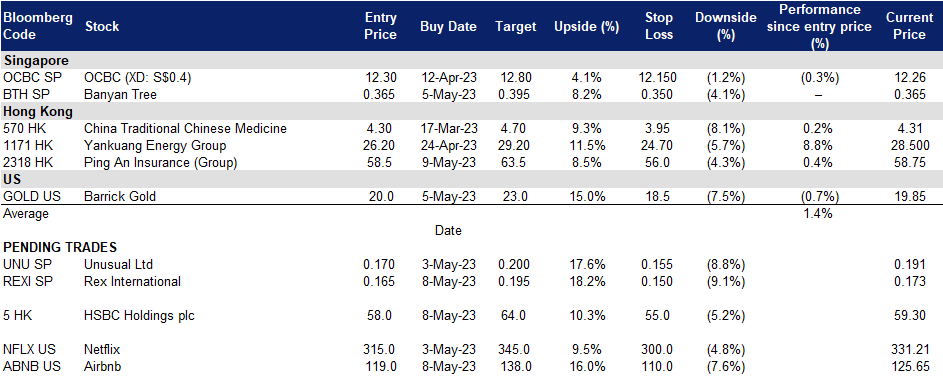

10 May 2023: Rex International Holding Ltd (REXI SP), HSBC Holdings plc (0005 HK), Airbnb Inc (ABNB US)

Singapore Trading Ideas | Hong Kong Trading Ideas |United States Trading Ideas | Sector Performance | Trading Dashboard

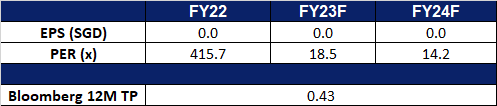

Rex International Holding Ltd (REXI SP): Oil rebound

- RE-ITERATE BUY Entry 0.165 – Target – 0.195 Stop Loss – 0.150

- Rex International Holding Limited operates as an independent oil exploration and production company. It operates through Oil and Gas, and Non-Oil and Gas segments. The company offers Rex Virtual Drilling, a liquid hydrocarbon indicator, which uses seismic data to search for oil. The company is involved in the oil and gas exploration and production activities with a focus in Oman and Norway.

- Oil and gas exploration in Norway. With the recent approval for REXI’s subsidiary Lime Petroleum AS for oil and gas exploration, the company would be able to find and tap into new sources of oil and gas in Norway. This would not only expand its Norwegian oil and gas supplies by tapping into new sources instead of solely depending on existing reserves, but it would also help improve its supply chain as it would now be less dependent on external stakeholders to source for oil and gas. Overall, while this approval may not result in immediate effects, it would be greatly beneficial for REXI in the long run.

- Oil to recover. The recent uncertainties facing the global economy such as the US banking crisis and high-interest rate environment, have led to a decline in oil prices, Brent and WTI futures, as well as a decrease in refining margins. However, with oil currently trading at the lower bound of the trading range, we expect it to recover in the coming weeks.

Brent crude oil price chart

(Source: Bloomberg)

- Plan to develop oil fields in Malaysia. A pact was made with Malaysia’s state-owned, Petronas regarding a project to develop oil fields in Malaysia. While the current costs do not allow REXI to effectively leverage the benefits of this agreement, we believe that it will be able to benefit from the developed oil fields in the future, allowing the firm to develop a competitive advantage over its peers.

- FY22 results review. Rex International posted a loss of US$1mn versus a net profit of US$67.2mn in 2021. Revenue for the financial year from crude oil sales was up 7% to US$170.3mn.

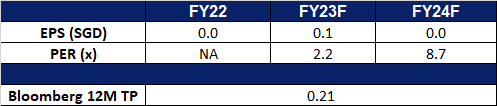

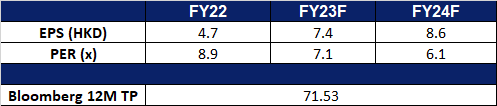

- Market consensus.

