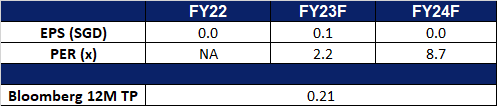

12 May 2023: Rex International Holding Ltd (REXI SP), HSBC Holdings plc (0005 HK), Airbnb Inc (ABNB US)

Singapore Trading Ideas | Hong Kong Trading Ideas |United States Trading Ideas | Sector Performance | Trading Dashboard

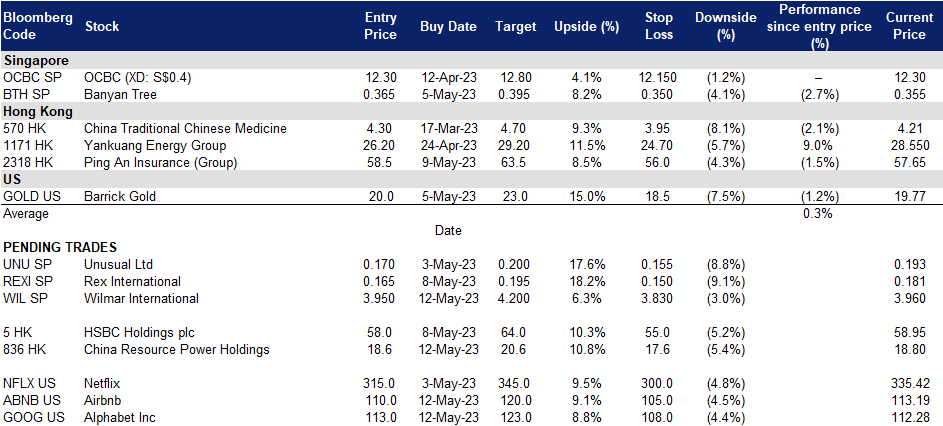

Wilmar International Ltd. (WIL SP): Rising Soft Commodities prices

- BUY Entry 3.95 – Target – 4.20 Stop Loss – 3.83

- Wilmar International Limited operates as a food processing company. The Company offers oil palm cultivation, edible oil refining, crushing, and gains processing services, as well as provides sugar, flour, and rice. Wilmar International serves customers worldwide.

- Sugar Futures prices. Raw sugar futures have risen above 26 cents/pound, nearing the 11-year high of 27 cents/pound due to tight supply. Severe droughts in India’s Maharashtra region have cut output by 25% to 10.5 million tonnes this year, prompting the government of the world’s second-largest producer, to reduce national export licenses. Higher gasoline taxes in Brazil are incentivizing ethanol production over sugar, reducing supply from the world’s top producer.

- Palm Oil Futures Prices. Malaysian palm oil prices rose above MYR 3,700/tonne, driven by higher crude oil prices and tight supply. Alleviated recession concerns in North America boosted global energy benchmarks, raising demand for biodiesel in Southeast Asia. Malaysian palm oil inventories are expected to have dropped to an 11-month low in April due to strong domestic demand. Output expectations were muted for top producer Indonesia, reducing chances of restocking for key consumers. Foreign demand remains robust, despite a decrease in shipments compared to the previous month.

Raw sugar (red) and crude palm oil (brown) futures price trend

(Source: Bloomberg)

- FY22 results review. The company announced record earnings of US$2.4bn (S$3.2 bn) for FY22, a 27.1% growth from US$1.9bn in FY21; core net profit for FY22 improved 31% to US$2.42bn.

