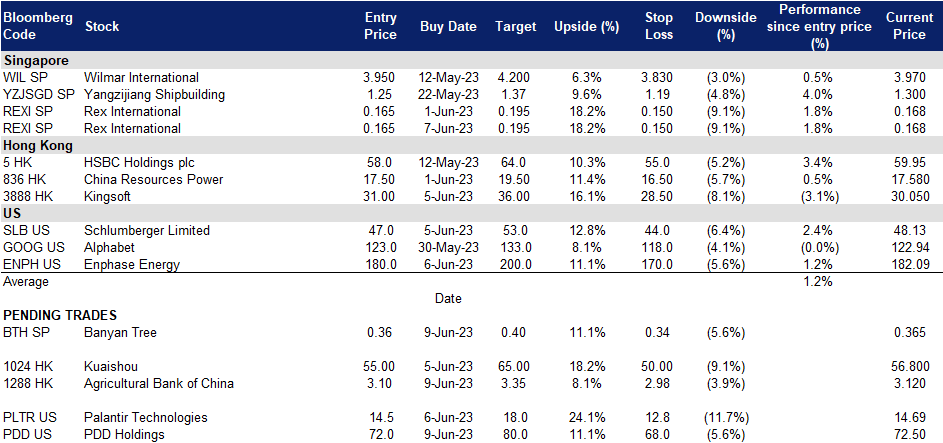

9 June 2023: Banyan Tree Holdings Ltd. (BTH SP), Agricultural Bank of China (1288 HK), PDD Holdings Inc (PDD US)

Singapore Trading Ideas | Hong Kong Trading Ideas |United States Trading Ideas | Sector Performance | Trading Dashboard

Banyan Tree Holdings Ltd. (BTH SP): Summer vacation to drive further recovery

- BUY Entry 0.360 – Target – 0.400 Stop Loss – 0.340

- Banyan Tree Holdings Limited operates as a holding company. The Company, through its subsidiaries, owns and manages hotel groups. The Company focuses on hotels, resorts, spas, galleries, golf courses, and residences, as well as provides investments, design, construction, and project management services. Banyan Tree Holdings serves customers worldwide.

- Summer vacation coming. As the summer season approaches, popular destinations in South East Asia and other parts of Asia such as Japan, anticipate a surge in tourist arrivals. This presents an opportunity for international travel and tourism businesses, like BTH, to attract visitors looking for high-quality experiences. By highlighting its enhanced offerings and service levels, BTH can position itself as a preferred choice for travellers seeking unique and tailored accommodation options. With a strong presence in Southeast Asia, particularly in Thailand, BTH is well-positioned to capitalise on the growing interest in the region and cater to the needs of discerning tourists.

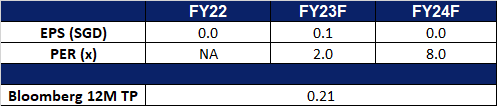

- Appeal to Chinese tourists. Thailand’s tourism industry has experienced a remarkable recovery in Chinese tourist arrivals since reopening its borders. In the first five months of the year, the country welcomed one million Chinese visitors, signalling a significant increase compared to the previous year. The Thai government has set a target of attracting five million Chinese tourists in 2023, with an expected expenditure of 446 billion baht (US$13.18 billion). This resurgence highlights the importance of the Chinese market and its contribution to Thailand’s overall tourism sector. With the approach of China’s summer holiday season and the majority of properties located in Southeast Asia, particularly in popular destinations like Thailand, the company is well-positioned to appeal to Chinese tourists seeking overseas trips.

China outbound tourist growth – Thailand

(Source: Bloomberg)

- FY22 results review. Revenue for FY22 increased 23% to S$271.3mn, from S$221.2mn a year ago. Return to profitability in 2022, from the previous year’s loss after tax and minority interests of S$55.2mn to a profit of S$0.8mn.