(Source: Bloomberg)

Banyan Tree Holdings Ltd. (BTH SP): On-track expansion amid tourism recovery

- RE-ITERATE BUY Entry 0.365 – Target – 0.395 Stop Loss – 0.350

- Banyan Tree Holdings Limited operates as a holding company. The Company, through its subsidiaries, owns and manages hotel groups. The Company focuses on hotels, resorts, spas, galleries, golf courses, and residences, as well as provides investments, design, construction, and project management services. Banyan Tree Holdings serves customers worldwide.

- Oil price decline, potential for incline. Oil prices recently fell due to the banking crisis seen affecting the markets the past week.

- May Day holiday tourism rebound. According to the Ministry of Culture and Tourism, the number of domestic trips reached 274mn during the five-day holiday, a 70.8% increase YoY and up 19% from 2019 levels, resulting in a total domestic tourism spending of 148bn yuan (US$21bn), rising 128.9% YoY and on par with pre-Covid levels. Furthermore, with overseas flights still below 2019 levels and China’s May Day holiday being the first travel season without Covid curbs in China boosting domestic tourism so significantly, it could be signalling a sustained recovery in China’s tourism sector. During this period hotels in China saw a surge in demand raising both their occupancy and average daily room rates.

- China’s recovery to contribute to revenue growth. Due to the lifting of travel restrictions and the issuance of all types of visas in China, Banyan Tree is well-positioned to benefit in FY23. With 14 hotels already operating in the country and four more scheduled to open this year, the group stands to attract a growing number of tourists to its properties in China and capitalise on the country’s recovering tourism sector and economy.

- FY22 results review. Revenue for FY22 increased 23% to S$271.3mn, from S$221.2mn a year ago. Return to profitability in 2022, from the previous year’s loss after tax and minority interests of S$55.2mn to a profit of S$0.8mn.

- Market consensus.

- Read the full fundamentals-based report here.

(Source: Bloomberg)

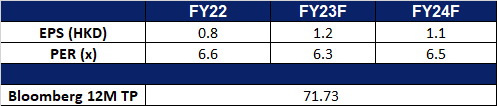

HSBC Holdings plc (0005 HK): Better Liquidity

- RE-ITERATE BUY Entry – 58.0 Target – 64.0 Stop Loss – 55.0

- HSBC Holdings plc (HSBC) is a banking and financial services company. The Company’s segments include Wealth and Personal Banking (WPB), Commercial Banking (CMB) and Global Banking and Markets (GBM). WPB provides a range of retail banking and wealth management services, including insurance and investment products, global asset management services, investment management and private wealth solutions for customers. CMB offers a range of products and services to serve the needs of commercial customers, including small and medium-sized enterprises, mid-market enterprises and corporates. These include credit and lending, international trade and receivables finance, commercial insurance and investments. GBM provides tailored financial solutions to government, corporate and institutional clients and private investors worldwide. The Company operates across various geographical regions, which include Europe, Asia-Pacific, Middle East and North Africa, North America, and Latin America.

- Funds rotation to quality banks. The banking crisis in the US sparked by the downfall of SVB brought fears to investors, resulting in the capital rotation towards higher quality banks such as HSBC Bank. Recently, HSBC Bank has displayed its resilience amidst turmoils in the global banking sectors due to aggressive policy tightening with its good quarterly result, beating expectations with profit tripling YoY.

- More money into the money market. China’s central recently announced that they will increase the amount of cash pumped into the market, so as to rein in funding costs. This adds to evidence that China is continuing to ease monetary conditions to revive an economy handicapped by years of tough Covid-19 restrictions. This is bound to increase the demand and consumption in China within the near term.

- 1Q23 earnings. Revenue rose to US$20.2bn, a 64.0% increase YoY. Pre-tax profit of US$12.9bn increased 3 times, compared to US$4.2bn in 1Q22. 1Q23 EPS was US$0.52.

