10 January 2024:Yangzijiang Shipbuilding (YZJSGD SP), Yankuang Energy Group Co. Ltd. (1171 HK), Barrick Gold Corp (GOLD US)

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

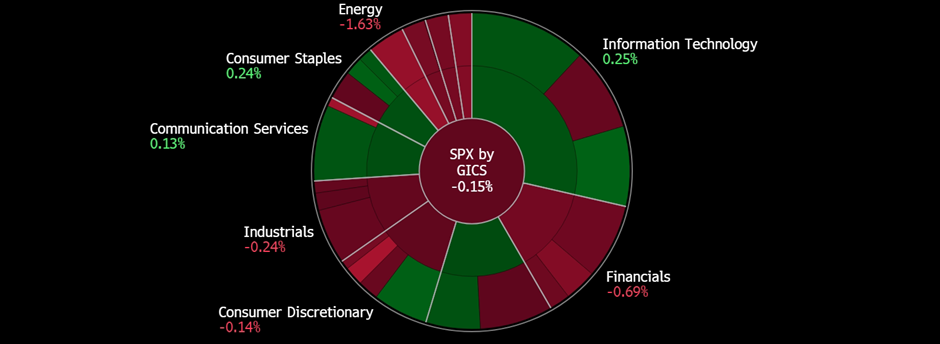

United States

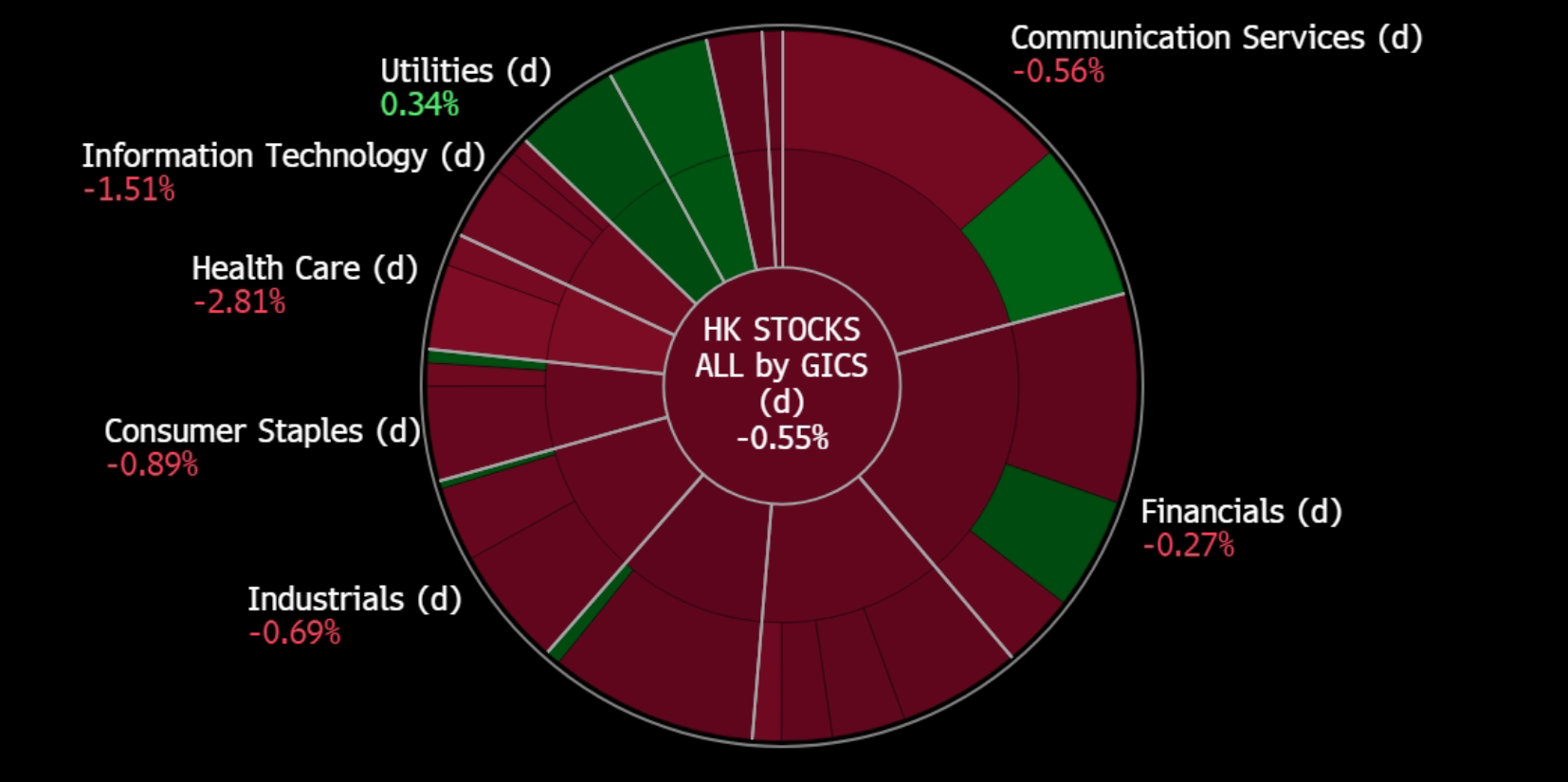

Hong Kong

News Feed |

2. China’s Dec services activity expands at quickest pace in 5 months |

5. China steps up efforts to adapt as US-led ‘reshoring’ campaign seems set in stone |

Yangzijiang Shipbuilding (YZJSGD SP): A nice start in 2024

- BUY Entry 1.50 – Target 1.65– Stop Loss – 1.42

- Yangzijiang Shipbuilding Holdings Limited builds a wide range of ships. The Company produces a wide range of commercial vessels, mini bulk carriers, multi-purpose cargo vessels, container ships, chemical tankers, offshore supply vessels, rescue and salvage vessels, and lifting vessels.

- Hedging against potential weakening RMB. The year-end rally in RMB against USD was due mainly to the pullback in US dollars as investors were optimistic about aggressive rate cuts from the Fed in 2024. However, the recent US labour market data showed the US economy remained strong, cooling down the previous rate-cut expectations. China’s economic recovery remains gloomy, and it will take longer to mitigate the impact of the property debt problem and rebuild confidence. Therefore, the RMB will weaken against the USD again once the previous positive expectations fail to be realised.

Share price and USD/RMB price trend comparison

(Source: Bloomberg)

