10 March 2023: Wilmar International Ltd. (WIL SP), Prada SpA (1913 HK), Daqo New Energy Corp (DQ US)

Singapore Trading Ideas | Hong Kong Trading Ideas |United States Trading Ideas | Sector Performance | Trading Dashboard

Wilmar International Ltd. (WIL SP): Rising Soft Commodities prices

- RE-ITERATE BUY Entry 3.95 – Target – 4.15 Stop Loss – 3.85

- Wilmar International Limited operates as a food processing company. The Company offers oil palm cultivation, edible oil refining, crushing, and gains processing services, as well as provides sugar, flour, and rice. Wilmar International serves customers worldwide.

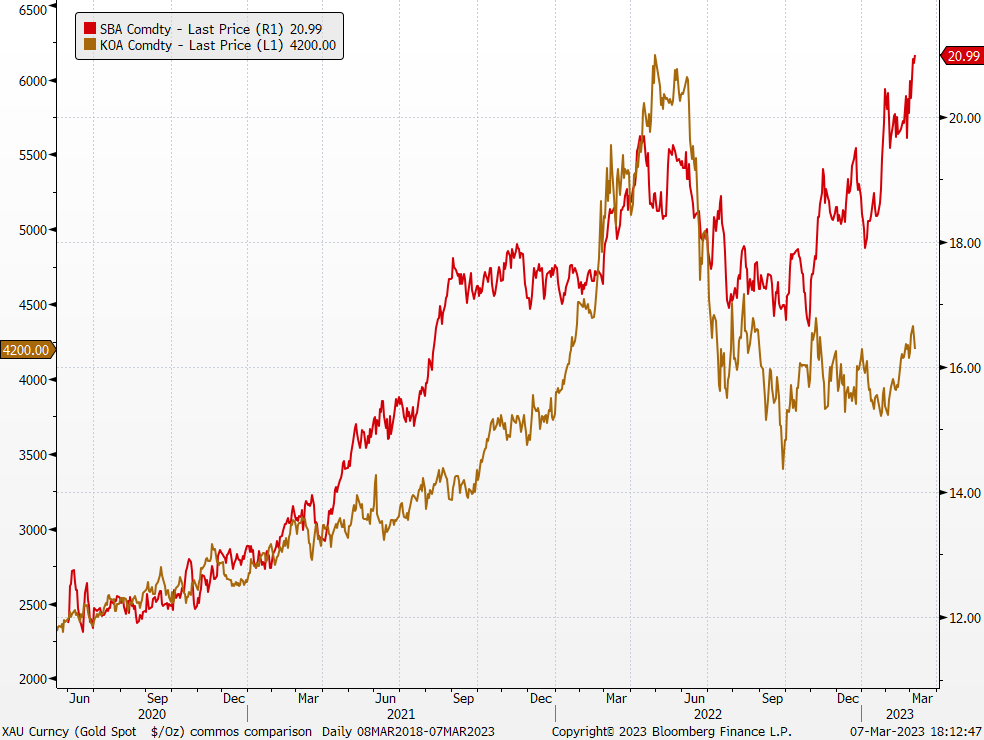

- Sugar Futures prices. Raw sugar futures hovers at the 21 cents/pound range and recently reached a 6-year high of 22.1 cents/pound due to tight supply concerns, supported by a strong demand expectation boosted by China’s recent re-opening, as well as a worsening production outlook by India and Europe. The latest estimates showed that the world’s second-largest sugar exporter is likely to produce 34mn tonnes of the commodity in 2023, down 7% from a previous forecast.

- Palm Oil Futures Prices. Short-term weather disruptions will likely support Malaysia’s crude palm oil prices in the short term as supply takes a hit from the ongoing floods. Asian palm oil buyers also recently seek stable export policies from producers to reduce the volatility of the supply chain. Palm oil production is also expected to be higher in FY23 than in FY22 due to improved labour supply.

