10

- Air China Limited is a China-based company principally engaged in the provision of air passenger transportation, freight transportation, postal transportation and maintenance services in Mainland China, Hong Kong, Macau and foreign regions. The Company is also engaged in domestic and international business aviation businesses, plane business, aircraft maintenance, airlines business agents, ground and air express services related to main businesses, duty free on boards, retail business on boards and aviation accident insurance sales agents business.

- Lifting of travel bans. China recently announced that it has lifted pandemic-era restrictions on group tours for more countries, including key markets such as the United States, Japan, South Korea and Australia in a potential boon for their tourism industries. This is the third list of countries to receive approvals, coming after 2 lists which consist of around 60 countries. With Korea and Japan being the more popular destinations amongst China tourists, the lifting of travel bans in these markets is likely to drive outbound tourism in China even more that its current level.

- More flight routes. China Air recently unveiled that the airline is set to launch commercial flights between Kaohsiung and Gimpo, South Korea, on Aug. 26 and between Taoyuan and Kumamoto, Japan, on Sept. 18, as the Taiwanese carrier continues to expand routes in the region. The airline has also recently announced more resumption of travel flights routes such as towards Milan, as well as daily flights to Beijing. This increased level of flight routes will allow the airline to capture the expected increase in demand now that travel restrictions are further lifted.

- FY22 earnings. Revenue rose to RMB25.1bn, up 94.1% YoY. Net loss was RMB 2.9bn, while basic earnings per share was -RMB0.19.

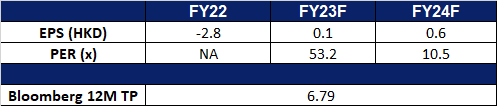

- Market Consensus.

(Source: Bloomberg)

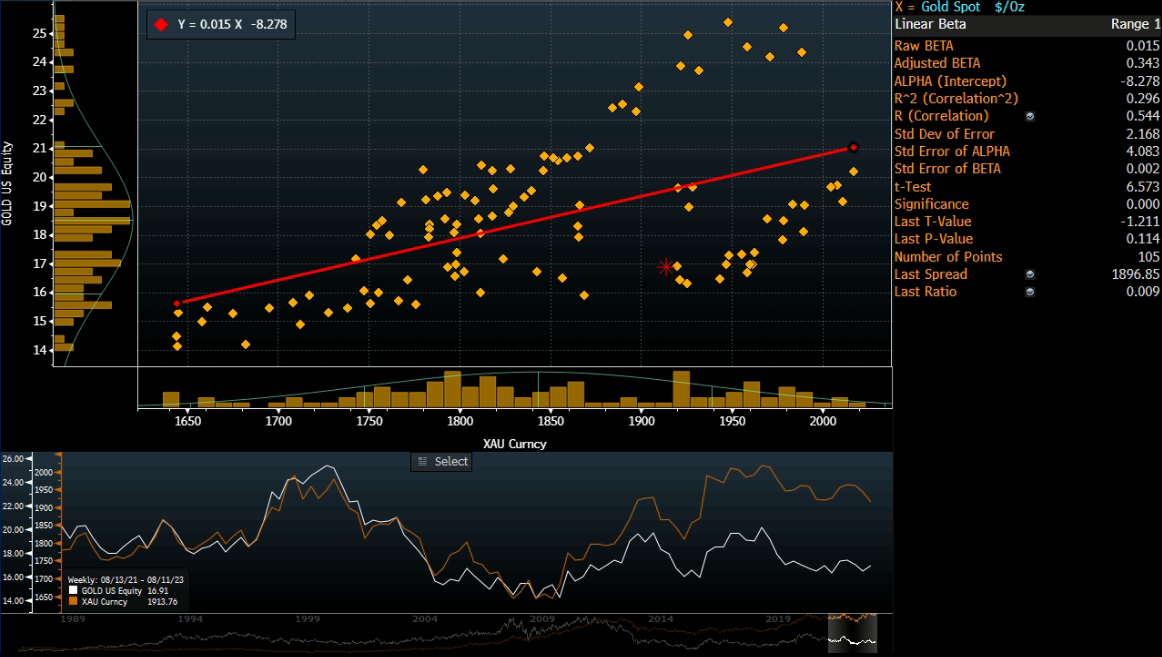

Barrick Gold Corporation (GOLD US): Short-term headwinds are buying opportunities

- BUY Entry – 16.75 Target – 18.00 Stop Loss –16.13

- Barrick Gold Corporation engages in the exploration, mine development, production, and sale of gold and copper properties. It has ownership interests in producing gold mines that are located in Argentina, Canada, Côte d’Ivoire, the Democratic Republic of Congo, the Dominican Republic, Mali, Tanzania, and the United States.

