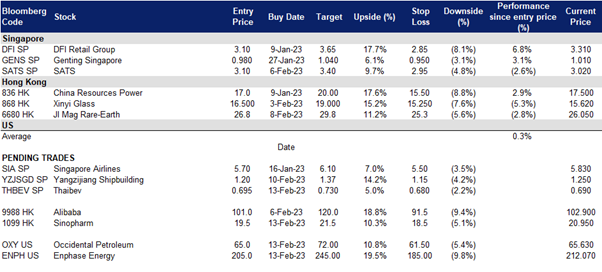

13 February 2023: ThaiBev (Y92 SP), Sinopharm Group Co Ltd (1099 HK), Occidental Petroleum Corporation (OXY US)

Singapore Trading Ideas | Hong Kong Trading Ideas |United States Trading Ideas | Sector Performance | Trading Dashboard

ThaiBev (Y92 SP): Southeast-Asia’s re-opening play

- BUY Entry 0.695 – Target – 0.730 Stop Loss – 0.680

- Thai Beverage Public Company Limited is Thailand’s largest and leading beverage producer and distributor. Its operation is considered among the leading distillers and brewers and in Southeast Asia. ThaiBev’s leading products include a variety of well-established spirits brands, including its famous brew Chang Beer. In the non-alcoholic beverage category, key products include water, tonic soda, energy drink, ready-to-drink coffee and green tea.

- Good geographic presence to drive growth in 2023. As tourism is back more in demand as international borders open, and with SEA being the hottest destination for North-Asia tourists, demand for Thaibev’s product would definitely see and increase. With 218 subsidiaries and associates, including 19 distilleries, three breweries, and 21 non-alcoholic beverage production facilities, and an international presence in over 90 countries, Thaibev is bound to drive growth with the re-opening of international borders following the easing of COVID-19 measures.

- Benefitting from robust Thailand tourism recovery in 2023. The easing of China’s stringent health policies is expected to unleash pent-up travel demand and result in a substantial increase in the number of Chinese tourists visiting Thailand. Thailand’s tourist industry is making a strong comeback, with November seeing over 1.75 million arrivals, which is four times the total for all of 2021. The country is now projecting 11-12 million arrivals in 2022, surpassing earlier predictions.

- Company Outlook. The company outlook seems positive in the upcoming months, as more borders are opening up following the pandemic, resulting in a surge in travel demand, which ThaiBev would be able to ride on for recovery. Challenges lie in the uncertain macro-economic environment with high inflation and interest rates which might impede consumers’ demand.

- The updated market consensus of the EPS growth in FY23/24 is 0.90%/6.99% YoY respectively, which translates to 14.7x/13.7x forward PE. Current PER is 14.8x. FY23F/24F dividend yield is 3.53%/3.82% respectively. Bloomberg consensus average 12-month target price is $0.85.

(Source: Bloomberg)