- Growth in container vessel and tanker demand in 2024. According to Clarkson, 350 newly built container vessels were delivered in 2023, totalling 2.21mn TEU. China delivered more than 200 units. Clarkson estimates that the total container shipping capacity will grow by 7% and 5% in 2024 and 2025 respectively. According to shipbroker Xclusiv, the tankers market is expected to grow in 2024, mainly driven by the Asian oil demand. Southeast Asia and China will see 3.2% and 2.9% growth in oil demand this year.

- 1H23 orderbook exceeded the full-year target. As of June, the company has obtained orders for 72 vessels, amounting to a value of US$5.76 billion, surpassing its target of US$3 billion for 2023. This has resulted in the highest-ever outstanding orderbook value for Yangzijiang, standing at US$14.7 billion for 181 vessels. Among all ordered vessels, 91 are containerships, 29 are oil tankers, 53 are bulk carriers, and 8 are LNG/LPG/LEG.

- 1H23 results review. Revenue for 1H23 increased by 16% YoY to RMB11.3bn. Gross profit increased by 48% YoY to RMB2.1bn. GPM increased by 4ppts to 19%. PATMI increased by 26% YoY to RMB1.7bn.

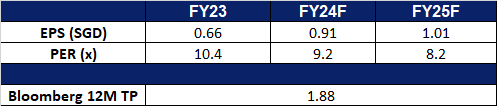

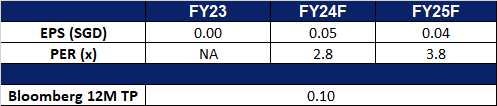

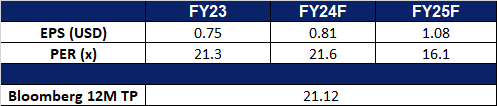

- Market Consensus.

(Source: Bloomberg)

Rex International Holding Ltd (REXI SP): Oil is rebounding

Rex International Holding Ltd (REXI SP): Oil is rebounding

- RE-ITEREATE Entry 0.185 – Target – 0.200 Stop Loss – 0.177

- Rex International Holding Limited operates as an independent oil exploration and production company. It operates through Oil and Gas, and Non-Oil and Gas segments. The company offers Rex Virtual Drilling, a liquid hydrocarbon indicator, which uses seismic data to search for oil. The company is involved in the oil and gas exploration and production activities with a focus in Oman and Norway.

