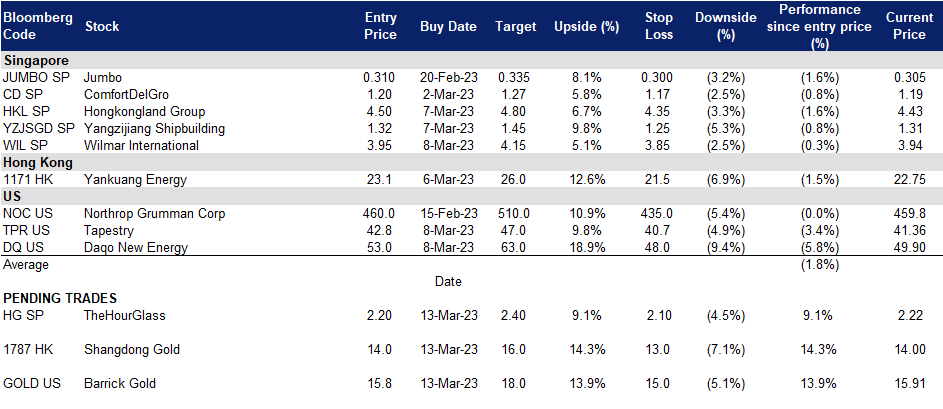

13 March 2023: TheHourGlass (HG SP), Weilong Delicious Global Holdings Ltd (9985 HK), Barrick Gold Corporation (GOLD US)

Singapore Trading Ideas | Hong Kong Trading Ideas |United States Trading Ideas | Sector Performance | Trading Dashboard

TheHourGlass (HG SP): The clock is ticking

- BUY Entry 2.20 – Target – 2.40 Stop Loss – 2.10

- The Hour Glass Limited retails and wholesales watches, jewelry and related products through its subsidiaries. The Company also manufactures watches and invests in properties. Having established itself in Singapore as a premier watch boutique, the Group expanded worldwide. The Group holds exclusive agency and distribution rights to Gerald Genta, Breguet, Daniel Roth, Bertolucci, Burberrys, Christian Dior, Revue Thommen, Hublot and Montega.

- Revival of Daniel Roth. Daniel Roth, a Swiss watch brand owned by LVMH, is set to make a comeback as an independent company, with its first new model scheduled to be released in 2023. However, those interested in purchasing the brand’s watches will have to go through The Hour Glass, as they hold exclusive distribution rights.

- Post-Covid boom. Last year, there were about 6.3 million visitors arriving in Singapore, a YoY increase of 1,810.5%. China lifted its overseas travelling restrictions in early January 2023, and Singapore is expected to see a spike in Chinese tourist influx this year. In January 2023, there were 931,500 visitors (up 1,529.3% YoY) in Singapore. According to a recent market survey from travel agents in China, Southeast Asian countries are among the top cross-border travelling preferences after a three-year lockdown.

- Luxury spending. Despite the challenging economic climate characterized by surging inflation, rising interest rates, and the looming possibility of recession, the demand for luxury goods has remained steady. This demand is largely driven by affluent individuals who have benefited from the recent wealth accumulation and the savings accrued during the Covid lockdown periods. Additionally, the return of Chinese shoppers – the primary source of profits for luxury companies before the pandemic – is expected to bolster the industry, with Chinese consumers saving one-third of their income and depositing 17.8 trillion yuan (US$2.6 trillion) into banks last year.

- Retail sales. Singapore’s retail industry, and other service sectors, are expected to reap the rewards of the ongoing revival of leisure and business air travel, as well as China’s decision to reopen its borders. Data from Singapore Tourism Board shows approximately 49% of tourists receipts from Mainland China in 2019 (pre-pandemic) were from shopping. According to the department of statistics Singapore, retail sales on watches and jewellery increased by 13.1% YoY in December 2022 and 10.8% MoM. In 1H23, it expects retail trade to improve by 8% and operating revenue to increase by 2% in the first quarter.

- 1H23 results review. Revenue rose 18% YoY for the six months ended Sept 30 to S$555.5mn from S$472.4mn. Net profit jumped 35% YoY from S$62.6mn to S$84.6mn, despite higher operating costs.

- Updated market consensus of the EPS in FY24/25 is 4.35%/4.17% respectively, which translates to 9.4x/9.0x forward PE. Current PER is 8.7x and the 5 year historical PER is 8.8x.