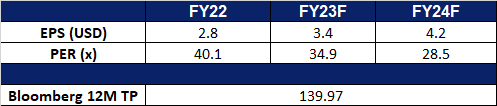

- Market Consensus

(Source: Bloomberg)

Ping An Insurance (Group) (2318 HK): A shelter from US banking fears

- RE-ITERATE BUY Entry – 58.5 Target – 63.5 Stop Loss – 56.0

- Ping An Insurance (Group) Company of China, Ltd. is a personal financial services provider. The Company provides insurance, banking, investment, and Internet finance products and services. The Company operates its businesses through four segments. The Insurance segment provides life insurance and property insurance, including term, whole-life, endowment, annuity, automobile and health insurance. The Banking segment is engaged in loan and intermediary businesses with corporate customers and retail business. The Assets management segment is engaged in security, trust and other assets management businesses, including investment, brokerage, trading and asset management services. The Internet Financing segment is engaged in the provision of Internet finance products and services.

- Funds rotation from US to China Stocks. Global funds are gradually returning to China’s onshore stock market as the nation emerges from Covid restrictions and pivots to pro-growth policies. The banking crisis in the US sparked by the downfall of SVB brought fears to investors, resulting in the capital rotation from the US financial sector to China one. Recently, shares of Chinese fincial stocks are outperforming American peers amid concerns over the global banking sector, emerging as an oasis shielded from volatility abroad.

MSCI China Financials (red) vs MSCI US Financials (blue)

(Source: Bloomberg)

(Source: Bloomberg)

- Home sales recovering. In April, China’s real estate sector continued to show signs of recovery as home sales by the country’s 100 biggest real estate developers increased for the third consecutive month. This growth is attributed to the financial support provided by regulators to the sector, including lowered mortgage rates and eased buying curbs in many large cities such as Shanghai. Preliminary data from China Real Estate Information Corp shows that the value of new home sales by the 100 biggest developers rose by 31.6% from the previous year to reach RMB566.5bn (US$81.9bn). This indicates a significant rebound in the real estate market, which had been struggling due to a slowing economy and tighter regulations in recent years.

- FY22 earnings. Revenue declined to RMB985.7bn compared to RMB1,057.6bn in FY2021 (-6.7% YoY). Net profit dropped to RMB83.8bn in FY2022, representing a decline by 17.6% compared to RMB101.6bn in FY2021. FY2022 EPS was RMB4.80.

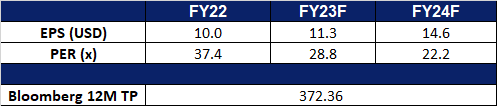

- Market Consensus

(Source: Bloomberg)

Airbnb Inc (ABNB US): Ontrack tourism recovery

- RE-ITERATE BUY Entry – 119 Target – 138 Stop Loss –110

- Airbnb, Inc., together with its subsidiaries, operates a platform that enables hosts to offer stays and experiences to guests worldwide. The company’s marketplace model connects hosts and guests online or through mobile devices to book spaces and experiences.

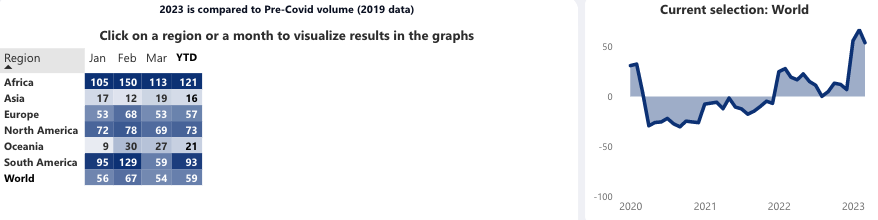

- Short-term rentals recovered back to pre-COVID level. According to the World Tourism Organization (UNWTO) tourism tracker, global short-term rentals in 1Q23 surged above the pre-COVID level, implying a strong demand for short-term accommodations.