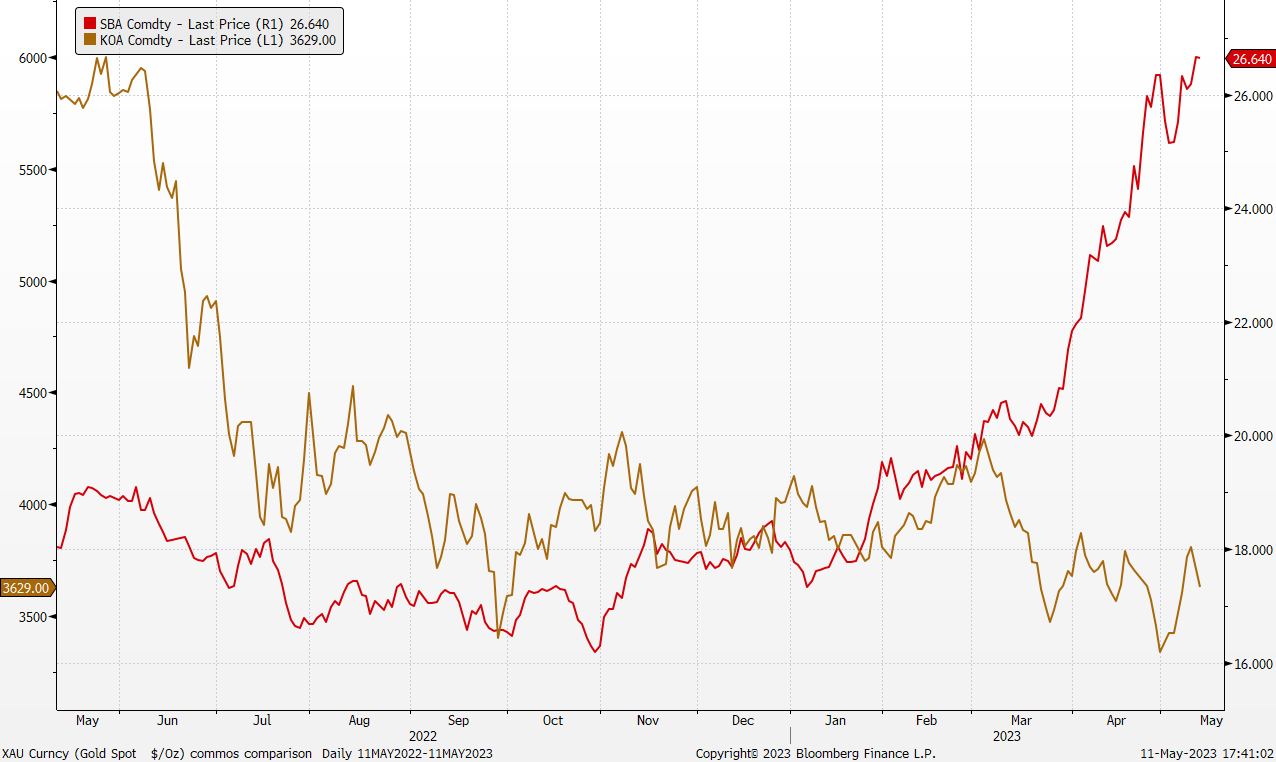

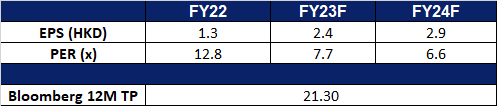

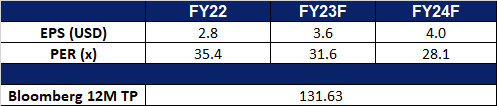

- Market consensus.

(Source: Bloomberg)

Rex International Holding Ltd (REXI SP): Oil rebound

Rex International Holding Ltd (REXI SP): Oil rebound

- RE-ITERATE BUY Entry 0.165 – Target – 0.195 Stop Loss – 0.150

- Rex International Holding Limited operates as an independent oil exploration and production company. It operates through Oil and Gas, and Non-Oil and Gas segments. The company offers Rex Virtual Drilling, a liquid hydrocarbon indicator, which uses seismic data to search for oil. The company is involved in the oil and gas exploration and production activities with a focus in Oman and Norway.

