10 July 2023: Bumitama Agri Ltd (BAL SP), Standard Chartered PLC (2888 HK), Interactive Brokers Group Inc (IBKR US)

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

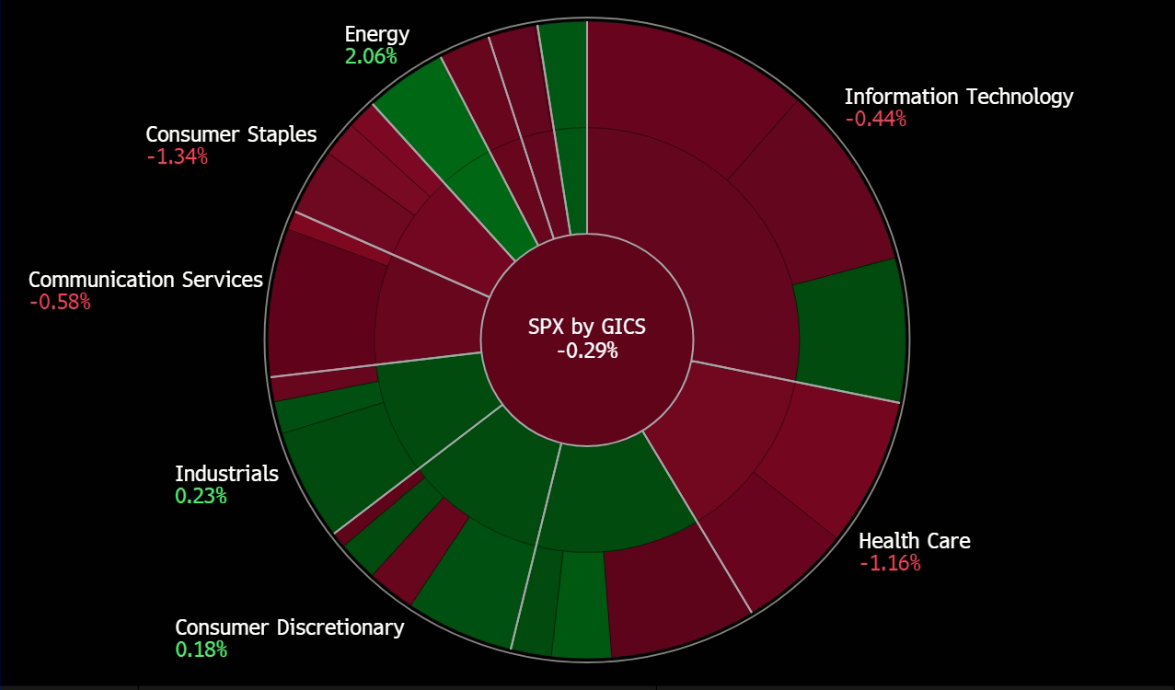

United States

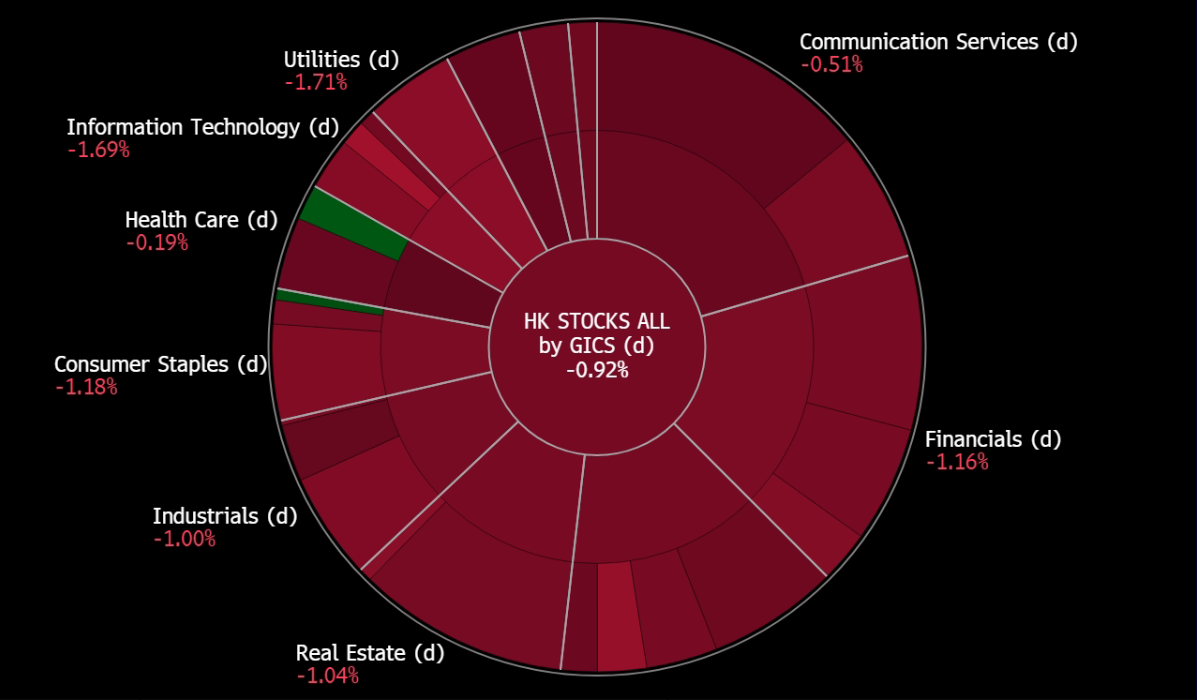

Hong Kong

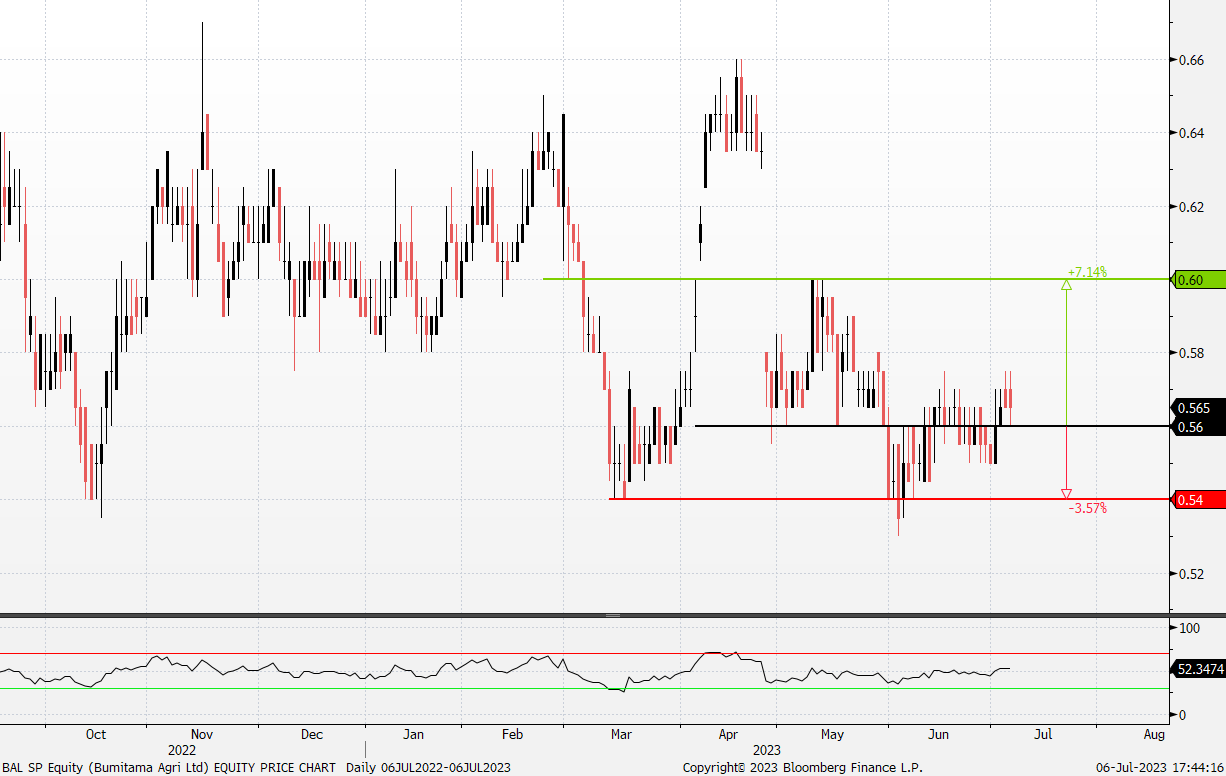

Bumitama Agri Ltd (BAL SP): Expecting a short-term rebound

- RE-ITERATE BUY Entry 0.560 – Target – 0.600 Stop Loss – 0.540

- Bumitama Agri Ltd. produces CPO and PK, with its oil palm plantations located in Indonesia. The Company’s primary business activities are cultivating and harvesting our oil palm trees, processing FFB from its oil palm plantations, its plasma plantations and third parties into CPO and PK, and selling CPO and PK in Indonesia.

