9 February 2024: Geo Energy Resources Ltd (GERL SP), China Mobile Ltd. (941 HK), Broadcom Inc (AVGO US)

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

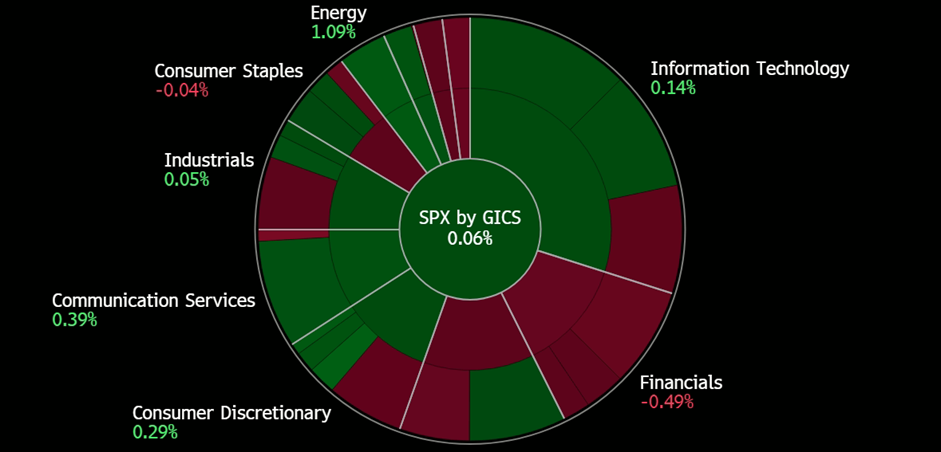

United States

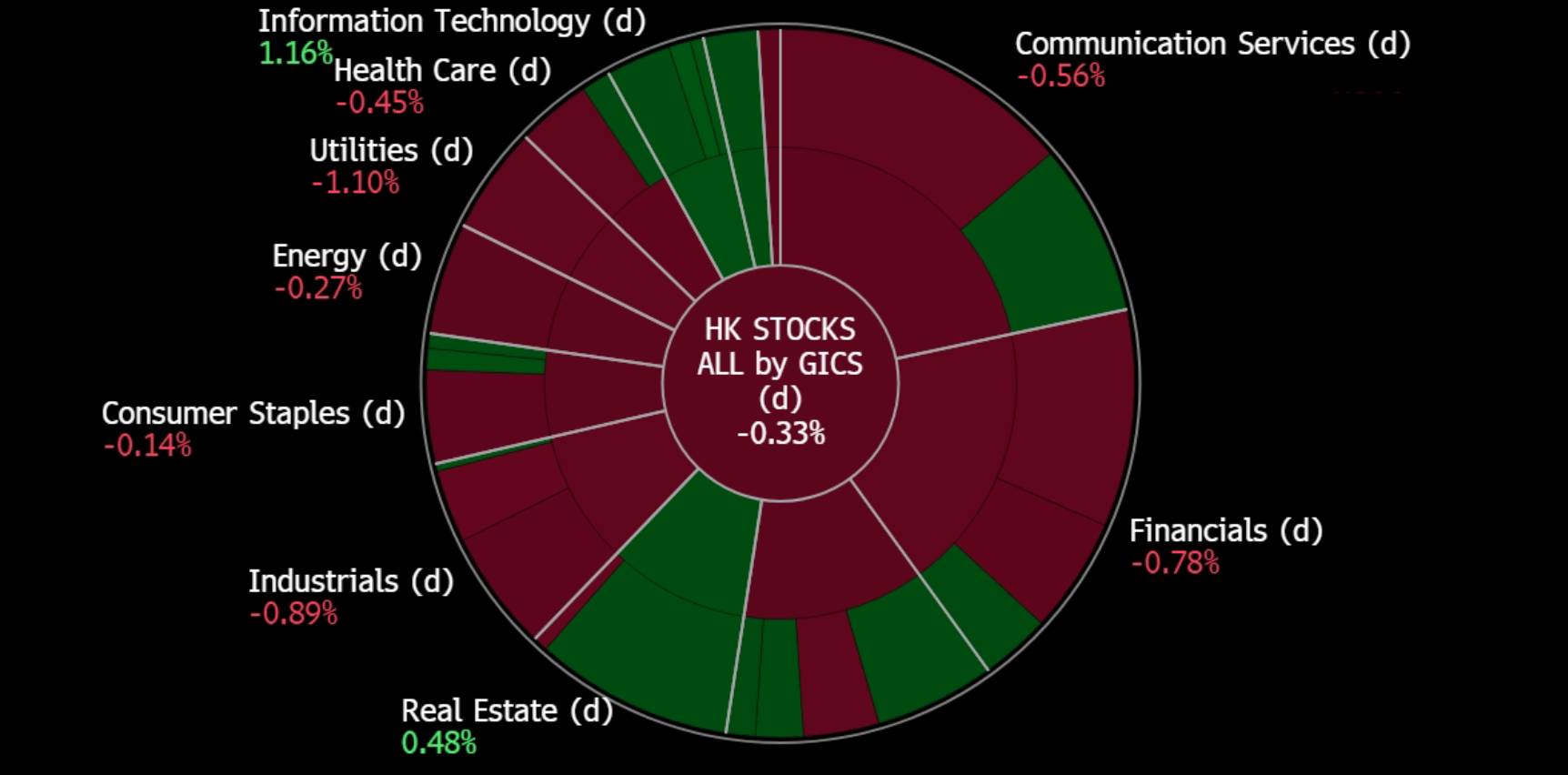

Hong Kong

Geo Energy Resources Ltd (GERL SP): Obtained good deals

- Entry – 0.41 Target– 0.45 Stop Loss – 0.39

- Geo Energy Resources Limited is an integrated coal mining specialist. The Company owns and operates coal mines, offers mine contracting services to third party mine owners, and sells coal to both coal traders and coal export companies.

- Secured life-of-mine coal offtake and long-term multi-million-dollar equity investment. On 7 February, Geo Energy signed a life-of-mine coal offtake agreement with EP Resources, for the supply of coal from Geo Energy’s subsidiary, TRA coal mine, which was recently acquired. The Group will supply 75% to 85% of export volumes of TRA coal up to 12mn tonnes per annum, priced at an index-linked price less the offtake margin. Additionally, EP Resources will have a standby prepayment facility for the coal offtake amounting up to US$20mn which will further inflate Geo Energy’s working capital and cash position. Alongside the offtake deal, Resource Invest AG plans to invest US$35mn in shares of the company to acquire at least a 5.5% equity stake by 31 March 2026, including through market purchases and directly from the company. The equity investment includes purchasing US$10mn of the Company’s treasury shares in two equal tranches, expected to happen in February 2024 and February 2025, at the placement