(Source: Bloomberg)

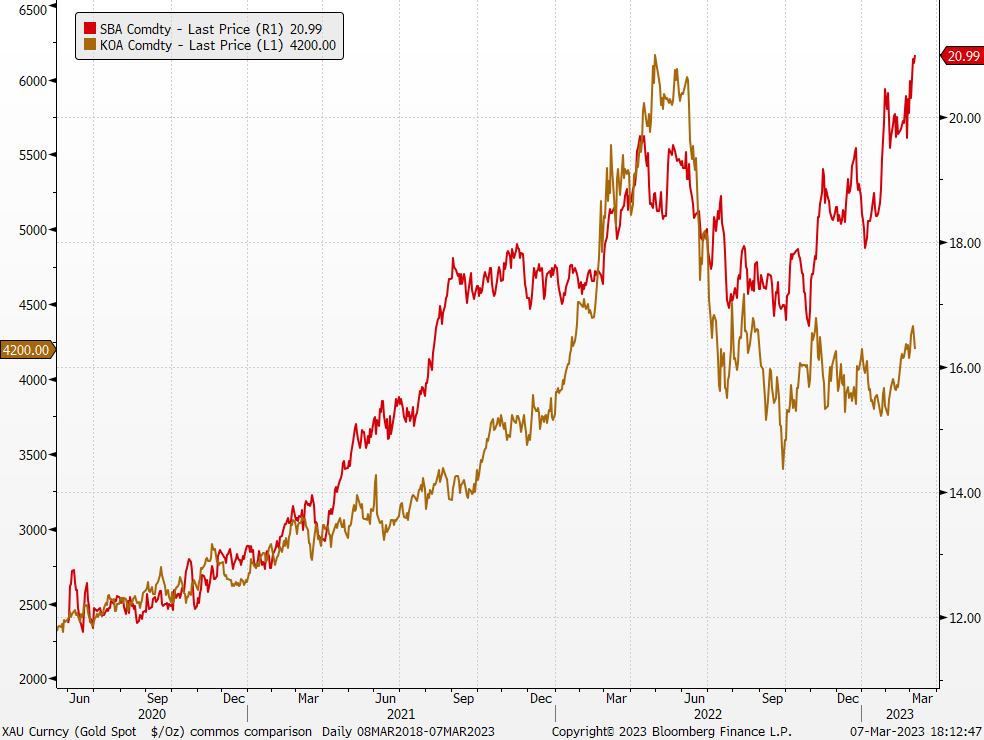

Wilmar International Ltd. (WIL SP): Rising Soft Commodities prices

Wilmar International Ltd. (WIL SP): Rising Soft Commodities prices

- RE-ITERATE BUY Entry 3.95 – Target – 4.15 Stop Loss – 3.85

- Wilmar International Limited operates as a food processing company. The Company offers oil palm cultivation, edible oil refining, crushing, and gains processing services, as well as provides sugar, flour, and rice. Wilmar International serves customers worldwide.

- Sugar Futures prices. Raw sugar futures hovers at the 21 cents/pound range and recently reached a 6-year high of 22.1 cents/pound due to tight supply concerns, supported by a strong demand expectation boosted by China’s recent re-opening, as well as a worsening production outlook by India and Europe. The latest estimates showed that the world’s second-largest sugar exporter is likely to produce 34mn tonnes of the commodity in 2023, down 7% from a previous forecast.

- Palm Oil Futures Prices. Short-term weather disruptions will likely support Malaysia’s crude palm oil prices in the short term as supply takes a hit from the ongoing floods. Asian palm oil buyers also recently seek stable export policies from producers to reduce the volatility of the supply chain. Palm oil production is also expected to be higher in FY23 than in FY22 due to improved labour supply.

Raw sugar (red) and crude palm oil (brown) futures price trend

(Source: Bloomberg)

(Source: Bloomberg)

- FY22 results review. The company announced record earnings of US$2.4bn (S$3.2 bn) for FY22, a 27.1% growth from US$1.9bn in FY21; core net profit for FY22 improved 31% to US$2.42bn.

- Updated market consensus of the EPS in FY23/24 is US$0.309/US$0.329 respectively, which translates to 9.52x/8.94x forward PE. Current PER is 7.68x. Bloomberg consensus average 12-month target price is S$5.24.

Weilong Delicious Global Holdings Ltd (9985 HK): Snacking good time

- BUY Entry – 9.8 Target – 11.0 Stop Loss – 9.2

- Weilong Delicious Global Holdings Ltd is a China-based holding company principally engaged in the production and sales of spicy snack foods. The Company operates in three segments: Seasoned Flour Products segment, Vegetable Products segment and Bean-based and Other Products segment. The Seasoned Flour Products segment mainly includes Big Latiao, Mini Latiao, Spicy Hot Stick, Mini Hot Stick and Kiss Burn. The Vegetable Products segment mainly includes Konjac Shuang and Fengchi Kelp. The Bean-based and Other Products segment mainly includes Soft Tofu Skin, 78° Braised egg and meat products.

- Snacking culture. According to David Walsh, SNAC International’s Vice President of Communications, snacking culture has evolved post-pandemic and is expected to continue to grow due to factors like high value, affordable, and fun products. The pandemic has shifted snacking trends towards snacking from home, resulting in an increase in e-commerce and snack shopping. Snacking frequency has also increased, with millennials and Gen Z consumers snacking throughout the day, grazing, and even replacing meals with snacks.