- Palm Oil Futures Prices. Malaysian palm oil futures slightly pulled back to MYR 3,900/tonne after it jumped to near MYR4,000/tonne as a US acreage report showed smaller-than-expected soybean plantings shocked crop markets.

- Palm oil price support. Lower soybean production in the US, ongoing El Nino weather conditions affecting oilseeds and oil palm crops, and a weaker ringgit are anticipated to uphold the elevated prices of crude palm oil (CPO) above RM3,400/tonne. Palm oil prices experienced an increase as a result of strong shipments from Malaysia in early July, which alleviated concerns regarding heightened production levels in the country. Exports more than doubled compared to the previous month, suggesting a positive outlook for export demand in July and August, potentially slowing the rise in stockpiles. Furthermore, palm oil prices are being supported by gains in rival soybean oil prices, following the unexpected reduction in the US soybean planting estimate for this summer. Additionally, petroleum prices have been bolstered by supply cuts from OPEC+, which may enhance the attractiveness of vegetable oils as alternative fuels.

- 1Q23 earnings review. Revenue declined by 8% YoY to 3.6tn IDR from the previous 3.9tn IDR. Net profit fell 51% YoY, to 429.1bn IDR (S$40mn) from 873bn IDR. The decline in net profit is attributable to lower ASP alongside rising fertiliser prices.

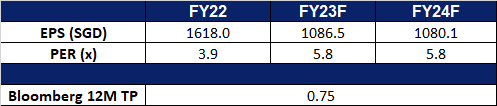

- Market consensus.

(Source: Bloomberg)

ThaiBev (THBEV SP): Recovering consumer confidence

ThaiBev (THBEV SP): Recovering consumer confidence

- RE-ITERATE BUY Entry 0.57 – Target – 0.65 Stop Loss – 0.53

- Thai Beverage Public Company Limited is Thailand’s largest and leading beverage producer and distributor. Its operation is considered among the leading distillers and brewers and in Southeast Asia. ThaiBev’s leading products include a variety of well-established spirits brands, including its famous brew Chang Beer. In the non-alcoholic beverage category, key products include water, tonic soda, energy drink, ready-to-drink coffee and green tea.