Raw sugar (red) and crude palm oil (brown) futures price trend

(Source: Bloomberg)

(Source: Bloomberg)

- FY22 results review. The company announced record earnings of US$2.4bn (S$3.2 bn) for FY22, a 27.1% growth from US$1.9bn in FY21; core net profit for FY22 improved 31% to US$2.42bn.

- Updated market consensus of the EPS in FY23/24 is US$0.309/US$0.329 respectively, which translates to 9.52x/8.94x forward PE. Current PER is 7.68x. Bloomberg consensus average 12-month target price is S$5.24.

(Source: Bloomberg)

HongKong Land (HKL SP): Benefiting from “World of Winners”

HongKong Land (HKL SP): Benefiting from “World of Winners”

- RE-ITERATE BUY Entry 4.50 – Target – 4.80 Stop Loss – 4.35

- Hongkong Land is a major listed property investment, management and development group. The Group owns and manages more than 850,000 sq. m. of prime office and luxury retail property in key Asian cities, principally Hong Kong, Singapore, Beijing and Jakarta. The Group also has a number of high quality residential, commercial and mixed-use projects under development in cities across China and Southeast Asia, including a 43% interest in a 1.1 million sq. m. mixed-use project in West Bund, Shanghai.

- Improving tourism sector sentiments. Cathay Pacific will provide 80,000 free round-trip air tickets to Hong Kong for residents throughout Southeast Asia as part of the “World of Winners” campaign sponsored by Airport Authority Hong Kong, which offers 500,000 free tickets to global visitors. The objective of this initiative is to support the “Hello Hong Kong” campaign of the Hong Kong Tourism Board, which aims to welcome tourists back to the city following the lifting of travel restrictions. This would definitely be an additional and effectively booster to drive tourism demand for Hong Kong.

- Removal of COVID-19 mask mandates. Hong Kong announced recently that the city will lift its COVID-19 mask mandate. This decision is aimed at attracting visitors and business and resuming normal life, more than three years after strict regulations were initially put in place in the financial hub. This shows confidence and strength in that the country is emerging from the pandemic. This is bound to drive the level of tourism within Hong Kong as well, as more activities resume as per pre-pandemic times.

- FY22 results review. Underlying profit fell 20% YoY to S$776mn in FY22 from S$966mn in FY21.Net profit came in at US$203 million for the year, after including net non-cash losses of US$573.4 million due to lower valuations of the group’s investment properties.

- Updated market consensus of the EPS growth in FY23/24 is 14.8%/5.2% respectively, which translates to 11.5x/10.9x forward PE. Current PER is 13.5x. Bloomberg consensus average 12-month target price is S$5.19.

Prada SpA (1913 HK): Expensive taste

- RE-ITERATE BUY Entry – 52 Target – 56 Stop Loss – 50

- Prada SpA is an Italy-based company engaged in fashion industry. The Company is a parent of the Prada Group. The Company, along with its subsidiaries, is engaged in the design, production and distribution of leather goods, handbags, clothing, eyewear, fragrances, footwear and accessories. Prada SpA manufactures jackets, trousers, skirts, dresses, sweaters, blouses, as well as perfumes and watches, among others. The Company trades its products through several brands, such as Prada, Miu Miu, The Church and The Car Shoe. Prada SpA operates in approximately 70 countries through directly operated stores, franchise operated stores, a network of selected multi-brand stores and department stores. Prada Spa operates through a numerous subsidiaries, including Artisans Shoes Srl, Angelo Marchesi Srl, Prada Far East BV, Tannerie Megisserie Hervy SAS and Prada SA, among others.

- Lyst index. Lyst, a reporting index that uses shopper data to rank popular fashion brands quarterly, has released its latest report for October to December 2022, marking its fifth year of customer insights. This unique index ranks fashion’s top brands and products by gathering shopping data from two hundred million customers globally. The determination of brand heat on the Lyst index chart goes beyond sales and views. It also includes social media mentions, activity, and engagement stats from around the world to determine which brands top the rankings. In Lyst’s latest report, Prada ranked at the top followed by Gucci and Moncler.