- Chinese snacks gaining appeal. The popularity of Chinese snacks is on the rise, fueled by the globalization of cuisine and the ease of online shopping. Chinese snacks are known for their unique flavors, textures, and ingredients, and snack producers are meeting the increasing demand for spicy options with a variety of spice and pepper types. In China, the demand for snacks is also growing due to changing lifestyles and preferences, and online shopping makes it easier for consumers to access a wide range of regional snacks. Chinese snacks are expected to continue growing in popularity globally due to their unique flavor profiles.

- Vegetarian options. A wide array of the company’s snacks are of the vegetarian variety appealing to a wider range of consumers such as vegetarians and environmentally conscious consumers. These snacks are often perceived as healthier options to traditional snacks and are also often seen as more environmentally sustainable than meat-based snacks, as the production of meat requires a significant amount of resources such as water, land, and energy. Additionally, one of the company’s most popular products the konjac products which can replicate the texture of meat are cheaper to produce than meat products and can help them to generate higher margins due to their low costs.

- Post-IPO prospects. Since their recent IPO, Weilong has been able to gather a lump sum of money that will help to boost their business through more investments in R&D and manufacturing capabilities. Furthermore, with the company being in a defensive sector, they will not be as affected by changes in macroeconomic conditions.

- 1H22 earnings. Revenue slightly dropped by 1.8% YoY to RMB2.3bn. Gross profit increased by 1.4% YoY to RMB861.5mn. Net loss was RMB260.8mn compared to a net profit of RMB357.6mn in 1H21.

- The updated market consensus of the EPS growth in FY23/24 is 538.9%/20.9% YoY respectively, which translates to 20.2x/16.7x forward PE. Bloomberg consensus average 12-month target price is HK$12.85.

(Source: Bloomberg)

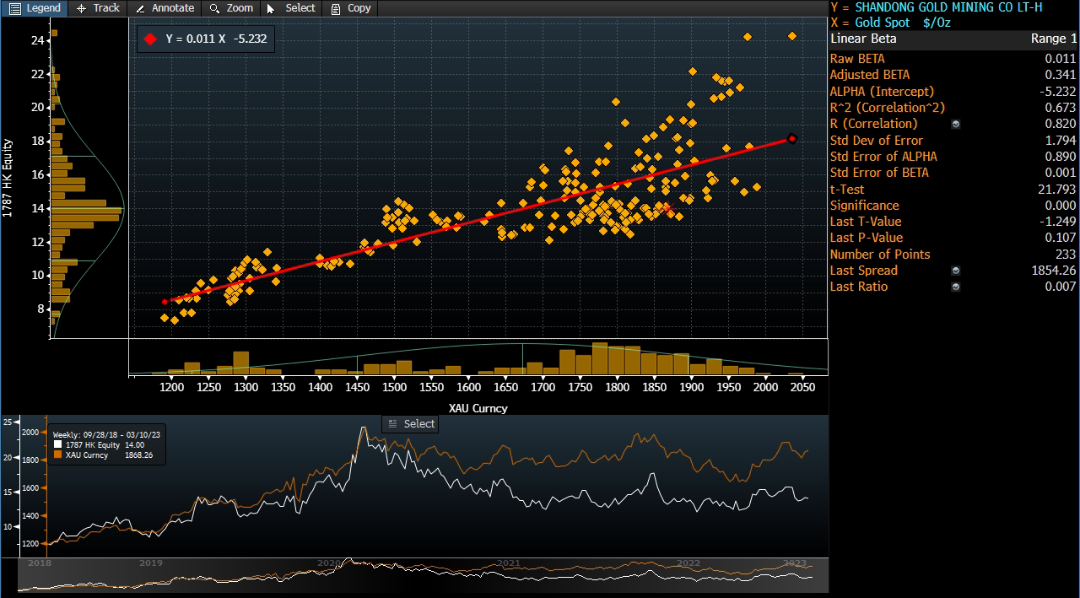

Shandong Gold Mining Co., Ltd. (1787 HK): Run to a safe haven

- BUY Entry – 14.0 Target – 16.0 Stop Loss – 13.0

- Shandong Gold Mining Co., Ltd. is a China-based company principally engaged in the mining, processing and sales of gold. The Company operates two segments. The Gold Mining segment is engaged in the mining of gold ore. The Gold Refining segment is engaged in the production and sales of gold. The Company is also engaged in the distribution of other metals extracted during the gold ore smelting process, such as silver, copper, iron, lead and zinc. The Company conducts its businesses in domestic and overseas markets.

- Financial crisis 2.0. Last week, a black swan event occurred in the US banking sector. The failure of Silicon Valley Bank (SVB) marked the second-largest bank failure in US history. The US Federal Deposit Insurance Corporation (FDIC) seized the assets of Silicon Valley Bank on Friday. The bank had $209bn in assets and $175.4bn in deposits at the time of failure, the FDIC said in a statement. The bank run is likely to spread to other regional banks in the US. Fears are crowded now, and investors rush to safe-haven assets such as gold and US Treasuries.