prices of S$0.45 per share and S$0.50 per share, which reflect 45% to 61% premiums compared to its average share buyback price of S$0.31. ResInvest will also receive 41,401,727 non-listed, transferrable, and free warrants, to be subscribed in two tranches and are exercisable within 3 years from the date of issue. The sale of its treasury shares will enable Geo Energy to raise about S$13.4mn, providing additional capital for its ongoing growth.

- Inorganic growth to expand sales volume. As of 31 December 2023, Geo Energy owns 73.11% of PT Golden Eagle Energy Tbk, listed on IDX, and it owns 85% of TRA mine. In December 2023, after the acquisition, TRA had its first export shipment of coal valued at around USD3.2mn based on the ASP of approximately USD58.98 per tonne, which was sold at a premium to the Indonesian Coal Index (ICI) price of USD58.05 per tonne at that time, indicating the favourable demand for TRA coal. TRA produces 3,800 kcal/kg gar coal and has 275Mt of 2P coal reserves, leading to a 262% increase in reserves after the acquisition.

- Long life of mine and low operating costs. Geo Energy obtains a strategic advantage stemming from the extensive lifespan and projected coal production of its mines, instilling confidence in long-term clients to engage in supply contracts with the company. Boasting over 351 million tonnes of thermal coal reserves, Geo Energy holds a prominent position in Indonesia. Additionally, its commendably low stripping ratio, approximately 4.8 for a large-scale coal operator, equips Geo Energy with resilience against cyclical fluctuations in volatile coal prices.