- World’s biggest luxury spenders. Growing global affluence has led to an upswing in luxury spending, contributing to Mr. Bernard Arnault’s rise as the world’s richest person through his luxury-goods powerhouse LVMH. Despite the pandemic, there was high consumer confidence, and South Koreans have emerged as the world’s top per-capita spenders on luxury brands. According to a Morgan Stanley report, South Korean nationals accounted for over 10% of total retail sales by high-end brands such as Prada, Moncler, Bottega Veneta, and Burberry Group, with spending on personal luxury goods rising 24% to 21.8 trillion won (S$23.2 billion) in 2022.

- Rise of social media marketing. Social media marketing has risen in recent years, with brands utilizing these platforms to reach more users. Brands engage celebrities and influencers to create content by sending them new products and occasionally paying them a fee. The popularity of South Korean pop culture has led top fashion houses and luxury brands to sign South Korean stars as ambassadors, influencing fans to purchase endorsed products through various advertisements.

- 1H22 earnings. Revenue in 1H22 was €1.9 bn, up 22% YoY. Retail Sales rose 26% YoY to €1.7 bn.

- The updated market consensus of the EPS growth in FY22/23 is 54.5%/18.5% YoY respectively, which translates to 35.5x/30.0x forward PE. Current PER is 41.92x. Bloomberg consensus average 12-month target price is HK$55.42.

(Source: Bloomberg)

China Shenhua Energy Co Ltd (1088 HK): Policy supports

- RE-ITERATE BUY Entry – 24.9 Target – 26.5 Stop Loss – 24.1

- China Shenhua Energy Co Ltd is a China-based comprehensive energy company. The Company operates its businesses through six segments. The Coal Business segment is engaged in coal mining and sales of surface and underground coal mines. The Power Generation Business segment is engaged in coal power generation, wind power generation, hydropower generation, gas power generation and power sales business. The Railway Business segment provides railway transportation services. The Port Business segment provides port cargo handling, handling and storage services. The Shipping Business segment provides shipping and transportation services. The Coal Chemical Business segment is engaged in the manufacturing and sales of olefin products. The Company conducts its businesses both in the domestic market and overseas markets.

- Support for SOEs. Chinese authorities plan to boost China’s state-owned enterprises (SOEs) valuations with more support for such firms. They have been encouraged by the government to expand globally and are also tasked to carry out research based on national strategic and industrial upgradng needs. With governmental support, SOEs will be able to better fortify international deals and attain more international infrastructural projects. In 2022, these SOEs have already seen their net profit grow to RMB1.9tn, a 35.7% growth compared to 2020.

- Coal demand. With China continuing its transition to green energy, they plan to promote clean and efficient utilization of coal to generate energy alongside building new renewable energy systems. As such they will continue to ramp up coal production which will be beneficial to China Shenhua Energy.

- FY22 earnings gudiance. The estimated profit attributable to the shareholders is between RMB71.9bn to RMB73.9bn, about a 39.3% to 43.2% YoY increase from RMB51.6bn in FY21.

- The updated market consensus of the EPS growth in FY23/24 is -8.0%/-1.9%, respectively, which translates to 6.4x/6.5x forward PE. FY23F/24F dividend yield is 12.4%/11.9%, respectively. Current PER is 6.08x. Bloomberg consensus average 12-month target price is HK$29.21.

(Source: Bloomberg)

Daqo New Energy Corp (DQ US): Gridlock alleviated

- RE-ITERATE BUY Entry – 53 Target – 63 Stop Loss – 48

- Daqo New Energy Corporation manufactures polysilicon. The Company markets its polysilicon to photovoltaic product manufacturers who process it into ingots, wafers, cells and modules for solar power products.

- Loosening restriction of solar panel imports. According to Reuters, the US custom officials clarified rules around complying with the law banning goods made with forced labor. Accordingly, solar panel imports from China rose. The clearance of the gridlock which lasted for months helps the recovery in the demand for solar panels and the prices of polusilicon in the near term.