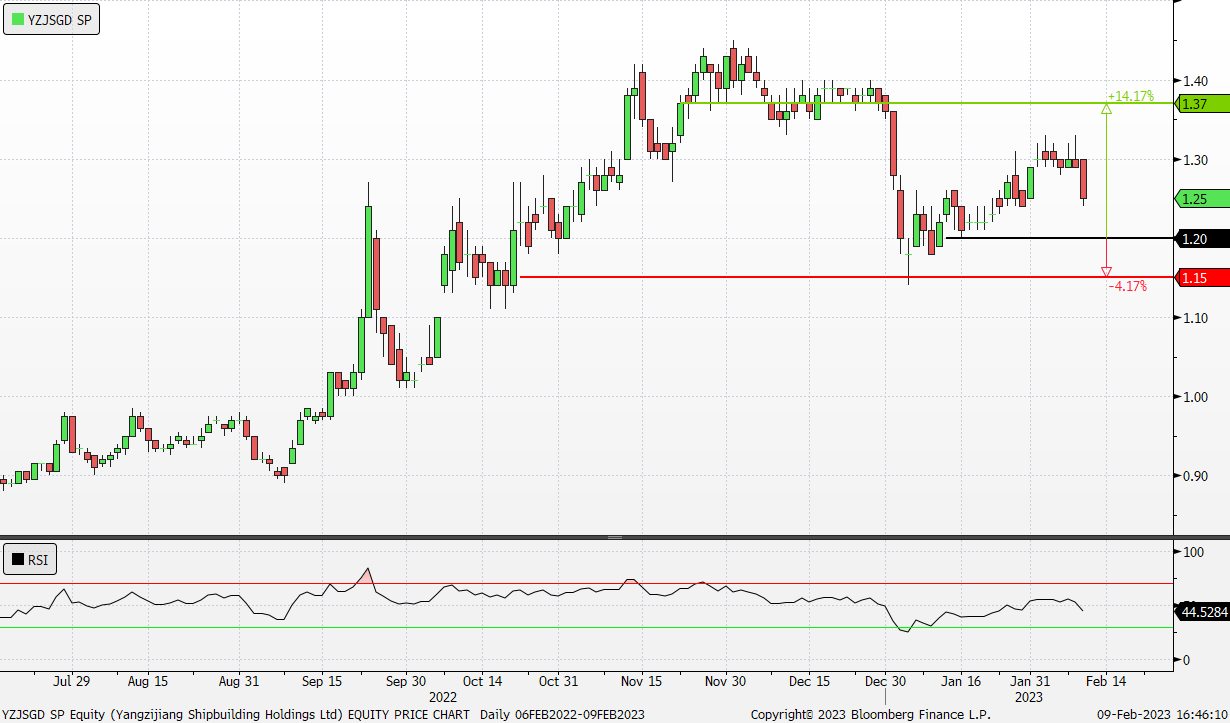

Yangzijiang Shipbuilding (BS6 SP): Benefitting from positive US data

Yangzijiang Shipbuilding (BS6 SP): Benefitting from positive US data

- RE-ITERATE Entry – 1.20 Target – 1.37 Stop Loss – 1.15

- Yangzijiang Shipbuilding Holdings Limited builds a wide range of ships. The Company produces a wide range of commercial vessels, mini bulk carriers, multi-purpose cargo vessels, containerships, chemical tankers, offshore supply vessels, rescue and salvage vessels, and lifting vessels.