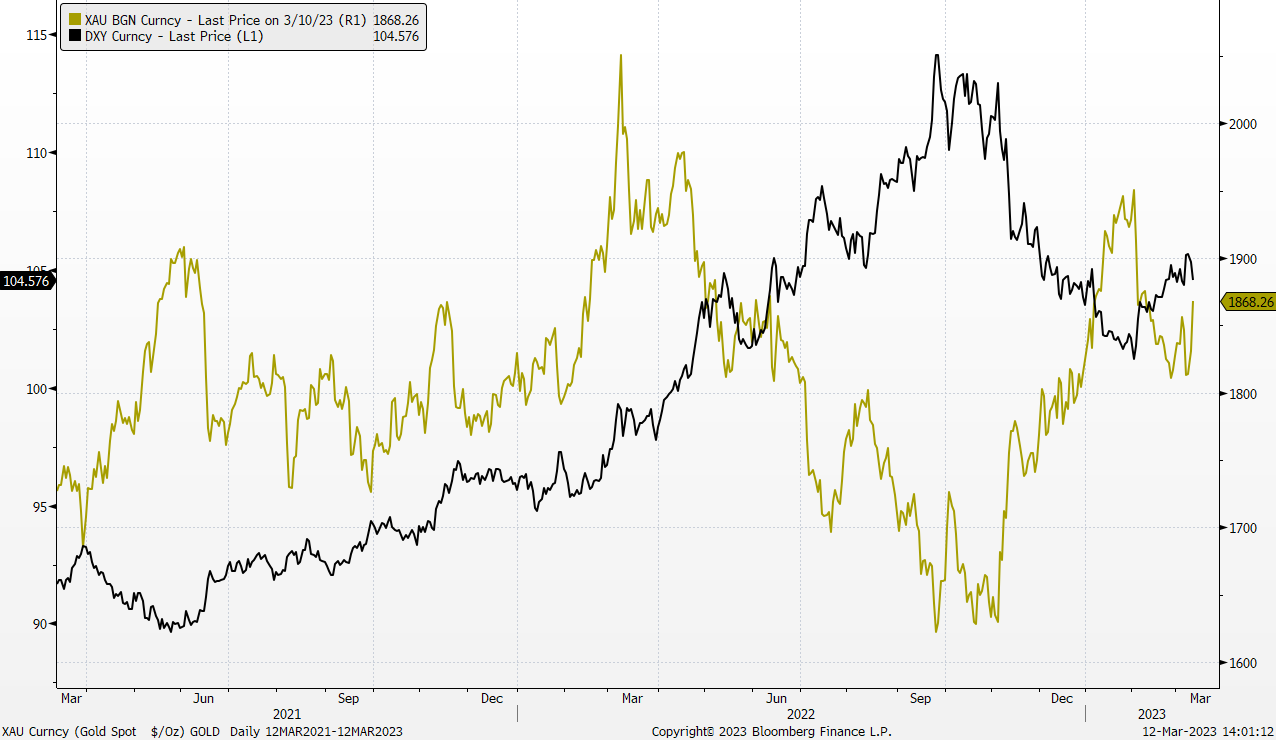

- Rate hike pace could slow down or even pause. The SVB failure is attributable to the aggressive rate hikes throughout 2022, which results in the plunge in US Treasuries (UST) and other government-backed fixed-income securities like mortgage-back securities. US banks have hugh amounts of unrealised losses from the these holdings as they purchased when interest rates were near zero (fixed-income prices at high). If the Fed fund terminal rate continues to rise, the floating losses will widen further for banks. Banks either raise more capital or sell UST and MBS at losses. In a nut shell, regional banks are facing a liquidity crunch once withdrawals of deposits accelerate. The crisis could force the Fed to slower and smaller rate hikes or even pause. The probability of 50bps rate hike in the upcoming FOMC meeting this month drops from previous 80% to current 30% after the SVB fails. The dollar index fell from near 105.9 to 104.6 as of Friday.

- Better outlook for gold price in 2023. There are several factors impact gold prices, and the key ones are the trend of the US dollars and global geopolitical risk. The broad market has expected that US dollars peaked last year as inflation has been on a downswing. Even though recent macro data such as January CPI and core PCE price were higher than expected, both showed overall prices were declining. The US job market starts showing some weaknesses as unemployment rate rose to 3.6% in February. The market expects Fed to cut rates by the end of after the peak in 3Q23. On the other hand, geopolitical tensions remain high and probably escalate anytime as China-US confrontations are more frequent. Gold is the good old safe haven.

