9 December 2022: Keppel Corp Ltd (KEP SP), Ping An Insurance (Group) Company of China, Ltd (2318 HK)

Singapore Trading Ideas | Hong Kong Trading Ideas | Market Movers | Trading Dashboard

Keppel Corp Ltd (KEP SP): Reviving infrastructure expansion in the post-COVID era

- RE-ITERATE Entry – 7.50 Target – 8.30 Stop Loss – 7.10

- Keppel Corporation is a Singaporean conglomerate headquartered in Keppel Bay Tower, HarbourFront. The company consists of several affiliated businesses that specialises in offshore & marine, property, infrastructure and asset management businesses. It is increasingly focused on transition energy and renewables, and is pivoting to renewables for a more sustainable future.

- Merger Votes. On 8 December, the group held its extraordinary general meeting to vote on the proposed merger of its offshore and marine (O&M) unit with Sembcorp Marine online.

- Keppel Infrastructure. The investing unit of Keppel Corp is investing about 30 million euros (S$42.6 million) to take a 49.9 percent stake in a new joint venture (JV) with Swiss-based energy company Met Group. The JV will be called Keppel MET Renewables. The company will pursue renewable energy projects across Western Europe. It targets to “scale up rapidly” to at least one gigawatt of operating and ready-to-build renewable energy projects. Additionally, Keppel New Energy, a subsidiary of Keppel Corporation’s infrastructure arm, will be collaborating with Pertamina Power Indonesia and Chevron New Energies International to explore the development of green hydrogen and green ammonia projects using renewable energy in Indonesia.

- New contract. Keppel Offshore & Marine, through its wholly-owned subsidiaries, has entered into new bareboat charter contracts with ADES Saudi Limited Company for two KFELS B Class jack-up rigs, Cantarell III and Cantarell IV. The new bareboat charters will be for a period of five years, expected to commence in the first half of 2023, and projected to generate total revenue of about $155 million for Keppel O&M, which includes modification works to prepare the rigs for deployment.

- Updated market consensus of the EPS growth in FY22/23 is -4.5%/-1.8% YoY respectively, which translates to 14.2x/15.2x forward PE. Current PER is 11.9x. Bloomberg consensus average 12-month target price is S$9.18.

Hongkong Land Holdings Ltd (HKL SP): China easing Covid restrictions

- Entry – 4.40 Target – 4.70 Stop Loss – 4.25

- Hongkong Land is a major listed property investment, management and development group. The Group owns and manages over 850,000 sq. m. of prime office and luxury retail property in key Asian cities, principally Hong Kong, Singapore, Beijing and Jakarta. The Group also has a number of high-quality residential, commercial and mixed-use projects under development in cities across China and Southeast Asia, including a 43% interest in a 1.1 million sq. m. mixed-use project in West Bund, Shanghai.

- Easing COVID measures. On 8 December, it was reported that Hong Kong may further loosen Covid-related restrictions. The government is considering scrapping its outdoor mask mandate and easing test requirements for inbound travelers. The Chinese government also recently announced that they would allow Covid patients with mild symptoms to isolate at home and drop the requirement for people to show negative tests when traveling between regions.

- Yuan strengthening. China’s onshore and offshore yuan is strengthening against the US dollar. The implementation of China’s policies would stabilise economic growth, restoring market confidence and supporting the yuan. With the Chinese economy expected to open up gradually in the coming year, the yuan will likely appreciate against the US dollar.

- Property sector supporting policy. On 23 November, China’s central bank and Banking and Insurance Regulatory Commission jointly announced 16 measures to ensure the stray and sound development of the housing sector. Additionally, they also urged financial institutions to support real estate financing through various channels. By providing financing to property developers, it can help to stabilise the housing market and prevent risks from spreading beyond the real estate sector. These new policies will also help to boost homebuyer confidence and help to release reasonable housing demand.

- Updated market consensus of the EPS growth in FY22/23 is -10.6%/10.3% YoY respectively, which translates to 12.0x/10.9x forward PE. Current PER is 12.7x. Bloomberg consensus average 12-month target price is S$5.17.

(Source: Bloomberg)

Ping An Insurance (Group) Company of China, Ltd (2318 HK): Some relieves for property developers

- Buy Entry – 50.0 Target – 55.0 Stop Loss – 47.5

- Ping An Insurance (Group) Company of China, Ltd. is a personal financial services provider. The Company provides insurance, banking, investment, and Internet finance products and services. The Company operates its businesses through four segments. The Insurance segment provides life insurance and property insurance, including term, whole-life, endowment, annuity, automobile and health insurance. The Banking segment is engaged in loan and intermediary businesses with corporate customers and retail business. The Assets management segment is engaged in security, trust and other assets management businesses, including investment, brokerage, trading and asset management services. The Internet Financing segment is engaged in the provision of Internet finance products and services.