- Oil and gas exploration in Norway. With the recent approval for REXI’s subsidiary Lime Petroleum AS for oil and gas exploration, the company would be able to find and tap into new sources of oil and gas in Norway. This would not only expand its Norwegian oil and gas supplies by tapping into new sources instead of solely depending on existing reserves, but it would also help improve its supply chain as it would now be less dependent on external stakeholders to source for oil and gas. Overall, while this approval may not result in immediate effects, it would be greatly beneficial for REXI in the long run.

- Oil to recover. The recent uncertainties facing the global economy such as the US banking crisis and high-interest rate environment, have led to a decline in oil prices, Brent and WTI futures, as well as a decrease in refining margins. However, with oil currently trading at the lower bound of the trading range, we expect it to recover in the coming weeks.

Brent crude oil price chart

(Source: Bloomberg)

- Plan to develop oil fields in Malaysia. A pact was made with Malaysia’s state-owned, Petronas regarding a project to develop oil fields in Malaysia. While the current costs do not allow REXI to effectively leverage the benefits of this agreement, we believe that it will be able to benefit from the developed oil fields in the future, allowing the firm to develop a competitive advantage over its peers.

- FY22 results review. Rex International posted a loss of US$1mn versus a net profit of US$67.2mn in 2021. Revenue for the financial year from crude oil sales was up 7% to US$170.3mn.

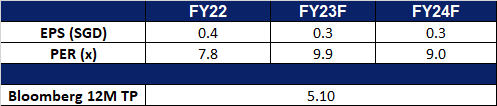

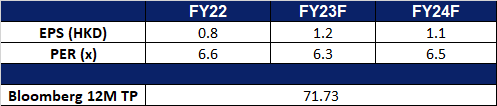

- Market consensus.

(Source: Bloomberg)

China Resources Power Holdings Company Limited (836 HK): A seasonality play

- BUY Entry – 18.6 Target – 20.6 Stop Loss – 17.6

- China Resources Power Holdings Company Limited is a Hong Kong-based investment holding company principally engaged in the investment, development and operation of power plants. The Company operates through three segments. Thermal Power segment is engaged in the investment, development, operation and management of coal-fired power plants and gas-fired power plants, as well as the sales of heat and electricity. Renewable Energy segment is engaged in wind power generation, hydroelectric power generation and photovoltaic power generation, as well as the sales of electricity. Coal Mining segment is engaged in the mining of coal mines, as well as the sales of coal. The Company mainly operates businesses in China.

- China’s rebounding economy. In March, China witnessed a notable increase in electricity consumption, as factory activities resumes after China’s re-opening. This surge in power usage reflected the gathering momentum of the nation’s post-pandemic recovery, leading manufacturers to ramp up production and instilling confidence in consumers. March saw a significant rise of 5.9% in power consumption, surpassing the growth experienced in the initial two months of the year, thus signalling an acceleration in economic revival. The recovery of economy will continue in 2H23.

- Ramping up coal power. Local governments in China recently approved more new coal power in the first three months of 2023 than in the whole of 2021, according to official documents. China’s coal imports from Australia also saw an increase following the easing of the ban on Coal imports from Australia. Local governments in energy-hungry Chinese provinces approved at least 20.45 gigawatts of coal-fired power in the first three months of 2023, Greenpeace said, which is more than double the 8.63 gigawatts Greenpeace reported for the same period last year.

- Strong seasonality. Summer and winter seasons are the top performing months for the company’s stock, shown in the chart below.

20-year historical monthly returns

(Source: Bloomberg)

(Source: Bloomberg)

- FY22 earnings. Revenue rose to HK$103.3bn, a 15.0% increase YoY. Net Income of HK$7.04bn was up 342% compared from FY2021.Net profit Margin rose to 6.8%, compared to 1.8% in FY2021.

