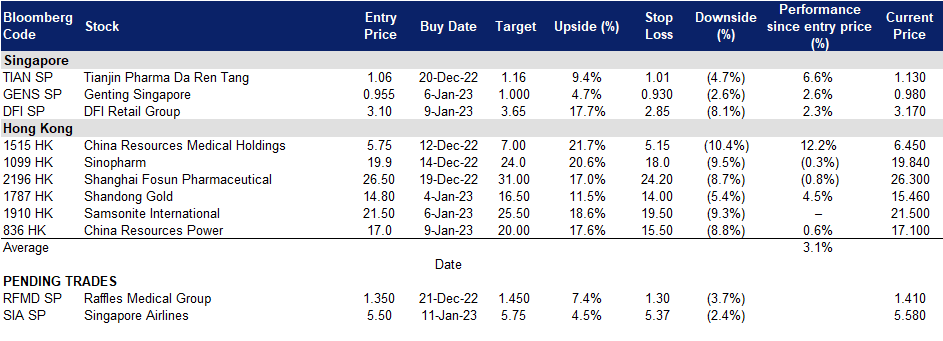

11 January 2023: Singapore Airlines Ltd (SIA SP), China Resources Power Holdings Company Limited (836 HK)

Singapore Trading Ideas | Hong Kong Trading Ideas | Market Movers | Trading Dashboard

Singapore Airlines Ltd (SIA SP): Further recover in 2023

- BUY Entry 5.50 – Target – 5.75 Stop Loss – 5.37

- The Singapore Airlines Group has over 20 subsidiaries, covering a range of airline-related services, from cargo to engine overhaul. Its subsidiaries also include SIA Engineering Company, Scoot, Tiger Airways, Singapore Flying College and Tradewinds Tours and Travel. Principal activities of the Group consist of air transportation, engineering services and other airline related activities.

- Post-Covid boom. In 11M22, according to statistics collated by Singapore Tourism Board, there has been an exponential increase in visitor arrivals since the reopening of our borders to vaccinated travellers without quarantine in April. Between January and November last year, there were about 5.37 million visitors, a YoY increase of 2,164.9% compared to the same period in 2021. China lifted its overseas travelling restrictions in early January 2023, and Singapore is expected to see a spike in Chinese tourist influx this year. According to the recent market survey from travel agents in China, Southeast Asian countries are among the top cross-border travelling preferences after a three-year lockdown.

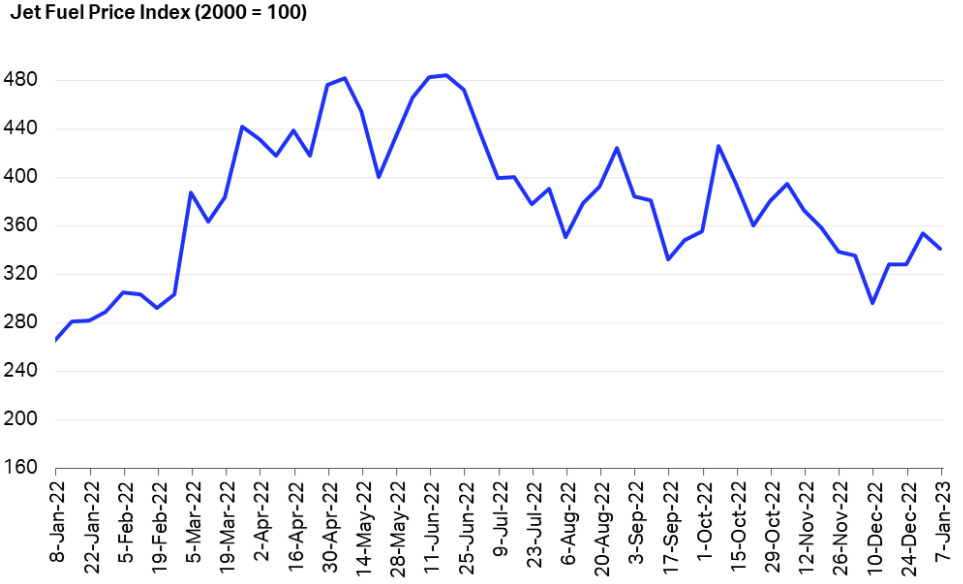

- Jet fuel prices fall. Due to concerns over a slowdown of global economic growth and recession, international oil prices have been trending downward since mid-2022. Accordingly, prices of crude oil derivatives fall, benefiting airline companies as part of operating costs drops.

Jet Fuel Price Index

(Source: IATA)

(Source: IATA)

- 1H23 results review. In1H23 (YE March), net profit arrived at S$927mn, recovering from an S$837mn loss during 1H22, resulting from the sharp revival in travel demand after economies reopened their borders. SIA and Scoot carried 11.4mn passengers during 1H23, a 13-fold jump from 1H22.

- Updated market consensus of the EPS in FY23/24 is S$0.584/S$0.390 respectively, which translates to 9.5x/14.3x forward PE. Bloomberg consensus average 12-month target price is S$5.62.