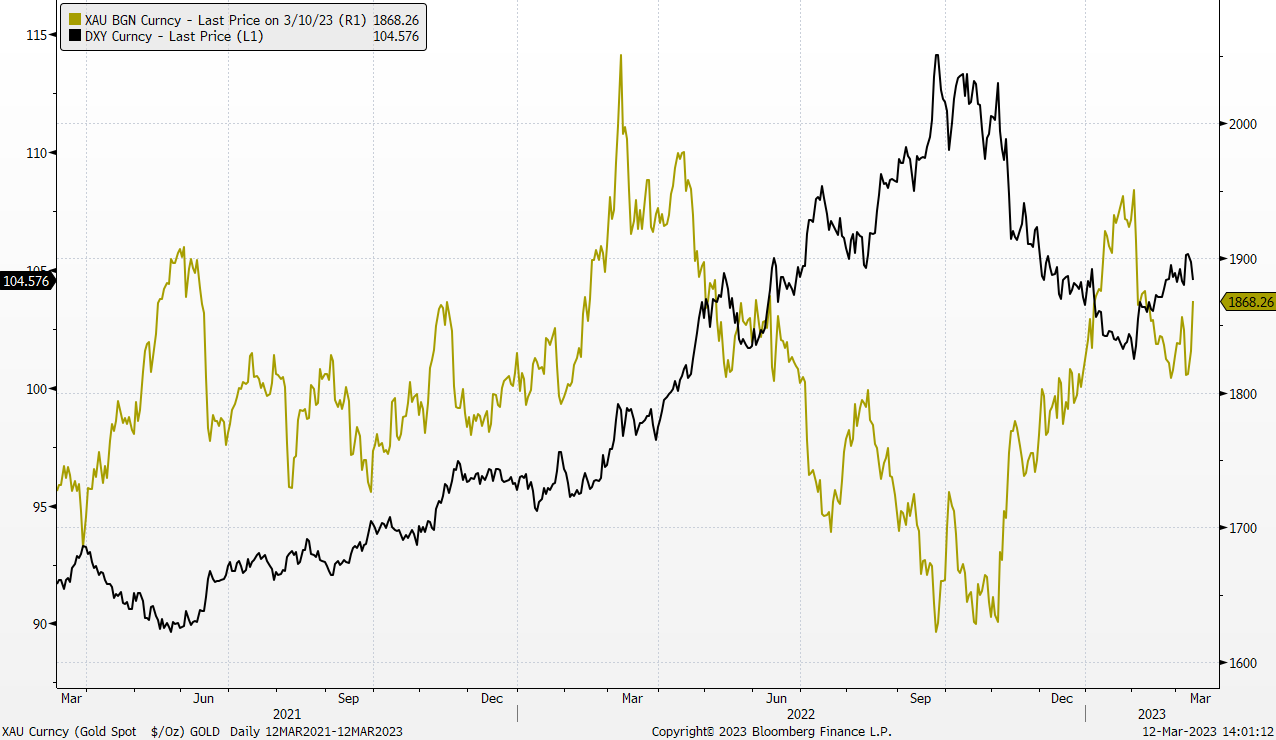

Gold Price and Dollar Index Trend

(Source: Bloomberg)

(Source: Bloomberg)

- Positive FY22 result guidance. The company expected to realise a net profit attributable to the company of RMB1bn to RMB1.3bn in FY22 compared to a net loss in FY21.

- The updated market consensus of the EPS growth in FY23/24 is 92%/37.5%, respectively, which translates to 25.7x/18.9x forward PE. Current PER is 37.9x. Bloomberg consensus average 12-month target price is HK$15.8.

Shandong Gold VS Gold price

(Source: Bloomberg)

(Source: Bloomberg)

(Source: Bloomberg)

Barrick Gold Corporation (GOLD US): Safe haven

- BUY Entry – 16.4 Target – 18.0 Stop Loss – 15.6

- Barrick Gold Corporation engages in the exploration, mine development, production, and sale of gold and copper properties. It has ownership interests in producing gold mines that are located in Argentina, Canada, Côte d’Ivoire, the Democratic Republic of Congo, the Dominican Republic, Mali, Tanzania, and the United States.

- Financial crisis 2.0. Last week, a black swan event occurred in the US banking sector. The failure of Silicon Valley Bank (SVB) marked the second-largest bank failure in US history. The US Federal Deposit Insurance Corporation (FDIC) seized the assets of Silicon Valley Bank on Friday. The bank had $209bn in assets and $175.4bn in deposits at the time of failure, the FDIC said in a statement. The bank run is likely to spread to other regional banks in the US. Fears are crowded now, and investors rush to safe-haven assets such as gold and US Treasuries.

- Rate hike pace could slow down or even pause. The SVB failure is attributable to the aggressive rate hikes throughout 2022, which results in the plunge in US Treasuries (UST) and other government-backed fixed-income securities like mortgage-back securities. US banks have hugh amounts of unrealised losses from the these holdings as they purchased when interest rates were near zero (fixed-income prices at high). If the Fed fund terminal rate continues to rise, the floating losses will widen further for banks. Banks either raise more capital or sell UST and MBS at losses. In a nut shell, regional banks are facing a liquidity crunch once withdrawals of deposits accelerate. The crisis could force the Fed to slower and smaller rate hikes or even pause. The probability of 50bps rate hike in the upcoming FOMC meeting this month drops from previous 80% to current 30% after the SVB fails. The dollar index fell from near 105.9 to 104.6 as of Friday.