- Near-term favourable catalysts. Middle east tension escalated due to another attack on a merchant vessel in the Red Sea. US and its allies have vowed to protect shipping on the Suez Canal from any military assaults, and meanwhile Iranian warship entered Red Sea. The potential conflicts are expected to expand, and oil prices are fuelled by worrisome sentiment. On the other hand, OPEC+ announced that it would hold a Joint Minister Monitoring Committee meeting on February 1st. Market expects OPEC+ to release further measures to defend oil price from falling. The recent protest in Libya led to a shutdown of Sharara oilfield which is the country’s largest output source, pushing upward pressure on oil prices.

- Production sharing agreement. Rex International Holding’s joint venture subsidiary, Porto Novo Resources, has secured a production sharing contract for operatorship and a 76% working interest in an offshore block in Benin’s Sèmè Field. The subsidiary, Akrake Petroleum SA, aims to redevelop the Sèmè Field using Rex’s low-cost production system, incorporating a jack-up Mobile Production Unit and a Floating Storage Unit. The offshore Block 1 covers 551 sqkm, with plans to file a field development plan in 2024 to restart oil production in the area, utilizing geological expertise and operational know-how from teams in Norway and Oman.

- Completed acquisition. The board of directors from Rex announced that its subsidiary, Lime Petroleum AS’s, has completed the acquisition of a 17% interest in PL740 in the Norwegian North Sea on 29 December 2023. The OKEA-operated Brasse Field is expected to start commercial production in 2027.

- 1H23 earnings. The company revenue rose to US$106.92mn, a 7.5% YoY increase compared to US$99.45mn in 1H22. Revenue rose due to the increase in the volume of oil lifted and sold from the Yumna Field in Oman and the inclusion of oil liftings from the Yme Field in Norway. Adjusted EBITDA amounted to US$47.13mn in 1H23. The company’s net profit for the period was US$3.69mn, a 38.9% YoY decline from its previous net profit in 1H22 of US$6.04. Earnings per share were US$0.23 (S$0.31) cents compared to the previous US$0.37 (S$0.51) cents in 1H22.

- Market Consensus.

(Source: Bloomberg)

Yankuang Energy Group Co. Ltd. (1171 HK): A burning issue

- BUY Entry – 16.0 Target – 17.4 Stop Loss – 15.3

- Yankuang Energy Group Co Ltd is a China-based international comprehensive energy company engaged in coal and coal chemical industry. The Company operates in five segments. The Coal Mining segment is engaged in underground and open-cut mining, preparation and sale of coal and potash mineral exploration. The Smart Logistics segment provides railway transportation services. The Electricity and Heating Supply segment provides electricity and related heat supply services. The Equipment Manufacturing segment is engaged in the manufacture of comprehensive coal mining and excavating equipment. The Chemical Products segment is engaged in the production and sale of chemical products. The coal products mainly include thermal coal, pulverized coal injection (PCI), and coking coal. The coal chemical products mainly include methanol, ethylene glycol, acetic acid, ethyl acetate and crude liquid wax, among others. The Company distributes products in the domestic market and to overseas markets.

- China reinstates coal tariffs. At the start of 2024, China has reinstated tariffs on coal imports. The reinstated tariffs include a 6% levy on coal for electricity and heating and a 3% tariff on coking coal used in steelmaking. Russia, South Africa, Mongolia, and the United States will be impacted by these tariffs, while Indonesia and Australia remain exempt due to free trade agreements with China. The implementation of these tariffs is likely to drive up domestic coal production and demand as there is less competition from foreign coal companies. This allows domestic producers like Yankuang Energy to extend their competitive edge in the Chinese market.

- Increasing coal use. China’s coal use remains high as the country has increased its reliance on coal-fired power generation, as hydroelectric power is severely reduced. The current winter season has also indirectly driven up the demand for coal due to increased usage of electricity and consumers keep themselves warm from the winter temperatures. Recently, China also reported that they have begun testing the production of ethanol through the use of coal, instead of using crops like corn or sugar cane. This allows China to “millions of tonnes” of grains annually which then can be used as food resources.