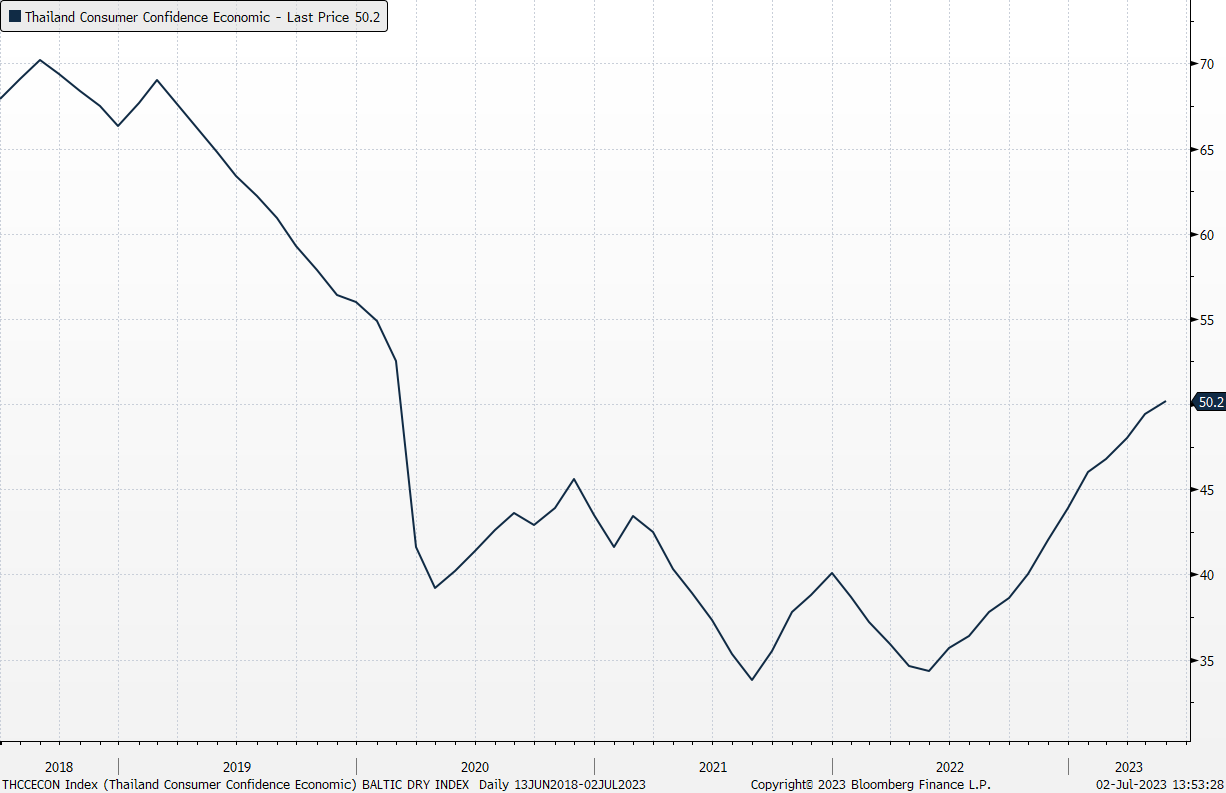

- Improving consumer confidence. According to the latest consumer confidence survey, the index recovered to the highest level since the COVID outbreak, reaching 50.2 in May. The promising recovery was driven by the growth in tourism and the demand for industrial and agricultural goods.

Thailand Consumer Confidence Economic Index

(Source: Bloomberg)

- Potential liquor industry disruption. Winning the most seats in the Thailand general election in 2023, the Move Forward Party opposed the existing strict liquor law which is viewed as preserving a duopoly by suppressing microbreweries and distilleries. Boon Rawd Brewery and ThaiBev, makers of Singha and Chang respectively, hold a combined 93% of the local beer market. Though it is possible for the new government to ease the production curb, the dominance of the two giants will remain unchanged in the near term as their economy of scale can maintain stable profit margins amidst a high inflation environment.

- 2Q23 earnings review. Revenue grew mildly by 2% YoY to 67.4bn THB. Gross profit margin was 30.3%, up 0.06 ppts YoY. PATMI grew mildly by 3% YoY to 7.4bn THB. Net margin was 10.9%, up 0.01 ppts YoY.

- Market consensus.

(Source: Bloomberg)

Standard Chartered PLC (2888 HK): Improving profitability

- BUY Entry – 65.5 Target – 71.5 Stop Loss – 62.5

- Standard Chartered PLC is an international banking company. The Company’s segments include Corporate, Commercial Institutional Banking; Consumer, Private & Business Banking; Ventures, and Central & other items. The Corporate, Commercial & Institutional Banking segment supports companies across the world, from small and medium-sized enterprises to large corporates and institutions, both digitally and in person. The Consumer, Private & Business Banking segment supports small businesses and individuals, from mass retail clients to affluent and high-net-worth individuals, both digitally and in person. The Ventures segment includes financial technology, and a pipeline of over thirty ventures, which includes two cloud-native digital banks. Its products and services include macro, commodities and credit trading, financing and securities services, sales and structuring, debt capital markets and leveraged finance, cash management, working capital, portfolio management, mortgages, and deposits.

- Lowering US dollar deposits. China’s biggest banks have once again lowered interest rates on the nation’s $453 billion corporate US dollar deposits, aiming to bolster the struggling yuan. This marks the second rate cut within a short span of time. The move involved nine banks, including the prominent state lenders, eliminating the additional spread they previously offered over the US Secured Overnight Financing Rate for corporate clients. Prior to this adjustment, one-year deposits were offered at 5.7%, down from 6% a month earlier. Retail investors also witnessed significant reductions, with state banks slashing one-year rates on household deposits to around 2.8% from 4.5%-5%. These lower deposit rates are intended to make the yuan less attractive for individuals and businesses looking to convert their cash holdings into dollars, thereby supporting the Chinese currency.