- Upbeat outlook after the acquisition. The recent EGM voting approved the acquisition of two promising companies, significantly expanding the group’s mining portfolio. The newly acquired mine boasts an estimated 275 million tonnes of reserves. Within 5-6 years, Geo Energy will scale up its production to up to 25 million tonnes from the current 8-10 million tonnes, implying a CAGR of 18.6%. The strategic move aligns with the robust demand for TRA coal, primarily fuelled by China and Korea. Despite challenges such as the Monsoon season impacting mining activities, the group anticipates sustained profitability, emphasizing the strategic imperative for acquiring additional mines.

- 3Q23 results review. 3Q23 revenue decreased by 33% YoY to US$111mn from US$164.7mn. Net profit fell 68% YoY to US$11.5mn from US$35.7mn. It attributed the lower revenue to lower sales volume and average selling price, noting that the average Indonesian Coal Index Price for 4,200 GAR coal fell to US$52.07 per tonne in Q3, from US$82.20 per tonne a year earlier. Coal sales declined from 2.4mn tonnes to 2.2mn tonnes.

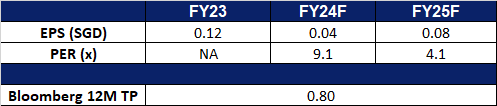

- Market Consensus. We have a fundamental coverage with a BUY recommendation and a TP of S$0.80. Please read the full report here.

(Source: Bloomberg)

Keppel Ltd (KEP SP): Continue to growth in 2024

Keppel Ltd (KEP SP): Continue to growth in 2024

- RE-ITEREATE BUY Entry – 7.24 Target– 7.68 Stop Loss – 7.02

- Keppel Limited is an asset manager and operator. The Company focuses on sustainability solutions spanning the areas of energy and environment, urban development, and digital connectivity, as well as provides critical infrastructure and services through its investment platforms and asset portfolios. Keppel serves clients worldwide.

- Profitability on the rise. Keppel reported a record net profit of S$4.1bn for FY23, marking a more than 4 times increase from the previous year’s profit of S$927mn. The surge was attributed to gains from the divestment of Keppel Offshore & Marine, contributing S$3.3bn, and S$996mn from continuing operations. Return on equity rose to 37.9%, compared to 8.1% in FY22. 2H23 increased by 36% to S$551mn. Its three business segments of infrastructure, real estate, and connectivity performed well. Keppel plans to become a global asset manager and operator, delivering a total shareholder return of 61.1% for 2023. Infrastructure net profit rose by 135% to S$699mn. The proposed final cash dividend is 19 cents per share, bringing the total cash dividend for FY23 to 34 cents per share. Keppel’s CEO highlighted the transformative year, including the successful divestment of the offshore and marine business and the acquisition of a 50% stake in European asset manager Aermont Capital for S$517mn. The company aims to grow its funds under management to $200bn by 2030, leveraging Aermont’s expertise in real estate. Despite challenging conditions in certain markets, Keppel’s real estate segment contributed S$426mn to the net profit for FY23. Looking ahead, Keppel anticipates recurring income growth and expansion in fund management and deal-making volume in 2024.

- S$1bn of sustainability-linked loans. Keppel recently introduced a sustainability-linked financing framework and secured S$1bn in sustainability-linked revolving loans from DBS Bank and United Overseas Bank. The framework outlines key performance indicators and sustainability targets, including a 50% reduction in Keppel’s absolute scope 1 and 2 carbon emissions by 2030 compared to the 2020 baseline. The company also aims to increase its portfolio of renewable energy assets to 7GW by 2030, with an interim target of 4.9GW by the end of 2027. Keppel secured S$500mn in sustainability-linked revolving credit facilities from each bank, with tenures of up to three years.

- Power supply deal with large chipmaker. Keppel’s infrastructure business recently secured a multi-year agreement to supply electricity to contract chipmaker GlobalFoundries’ Singapore operations. The chipmaker operates a US$4bn semiconductor fabrication plant in Singapore serving 200 clients globally in the automotive and 5G technology sectors. Starting May, Keppel’s existing power plants will provide 150 to 180 megawatts of electricity annually to GlobalFoundries’ site. GlobalFoundries is expected to be a long-term buyer from Keppel Sakra Cogen Plant (KSC), which is being developed in collaboration with Mitsubishi Power and Jurong Engineering. GlobalFoundries is anticipated to contract about 25% of KSC’s total generation capacity for over 15 years. KSC, set to be completed in 2026 with a total annual capacity of about 600MW, aims to reduce up to 70,000 metric tons or 10% of annual carbon dioxide emissions at GlobalFoundries’ Singapore site. The plant’s use of hydrogen as feedstock enhances its potential to provide even lower-carbon power in the future. GlobalFoundries has the option to switch part of the power supplied by Keppel to renewable energy sources as part of its goal to achieve a 25% reduction in total greenhouse gas emissions by 2030.