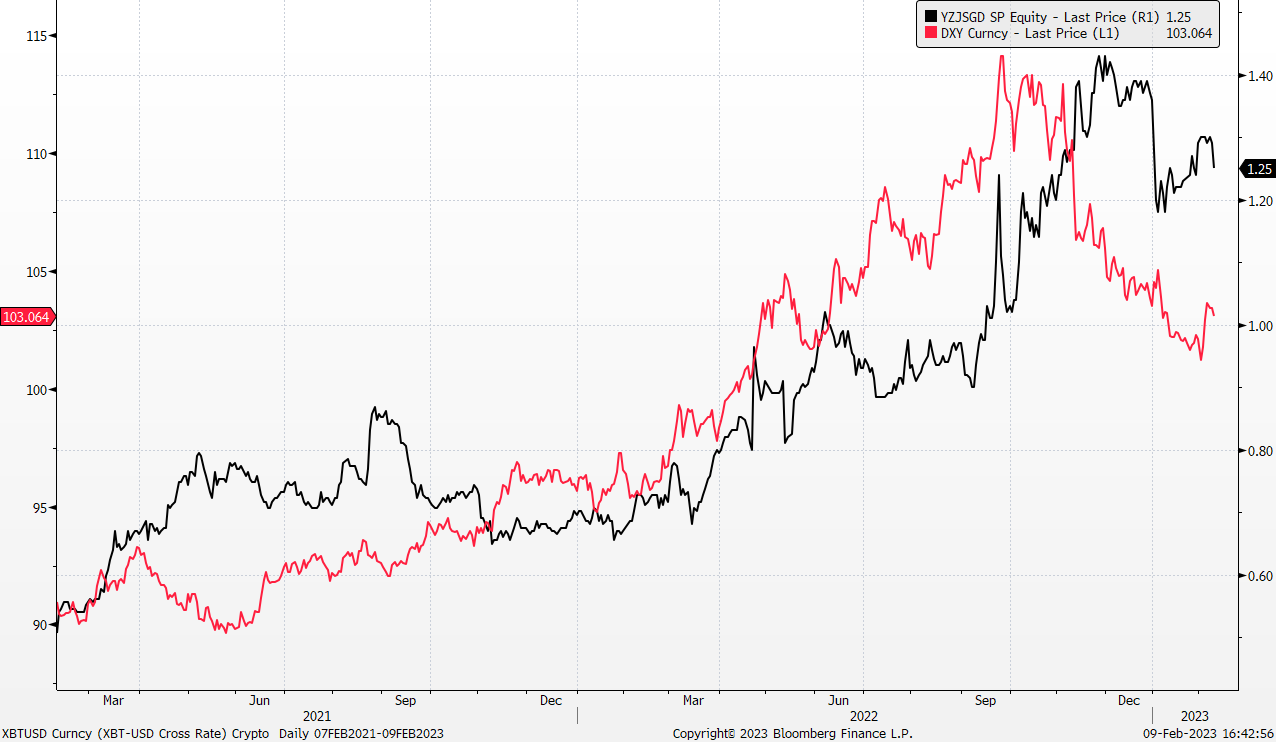

- Benefitting from a stronger US Dollar. Following the most recent US strong nonfarm payroll data for the month of January, the US dollar index saw a rebound with the positive results. Yangzijiang Shipbuilding Holdings Limited, whose financial results, as well as operations, which are mainly denominated in USD, can benefit from the appreciate of the US dollar in upcoming months.

Share price and dollar index comparison

(Source: Bloomberg)

- Dropping Iron Ore and Steel prices. Hard commodities, such as iron ore and steel, saw a price decline following the appreciation of the US dollar. This allows the company to find opportunities in lowering their cost of production, whereby iron ore and steel make up a key component of the production of a ship.

- Visibility on secured contracts. As of 3Q22, the company’s total order book value reached US$10.27bn which extended the company’s top line visibility to mid-2025. This allows the company to have a confirmed and visible stream of revenue for the upcoming years.

- Company Outlook. The company’s outlook is positive in the upcoming months, with the rebound of the U.S. dollars as economic pressure starts to ease. There is also clear visibility on the company’s revenue stream given that its’ order book are filled till mid-2025. The re-opening of China’s economy also allows the company to re-accelerate the production of its business. This suggests that the company’s performance is likely to continue to improve in the near future.

- The updated market consensus of the EPS growth in FY23/24 is 22.98%/4.72% YoY respectively, which translates to 8.1x/7.8x forward PE. Current PER is 8.0x. FY23F/24F dividend yield is 3.7%/3.8% respectively. Bloomberg consensus average 12-month target price is $1.46.

(Source: Bloomberg)

Sinopharm Group Co Ltd (1099 HK): Defensive and risk-off play

- BUY Entry – 19.50 Target – 21.50 Stop Loss – 18.50

- Sinopharm Group Co Ltd is a China-based company principally engaged in pharmaceutical and medical devices distribution business. The Company operates its business through four segments. Pharmaceutical Distribution segment is engaged in the distribution of pharmaceutical products to hospitals, other distributors, retail pharmacy stores and clinics. Medical Devices segment is engaged in the distribution of medical devices, as well as provides installation and maintenance services. Retail Pharmacy segment is engaged in the operation of chain pharmacy stores. Other Business segment is engaged in the distribution of laboratory supplies, manufacture and distribution of chemical reagents, production and sale of pharmaceutical products.

- Growing ageing population. China’s population decreased for the first time in 60 years, signalling the start of a prolonged decline. This, combined with an ageing population, could slow down the economy due to decreased revenue and increased government debt for healthcare and welfare expenses. With a rapidly ageing population, more costs would be incurred on medical equipment and drugs, benefiting Sinopharm’s business.