- Market Consensus

(Source: Bloomberg)

HSBC Holdings plc (0005 HK): Better Liquidity

- RE-ITERATE BUY Entry – 58.0 Target – 64.0 Stop Loss – 55.0

- HSBC Holdings plc (HSBC) is a banking and financial services company. The Company’s segments include Wealth and Personal Banking (WPB), Commercial Banking (CMB) and Global Banking and Markets (GBM). WPB provides a range of retail banking and wealth management services, including insurance and investment products, global asset management services, investment management and private wealth solutions for customers. CMB offers a range of products and services to serve the needs of commercial customers, including small and medium-sized enterprises, mid-market enterprises and corporates. These include credit and lending, international trade and receivables finance, commercial insurance and investments. GBM provides tailored financial solutions to government, corporate and institutional clients and private investors worldwide. The Company operates across various geographical regions, which include Europe, Asia-Pacific, Middle East and North Africa, North America, and Latin America.

- Funds rotation to quality banks. The banking crisis in the US sparked by the downfall of SVB brought fears to investors, resulting in the capital rotation towards higher quality banks such as HSBC Bank. Recently, HSBC Bank has displayed its resilience amidst turmoils in the global banking sectors due to aggressive policy tightening with its good quarterly result, beating expectations with profit tripling YoY.

- More money into the money market. China’s central recently announced that they will increase the amount of cash pumped into the market, so as to rein in funding costs. This adds to evidence that China is continuing to ease monetary conditions to revive an economy handicapped by years of tough Covid-19 restrictions. This is bound to increase the demand and consumption in China within the near term.

- 1Q23 earnings. Revenue rose to US$20.2bn, a 64.0% increase YoY. Pre-tax profit of US$12.9bn increased 3 times, compared to US$4.2bn in 1Q22. 1Q23 EPS was US$0.52.

- Market Consensus

(Source: Bloomberg)

Alphabet Inc (GOOG US): Level the playing field

- BUY Entry – 113 Target – 123 Stop Loss –108

- Alphabet Inc. operates as a holding company. The Company, through its subsidiaries, provides web-based search, advertisements, maps, software applications, mobile operating systems, consumer content, enterprise solutions, commerce, and hardware products.

- Sprinkling in more Artificial intelligence. Google has announced its plan to incorporate AI technology into its search engine and other products. As part of this effort, the company will launch a new version of its search engine, called Search Generative Experience. This updated engine is designed to craft responses to open-ended questions and retain a recognizable list of links to the web, all using AI technology. Products such as Gmail will be able to draft messages while Google Photos will be equipped with more advanced image editing features that allow AI to modify users photos in various ways. Additionally, since Google wishes to prioritise accuracy and authenticity, its search engine will generate information citing reliable sources and will mark up its images that are generated with the help of AI.

- International Bard. Bard is a chatbot created by Google to rival OpenAI’s ChatGPT-4, which is accessible to users globally. Bard can be prompted with not only images but also text. Furthermore, Google has also announced the presence of a more powerful AI model it is working on, PaLM 1, which would be able to solve tougher problems and work on smartphones.

- 1Q23 earnings review. 1Q23 revenue grew by 2.6% YoY to US$69.79bn, beating estimates by US$950mn. 1Q23 GAAP EPS was US$1.17, beating estimates by US$0.10.

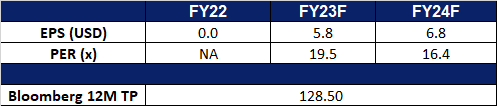

- Market consensus.

(Source: Bloomberg)

Airbnb Inc (ABNB US): Ontrack tourism recovery

- BUY Entry – 110 Target – 120 Stop Loss –105

- Airbnb, Inc., together with its subsidiaries, operates a platform that enables hosts to offer stays and experiences to guests worldwide. The company’s marketplace model connects hosts and guests online or through mobile devices to book spaces and experiences.