- FY23 results review. FY23 revenue increased by 5% YoY to S$6,967mn from S$6,620mn. Net profit rose 339% YoY to S$4,067mn from S$927mn. Earnings per share rose 337% to 227.6 cents from 52.1 cents in FY22.

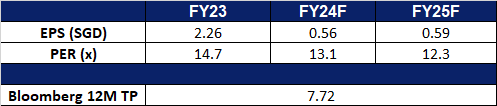

- Market Consensus.

(Source: Bloomberg)

China Mobile Ltd. (941 HK): A buying target amidst the market bail-out

- BUY Entry – 66.6 Target – 70.6 Stop Loss – 64.1

- China Mobile Ltd is a China-based company mainly engaged in communication and information services. The Company’s businesses include personal market business, family market business, government enterprise market business and emerging market business. The personal market business mainly provides mobile communication services and Internet access services. The family market business mainly provides broadband access services. The government enterprise market business provides basic communication services, information application products and data, information, communication and technology (DICT) solutions. The emerging market businesses include emerging fields such as international business, digital content and mobile payment.

- Market bail-out. In recent efforts to bolster market confidence, Chinese regulators have introduced new policies to support economic growth and capital markets. Officials are emphasizing initiatives to advance the high-quality development of public companies to stabilize markets and sustain quality economic expansion. Central Huijin Investment Ltd, a sovereign wealth fund subsidiary, recently expanded exchange-traded fund (ETF) purchases and plans to further increase ETF holdings. Regulators also imposed additional short-selling restrictions following last week’s market plunge to five-year lows amid declining confidence in China’s struggling economy. This array of measures aims to buoy share prices and restore faith in the wake of substantial declines. SOEs such as China Mobile are primary beneficiaries to benefit from these policy supports.

- 6G test satellite. China Mobile recently launched the world’s first satellite to test 6G network architectures, representing a key milestone in exploring integrated space and ground communications tech. The company developed the distributed autonomous 6G architecture with the Chinese Academy of Sciences’ Innovation Academy for Microsatellites and integrated it into the test satellite. As a crucial platform for future converged space and terrestrial networks, low-earth orbit satellites can fill coverage gaps, delivering higher bandwidth satellite internet globally. China Mobile stated it intends to perform experiments using the test satellite to accelerate the integration and advancement of space-to-ground industries.

- Signs of smartphone recovery. The smartphone market has shown signs of recovery in China, picking up steam after the launch of new products by Apple and Huawei technology. China, the world’s largest smartphone market, is expected to ship 287mn units in 2024, a 3.6% YoY increase. The recovery smartphone market would bring about increased mobile data usage, as consumers upgrade their phones and utilize features like 5G connectivity, driving revenue for China Mobile.

- 9M23 earnings. Operating Revenue increased by 7.2% YoY to RMB775.6bn in 9M23, compared to RMB723.5bn in 9M22. Net profit rose by 7.1% YoY to RMB105.6bn in 9M23, compared to RMB98.6bn in 9M22. Basic EPS of RMB4.94 in 9M23, compared to RMB4.62 in 9M22.

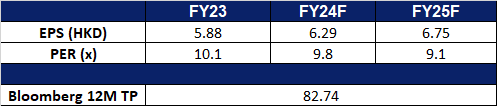

- Market consensus.

(Source: Bloomberg)

Trip.com Group Ltd. (9961 HK): Tailwinds of seasonality

- RE-ITERATE BUY Entry – 303 Target – 327 Stop Loss – 291

- Trip.com Group Ltd is a China-based company mainly engaged in the operation of one-stop travel platform. The Company’s platform integrates a comprehensive suite of travel products and services and differentiated travel content. Its platform aggregates its product and service offerings, reviews and other content shared by its users based on their real travel experiences, and original content from its ecosystem partners to enable leisure and business travelers to have access to travel experiences and make informed and cost-effective bookings. Users come to its platform for any type of trip, from in-destination activities, weekend getaways, and short-haul trips, to cross-border vacations and business trips.