- Acquisition of RBC Investor Services Trust Hong Kong Ltd. The objective of the acquisition is to strengthen Standard Chartered’s securities services capabilities and broaden its client base, aligning with its overall strategy to expand its custodian and fund servicing operations. Additionally, the company intends to enter the trusteeship business for the Mandatory Provident Fund (MPF) and Occupational Retirement Schemes Ordinance (ORSO) schemes in Hong Kong, further diversifying their offerings.

- Cost Cutting to improve profitability. Last month, as part of its ongoing efforts to reduce costs by over US$1 billion (S$1.35 billion) by 2024, the Asia-focused lender initiated workforce reductions in its Singapore, London, and Hong Kong branches. Over 100 positions were eliminated in these locations. Standard Chartered began streamlining its middle-office operations, which encompass areas such as human resources and digital transformation. The bank’s decision to implement targeted staff reductions aligns with the challenging economic conditions and subdued deal-making activity that have adversely affected revenue in the global financial industry.

- 1Q23 results. Operating Income rose to US$4,396mn (+8.0% YoY), compared to US$4,076mn in 1Q22. Pre-tax profit rose to US$1,808mn, (+21.0% YoY), compared to US$1,492mn in 1Q22. Diluted EPS stands at 40.7 US cents, (+6.0% YoY) compared to 34.6 US cents in 1Q22. 2Q23 results will be released on 28th July 2023.

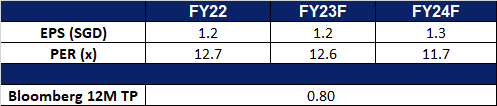

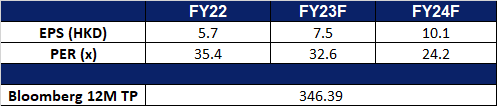

- Market Consensus.

(Source: Bloomberg)

BYD Co. Ltd (1211 HK): Record sales

BYD Co. Ltd (1211 HK): Record sales

- RE-ITERATE BUY Entry – 256 Target – 280 Stop Loss – 244

- BYD COMPANY LIMITED is a China-based company principally engaged in the manufacture and sales of transportation equipment. The Company is also engaged in the manufacture and sales of electronic parts and components and electronic devices for daily use. The Company’s products include rechargeable batteries and photovoltaic products, mobile phone parts and assembly, and automobiles and related products. The Company mainly conducts its businesses in China, the United States and Europe.

- Record Breaking Sales. In the second quarter, BYD achieved a milestone with record-breaking deliveries of their domestically produced vehicles in China. Their Dynasty and Ocean series, which include electric vehicles (EVs) and petrol-electric hybrid vehicles, experienced a remarkable surge in June sales, witnessing an 88.16% year-on-year increase to reach 251,685 vehicles. This noteworthy accomplishment marked the first time BYD’s monthly sales exceeded 250,000 units. Additionally, according to CPCA data, the period from April to June witnessed BYD delivering a total of 700,244 vehicles.

- Launch of new premium SUV. BYD has taken a significant step forward in its pursuit of the premium market by introducing the Denza N7, a cutting-edge electric sport utility vehicle. The company has already received an overwhelming response, with pre-orders surpassing 24,000 units since its debut at the Shanghai Auto Show in April, which showcased five N7 SUVs in an expansive exhibition hall. Initially, the Denza N7 electric vehicle (EV) will be exclusively available for purchase in mainland China.

- New EV production base in Brazil. BYD will invest US$620 million in a Brazilian industrial complex in Bahia state. This move will support the production of affordable vehicles and batteries for the local market. The project consists of three plants that will begin operations in the second half of 2024. These plants will manufacture chassis for buses and electric trucks, assemble EVs, and produce lithium iron phosphate, a crucial material for EV batteries. This investment highlights BYD’s commitment to global expansion and accelerating its presence in Brazil.

- 1Q23 results. Net sales improved to RMB120.17bn in 1Q23(+79.83% YoY). Net profit rose to RMB$4.13bn in 1Q23 (+410.89% YoY). Diluted EPS rose to RMB1.42 in 1Q23 (+407.14% YoY).

