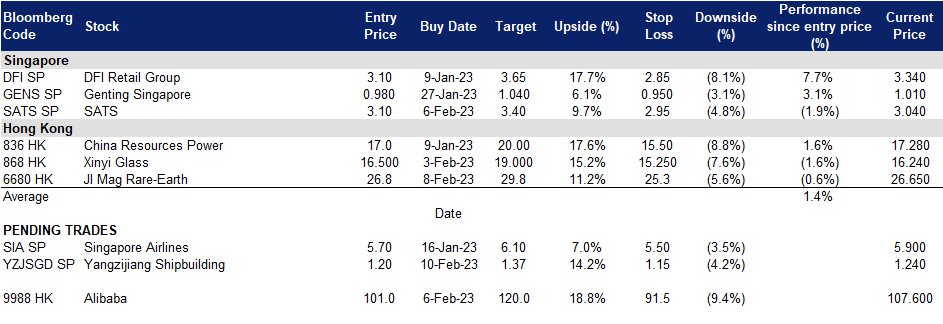

10 February 2023: Yangzijiang Shipbuilding (BS6 SP), Jl Mag Rare-Earth Co Ltd (6680 HK)

Singapore Trading Ideas | Hong Kong Trading Ideas | Sector Performance | Trading Dashboard

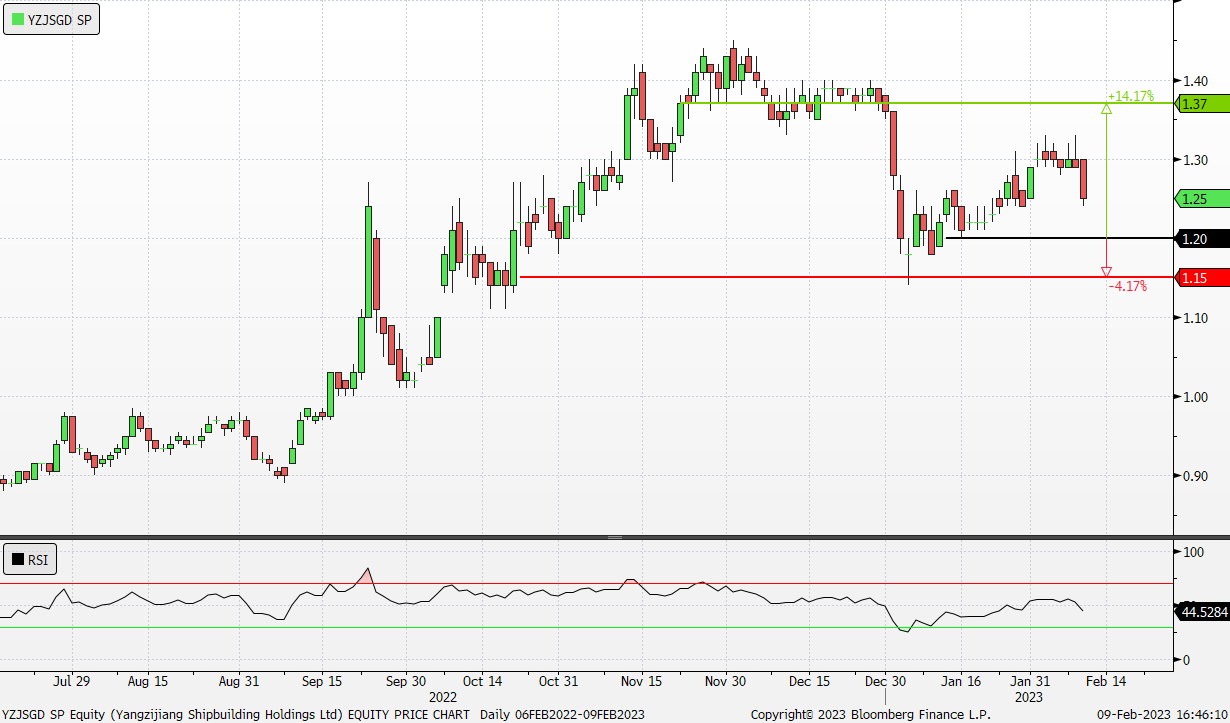

Yangzijiang Shipbuilding (BS6 SP): Benefitting from positive US data

- RE-ITERATE Entry – 1.20 Target – 1.37 Stop Loss – 1.15

- Yangzijiang Shipbuilding Holdings Limited builds a wide range of ships. The Company produces a wide range of commercial vessels, mini bulk carriers, multi-purpose