- MRNA vaccine approval. China National Biotec Group Co Ltd, a unit of Sinopharm, has announced that it has designed an mRNA vaccine candidate targeting the Omicron variant of the coronavirus. It has received regulatory approval from the National Medical Products Administration to begin clinical trials. The Shanghai-based biotech unit has a research and development platform and a production facility with a yearly capacity of 2 billion doses. This vaccine is one of several mRNA candidates being studied in China, but none have been approved for use yet.

- Sole authorised distributor. Sinopharm is the only legally authorized distributor of Merck & Co’s COVID-19 antiviral oral treatment, molnupiravir in China. The treatment was launched in the Chinese market under the brand name Lagevrio. Molnupiravir is currently covered by China’s public health insurance until March 31.

- 3Q22 results. Revenue increased 9.6% YoY in 2022 as compared with the same period last year, reaching RMB144.9bn. Net income attributable to ordinary shareholders was RMB2.16bn, a 2.1% increase YoY.

- The updated market consensus of the EPS growth in FY22/23 is -2.5%/10.0% YoY respectively, which translates to 6.5x/5.9x forward PE. Current PER is 6.9x. FY23F/24F dividend yield is 4.6%/4.8% respectively. Bloomberg consensus average 12-month target price is HK$21.90.

(Source: Bloomberg)

Alibaba Group Holding Ltd (9988 HK): Make the elephant dance

Alibaba Group Holding Ltd (9988 HK): Make the elephant dance

- ITERATE BUY Entry – 101.0 Target – 120.0 Stop Loss – 91.5

- Alibaba Group Holding Ltd provides technology infrastructure and marketing platforms. The Company operates through seven segments. China Commerce segment includes China retail commerce businesses such as Taobao, Tmall and Freshippo, among others, and wholesale business. International Commerce segment includes international retail and wholesale commerce businesses such as Lazada and AliExpress. Local Consumer Services segment includes location-based businesses such as Ele.me, Amap, Fliggy and others. Cainiao segment includes domestic and international one-stop-shop logistics services and supply chain management solutions. Cloud segment provides public and hybrid cloud services like Alibaba Cloud and DingTalk for domestic and foreign enterprises. Digital Media and Entertainment segment includes Youku, Quark and Alibaba Pictures, other content and distribution platforms and online games business. Innovation Initiatives and Others segment include Damo Academy, Tmall Genie and others.

- China’s economic recovery. China’s policymakers plan to step up support for domestic demand this year, with top policymakers repeatedly signalling their intention to harvest the spending power of China’s 1.4 billion people, after economic growth in 2022 slumped to one of its weakest levels in nearly half a century. Some chinese banks have launched promotions and lowered lending rates to encourage more consumer spending in China. Many leading banks have cut their consumer lending rates to below 4 percent, some have even offered certain consumer lending products at the minimum rate of 3.65 percent, the benchmark lending rate of China’s central bank. With China’s efforts to expand domestic demand and consumption alongside its reopening, which would stimulate increased spending and household consumption, the company should expect higher consumer demand this year.

- Cloud segment growth. Cloud infrastructure and services are becoming a prominent part of any business that uses the web for its operations. Total revenue from its Cloud segment, before inter-segment elimination, which includes revenue from services provided to other Alibaba businesses, was RMB50,698mn (US$7,127mn), an increase of 5% compared to RMB48,448mn in the same period of 2021. YoY growth reflected the strong revenue growth from non-Internet industries driven by financial services, public services and telecommunication industries. With cloud services being an integral part of the operations of all three of these areas, it could lead to long-term recurring revenue for Alibaba. Additionally, with the global cloud computing market projected to reach over $1.7 trillion by 2029, Alibaba’s share of the cloud segment is expected to expand as well.

- 1H23 results. Revenue was RMB412,731mn (US$58,021mn), an increase of 2% year-over-year. Net income attributable to ordinary shareholders was RMB2,178mn (US$306mn), and net loss was RMB2,169mn (US$305mn), compared to net income of RMB46,212mn in the same period of 2021.