- Better outlook for gold price in 2023. There are several factors impact gold prices, and the key ones are the trend of the US dollars and global geopolitical risk. The broad market has expected that US dollars peaked last year as inflation has been on a downswing. Even though recent macro data such as January CPI and core PCE price were higher than expected, both showed overall prices were declining. The US job market starts showing some weaknesses as unemployment rate rose to 3.6% in February. The market expects Fed to cut rates by the end of after the peak in 3Q23. On the other hand, geopolitical tensions remain high and probably escalate anytime as China-US confrontations are more frequent. Gold is the good old safe haven.

Gold Price and Dollar Index Trend

(Source: Bloomberg)

(Source: Bloomberg)

- Mixed 4Q23 results. Revenue dropped by 16.3% YoY to US$2.77bn, missing estimates by US$20mn. Non-GAAP net loss per share was US$0.13. 4Q22 gold and copper production was 1.12mn oz and 96mn pounds, respectively. Gold and copper prices averaged at US$1,728/oz and US$3.81/pound respectively.

- US$750mn share buyback. The company authorized a share buyback program of up to US$750mn in 2023, compared to US$1.6bn of dividends and buybacks in 2022.

- The updated market consensus of the EPS growth in FY23/24 is 8.8%/24.2%, respectively, which translates to 20.3x/16.3x forward PE. Current PER is 19.5x. Bloomberg consensus average 12-month target price is US$21.6.

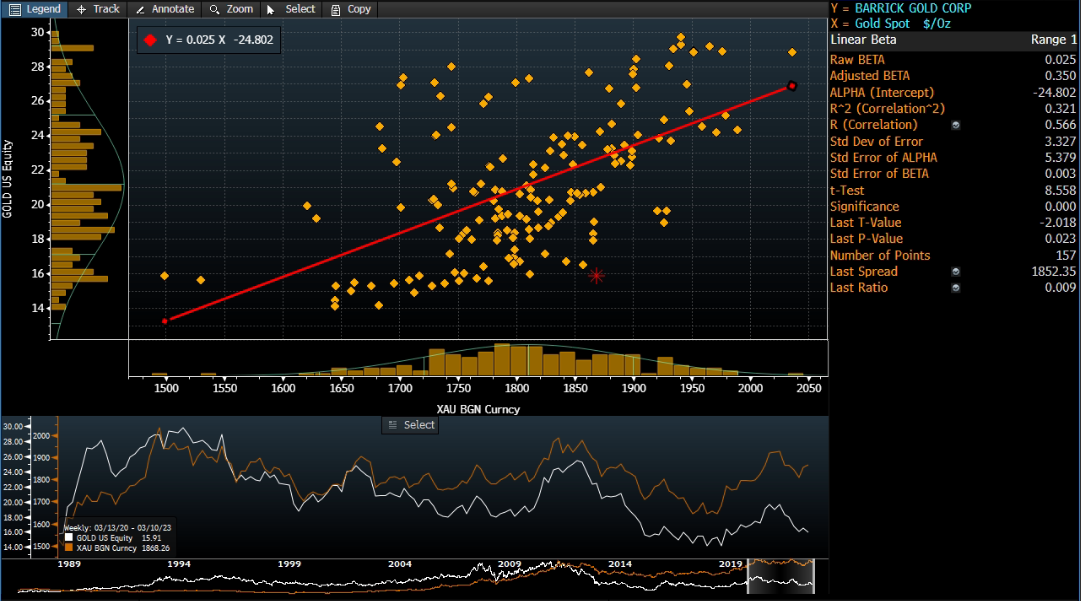

Barrick Gold VS Gold price

(Source: Bloomberg)

(Source: Bloomberg)

(Source: Bloomberg)

(Source: Bloomberg)

Daqo New Energy Corp (DQ US): Gridlock alleviated

Daqo New Energy Corp (DQ US): Gridlock alleviated

- RE-ITERATE BUY Entry – 53 Target – 63 Stop Loss – 48

- Daqo New Energy Corporation manufactures polysilicon. The Company markets its polysilicon to photovoltaic product manufacturers who process it into ingots, wafers, cells and modules for solar power products.

- Loosening restriction of solar panel imports. According to Reuters, the US custom officials clarified rules around complying with the law banning goods made with forced labor. Accordingly, solar panel imports from China rose. The clearance of the gridlock which lasted for months helps the recovery in the demand for solar panels and the prices of polusilicon in the near term.