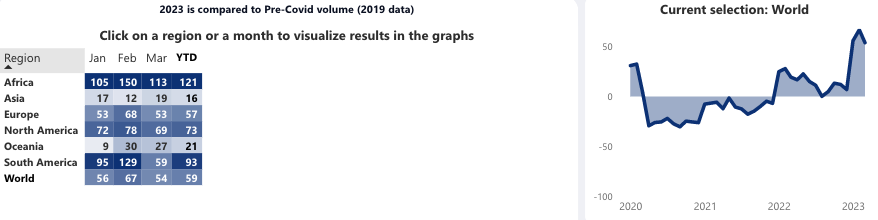

- Short-term rentals recovered back to pre-COVID level. According to the World Tourism Organization (UNWTO) tourism tracker, global short-term rentals in 1Q23 surged above the pre-COVID level, implying a strong demand for short-term accommodations.

Tourism Recovery Tracker – Short-term rentals

(Source: UNWTO)

(Source: UNWTO)

- Slowed growth. Airbnb has projected a lower YoY growth in nights and experiences booked, as well as in average daily rate (ADR) for the upcoming quarter. Despite recent market sell-offs, we remain bullish on ABNB as a buy. While the company previously benefited from the surge in demand for accommodations following the lifting of travel restrictions, it is now experiencing a slowdown in YoY revenue growth due to slowing travel demand. However, Airbnb is proactively responding to this shift by focusing on affordability. The company has introduced new features and upgrades such as Airbnb Rooms, lowered fees, and enabled payments made in installments. These changes increase price transparency and affordability, which is particularly appealing to price-sensitive travelers during this period of current inflation and volatile economic situation. Overall, we believe that these initiatives will help Airbnb continue to attract customers and drive growth in the long term.

- Competitions from professional hosts are not a threat. The recent short report indicated that the company faces competition from other peers who are building similar platforms and offering lower prices. However, the tourism market is such a big market that multiple players will co-exist and compete. On the other hand, travellers are more prone to hotels and resorts for a short term in the post-COVID era as more lavish trips are preferred after a three-year lockdown. However, the homestay market will continue to grow as budgeted travelling remains.

- 1Q23 earnings review. Revenue grew by 20.5% YoY to US$1.82bn, beating estimates by US$30mn. 1Q23 GAAP EPS was US$0.18, beating estimates by US$0.08. Gross booking value grew by 19% YoY to US$20.4bn. Nights and experiences booked grew by 19% YOY to 121.1mn. Average daily rates remained flat YoY at US$168. 2Q23 revenue is expected to between US$2.35bn to US$2.45bn. The consensus revenue estimate is US$2.42bn.

- Market consensus.

(Source: Bloomberg)