- 3Q23 earnings. Revenue fell by 28.01% YoY to RMB40.34bn in 3Q2023, compared to RMB56.03bn in 3Q22. Net profit fell 52.43% YoY to RMB4.52bn, compared to RMB9.49bn in 3Q22. Basic EPS fell by 55.36% YoY to RMB0.58, compared to RMB1.30 in 3Q22.

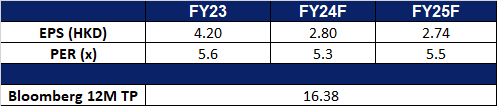

- Market consensus.

China Qinhuangdao thermal port coal 5,500 GAR spot price

(Source: Bloomberg)

(Source: Bloomberg)

CNOOC Ltd. (883 HK): Focusing on Supply Chain

- RE-ITERATE BUY Entry – 13.0 Target – 14.0 Stop Loss – 12.5

- CNOOC Ltd is a China-based investment holding company principally engaged in the exploration, production and sales of crude oil and natural gas. The Company operates three segments. Exploration and Production segment is engaged in conventional oil and gas business, shale oil and gas business, oil sands business and other unconventional oil and gas businesses. Trading segment is engaged in entrepot trade of crude oil in overseas areas. Corporate segment is engaged in headquarter management, assets management, research & development, and other businesses. The Company mainly operates businesses in China, Canada, the United Kingdom, Nigeria, and Brazil, among others.

- Commencement of production. CNOOC recently announced that its Mero2 Project has begun production. The project consists of 16 development wells which are planned to be commissioned, including 8 production wells and 8 injectors. The Floating Production Storage and Offloading (FPSO) used in the project also has a designed storage capacity of approximately 1.4million barrels, one of the largest FPSO in the world. This project is expected to bring an additional 180,000 barrels of crude oil per day for the company.

- Approval of license for LPG Facility. Uganda’s cabinet recently approved CNOOC to proceed with the construction of a Liquified Petroleum Gas (LPG) facility in the Kingfisher development area in Uganda. The facility will produce clean and affordable energy for the local market in the East African country, facilities the country’s transition to green energy.

- Construction of underground oil reserve. CNOOC recently started construction in Ningbo, China, on its largest commercial underground oil reserve project. The oil reserve is designed with a capacity of 3 million cubic meters, encompassing crude oil caverns, along with surface crude oil storage, transportation, and other supporting facilities. The project would be receiving a total investment of around 3 bn yuan and is scheduled to be completed by 2026. Upon completion, the oil reserve would provide a steady supply of crude oil to surrounding cities and provinces.

- 3Q23 earnings. Revenue rose by 5.48% YoY to RMB114.8bn in 3Q2023, compared to RMB108.8bn in 3Q22. Net profit fell 8.23% YoY to RMB33.4bn, compared to RMB36.4bn in 3Q22. Basic EPS fell by 7.78% YoY to RMB0.71, compared to RMB0.77 in 3Q22.

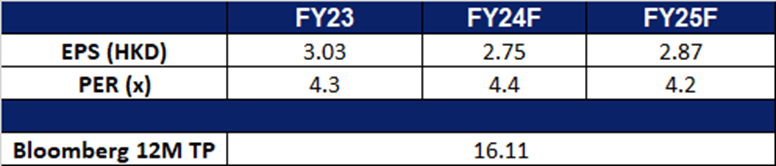

- Market consensus.

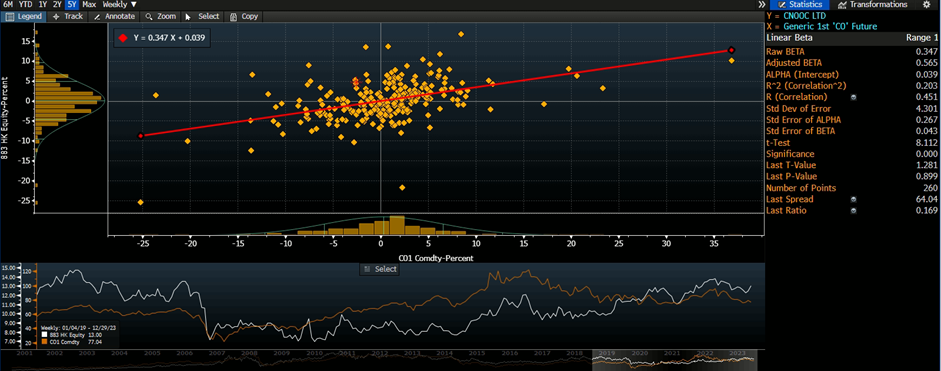

Share price and Brent crude oil price correlation

(Source: Bloomberg)