cargo vessels, containerships, chemical tankers, offshore supply vessels, rescue and salvage vessels, and lifting vessels.

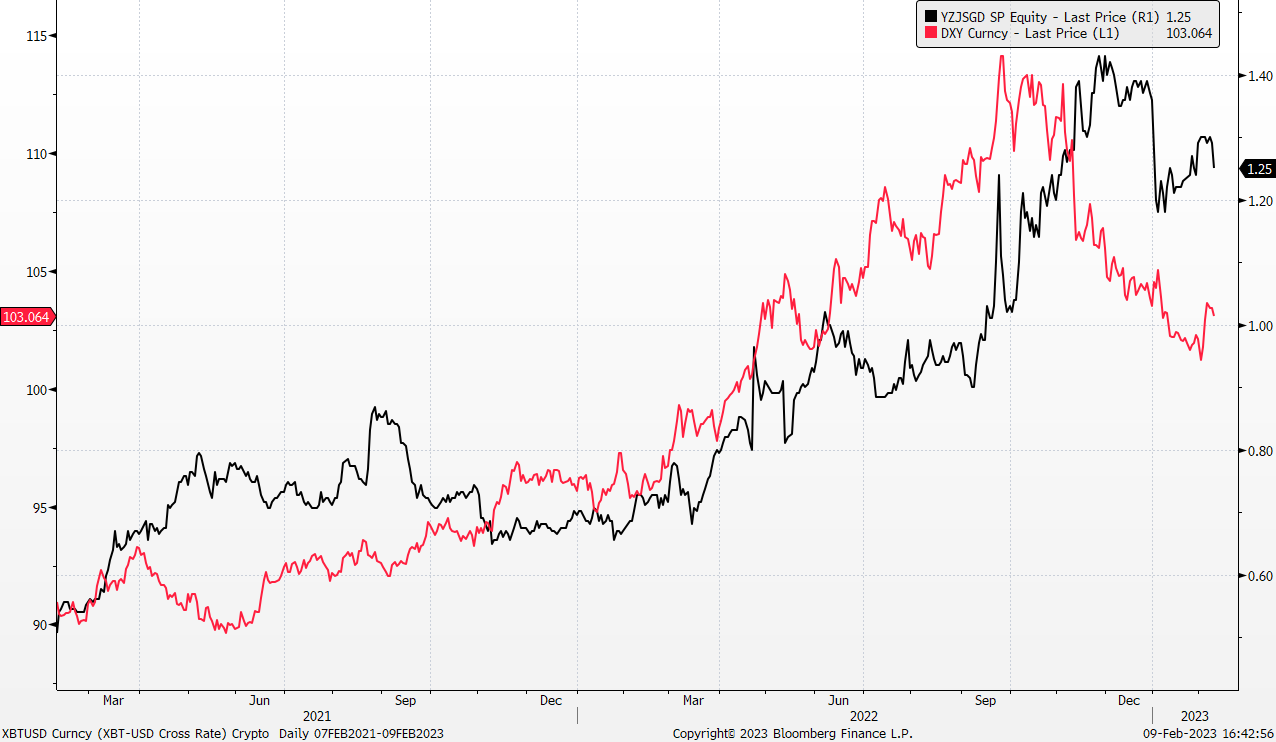

- Benefitting from a stronger US Dollar. Following the most recent US strong nonfarm payroll data for the month of January, the US dollar index saw a rebound with the positive results. Yangzijiang Shipbuilding Holdings Limited, whose financial results, as well as operations, which are mainly denominated in USD, can benefit from the appreciate of the US dollar in upcoming months.