DFI Retail Group Holdings Ltd (DFI SP): Year of recovery

DFI Retail Group Holdings Ltd (DFI SP): Year of recovery

- RE-ITERATE BUY Entry – 3.10 Target – 3.65 Stop Loss – 2.85

- DFI Retail Group Holdings Limited operates as a retailer in Asia. The company operates through five segments: Food, Health and Beauty, Home Furnishings, Restaurants, and Other Retailing. It primarily operates supermarkets and hypermarkets under the Wellcome, Yonghui, CS Fresh, MarketPlace, Giant, Hero, Mercato, Oliver’s, 3hreesixty, San Miu, Jasons, and Lucky brands; and convenience stores under the 7-Eleven brand. The company also operates health and beauty stores under the Mannings, Guardian, and GNC brands; and home furnishings stores under the IKEA brand, as well as restaurants under the Maxim’s brand.

- Hong Kong-mainland China border reopens. The border reopened on 8th January after a three-year lockdown. The winter of Hong Kong’s retail sector is expected to be over. Tens of thousands of mainlanders will visit Hong Kong for vaccinations and medicines procurement. The influx of visitors will drive retail sales in Hong Kong, revitalising the sector which was badly hit by the pandemic over the past three years.

- Regional retail sector to recover further in 2023. As China reopened its borders, it is expected to see a sharp pent-up demand for overseas travelling. After three-year lockdowns in China, Chinese residents will favour Southeast countries as the destinations as the tour expenditures are relatively affordable. Hence, retail sales in Thailand, Malaysia, Singapore, and other popular tourist countries in the region are expected to further grow, boosted by Chinese tourist consumption.

- 1H22 results review. Total sales mildly edged up by 1% YoY to US$14bn. Loss attributable to shareholders was US$58mn compared to a net profit of US$17mn in 1H21.

- Updated market consensus of the EPS growth in FY23/24 is 523.3%/42.5% YoY respectively, which translates to 21.3x/15.0x forward PE. Current PER is 149.9x. Bloomberg consensus average 12-month target price is S$2.99.

China Resources Power Holdings Company Limited (836 HK): Power the economic revitalisation

- RE-ITERATE Buy Entry – 17.0 Target – 20.0 Stop Loss – 15.5

- China Resources Power Holdings Company Limited is a Hong Kong-based investment holding company principally engaged in the investment, development and operation of power plants. The Company operates through three segments. Thermal Power segment is engaged in the investment, development, operation and management of coal-fired power plants and gas-fired power plants, as well as the sales of heat and electricity. Renewable Energy segment is engaged in wind power generation, hydroelectric power generation and photovoltaic power generation, as well as the sales of electricity. Coal Mining segment is engaged in the mining of coal mines, as well as the sales of coal. The Company mainly operates businesses in China.

- Year of economic revitalisation. China has abandoned zero-covid policies by the end of 2022. Meanwhile, the authority released guidelines to expand domestic consumption in 2023, easing the crackdowns on several key sectors including real estate, technology, and education. On the other hand, China will continue to rely on infrastructure expansion to drive its economic growth, and one of the subsectors that are supported by policies is renewable energy. There are two tailwinds for the power sector, inorganic growth from clean energy (wind and solar) demand and margin improvement.

- Resumption of Australian coal import. In the first week of 2023, the National Development and Reform Commission is reported to hold talks with four state-owned importers over the partial lifting of the import ban on Australian thermal and coking coal. It is positive for the power sector as there will be more supply during the spring re-stocking period, and the seasonal increase in coal prices during the summer season will be mitigated accordingly. Therefore, the power sector will not see a sharp margin compression during the peak season in mid-year.

- November operation updates. Total net generation of subsidiary power plants in 11M22 increased by 3.9% YoY to 166,051,785MWh, among which, subsidiary wind farms increased by 10.5% YoY to 31,718,587MWh, subsidiary photovoltaic plants increased by 18.2% YoY to 1,243,941MWh.

- 1H22 earnings review. Turnover grew by 17.78% YoY to HK$50.4bn. The increase was mainly attributable to a YoY increase of 23.9% in the average on-grid tariffs (tax exclusive) of subsidiary coal-fired power plants and a YoY increase of 19.9% in the average sales price of heat supply of subsidiary coal-fired power plants. Net profit attributable to shareholders of the company dropped by 22.46% YoY to HK$4.4bn. The fall in net profit was due to the increase in operating expenses resulted from higher raw material costs.

- The updated market consensus of the EPS growth in FY23/24 is 37.8%/17.6% YoY, respectively, translating to 7.5×/6.4x forward PE. The current PER is 98.2x. FY23F/24F dividend yield is 5.4%/6.5% respectively. Bloomberg consensus average 12-month target price is HK$20.51.