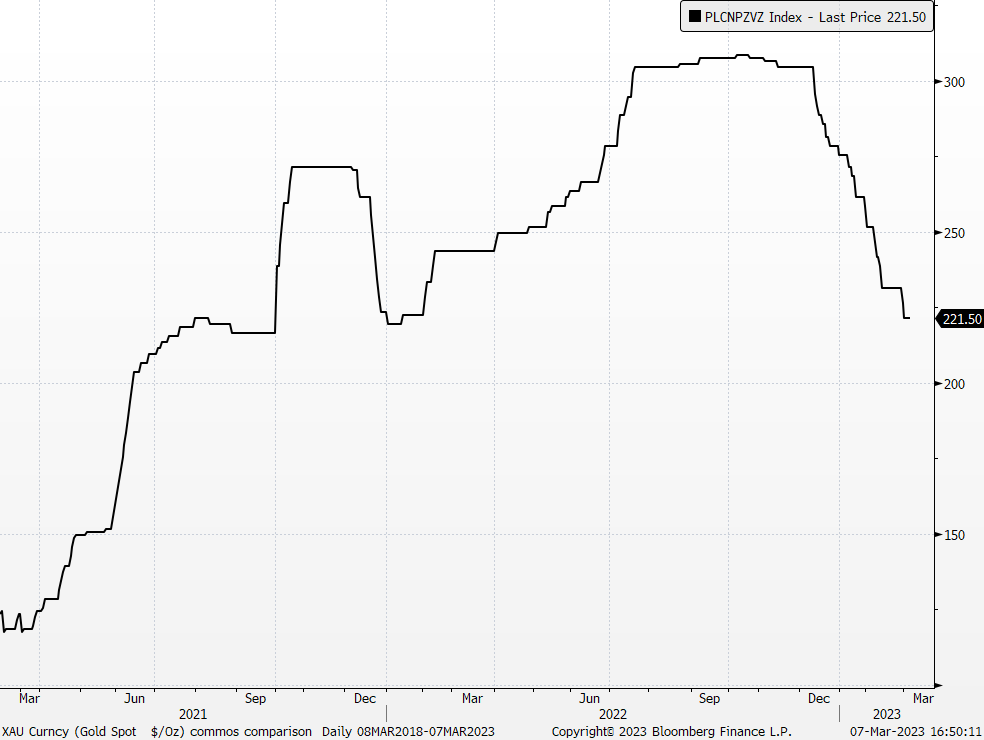

China polysilicon 9N delivered (RMB/kg)

(Source: Bloomberg)

(Source: Bloomberg)

- China reiterated renewable energy development. The government work report 2023 released during the two sessions a few days ago mentioned the general goals and proposals that China will strenthern the construction of urban and rural environmental infrastructure, and continuing to implement major projects for the protection and restoration of important ecosystems.

- 4Q22 results reveiw. Revenue jumped by 118.5% YoY to US$864.3mn. Non-GAAP EPS was US$5.17. Polysilicon production volume was 33,702 MT in 4Q22, compared to 33,401 MT in 3Q22. Polysilicon sales volume was 23,400 MT in 4Q22, compared to 33,126 MT in 3Q22. Polysilicon average selling price was US$37.41/kg in 4Q22, compared to US$36.44/kg in 3Q22.

- The updated market consensus of the EPS growth in FY23/24 is -37.9%/-32.6%, respectively, which translates to 3.2x/4.7x forward PE. Current PER is 2.3x. Bloomberg consensus average 12-month target price is US$61.73.

(Source: Bloomberg)

Tapestry (TPR US): Hedging against inflation

Tapestry (TPR US): Hedging against inflation

- RE-ITERATE BUY Entry – 42.8 Target – 47.0 Stop Loss – 40.7

- Tapestry, Inc. provides luxury accessories and branded lifestyle products in the United States, Japan, Greater China, and internationally. The company operates in three segments: Coach, Kate Spade, and Stuart Weitzman.

- High-end consumption will remain in the post-COIVD era. Under the macro environment of continuous inflation, luxury goods giants have successively raised the unit prices of products to maintain profit margins. The tourism industry in various countries is expected to continue to recover this year, which will grow the industry’s sales further. High-end consumers are less sensitive to luxury prices. Price hikes and hunger marketing keep attracting consumers’ attention.