- July US CPI below expectations. The July US Consumer Price Index (CPI) report indicates a rise of 3.2% in inflation YoY, slightly below expectations. The core CPI, excluding volatile food and energy prices, increased by 0.2% for the month, equating to a 12-month rate of 4.7%, lower than the estimate. The majority of the monthly inflation increase was attributed to rising shelter costs, which grew by 0.4% and were up 7.7% YoY. Real wages, adjusted for inflation, increased by 0.3% for the month and 1.1% YoY. The report suggests that while inflation has reduced from its mid-2022 highs, it remains above the desired 2% level set by the Federal Reserve. The indicated moderate inflation in July, driven by a rise in rents offset by declining costs of goods such as vehicles and furniture, suggests that the Federal Reserve might maintain unchanged interest rates in the upcoming month. Despite a slowdown in inflation, economists believe that the central bank may continue its gradual rate increase to keep inflation in check and rate cuts are unlikely in the near future.

- July US PPI data above expectations. The July U.S. Producer Price Index (PPI) increased by 0.8% YoY, up from a 0.2% rise in the previous month. This rise was primarily due to increased service costs. Economists had anticipated a 0.7% gain. While the Federal Reserve is expected to maintain its current credit conditions for the rest of the year, the likelihood of a rate hike in September decreased slightly from 90% to 88.5% after the data release. Despite lingering concerns about inflation, investors note progress in the CPI data. This increase in PPI also impacted yields on the 2-year treasury note, leading to pressure on technology and growth-oriented stocks.