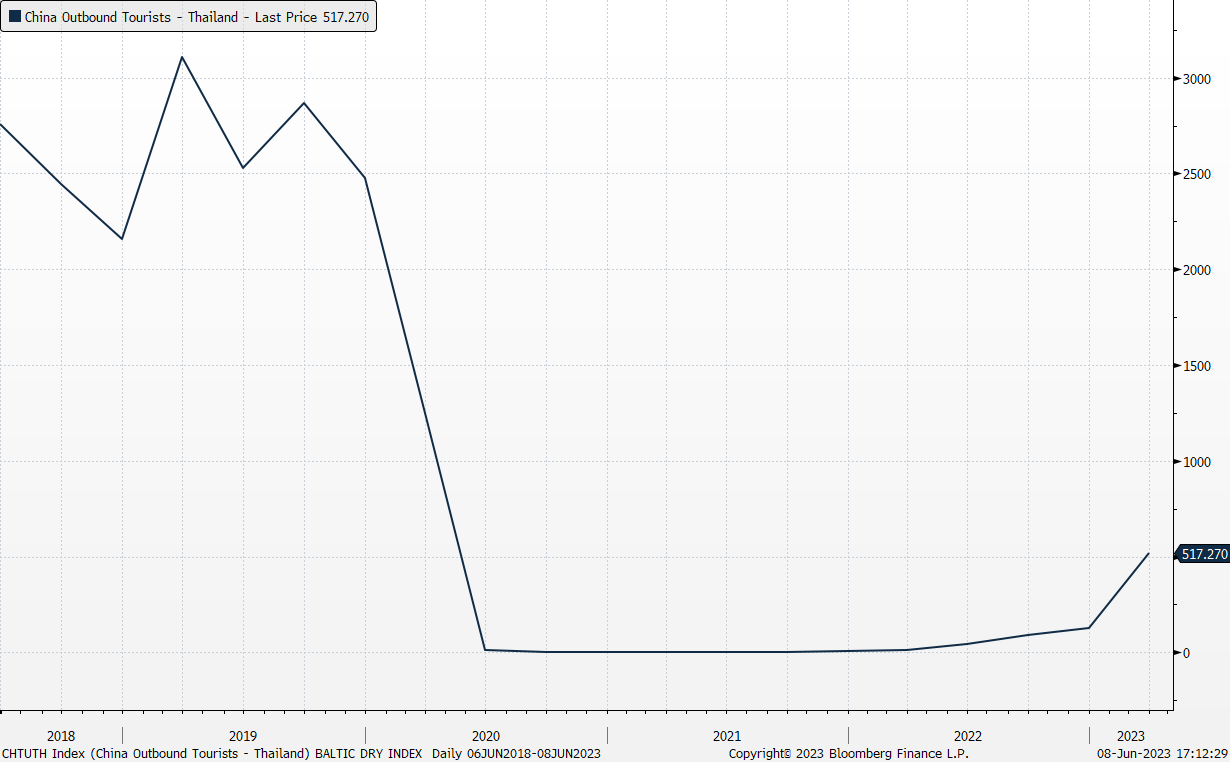

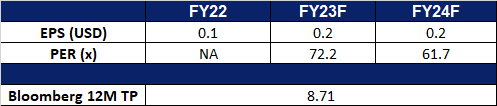

- Market consensus.

- Read the full fundamentals-based report here.

(Source: Bloomberg)

Rex International Holding Ltd (REXI SP): Oil rebounds

- RE-ITERATE BUY Entry 0.165 – Target – 0.195 Stop Loss – 0.150

- Rex International Holding Limited operates as an independent oil exploration and production company. It operates through Oil and Gas, and Non-Oil and Gas segments. The company offers Rex Virtual Drilling, a liquid hydrocarbon indicator, which uses seismic data to search for oil. The company is involved in the oil and gas exploration and production activities with a focus in Oman and Norway.

- Robust non-farm payroll fuels oil rebounding. Brent increased by 2.63% to US$76.20/bbl, and U.S. West Texas Intermediate rose 2.45% to US$71.83/bbl. The two days’ rebound is driven by the lifting of debt ceiling limit and the robust May non-farm payroll. The near-term US recession concerns are mitigated as the US labour market remains healthy, upholding better than expected oil demand outlook.

- Another 1mn bbls/d output cut. OPEC+ held a meeting in Vienna on Sunday to discuss the global oil outlook and the potential 1mn bbls/d output cut. On Monday morning, Saudi decided to cut 1mn bbls/d oil production. Previously, OPEC+ agreed to voluntarily cut by more than 1mn bbls/d in April.

- Oil and gas exploration in Norway. With the recent approval for REXI’s subsidiary Lime Petroleum AS for oil and gas exploration, the company would be able to find and tap into new sources of oil and gas in Norway. This would not only expand its Norwegian oil and gas supplies by tapping into new sources instead of solely depending on existing reserves, but it would also help improve its supply chain as it would now be less dependent on external stakeholders to source for oil and gas. Overall, while this approval may not result in immediate effects, it would be greatly beneficial for REXI in the long run.