Share price and dollar index comparison

(Source: Bloomberg)

- Dropping Iron Ore and Steel prices. Hard commodities, such as iron ore and steel, saw a price decline following the appreciation of the US dollar. This allows the company to find opportunities in lowering their cost of production, whereby iron ore and steel make up a key component of the production of a ship.

- Visibility on secured contracts. As of 3Q22, the company’s total order book value reached US$10.27bn which extended the company’s top line visibility to mid-2025. This allows the company to have a confirmed and visible stream of revenue for the upcoming years.

- Company Outlook. The company’s outlook is positive in the upcoming months, with the rebound of the U.S. dollars as economic pressure starts to ease. There is also clear visibility on the company’s revenue stream given that its’ order book are filled till mid-2025. The re-opening of China’s economy also allows the company to re-accelerate the production of its business. This suggests that the company’s performance is likely to continue to improve in the near future.

- The updated market consensus of the EPS growth in FY23/24 is 22.98%/4.72% YoY respectively, which translates to 8.1x/7.8x forward PE. Current PER is 8.0x. FY23F/24F dividend yield is 3.7%/3.8% respectively. Bloomberg consensus average 12-month target price is $1.46.

(Source: Bloomberg)

SATS Ltd. (SATS SP): Tourism returning to Pre-Covid Levels driven by China’s re-opening

SATS Ltd. (SATS SP): Tourism returning to Pre-Covid Levels driven by China’s re-opening

- RE-ITERATE Entry – 3.10 Target – 3.40 Stop Loss – 2.95

- SATS – Singapore Airport Terminal Services – is a provider of Airport Services and Food Solutions. Its comprehensive scope of airport services encompasses airfreight handling, passenger services, ramp handling, baggage handling, aviation security and aircraft interior cleaning, while its food solutions business comprises inflight catering, food distribution and logistics, industrial catering as well as chilled and frozen food manufacturing. Today, its network of ground handling and inflight catering operations spans nearly 40 airports in the Asia Pacific region.

- Singapore Expects full tourism recovery by 2024. With China’s border re-opening, the Southeast Asian country is expecting 12 to 14 million arrivals and up to S$21B in revenue in 2023. China was the largest contributor to Singapore’s tourism before the pandemic, with 3.6M visitors from China in 2019. The re-opening of China would bring more Chinese tourists back into Singapore and drive growth for SATS.

- Acquisition of Worldwide Flight Services. SATS is on track to complete a $1.29B purchase of air cargo handler Worldwide Flight Services as early as March. With this acquisition, SATS would be better positioned to provide their global customer base with end-to-end solutions.The acquisition will raise the revenue share to 30% from the U.S., and the share generated by Europe, the Middle East and Africa will climb to roughly 25%. The deal will also boost the revenue contribution of the cargo business to 50% from 15%. Consolidated earnings before interest, taxes, depreciation and amortization will increase roughly sevenfold as the result of the deal, according to SATS.

- Company Outlook. The company’s outlook is positive, as they are seeing a key re-opening play for the China market, bringing tourism back to pre-pandemic level by 2024, alongside a good acquisition move on Worldwide Flight Services. This suggests that the company’s performance is likely to continue to improve in the near future.

- The updated market consensus of the EPS growth in FY23/24 is -50.0%/1298.15% YoY respectively, which translates to 345.6x/24.7x forward PE. Bloomberg consensus average 12-month target price is $3.44.