- The updated market consensus of the EPS growth in FY24/25 is 4.32%/14.59% YoY respectively, which translates to 13.62x/11.88x forward PE. Bloomberg consensus average 12-month target price is HK$142.63.

(Source: Bloomberg)

Occidental Petroleum Corporation (OXY US): Bouncing on Russia’s output cut

- BUY Entry – 65.0 Target – 72.0 Stop Loss – 61.5

- Occidental Petroleum Corporation explores for, develops, produces, and markets crude oil and natural gas. The Company also manufactures and markets a variety of basic chemicals, vinyls and performance chemicals. Occidental also gathers, treats, processes, transports, stores, trades and markets crude oil, natural gas, NGLs, condensate and carbon dioxide (CO2) and generates and markets power.

- Russia to cut oil output. Last Friday, Russia deputy minister said that Russia will reduce oil production by 500,000 bbls/d or 5% of the total output. Accordingly, Brent and WTI closed at US$86.4 and US$79.7, up 2.67% and 2.73% respectively.

- Prioritize share buyback. Previously, the company CEO mentioned that they will prioritize share buyback over growth in 2023. Meanwhile, the company will consider redeeming Berkshire Hathaway’s preferred stock this year. Warren Buffett bought US$10B of preferred stock in 2019.

- 3Q22 earnings review. Revenue jumped by 39.3% YoY to US$9.5bn, beating estimates by US$450mn. Non-GAAP EPS was US$2.44, missing estimates by US$0.01.

- The updated market consensus of the EPS growth in FY23/24 is -33.1%/-9.3% YoY respectively, which translates to 10.2x/11.3x forward PE. Current PER is 5.4x. Bloomberg consensus average 12-month target price is US$74.08.

(Source: Bloomberg)

Enphase Energy Inc (ENPH US): Buy the dip amidst sell-down after earnings

- BUY Entry – 205 Target – 245 Stop Loss – 185

- Enphase Energy, Inc. manufactures solar energy equipment. The Company offers home and commercial solar and storage solutions. Enphase Energy serves clients in the United States.

- Favourable macro trend. Global investments in clean energy projects amount to US$1.1tn in 2022, this amount is sure to increase in FY2023 as governments transition towards a net-zero future.

- Growth drivers intact. The company plans to add a quarterly production capacity of 4.5mn microinverters in 2023 and reach a total of 10mn by the end of 2023. It is expected to increase its supply through a new domestic contract manufacturing partner in 2Q23 and two existing partners in 2H23. Another growth drivers are EV charging systems which bolster a holistic consumer ecosystem, benefiting from the increase in EV and solar adoptions in Europe and US markets.

- 4Q22 earnings beat but sell down afterwards. Revenue jumped by 75.6% YoY to US$724.65mn, beating estimates by US$21.59mn, Non-GAAP EPS was US$1.51, beating estimates by US$0.25. The sell-off is due mainly to the guidance of business is expected to slightly go down in 1Q23 compared to 4Q22, primarily driven by seasonality and the macroeconomic environment.

- The updated market consensus of the EPS growth in FY23/24 is 18.2%/30.0% YoY respectively, which translates to 38.8x/30.0x forward PE. Current PER is 76.2x. Bloomberg consensus average 12-month target price is US$296.82.

(Source: Bloomberg)