- Reopen gateways for developers to finance. On November 28th, China’s securities regulator lifted a ban on equity refinancing for listed firms, allowing eligible listed developers to issue shares to buy property-related assets, replenish working capital or repay debts. Meanwhile, the authority will promote developer financing through the listing of qualified projects via real estate investment trusts (Reits), and will encourage the setting up of property-focused private equity funds. The measures will give some room for developers to solve the near-term liquidity crunch and reduce defaults on borrowings.

- Another 25bps of RRR cut. Last week, The People’s Bank of China announced that it will cut the reserve requirement ratio for most banks by 25bps, effective on December 5th. There will be RMB500bn injected into the economy. This was the second time of RRR cut this year. The general year-end liquidity crunch is expected to be mitigated to some extent.

- 9M22 earnings review. Total revenue declined by 3.2% YoY to RMB952.7bn in 9M22. Operating profit attributable to shareholders of the parent company rose 3.8% YoY to RMB123.3bn. Profit attributable to the parent declined by 6.34% YoY to RMB76.5bn. Total premium income rose by 3.6% YoY to RMB587.5bn.

- The updated market consensus of the EPS growth in FY22/23/24 is -0.3%/29.5%/14.2% YoY respectively, translating to 7.5×/5.8x/5.1x forward PE. The current PER is 7.8x. Bloomberg consensus average 12-month target price is HK$64.79.

Fuyao Glass Industry Group Co Ltd (3606 HK): Benefiting from the booming EV trend

Fuyao Glass Industry Group Co Ltd (3606 HK): Benefiting from the booming EV trend

- RE-ITERATE Buy Entry – 33.0 Target –37.0 Stop Loss – 31.0

- Fuyao Glass Industry Group Co Ltd is a China-based company, principally engaged in the manufacture and distribution of float glasses and automobile glasses. The Company’s products portfolio consist of automobile glasses, such as coating glasses and others, which are applied in passenger cars, buses, limousines and others, and float glasses. The Company distributes its products within domestic markets and to overseas markets.

- High-value-added products are the growth driver. In 9M22, the high value-added products such as panoramic roof glass, windshield glass with a camera, head-up display glass, and soundproof glass accounted for 43.8% of the overall product mix. Accordingly, the overall ASP increased by 11.0% YoY during the period. Moving forward, the increasing demand for EVs will drive the growth of the utilization of smart glass and energy conservation glass.