(Source: Bloomberg)

Barrick Gold Corp (GOLD US): Rate cut expectations driving gold prices upward

- BUY Entry – 17.46 Target – 19.00 Stop Loss – 16.69

- Barrick Gold Corporation is an international gold company with operating mines and development projects in the United States, Canada, South America, Australia, and Africa.

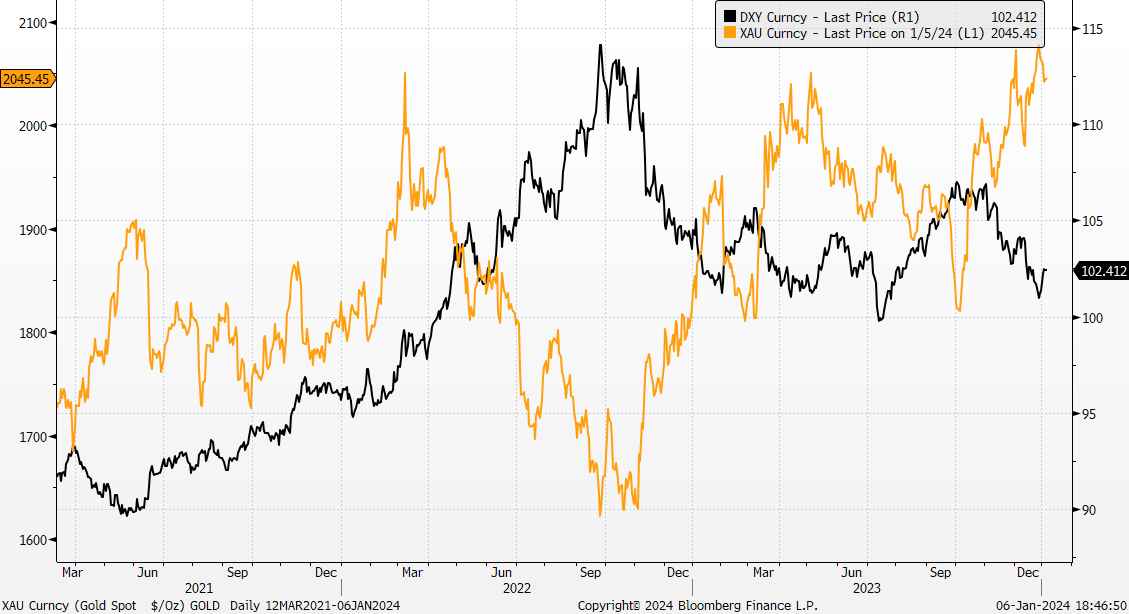

- Mixed US economic data, rate cuts still expected. The trend of gold price has been downwards, driving the prices of gold up since it is denominated in USD. This is mainly due to the change in the Fed’s stance towards interest rates, where they have indicated that a rate cut may be on the horizon. While the recent Nonfarm Payrolls exceeded expectations, causing the gold to see a slight rally, the decline in ISM Services PMI helped partially ease concerns that the Fed would delay their cuts. Despite rising US bond yields, the CME FedWatch Tool suggests increased expectations of earlier rate cuts by the Federal Reserve. Currently the market anticipates a 67% chance of a Fed rate cut by March, and with the decline in USD following these rate hikes, the upside potential for gold remains promising. This is especially beneficial for Barrick Gold Corp as the appreciation of Gold prices would in turn lead to a higher profit for them potentially boosting their share price.

Gold Price vs Dollar Index

(Source: Bloomberg)

- Geopolitical unease remains elevated. With Houthi rebel attacks on shipping in the Red Sea disrupting global supply chains and anticipated geopolitical uncertainties surrounding the Taiwan election in January and the US election in November, the economic outlook remains cautious. This risk aversion, along with ongoing wars in Europe and the Middle East, continues to underpin elevated gold prices.