- Livestream collaboration and upcoming visa free travel. Trip.com recently collaboration with the Tourism Authority of Thailand (TAT) and Thailand’s Ministry of Tourism & Sports, hosting a livestream session that showcased the different charms of Thailand. Through the livestream, a wide range of deals were sold, with the transaction grossing over THB100mn in total. This showcased the popularity of Thailand as a tourist destination amongst the Chinese. With China and Thailand waiving visa requirements permanently from March, Trip.com would be able to benefit from the expectations of the increase in travel bookings in 2024 in these 2 countries.

- Trip.vision application. Trip.com just unveiled its Trip.vision application, which is designed to leverage the advanced capabilities of Apple’s latest mixed-reality headset, the Apple Vision Pro. With Trip.Vision, users can virtually explore destinations such as Antarctica, the Maldives, Mount Everest and others, and also check out 360-degree panoramic videos accompanied by voiceovers and attraction information. This application is likely to captivate and entice consumers, driving more travel bookings as consumers virtually immerse themselves in different travel destinations before making a booking to experience it firsthand.

- Lunar New Year Travel Surge. Trip.com saw an increase in travel bookings over the upcoming Lunar New Year Festival. Bookings for trips to and from China over the period have soared more than 900% YoY, supported by easier visa policies, especially in the Asia Pacific region. Both outbound and inbound travel saw increased demand, with inbound travel reservations surging more than 10 times as tourists flock to China to experience the festivity. Furthermore, with around 9bn people travelling between regions in China in 1Q24, this also set s a new record high in the post-COVID period and nearly the pre-pandemic level of 2019.

- 3Q23 earnings. Revenue increased by 99.4% YoY to RMB13.74bn in 3Q23, compared to RMB6.89bn in 3Q22. Net profit rose to RMB4.62bn in 3Q23, compared to RMB266mn in 3Q22. Basic EPS of RMB7.05 in 3Q23, compared to RMB0.41 cents in 3Q22.

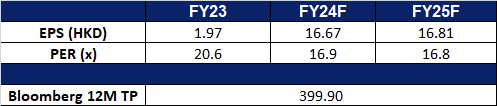

- Market consensus.

(Source: Bloomberg)

Broadcom Inc (AVGO US): Another leg-up soon

- BUY Entry – 1285 (Buy stop) Target – 1400 Stop Loss – 1227

- Broadcom Inc. designs, develops, and supplies semiconductor and infrastructure software solutions. The Company offers storage adapters, controllers, networking processors, motion control encoders, and optical sensors, as well as infrastructure and security software to modernize, optimize, and secure the most complex hybrid environments. Broadcom serves customers worldwide.

- Expecting AI spending boom. Bank of America recently released a report which highlights an anticipated increase of US$45bn in cloud and AI capital spending by major hyperscalers like Microsoft, Alphabet, Amazon, and Meta. This upswing in spending is expected to benefit chipmakers over the next three years. Beyond tech giants, industries like healthcare and finance are embracing AI, further driving demand for chips. Broadcom leads in high-end AI ASIC market, collaborating with companies like Google to design custom chips for AI, known as Tensor Processing Units (TPUs). With Broadcom’s strong position in the AI semiconductor market, it presents an attractive opportunity for investors amidst soaring demand for AI semiconductors.

- Room for growth. In Q4, Broadcom’s revenue and adjusted profit per share surpassed estimates. However, the company forecasts annual revenue for FY24 below Wall Street estimates due to weak enterprise spending and competition, impacted by its acquisition of VMware. In FY24 revenue is expected to be around US$50.0bn, lower than analysts’ expectations of US$52.50bn. The company plans to divest VMware’s non-core businesses, such as end-user computing and Carbon Black and aims for an adjusted EBITDA of about 60% of projected revenue, approximately US$30bn. Transition costs related to VMware are estimated at about US$1bn. Revenue from telecom and enterprise clients has moderated, with concerns about the impact of a slowdown in new orders from major client Cisco Systems and growing competition from Nvidia also adding pressure. However, with the acquisition providing new synergies in the cloud computing domain that has yet to be reflected in its financial statement, there may still be room for growth and upside for Broadcom if it can utilise this acquisition to its fullest potential.