(Source: Bloomberg)

Jl Mag Rare-Earth Co Ltd (6680 HK): Magneto

- RE-ITERATE BUY Entry – 26.8 Target – 29.8 Stop Loss – 25.3

- Jl Mag Rare-Earth Co Ltd is a China-based company mainly engaged in the production of high-performance rare earth permanent magnet materials. The Company focuses on the research and development, production and sales of high-performance Nd-Fe-B permanent magnet materials used in the global new energy, energy saving and environmental protection fields. The Company’s products are widely used in new energy vehicles and auto parts, permanent magnet wind generators, energy-saving inverter air conditioners and other industries. The Company sales its products in the domestic and foreign market.

- EV demand growing. The IBM Institute for Business Value recently conducted a study on consumer demand for electric vehicles and found that 50% of surveyed customers are considering buying an EV in the next three years, while only 13% of industry executives expect their countries to be ready to support EVs by 2030, indicating a gap in readiness. Key factors such as charging point availability, reliability, costs, network connectivity, and digital experience are impacting EV adoption. Companies and governments must gear up to meet consumer demand and infrastructure needs. Executives estimate that 40% of new car sales will be all-electric by 2030, and most consumers are motivated by access to charging points, environmental awareness, and the ability to charge at home. Consumers are willing to invest in EVs despite the costs of home charging.

- Increase in demand for magnet materials. Together with the increasing demand for EVs, the demand for magnet materials will grow in order to support the rise of new energy products. In 2022, global investment in the green energy transition reached a record high of $1.1 trillion, as per a report by BloombergNEF. The report states that this significant increase was a result of the energy crisis driving faster deployment of low-carbon technologies. With more transitions and investments into clean energy the demand for their magnet materials will continue to surge.

- Positive FY22 earning guidance. Revenue is expected to increase by 70%-90% YoY in 2022 as compared with the same period last year, reaching RMB6.9bn to RMB7.8bn. Net income attributable to ordinary shareholders is expected to be between RMB702.2mn to RMB838.2mn, a 55%-85% increase YoY from RMB453.1mn in 2021.

- The updated market consensus of the EPS growth in FY22/23 is 71.5%/22.0% YoY respectively, which translates to 21.2x/17.4x forward PE. Current PER is 24.2x. Bloomberg consensus average 12-month target price is HK$29.30.

(Source: Bloomberg)

Alibaba Group Holding Ltd (9988 HK): Make the elephant dance

Alibaba Group Holding Ltd (9988 HK): Make the elephant dance

- ITERATE BUY Entry – 101.0 Target – 120.0 Stop Loss – 91.5

- Alibaba Group Holding Ltd provides technology infrastructure and marketing platforms. The Company operates through seven segments. China Commerce segment includes China retail commerce businesses such as Taobao, Tmall and Freshippo, among others, and wholesale business. International Commerce segment includes international retail and wholesale commerce businesses such as Lazada and AliExpress. Local Consumer Services segment includes location-based businesses such as Ele.me, Amap, Fliggy and others. Cainiao segment includes domestic and international one-stop-shop logistics services and supply chain management solutions. Cloud segment provides public and hybrid cloud services like Alibaba Cloud and DingTalk for domestic and foreign enterprises. Digital Media and Entertainment segment includes Youku, Quark and Alibaba Pictures, other content and distribution platforms and online games business. Innovation Initiatives and Others segment include Damo Academy, Tmall Genie and others.

- China’s economic recovery. China’s policymakers plan to step up support for domestic demand this year, with top policymakers repeatedly signalling their intention to harvest the spending power of China’s 1.4 billion people, after economic growth in 2022 slumped to one of its weakest levels in nearly half a century. Some chinese banks have launched promotions and lowered lending rates to encourage more consumer spending in China. Many leading banks have cut their consumer lending rates to below 4 percent, some have even offered certain consumer lending products at the minimum rate of 3.65 percent, the benchmark lending rate of China’s central bank. With China’s efforts to expand domestic demand and consumption alongside its reopening, which would stimulate increased spending and household consumption, the company should expect higher consumer demand this year.