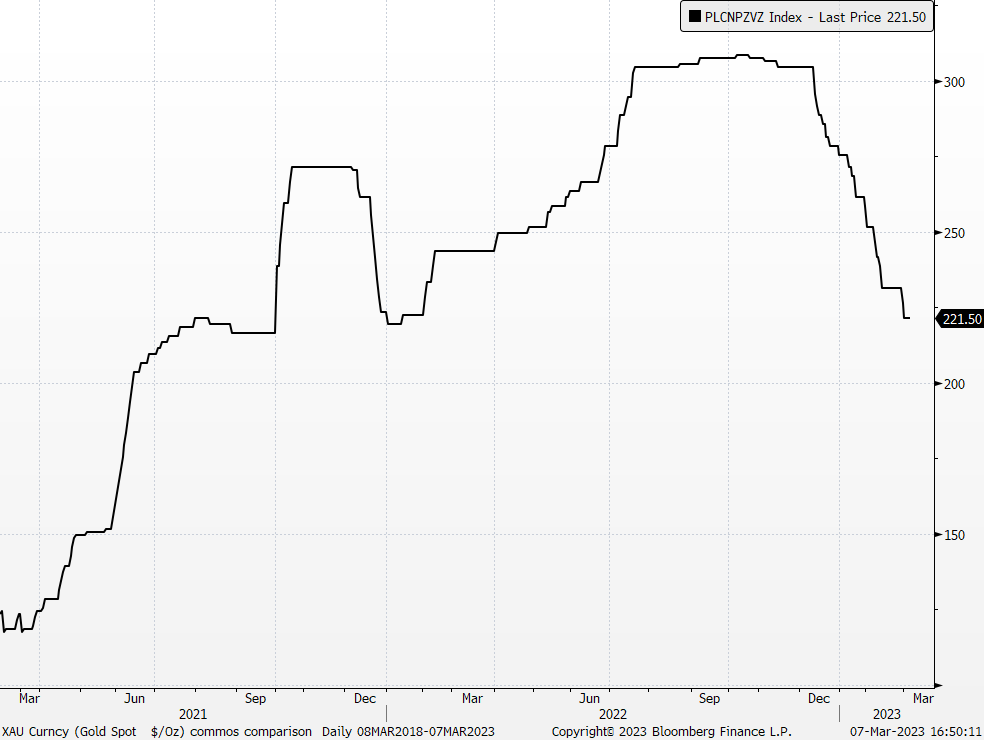

China polysilicon 9N delivered (RMB/kg)

(Source: Bloomberg)

(Source: Bloomberg)

- China reiterated renewable energy development. The government work report 2023 released during the two sessions a few days ago mentioned the general goals and proposals that China will strenthern the construction of urban and rural environmental infrastructure, and continuing to implement major projects for the protection and restoration of important ecosystems.

- 4Q22 results reveiw. Revenue jumped by 118.5% YoY to US$864.3mn. Non-GAAP EPS was US$5.17. Polysilicon production volume was 33,702 MT in 4Q22, compared to 33,401 MT in 3Q22. Polysilicon sales volume was 23,400 MT in 4Q22, compared to 33,126 MT in 3Q22. Polysilicon average selling price was US$37.41/kg in 4Q22, compared to US$36.44/kg in 3Q22.

- The updated market consensus of the EPS growth in FY23/24 is -37.9%/-32.6%, respectively, which translates to 3.2x/4.7x forward PE. Current PER is 2.3x. Bloomberg consensus average 12-month target price is US$61.73.