- 3Q23 results. Revenue rose 13% YoY, to US$2.86bn. Non-GAAP EPS beat estimates by US$0.04 at US$0.24. Expect stronger 4Q23 results, but FY23 gold production to be slightly below previous guidance range of 4.2mn oz to 4.6mn oz.

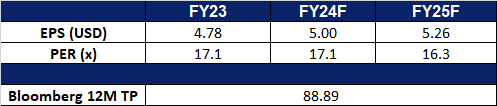

- Market consensus.

(Source: Bloomberg)

RTX Corp (RTX US): Tensions arising

- RE-ITERATE BUY Entry – 85.5 Target – 91.5 Stop Loss – 82.5

- RTX Corporation operates as an aerospace and defense company. The Company offers avionics systems, aviation systems, communications and navigation equipment, interior and exterior aircraft lighting, aircraft seating, environmental control systems, flight control systems, and engine components.

- Secured a US$345mn contract. Raytheon Technologies recently secured a modification contract worth US$344.6mn from the Air Force Life Cycle Management Center for the StormBreaker munition. The contract, expected to be completed by 30 August 2028, involves manufacturing the 10th lot of StormBreaker munitions, supplying additional components, and includes foreign military sales to Norway, Germany, Italy, and Finland. The geopolitical tensions globally have increased the demand for missile defense systems, benefiting RTX as a prominent US missile maker. The StormBreaker is a precision-guided winged munition, with its smart features for target detection in challenging conditions, contributing to RTX’s growth opportunities. The integration of StormBreaker on various aircraft platforms enhances the potential for more contract wins in the future.

- Rising geopolitical tensions. The demand for missiles is expected to increase due to geopolitical tensions, such as those between Russia and Ukraine, and ongoing hostilities in the Middle East. RTX is well-positioned to benefit from the tensions, given its extensive missile portfolio, including AIM-9X Sidewinder, SM-6, SM-3 interceptor, TOW missiles, among others. Furthermore, the most recent Red Sea attacks, which have disrupting global commerce has resulted in twelve nations, led by the United States, to issue a joint warning to Yemen’s Houthi rebels, urging them to cease their attacks. This has caused further chaos and uncertainty about the global economy and the freedom of navigation.

- 3Q23 results. Sales rose to US$13.5bn, down 21% YoY, due to a US$5.4bn charge relating to the disclosed Pratt powder metal matter. Adjusted sales rose 12% YoY to US$19.0bn. GAAP EPS was at a loss of US$0.68 whereas adjusted EPS was US$1.25 an increase of 3% YoY. Furthermore, the board of directors approved a US$10bn share repurchase program.

- Market consensus.

(Source: Bloomberg)

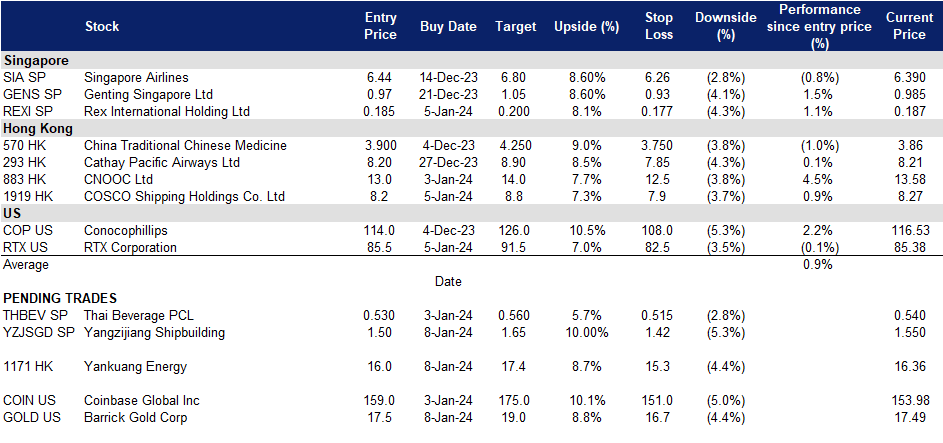

Trading Dashboard Update: Add Rex International (REXI SP) at S$0.185, COSCO Shipping (1919 HK) at HK$8.2, and RTX Corporation (RTX US) at US$85.5.