- 4Q23 earnings review. Revenue rose by 4.1% YoY to US$9.3bn, beating estimates by US$20mn. Non-GAAP EPS was US$11.06, beating estimates by US$0.10. In FY24 it expects revenue to be approximately US$50bn including contribution from VMware, an increase of 40% from the prior year period, and adjusted EBITDA guidance of approximately 60% of projected revenue.

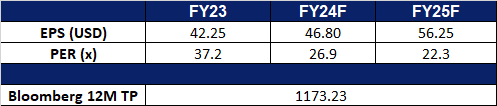

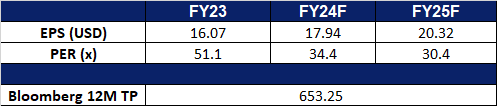

- Market consensus.

(Source: Bloomberg)

Adobe Inc (ADBE US): A lagging AI-themed stock

- RE-ITEREATE BUY Entry – 612 Target – 650 Stop Loss – 593

- Adobe Inc. develops, markets, and supports computer software products and technologies. The Company’s products allow users to express and use information across all print and electronic media. Adobe offers a line of application software products, type products, and content for creating, distributing, and managing information.

- Artificial intelligence application layer explodes. The artificial intelligence application layer explodes. Artificial intelligence stands at the forefront of the upcoming technological revolution, with distinct leaders emerging in various application domains. Microsoft dominates the office software realm, while Adobe leads in drawing and editing applications. The current surge of start-ups focused on short video and drawing artificial intelligence indicates a rapid evolution in this sector, suggesting it could be the first to achieve mature applications of AI.

- Abandoned the acquisition of Figma. In December of 2023, Adobe decided to halt its $20bn acquisition of Figma due to regulatory pressures from the EU and British authorities. This announcement was well-received by the market. While technological revolutions often spark waves of mergers and acquisitions among related startups, the subsequent return to market rationality often reveals overvaluations in many target companies. Therefore, the termination of Adobe’s acquisition of Figma may ultimately be beneficial for the company, allowing it to judiciously allocate cash toward acquisitions or stock buybacks.

- 4Q23 results. Revenue increased to US$5.05bn, an increase of 11.5% YoY, exceeding expectations by US$30mn. Non-GAAP earnings per share were $4.27, beating expectations by $0.13. Revenue in the first quarter of FY24 is expected to be US$5.1bn to US$5.15bn, compared with market expectations of US$5.15bn. Non-GAAP earnings per share were between $4.35 and $4.40, compared with consensus expectations of $4.27.

- Market consensus.

(Source: Bloomberg)

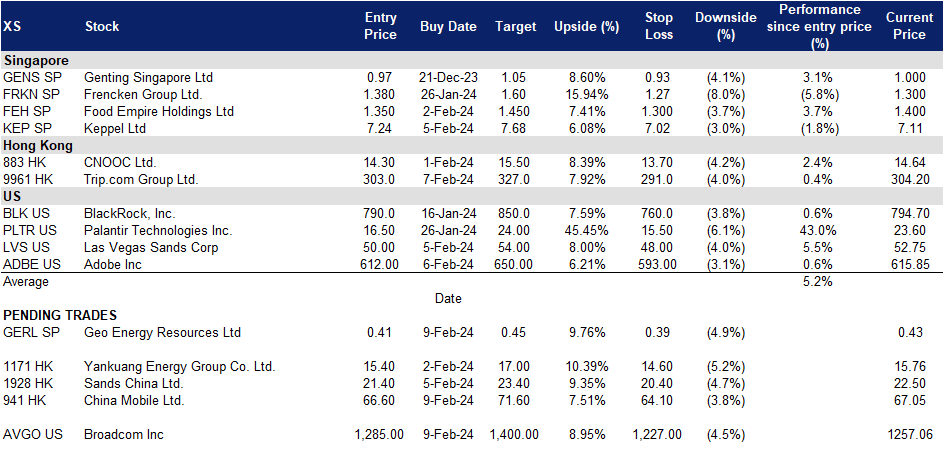

Trading Dashboard Update: Add Trip.com Group Ltd. (9961 HK) at HK$303.0 and Adobe Inc (ADBE US) at US$612.0. Cut loss on Jumbo Group Ltd (JUMBO SP) at S$0.255.