- Plan to develop oil fields in Malaysia. A pact was made with Malaysia’s state-owned, Petronas regarding a project to develop oil fields in Malaysia. While the current costs do not allow REXI to effectively leverage the benefits of this agreement, we believe that it will be able to benefit from the developed oil fields in the future, allowing the firm to develop a competitive advantage over its peers.

- FY22 results review. Rex International posted a loss of US$1mn versus a net profit of US$67.2mn in 2021. Revenue for the financial year from crude oil sales was up 7% to US$170.3mn.

- Market Consensus.

(Source: Bloomberg)

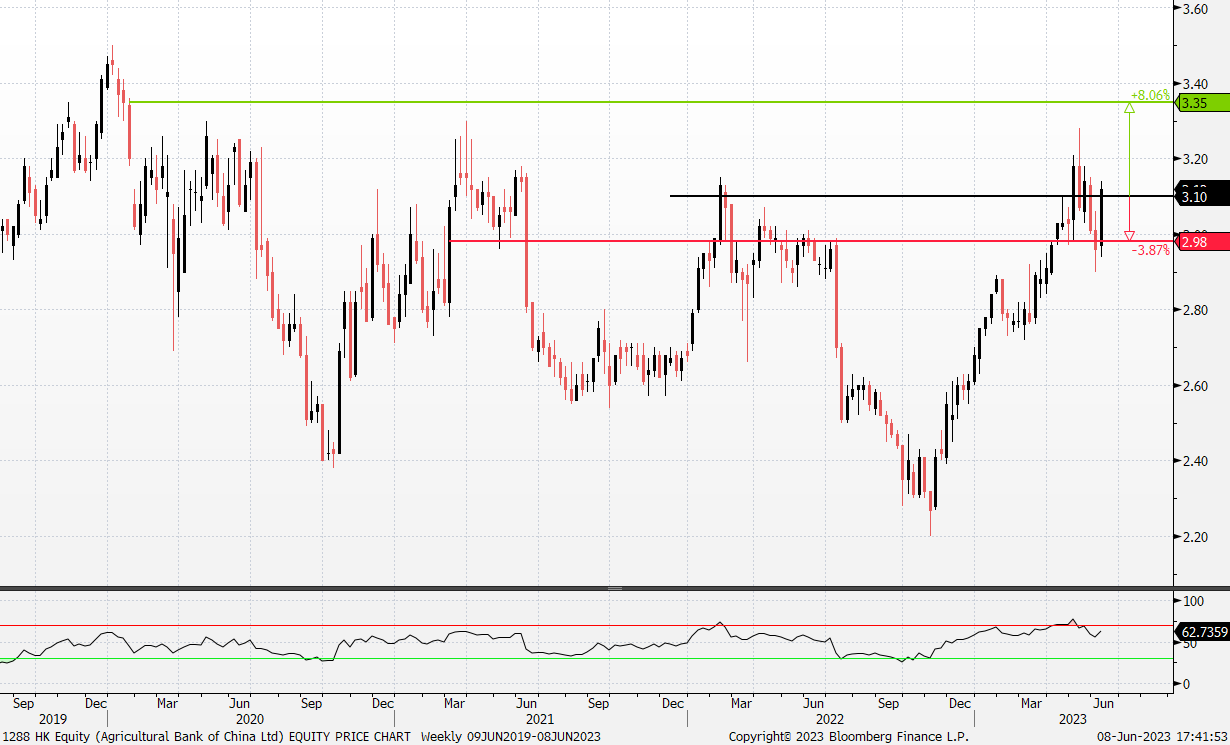

Agricultural Bank of China (1288 HK): Lower deposit rates

- BUY Entry – 3.10 Target – 3.35 Stop Loss – 2.98

- Agricultural Bank of China Ltd. is a China-based commercial bank. The Bank mainly operates through four business segments. The Corporate Finance segment is engaged in the deposit and loan business, small and micro business finance, settlement and cash management, trade financing and investment banking, among others. The Personal Finance segment is engaged in personal deposit and loan, credit card business and private banking business. The Treasury segment is engaged in money market business and investment portfolio management. The Asset Management segment is engaged in the provision of financial services, asset custody business, pension business and precious metal business.