- Cloud segment growth. Cloud infrastructure and services are becoming a prominent part of any business that uses the web for its operations. Total revenue from its Cloud segment, before inter-segment elimination, which includes revenue from services provided to other Alibaba businesses, was RMB50,698mn (US$7,127mn), an increase of 5% compared to RMB48,448mn in the same period of 2021. YoY growth reflected the strong revenue growth from non-Internet industries driven by financial services, public services and telecommunication industries. With cloud services being an integral part of the operations of all three of these areas, it could lead to long-term recurring revenue for Alibaba. Additionally, with the global cloud computing market projected to reach over $1.7 trillion by 2029, Alibaba’s share of the cloud segment is expected to expand as well.

- 1H23 results. Revenue was RMB412,731mn (US$58,021mn), an increase of 2% year-over-year. Net income attributable to ordinary shareholders was RMB2,178mn (US$306mn), and net loss was RMB2,169mn (US$305mn), compared to net income of RMB46,212mn in the same period of 2021.

- The updated market consensus of the EPS growth in FY24/25 is 4.32%/14.59% YoY respectively, which translates to 13.62x/11.88x forward PE. Bloomberg consensus average 12-month target price is HK$142.63.

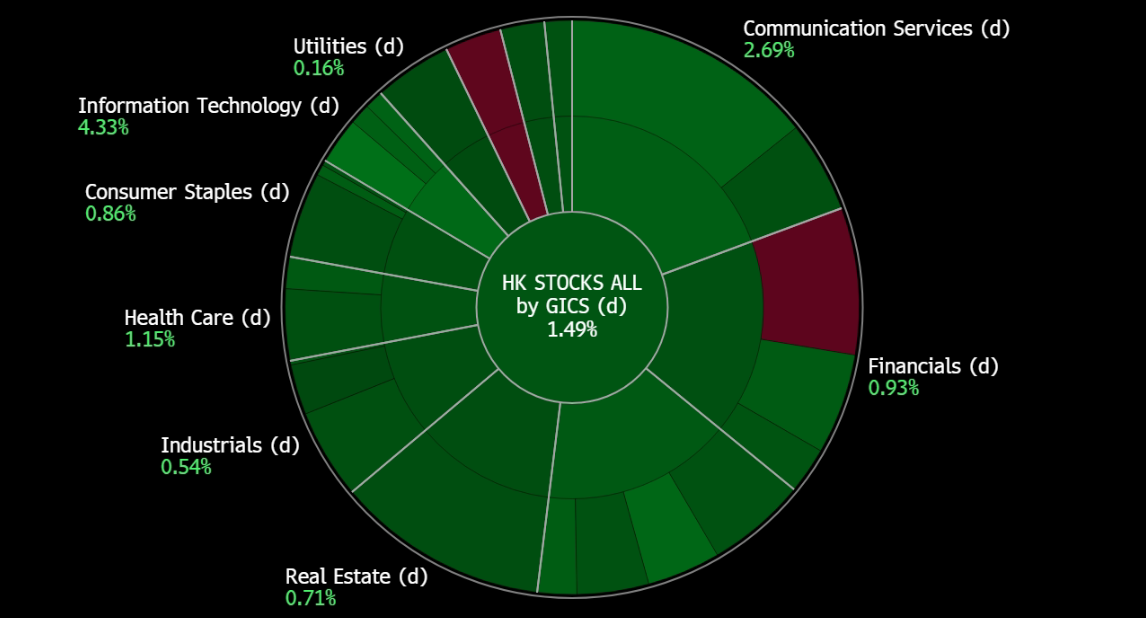

United States

Hong Kong

Trading Dashboard Update: Cut loss on Sembcorp Marine (SMM SP) at S$0.135 and Yangzijiang shipbuilding (YZJSGD SP) at S$1.25.