United States

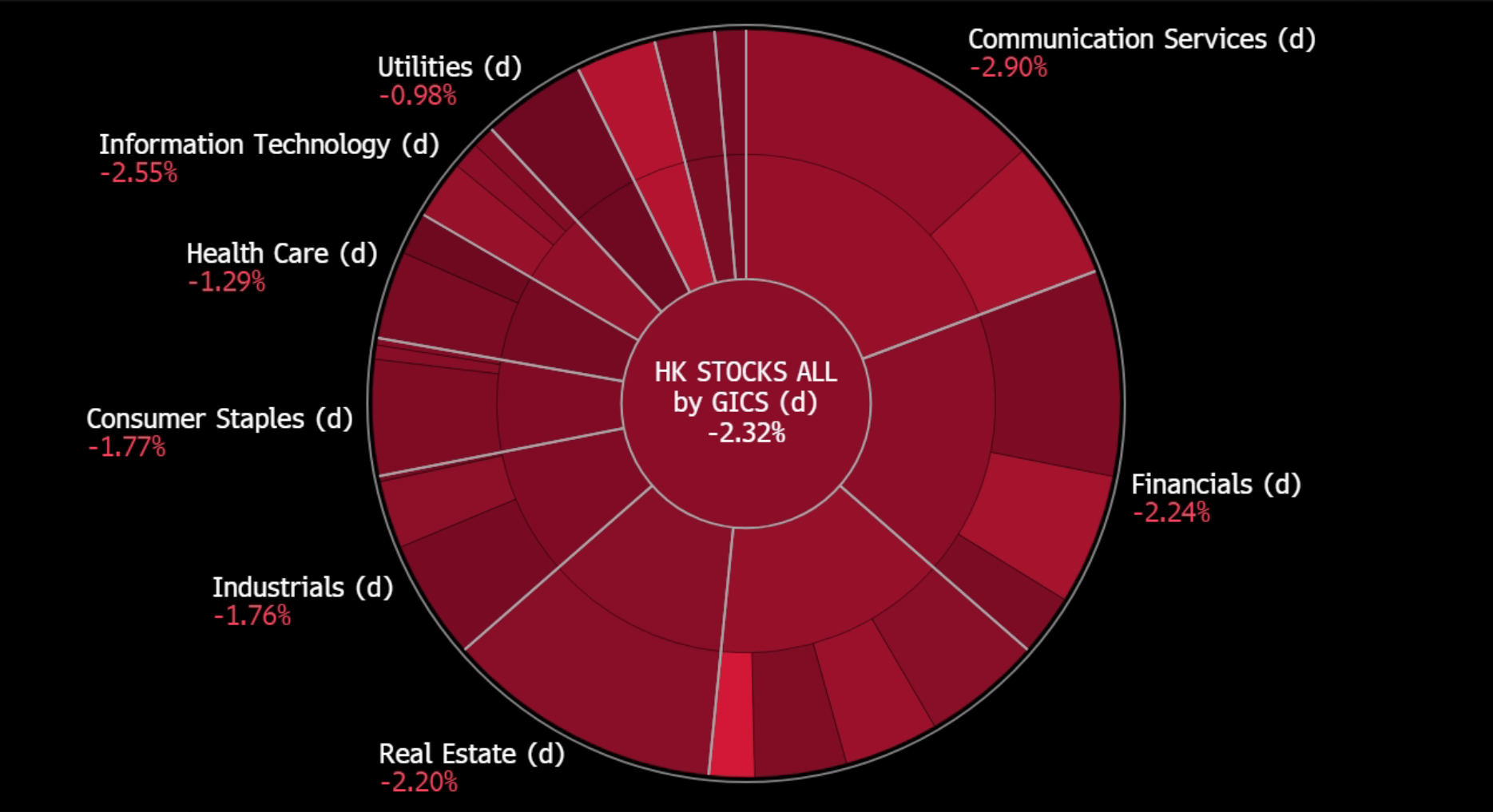

Hong Kong

| News Feed |

| 2. Xi Jinping declared China president for a historic third term |

| 5. This Week in China: A $4 Trillion Rebound Is Giving Way to Gloom |

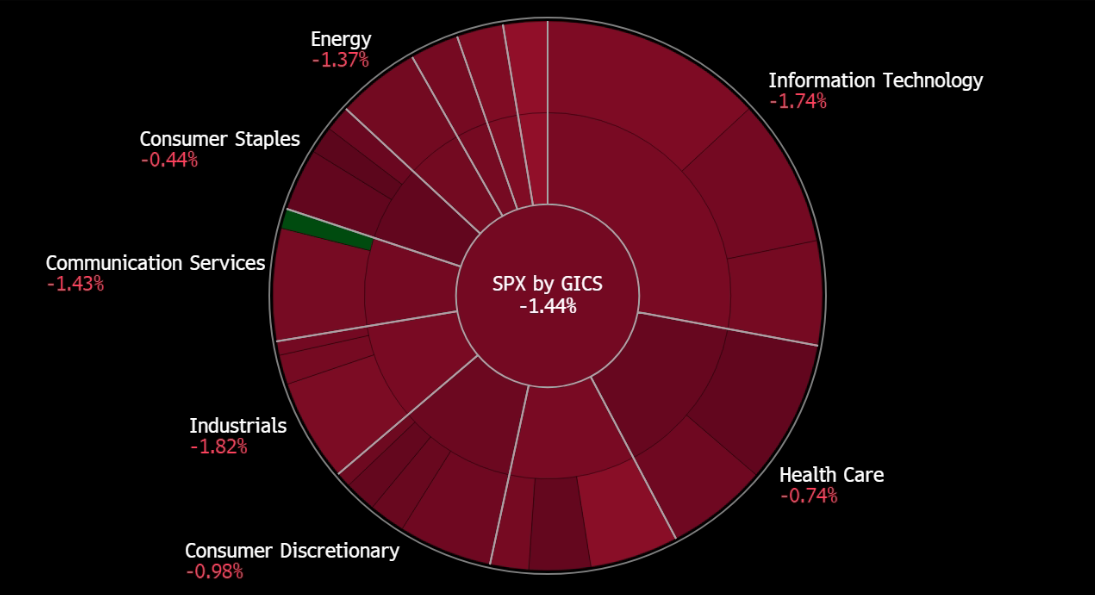

Trading Dashboard Update: Take profit on Prada (1913 HK) at HK$56. Cut loss on Cloudflare (NET US) at US$54.0.