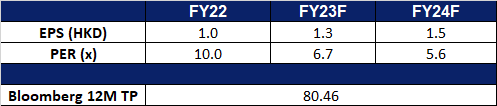

- Market Consensus.

(Source: Bloomberg)

Interactive Brokers Group Inc (IBKR US): Benefiting from a bull market

- BUY Entry – 84 Target – 90 Stop Loss – 81

- Interactive Brokers Group, Inc. is an automated electronic broker. The Company specializes in executing and clearing trades in stocks, options, futures, foreign exchange instruments, bonds, mutual funds, and exchange-traded funds, as well as offers custody, prime brokerage, securities, and margin lending services.

- Strong performance. Interactive Brokers reported strong performance in June, with positive growth across various metrics. The company saw a 5% monthly increase in daily average revenue trades (DARTs), although there was a 3% decline compared to the previous year. Ending client equity surged to $365B, 24% higher YoY and 6% higher than the prior month. Ending client margin loan balances were $41.9B, 2% down from last year and 5% higher MoM. Ending client credit balances of $98.9B, 7% up from prior year and about even with the previous month. The total number of client accounts rose by 19% YoY to 2.29M. It expanded its services in Asia, particularly in the digital asset space, and became the primary international broker for Sinopac Securities in Taiwan. Additionally, the company is broadening its market coverage by allowing clients to trade shares on Nasdaq Copenhagen and the Prague Stock Exchange, further diversifying its global offerings.

- Robust labour demand. The US economy added the fewest jobs in 2.5 years in June, signalling a slowdown in job growth, but strong wage growth suggests a tight labour market that will likely prompt the Federal Reserve to raise interest rates later this month. The Labour Department’s employment report revealed that nonfarm payrolls increased by 209,000 jobs, missing expectations, and indicating that higher borrowing costs affected businesses’ willingness to hire. However, the overall pace of job growth remains strong, and other data suggest that the economy is not heading toward a recession. Average hourly earnings continued to rise, and unemployment dropped to 3.6%. Labour force participation remained steady, but more people entered the workforce. With the US labour markets remaining robust despite facing challenges, more people are likely to invest their money, leading to increased trading activity for Interactive Brokers.

- 1Q23 earnings review. Revenue rose 64.3% YoY to US$1.06bn, in line with estimates. Non-GAAP earning per share was US$1.35, $0.06 below expectations.

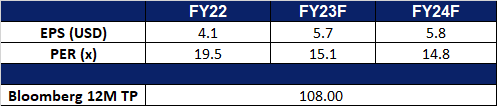

- Market consensus.

(Source: Bloomberg)

Live Nation Entertainment Inc (LYV US): Wildest Dreams

Live Nation Entertainment Inc (LYV US): Wildest Dreams

- RE-ITERATE BUY Entry – 92 Target – 100 Stop Loss – 88

- Live Nation Entertainment, Inc. produces live concerts and sells tickets to those events over the Internet. The Company offers ticketing services for leading arenas, stadiums, professional sports franchises and leagues, college sports teams, performing arts venues, museums and theaters. Live Nation Entertainment serves customers worldwide.

- Strong demand for live events. The demand for live events remains strong, even in the face of economic challenges. In 1Q23, Ticketmaster reported record-breaking activity, with revenue of $3.1 billion, a significant increase of 73% compared to 1Q22. Ticket sales for shows exceeded 90 million, up over 20% from the previous year. This surge in ticket sales, along with high attendance rates, reflects the unwavering passion and dedication of fans to indulge in live events. The company’s concert division experienced the highest attendance ever for 1Q, with 19.5 million fans attending shows, up 79% compared to the previous year. The international markets drove much of this growth, and the company expects continued strength across all global markets in 2023. In the ticketing business, Ticketmaster sold 73 million fee-bearing tickets, up 40% from the previous year, with revenue of $678 million and AOI of $271 million. The sponsorship business also saw significant growth, with top-line revenue improving by 47% and adjusted operation income increasing by 37%. The company’s strong performance in 1Q23 sets them up for continued growth throughout the year. Despite potential financial constraints, fans continue to invest in the live experience, reaffirming the enduring appeal and value they place on witnessing their favorite artists perform live on stage.