- Mixed 2Q23 results but better FY23 outlook. In 2Q23, revenue slightly dropped by 5.4% YoY to US$2.03bn, missing estimates by US$10mn. Non-GAAP EPS beat estimates by US$0.06 and arrived at US$1.33. FY23 revenue is expected to reach US$6.6bn, up 2%-3% YoY on a constant currency basis. Diluted EPS is expected to range from US$3.70-US$3.75.

- The updated market consensus of the EPS growth in FY23/24 is 7.6%/12.7%, respectively, which translates to 11.6x/10.3x forward PE. Current PER is 12.5x. Bloomberg consensus average 12-month target price is US$51.33.

(Source: Bloomberg)

United States

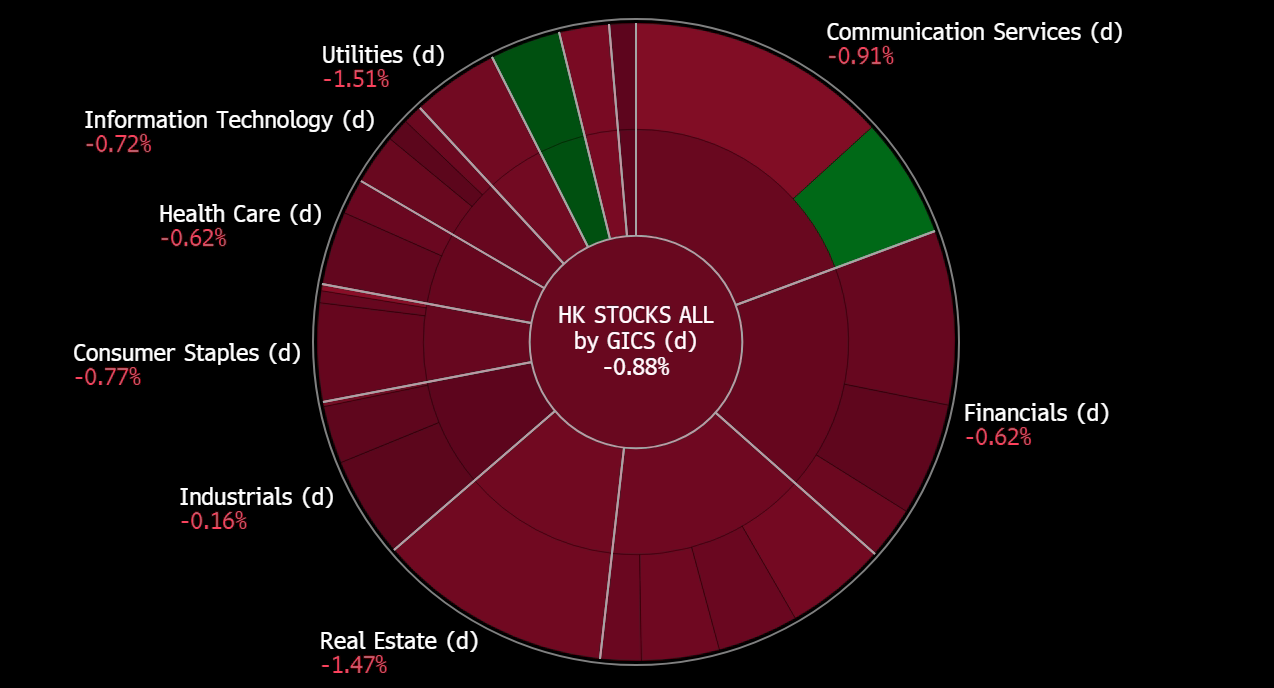

Hong Kong

Trading Dashboard Update: Add Tapestry (TPR US) at US$42.8 and Daqo New Energy (DQ US) at US$53.0. Take profit on Enphase Energy (ENPH US) at US$218.3. Cut loss on Cathay Pacific Airways (293 HK) at HK$7.61 and Barrick Gold (GOLD US) at US$15.6.