- Lower deposit rates. In an effort to stimulate economic growth in a sluggish consumption environment, China’s six state-owned commercial banks have recently lowered deposit rates. Demand deposits rate is cut by 5bps to 0.2% and two-, three- and five-year time deposits rates are cut by 10bps/15bps/15bps to 2.05%/2.45%/2.50% respectively. This move not only aims to improve the banks’ profitability but also paves the way for the People’s Bank of China to decrease other interest rates. As a result, China’s banks can stabilize their Net Interest Margins and sustain their lending capacity, thereby providing crucial support to the economy.

- Encouraging spending to stimulate growth. Lowering interest rates creates a stronger incentive for businesses to seek loans, while the decrease in deposit rates raises the cost for individuals to maintain their savings in banks. Consequently, this dynamic drives higher levels of spending, which in turn stimulates economic growth. This indirect positive impact benefits banks by creating a greater number of lending opportunities and expanding their customer base. Additionally, the overall boost in consumption within China allows for a further recovery of the country’s economy, particularly following a sluggish performance in the first half of 2023.

- 1Q23 earnings. The company saw a rise in Net Income rose to RMB71.55bn (+1.75% YoY), compared to RMB70.75bn in 1Q22. Basic EPS remain the same YoY at RMB0.20.

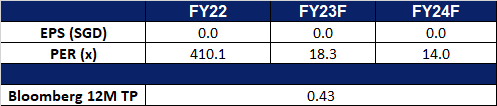

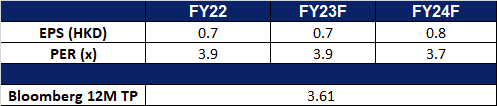

- Market Consensus. FY23F/24F dividend yield is 8.0%/8.6% respectively.

(Source: Bloomberg)

Kingsoft Corp. (3888 HK): Shift to local demand

- RE-ITERATE BUY Entry – 31.0 Target – 36.0 Stop Loss – 28.5

- Kingsoft Corporation Limited is an investment holding company. The Company operates its business through two segments. The Online Game segment mainly engages in the research, development and operation of online games and mobile games, as well as the provision of game licensing services. The Office Software and Services segment mainly engages in the design, research and development, and sales and marketing of the office software products and services. The Company also provides cloud services such as cloud computing, storage, delivery and comprehensive cloud-based solutions.

- Launch of Word Processing Software (WPS) AI. The company has recently revealed its upcoming launch of a generative AI tool called WPS AI. This innovative tool will be initially integrated into a new generation of online content collaborative editing tools known as “light document” and will eventually be incorporated into the entire range of Kingsoft Office products. With capabilities such as generating emails and articles based on prompts, performing multilingual translations, and crafting advertising slogans, this AI tool enables the company to capitalize on the growing demand for AI tools in the industry.

- Replacement of foreign software and hardware. Starting from 2022, the Chinese central government authorities issued a directive instructing government agencies, state-owned, and state-backed enterprises to discontinue the use of foreign-branded computers and software within a two-year timeframe. They are to be replaced with domestically developed hardware and software. This ambitious initiative aims to replace a minimum of 50 million PCs used solely by central government agencies. The objective behind this directive is to retain Chinese capital within the country and minimize its outflow to foreign companies. Additionally, it seeks to establish China’s self-reliance in technology development and manufacturing. As a result of this plan, the demand for domestically developed software in China is expected to surge, thereby driving revenue growth for Kingsoft in the software sector.

- 1Q23 earnings. The company saw a rise in revenue to RMB1.970bn (+6.0% YoY), compared to RMB1.853bn in 1Q21. Net Income rose to RMB192.3mn (+96.0% YoY), compared to RMB98.1mn in 1Q21. Basic EPS rose to RMB0.14, (+100.0% YoY) compared to RMB0.07 in 1Q21.

- Market Consensus

(Source: Bloomberg)

PDD Holdings Inc (PDD US): 618 “fire sale”

- BUY Entry – 72 Target – 80 Stop Loss – 68

- PDD Holdings Inc. is a multinational commerce group that owns and operates a portfolio of businesses. The Company focuses on digital economy so that local communities and small businesses can benefit from the increased productivity and new opportunities. PDD Holdings has built a network of sourcing, logistics, and fulfillment capabilities for its underlying businesses.