Samsonite International S.A. (1910 HK): Chase the upward momentum

Samsonite International S.A. (1910 HK): Chase the upward momentum

- RE-ITERATE Buy Entry –21.5 Target – 25.5 Stop Loss – 19.5

- Samsonite International S.A. is a Hong Kong-based company principally engaged in the design, manufacture, sourcing and distribution of luggages, business and computer bags, outdoor and casual bags, travel accessories and slim protective cases for personal electronic devices. The Company operates its business through three segments. The Travel Bag segment is engaged in travel products with suitcases and carry-ons of three main categories, including hard-side, soft-side and hybrid luggages. The Casual Bags segment is engaged in daily use, including different types of backpacks, female and male shoulder bags and wheeled duffel bags. The Business Bags segment is engaged in business use, including rolling mobile office bags, briefcases and computer bags.

- China to see a peak of the current COVID wave by February 2023. China has further lifted COVID measures since early November, and ensuing COVID outbreaks spread across cities with dense populations. However, most cities release a timetable of peak estimates before or during the Chinese New Year period. Meanwhile, China is expected further to lift the quarantine restrictions for inbound tourists in 1Q23. Accordingly, China’s tourism sector is expected to recover quickly in 2023.

- Global tourism to continue to recover in 2023. According to the Economist Intelligence Unit Tourism in 2023 report, the global tourism arrivals will increase by 30% YoY in 2023, following growth of 60% YoY in 2022, but will remain below pre-COVID levels. Meanwhile, EIU also expects international arrivals to recover back to 2019 levels in 2024.

- 3Q22 results review. Net sales jumped by 42.0% (+54.7% constant currency) YoY to US$790.9mn. Operating profit jumped by 140% YoY to US$121.8mn. Profit attributable to the equity shareholders arrived at US$58.2mn in 3Q22 compared to a loss of US$5.2mn in 3Q21. The turnaround of the business and financials was due mainly to the effects of the COVID-19 pandemic on demand for the Group’s products moderated in most countries due to the continued rollout and effectiveness of vaccines leading governments in many countries to further loosen socialdistancing, travel and other restrictions, which has led to the continuing recovery in travel. However, the Chinese government reinstated travel restrictions and social distancing measures in an effort to combat further outbreaks of COVID-19, which has slowed the Group’s net sales recovery in China.

- The updated market consensus of the EPS growth in FY23/24 is 43.9%/16.3% YoY respectively, translating to 14.4x/12.4x forward PE. The current PER is 12.3x. Bloomberg consensus average 12-month target price is HK$27.42.

(Source: Bloomberg)

United States

Top Sector Gainers

| Sector | Gain/ Loss | Related News |

| Non-Energy Mineral | +2.31% | Dubai’s non-oil sector continues growth on sharp output rise: S&P Global BHP Group Ltd. (BHP US) |

| Retail Trade | +1.51% | Amazon expands its service that adds Prime badge to other sites Amazon.com Inc. (AMZN US) |

| Producer Manufacturing | +1.26% | John Deere announces its 2023 Startup Collaborators Deere & Company (DE US) |

Top Sector Losers

| Sector | Gain/ Loss | Related News |

| Consumer Non-Durables | -0.06% | US wholesale inventories rise 1% in November Procter & Gamble Company (PG US) |

| Utilities | +0.03% | How the U.S. will generate its power in 2050 and the stocks that will benefit, according to Wells Fargo NextEra Energy Inc. (NEE US) |

| Health Services | +0.18% | UnitedHealth Group Enters Oversold Territory United Health Group (UNH US) |

Hong Kong

Top Sector Gainers

|

Sector |

Gain/ Loss |

Related News |

|

Gamble |

+5.64% | Casinos Thrive against HK Mkt; MO To Offer Traffic Discount to HKers from Fri Galaxy Entertainment Group Ltd(0027 HK) |

|

Electronic Components |

+1.96% | Sunny Optical Proposes Issue of US$400M Sustainability-Linked Bonds Sunny Optical Technology Company Ltd.(2382 HK) |

|

Semiconductors |

+1.77% | Global semiconductor market to exceed US$1 trillion in 2030, at CAGR of 7% Semiconductor Manufacturing International Corporation(0981 HK) |

Top Sector Losers

|

Sector |

Gain/ Loss |

Related News |

|

Dairy Products |

-1.29% | Fitch Affirms Bright Food’s Rating at ‘A-‘; Outlook Stable Mengniu Dairy(2319 HK) |

|

Automobile Retailing, Maintenance & Repair |

-1.20% | Berkshire Hathaway sells 1.1 mn H-shares in China’s BYD Zhongsheng Group Holdings Ltd.(0881 HK) |

|

Watch & Jewellery |

-1.15% | Chow Tai Fook Group(1929 HK) |

Trading Dashboard Update: Add DFI Retail Group (DFI SP) at S$3.10 and China Resources Power (836 HK) at HK$17.0. Take profit on Fuyao Glass Industry (3606 HK) at HK$32.25. Cut loss on Keppel (KEP SP) at S$7.10.

(Source: Bloomberg)

(Source: Bloomberg) (Source: Bloomberg)

(Source: Bloomberg)

(Source: Bloomberg)

(Source: Bloomberg)