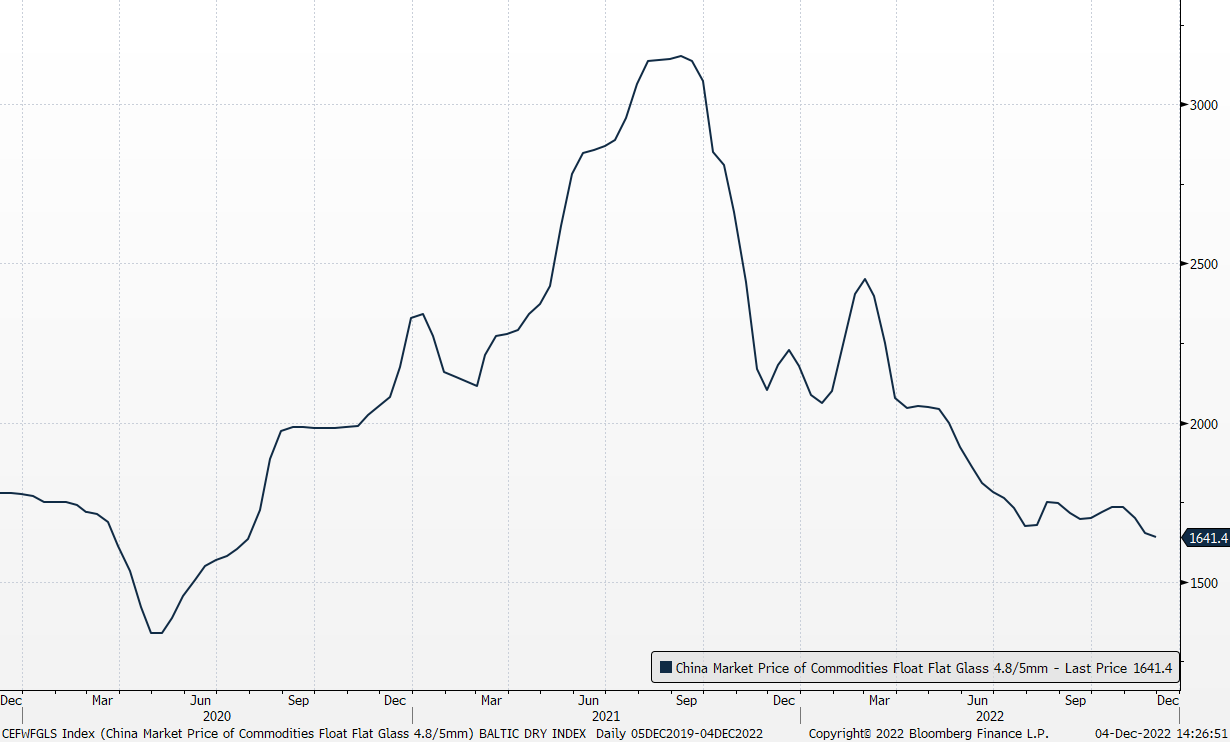

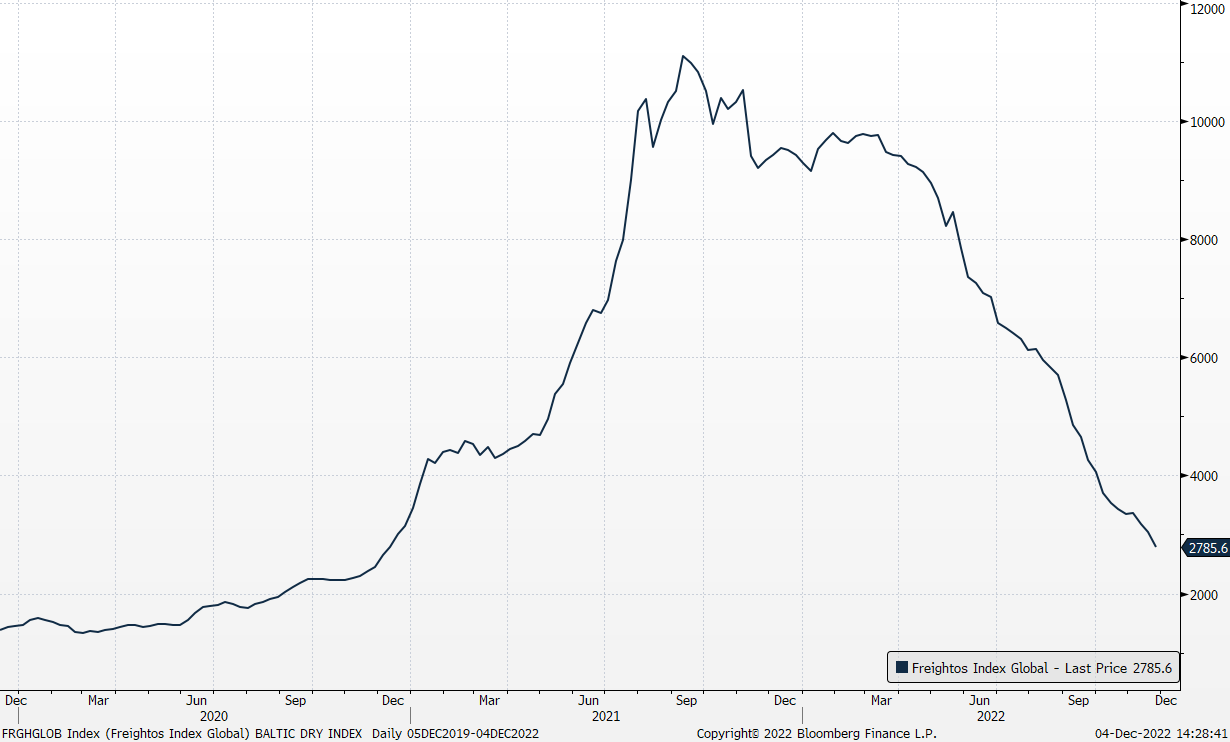

- Falling raw material and shipping costs. Float glass prices further dropped in November due to soft demand and excessive inventories. Meanwhile, global freight rates had been trending downward with the gradual normalization of the global supply chain. Both tailwinds will help margin improvement in the near term.