- Expecting high volume from 618 sales. The ongoing 618 mid-year sales event in China is anticipated to generate high sales volumes for domestic e-commerce platforms. This shopping festival, following the country’s adjustment of COVID-19 measures, signals a recovery in consumer spending and reflects the rising demand for high-quality products. Chinese consumers, who have become more discerning, seek value for money and prioritise quality at reasonable prices. With attractive discounts and vouchers offered by domestic e-commerce platforms and brands, increased sales are expected, driven by pent-up demand and the preference for high-quality and new-generation products. The reported success of major Chinese e-commerce platforms during this event further affirms the recovery in consumer spending and manufacturing activity in China. PDD platform’s focus on fast-moving consumer goods (FMCG) and its unique approach of encouraging customers to join together in purchasing groups to maximise savings through bulk purchases will further contribute to its anticipated success during this sales period.

- Extra discounts. In preparation for the 618 shopping festival, PDD introduced a 10 bn yuan subsidy program targeting home appliances and consumer electronics. This program, launched on April 6th, includes major domestic and international brands such as Apple, Huawei, Xiaomi, Midea, Sony, Nintendo, Dyson, and more. PDD has also partnered with brands like Haier, Vivo, TCL, Asus, and others to offer factory-direct products, combining subsidies with direct sales to provide consumers with better discounts and benefits. By connecting popular factory products directly to consumers through subsidies and direct sales, this initiative aims to stimulate both the supply and demand sides, offering competitive prices to consumers and boosting the recovery of the manufacturing sector.

- Expansion to the West. Temu, PDD’s e-commerce platform, made its entry into the US market in September 2022. This Chinese-owned marketplace connects predominantly Chinese merchants with customers in the US, Canada, Europe, and Australia. Temu distinguishes itself with its focus on ultra-low prices, achieved by reducing supply chain inefficiencies and passing the savings to consumers. Its website and app heavily emphasize deals and discounts, with products often marked down by up to 80%. This approach has led some consumers to compare Temu to a dollar store. The platform has gained significant traction, surpassing popular platforms like Amazon, TikTok, and Instagram in download charts, indicating its appeal to budget-conscious customers seeking affordable goods online. Temu’s success lies in serving this specific customer segment and filling a void in the discount market.

- 1Q23 earnings review. Revenue rose 58% year-over-year to US$5.48bn, beating estimates by US$920mn. Non-GAAP EPADS of $1.01 beat expectations by $0.38.

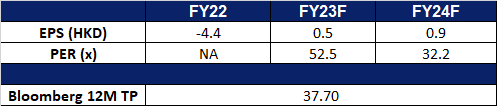

- Market consensus.

(Source: Bloomberg)

Palantir Technologies Inc (PLTR US): The importance of digitalisation security

Palantir Technologies Inc (PLTR US): The importance of digitalisation security

- RE-ITERATE BUY Entry – 14.5 Target – 18.0 Stop Loss – 12.8

- Palantir Technologies Inc develops software to analyze information. The Company offers solutions support many kinds of data including structured, unstructured, relational, temporal, and geospatial. Palantir Technologies serves customers worldwide.

- Regulations for the deployment of responsible artificial intelligence (AI). The Biden-Harris Administration has introduced measures to regulate the progress of AI technology in order to safeguard individuals, manage risks, and address national security concerns. These efforts include the establishment of an AI Bill of Rights, the development of an AI risk management framework, and the creation of a roadmap for a National AI research resource. The administration also aims to address security concerns, invest in research and development, gather public input on important AI issues, and explore the risks and opportunities of AI in education. Given Plantir’s established work with the government, it is likely to benefit from these initiatives.

- Cybersecurity remains resilient. The importance of cybersecurity has grown significantly due to rapid digital transformation in various industries. Despite a slowdown in tech spending, the demand for cybersecurity services remains strong and essential. Recent security threats, including a Chinese cyber-espionage campaign targeting US military and government targets, have further increased the need for robust cybersecurity measures. Market analysts predict a 12.1% increase in global cybersecurity spending, reaching £219 billion in 2023. Enterprises are consolidating their cybersecurity vendors to simplify operations and protect against attacks. Comprehensive cybersecurity solutions help clients analyze security data, integrate applications, reduce costs, and improve risk management.

- 1Q23 earnings review. Revenue rose 17.8% year-over-year to US$525mn, beating estimates by US$19.25mn. Non-GAAP EPS of $0.05 beat expectations by $0.01. The number of U.S. business customers grew 50% year-over-year, from 103 to 155.

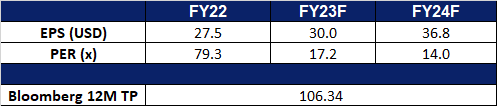

- Market consensus.