- Fans still spending despite exorbitant prices. Despite the costs of concert tickets, with Taylor Swift’s tickets amounting to $134 more per ticket, fans are still willing to spend on live shows. Taylor Swift’s “Eras” tour is generating ticket sales of over $13 million per night, positioning her to have the highest-grossing tour in music history. With an average ticket price of $254, Swift is setting a high-water mark for prices in a year marked by concert inflation. However, this hasn’t deterred fans, as the tour has already grossed $300 million through 22 dates. In fact, Swift is on track to surpass the $1 billion mark, a feat no artist has achieved before. Despite the increasing ticket prices in the industry, more than 1.1 million people have purchased tickets to see Taylor Swift perform. Furthermore, the sustained demand from fans, who anticipate increasing their spending on live experiences in the future, will help support these high prices. This bodes well for both Live Nation and artists, as they can capitalise on the ongoing enthusiasm and willingness of fans to invest in live events.

- Goodbye to hidden fees. Concert promoter Live Nation has pledged to improve transparency in ticket pricing following pressure from the Biden administration. In an effort to crack down on “junk” fees, Live Nation plans to introduce “all-in” pricing for its owned venues, allowing ticket buyers to see the full fees upfront. This system will be implemented in September. Ticketmaster, owned by Live Nation, will also offer an optional feature for users to view upfront pricing for all tickets sold on the platform. However, individual venues will have the choice of how to display their prices. The move aims to provide consumers with a clearer understanding of the total costs and align ticket purchasing with other retail experiences. The elimination of surprise fees is seen as a positive development for consumers, particularly as Ticketmaster controls about 80% of ticket sales in the U.S. Consumer advocacy groups hope for greater transparency across various industries, including airlines, retailers, and banking. The introduction of all-in pricing is welcomed as a step toward better purchasing decisions, although it may not directly impact the actual ticket prices charged by venues.

- 1Q23 earnings review. Revenue rose 73.9% YoY to US$3.13bn, beating estimates by US$860mn. GAAP earning per share was -US$0.25, $0.21 above expectations.

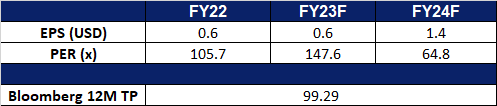

- Market consensus.

(Source: Bloomberg)

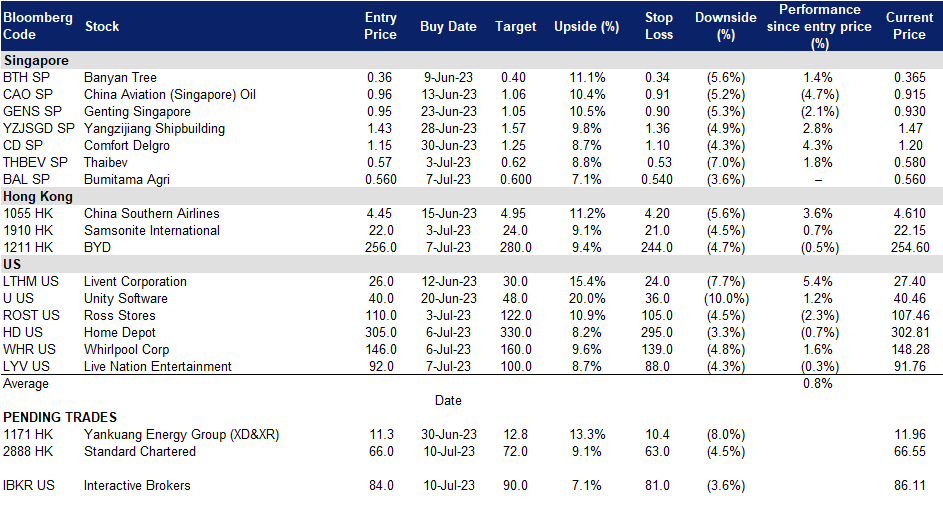

Trading Dashboard Update: Take profit on Schlumberger Limited (SLB US) at US$53.0 and Palantir Technologies (PLTR US) at US$15.34. Cut loss on Estee Lauder (EL US) at US$190.5. Add Bumitama Agri (BAL SP) at S$0.56, BYD (1211 HK) at HK$256, Home Depot (HD US) at US$305, Whirlpool Corp (WHR US) at US$146, and Live Nation Entertainment (LYV US) at US$92.