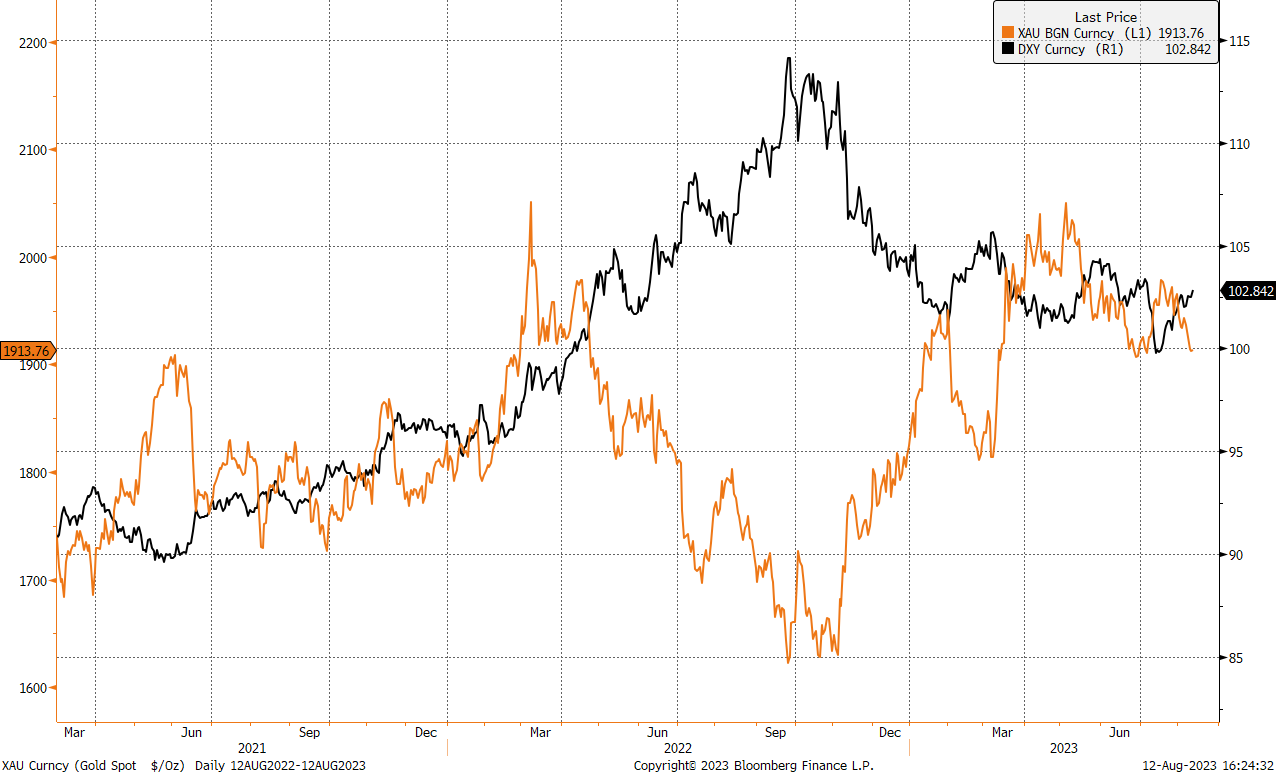

- Better outlook for gold price in 2023. Gold prices are influenced by various factors, with significant impact coming from the direction of the US dollar and global geopolitical risks. Gold tends to find support from limited inflation and low unemployment, serving as a hedge against inflation and a safe haven during uncertain economic times. Although US CPI rose slower than expected in July, it still exceeds the Fed’s 2% target. However, the anticipation of a rate cut in 2024 is dampening prices. The US dollar’s ascent, driven by rebounding gasoline prices and expectations of more Fed interest rate hikes, is contributing to the situation. Producers have raised prices by 0.3% at factory gates, surpassing the projected 0.2%, leading to a headline PPI increase to 0.8%. Gold prices are also affected by persistent inflation and geopolitical tensions, with concerns in both areas influencing the market. Added caution emerges from Biden’s restrictions on Chinese tech investments, intensifying US-China tensions. As a result, gold prices are likely to remain volatile, with their direction contingent upon inflation, interest rates, and geopolitical developments. Gold continues to be viewed as a reliable safe haven.

Gold Price and Dollar Index Trend

(Source: Bloomberg)

(Source: Bloomberg)

- 2Q23 earnings review. Revenue dropped by 1.0% YoY to US$2.83bn, missing estimates by US$100mn. Non-GAAP EPS was US$0.19, beating estimates by US$0.01. Gold production in Q2 was up 6% at just over 1mn ounces while copper production increased by 22% to 107mn pounds.

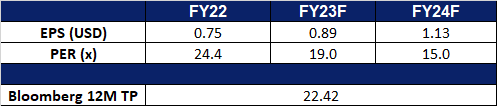

- Market consensus.

Barrick Gold VS Gold price

(Source: Bloomberg)

(Source: Bloomberg)

(Source: Bloomberg)

Amazon.com Inc (AMZN US): Dip-buying opportunity

Amazon.com Inc (AMZN US): Dip-buying opportunity

- RE-ITERATE BUY Entry – 132 Target – 142 Stop Loss – 127

- Amazon.com, Inc. is an online retailer that offers a wide range of products. The Company products include books, music, computers, electronics, and numerous other products. Amazon offers personalized shopping services, Web-based credit card payment, and direct shipping to customers. Amazon also operates a cloud platform offering services globally.

- Potential IPO anchor investor. Amazon is in talks to invest in Arm, a chip designer owned by SoftBank, as a cornerstone investors ahead of its IPO. Arm is expected to list on the Nasdaq in early September and is seeking to raise $8nn to $10nn. Amazon is one of about 10 technology companies that have been approached about investing in Arm. Amazon is interested in investing in Arm because it uses Arm’s chips in its cloud computing business. The IPO is expected to be a much-needed boon for SoftBank, which is battling to stabalise its massive Vision Fund.

- Leader in cloud. Amazon Web Services (AWS) revenue grew 12% YoY in 2Q23, beating analyst expectations. AWS is the leading cloud computing platform with a 40% market share in 2022, and it is still in the early stages of its growth. AWS is facing increasing competition from Microsoft Azure and Google Cloud Platform, but it is investing heavily in new technologies, such as generative AI, to stay ahead of the competition. AWS is also expanding its global footprint, with new regions opening up all the time. The most recent being, the $7.2bn investment in Israel through 2037. It includes opening AWS data centers in Israel, which will allow the Israeli government to run applications and store data in Israel; making it easier for Israeli companies to use AWS services, which are used by companies globally. Overall, AWS is still growing rapidly and is well-positioned to maintain its leadership position in the cloud infrastructure market.

- Introducing more services. Amazon Web Services (AWS) has expanded its Amazon Bedrock service to include new foundation model (FM) providers and a new capability for creating fully managed agents. This makes it easier for customers to build and scale generative AI applications with a wide range of FMs and to complete complex tasks that require access to external systems and up-to-date knowledge sources. Amazon Bedrock is a fully managed service that is secure, scalable, and easy to use, making it a great option for businesses of all sizes that want to get started with generative AI quickly and easily.

- 2Q23 earnings review. Revenue rose 10.8% YoY to $134.3bn, beating estimates by $2.96bn. Earning per share was $0.65, no comparable to expectations of $0.34.

- Market consensus.

(Source: Bloomberg)

Trading Dashboard Update: Take profit on CNOOC (883 HK) at HK$13.10. Add Air China (753 HK) at HK$6.40. Cut Loss on Banyan Tree(BTH SP) at S$0.425.