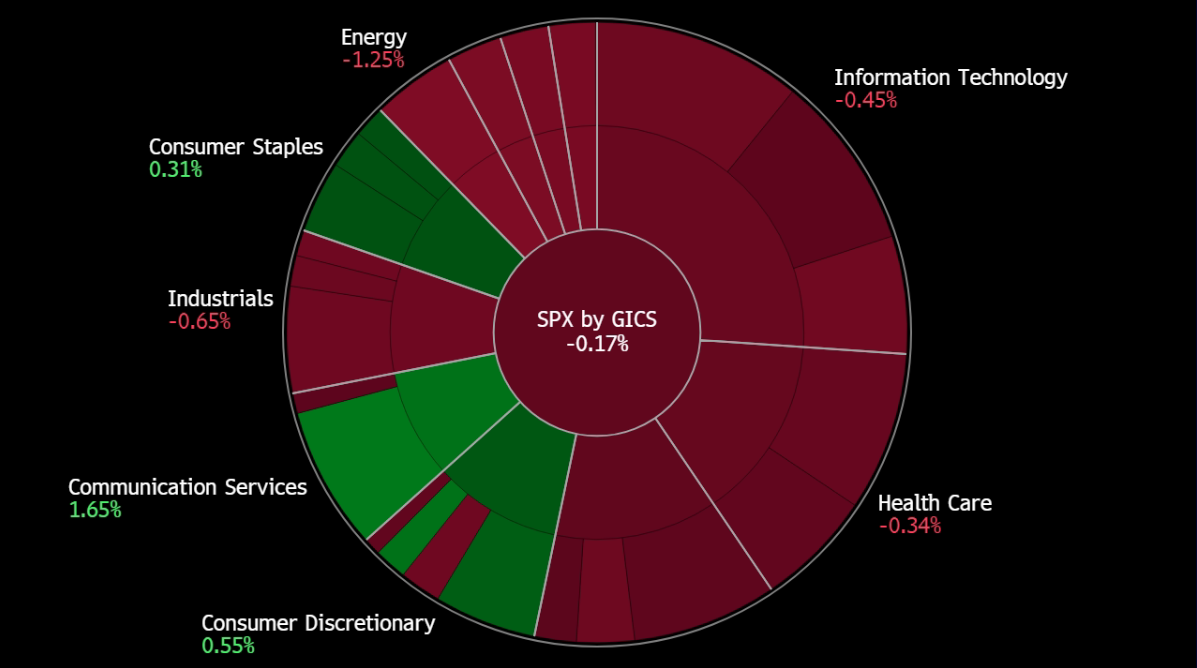

United States

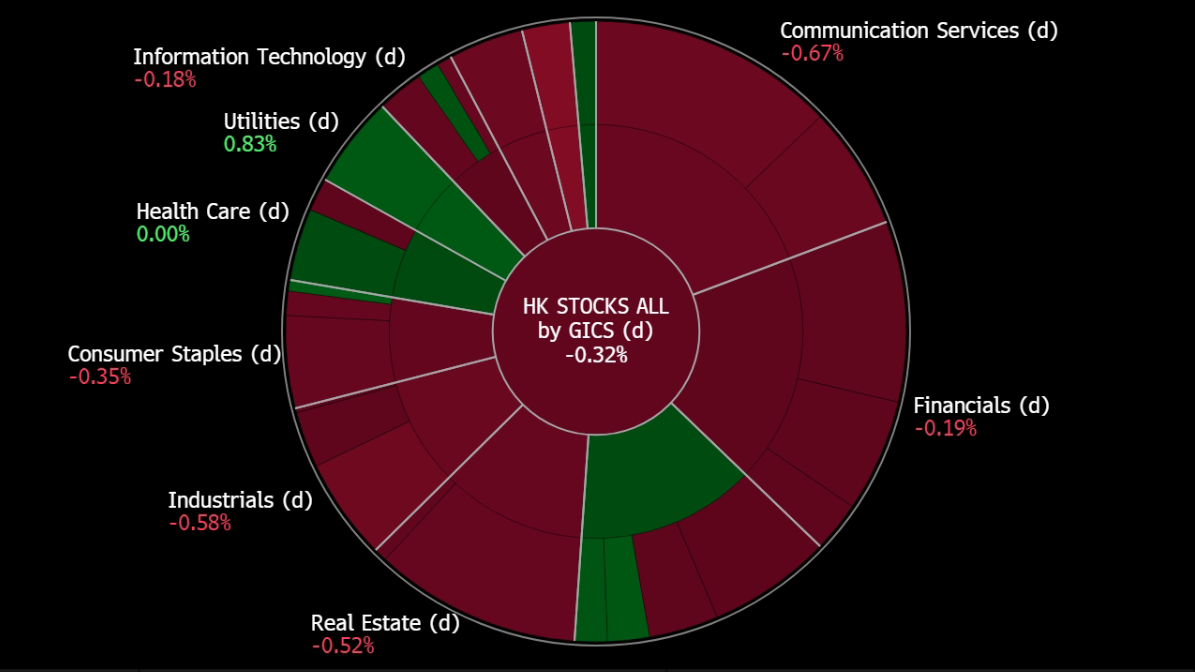

Hong Kong

Trading Dashboard Update: No stock additions/deletions.