Tourism Recovery Tracker – Short-term rentals

(Source: UNWTO)

(Source: UNWTO)

- Competitions from professional hosts are not a threat. The recent short report indicated that the company faces competition from other peers who are building similar platforms and offering lower prices. However, the tourism market is such a big market that multiple players will co-exist and compete. On the other hand, travellers are more prone to hotels and resorts for a short term in the post-COVID era as more lavish trips are preferred after a three-year lockdown. However, the homestay market will continue to grow as budgeted travelling remains.

- 4Q22 earnings review. Revenue grew by 24.2% YoY to US$1.9bn, beating estimates by US$40mn. 4Q22 GAAP ESP was US$0.48, beating estimates by US$0.21. Gross booking value grew by 20% YoY to US$13.5bn. Nights and experiences booked grew by 20% YOY to 88.2mn. Average daily rates fell 1% YoY to US$153. 1Q23 revenue is expected to between US$1.75bn to US$1.82bn. The consensus revenue estimate is US$1.69bn.

- Market consensus.

(Source: Bloomberg)

(Source: Bloomberg)

Netflix, Inc. (NFLX US): Ignore noises

- RE-ITERATE BUY Entry – 315 Target – 345 Stop Loss –300

- Netflix, Inc. provides entertainment services. It offers TV series, documentaries, feature films, and mobile games across various genres and languages. The company provides members the ability to receive streaming content through a host of internet-connected devices, including TVs, digital video players, television set-top boxes, and mobile devices.

- Hollywood writer strike is a dip-buying opportunity. Hollywood writers voted to strike after six weeks of negotiating with major entertainment and filming companies including Netflix. This is a strike since 2007, and it cost billions of dollars in lost output and a quarter of prime-time programming for the network TV season back then. However, this is a buying opportunity as Netflix’s productions are more diversified. In recent years, Korean films and dramas which increasingly gains attraction, and previously the company was set to invest US$2.5bn in Korean content over the next 4 years. The strike has a limited impact on those productions. Besides, the main crowd of the strike is scriptwriters but actors, hence, productions are expected to continue even when the strike is on.

- 1Q23 earnings review. 1Q23 revenue grew by 3.7% YoY to US$8.16bn, missing estimates by US$20mn. 1Q23 GAAP EPS was US$2.88, beating estimates by US$0.01. Average paid memberships grew by 4% YoY to 1.75mn.

- Market consensus.