China Float Flat Glass 4.8/5mm price

(Source: Bloomberg)

(Source: Bloomberg)

Global Container Freight Index

(Source: Bloomberg)

(Source: Bloomberg)

- Record high quarterly performance. 3Q22 operating revenue jumped by 34.3% YoY to a historical high of RMB7.5bn. 9M22 operating revenue grew by 19.2% YoY to RMB20.4bn. 3Q22 gross profit jumped by 66.1% YoY to RMB2.6bn. 3Q22 GMP increased by 6.6ppts to 34.9%. Profit attributable to owners of the company jumped by 83.8% YoY to RMB1.5bn. NPM grew by 6.6ppts to 20.4%.

- The updated market consensus of the EPS growth in FY22/23 is 46.5%/10.0% YoY respectively, which translates to 17.0x/15.5x forward PE. The current PER is 21.3x. Bloomberg consensus average 12-month target price is HK$46.45.

United States

Top Sector Gainers

| Sector | Loss | Related News |

| Internet Retail | +3.11% | Amazon CEO, Putting Stamp on Company, Promotes Four Leaders Amazon.com Inc (AMZN US) |

| Semiconductors | +2.66% | Nvidia, NXP among biggest semiconductor gainers ahead of Broadcom’s Q4 results NVIDIA Corp (NVDA US) |

| Other Metals/Minerals | +2.61% | Copper rises while Goldman predicts prices reaching $11,000 in a year Rio Tinto PLC (RIO US) |

Top Sector Losers

| Sector | Loss | Related News |

| Oil & Gas Production | -1.80% | Oil falls on prospect of Keystone resumption, weakening demand ConocoPhillips (COP US) |

| Wireless Telecommunications | -1.67% | AT&T Stock Is Now a Buy, This Analyst Says. Growth Potential Is Why. T-Mobile US Inc (TMUS US) |

| Oil & Gas Pipelines | -0.77% | Oil falls on weakening demand, shrugs off Keystone closure Enbridge Inc (ENB US) |

Hong Kong

Top Sector Gainers

| Sector | Gain | Related News |

| Gamble | +6.47% | Hong Kong Stocks Rebound on Report City May Relax Covid Rules Galaxy Entertainment Group Limited (0027 HK) |

| Biotechnology | +5.12% | People stock up on drugs after controls eased WuXi Biologics (Cayman) Inc (2269 HK) |

| Travel & Tourism | +4.60% | Hong Kong May End Outdoor Mask Rule, Relax Covid Tests, Report Says Trip.com Group Ltd (9961 HK) |

Top Sector Losers

| Sector | Loss | Related News |

| Precious Metal | -1.17% | Gold Price Forecast: XAU/USD eyes further upside on downbeat United States Treasury bond yields Zijin Mining Group (2899 HK taiwan) |

| Leisure & Recreation | -0.70% | Alibaba, Tencent, Macau casino stocks fuel market rebound as China eases more Covid measures in bullish reopening signal Haichang Ocean Park Holdings Ltd (2255 HK) |

| Semiconductors | -0.60% | US lawmakers water down chip ban amid outcry from business community Semiconductor Manufacturing International Corp (981 HK) |

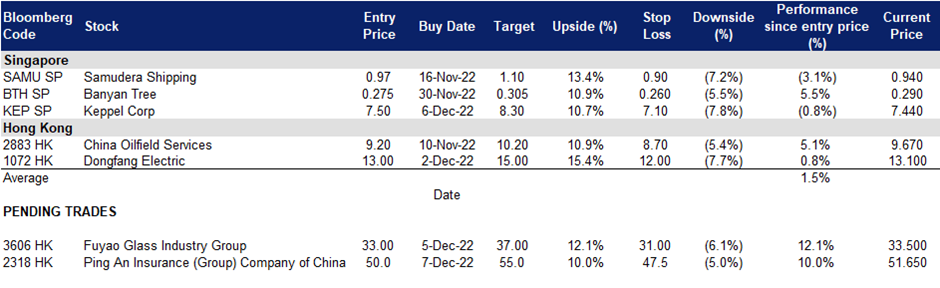

Trading Dashboard Update: Add Fuyao Glass Industry (3606 HK) at HK$33 and Ping An Insurance (2318 HK) at HK$50. Take profit on Banyan Tree (BTH SP) at S$0.305. Cut loss on Samudera Shipping (SAMU SP) at S$0.90.

(Source: Bloomberg)

(Source: Bloomberg)

(Source: Bloomberg)

(Source: Bloomberg)

(Source: Bloomberg)

(Source: Bloomberg)