(Source: Bloomberg)

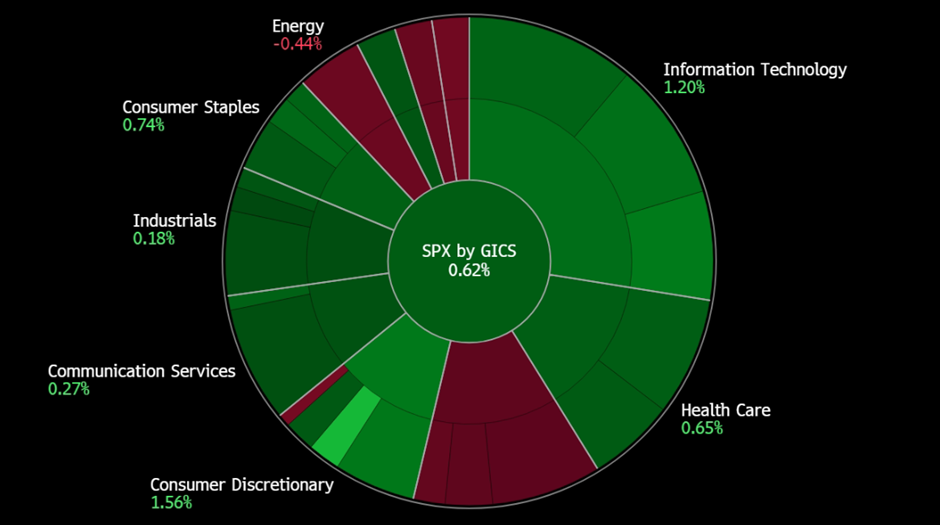

United States

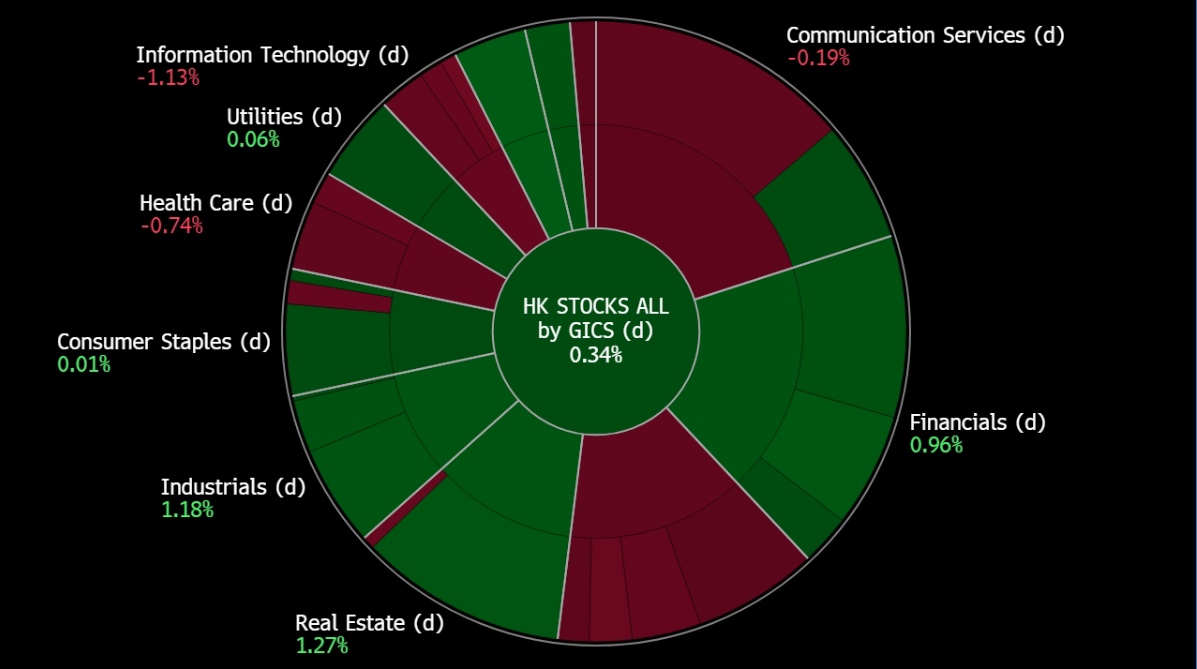

Hong Kong

Trading Dashboard Update: Add Rex International (REXI SP) at S$1.65. Cut loss on China Mobile (941 HK) at HK$62.50 and Fortress Minerals (FMIL SP) at S$0.33.