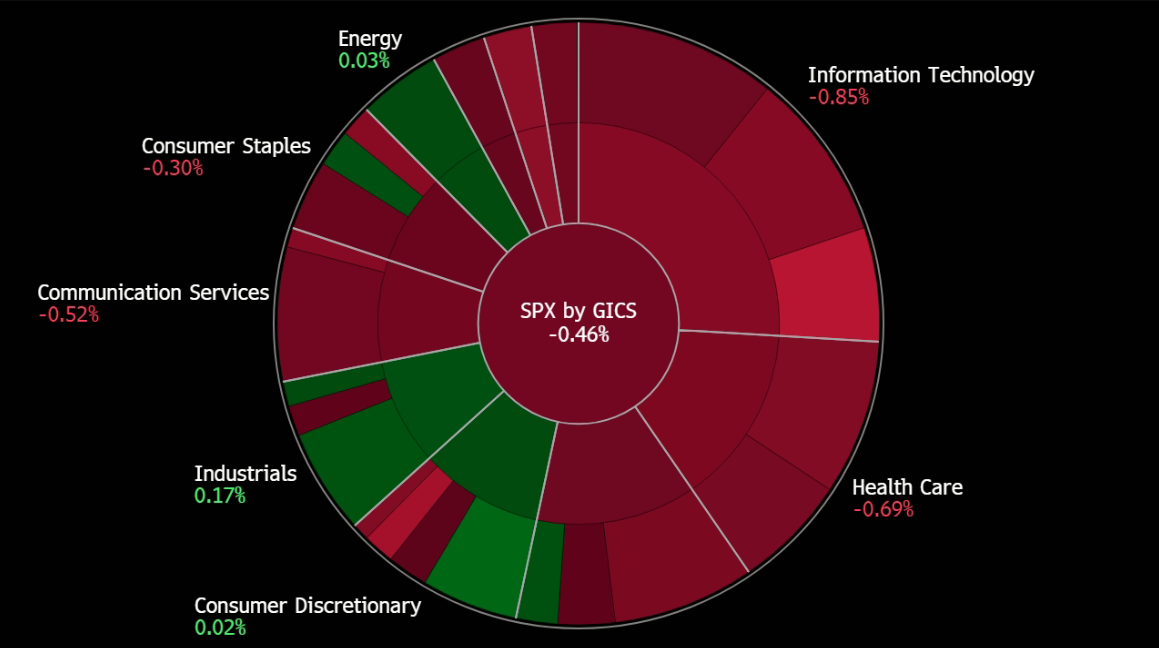

United States

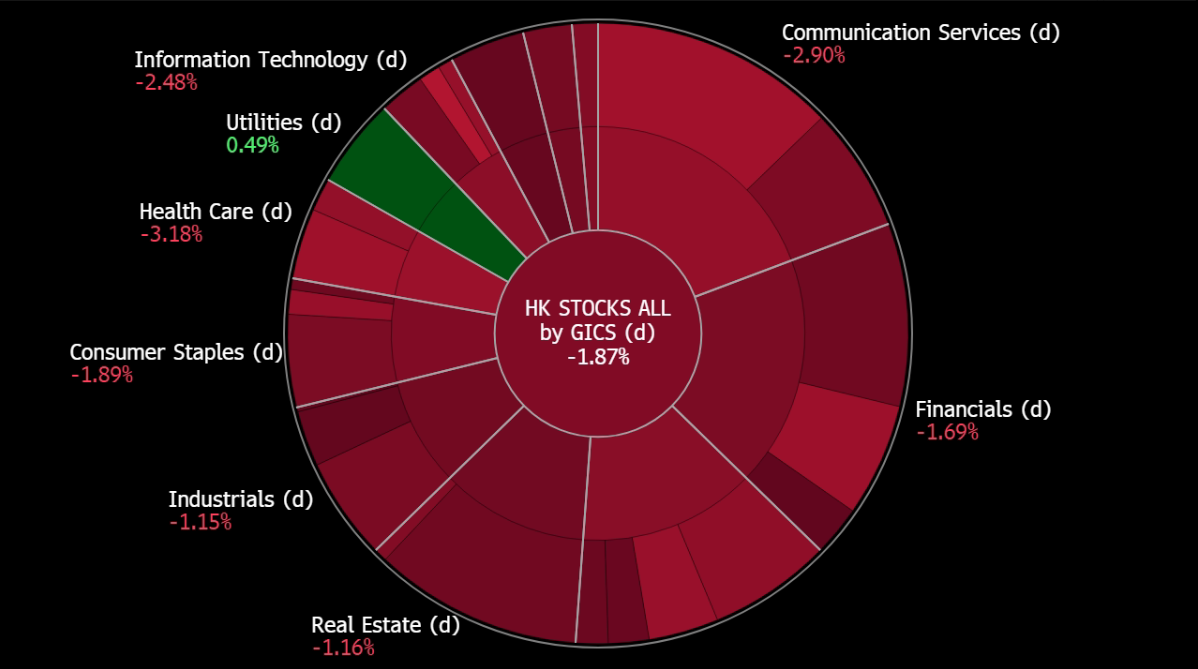

Hong Kong

Trading Dashboard Update: Add Ping An Insurance (2318 HK) at HK$58.5.