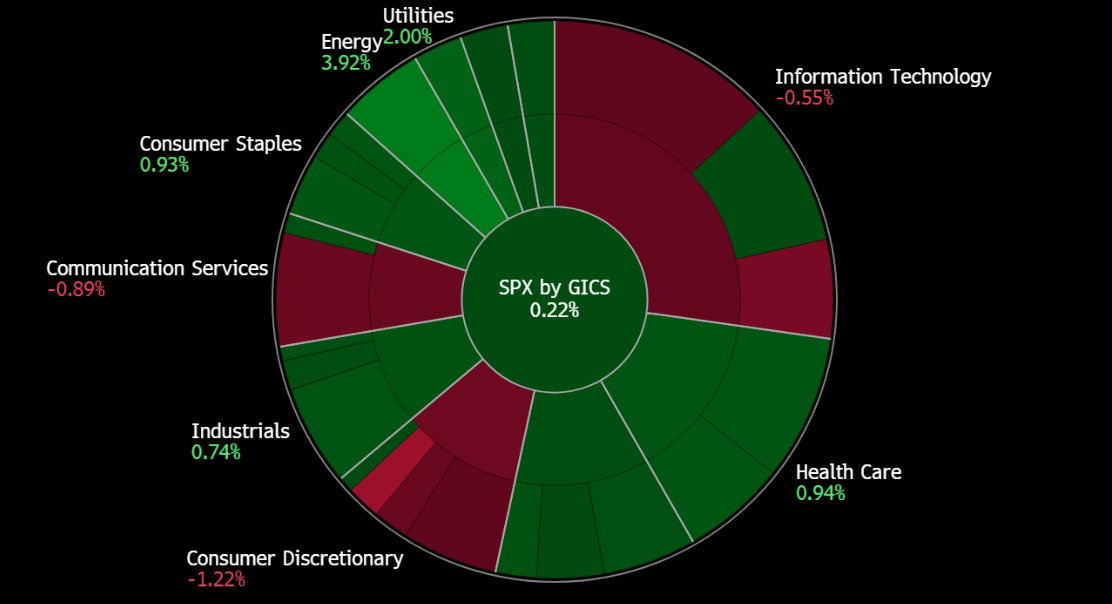

United States

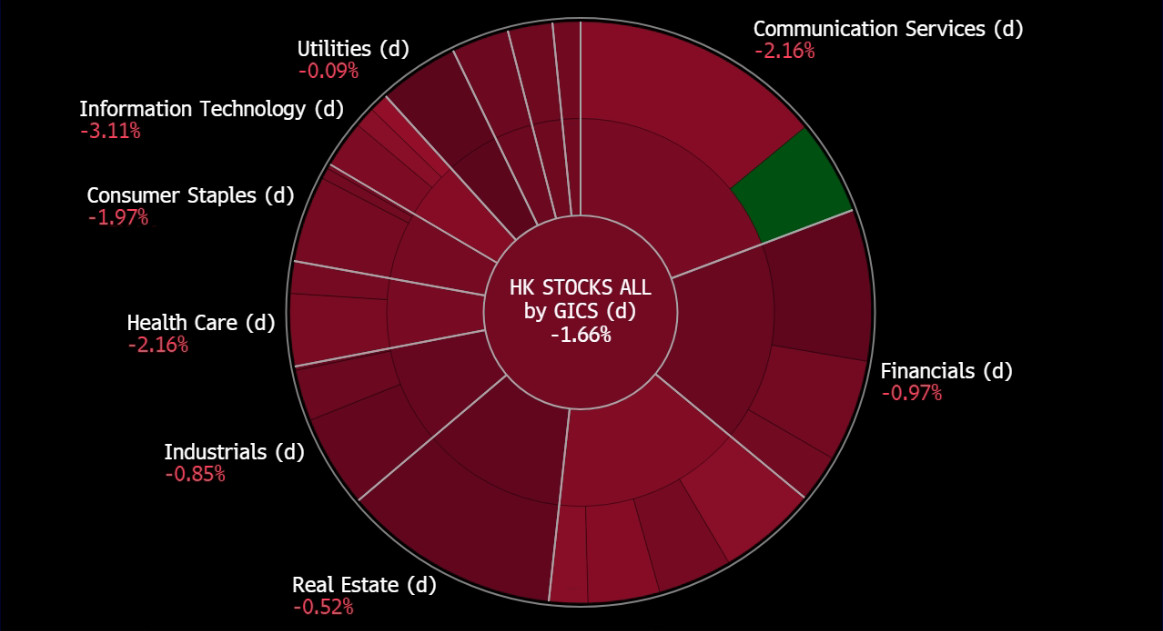

Hong Kong

Trading Dashboard Update: No stocks additions/deletions.