6 March 2023: HongKong Land (HKL SP), ANTA Sports Products Ltd (2020 HK), Barrick Gold Corporation (GOLD US)

Singapore Trading Ideas | Hong Kong Trading Ideas |United States Trading Ideas | Sector Performance | Trading Dashboard

HongKong Land (HKL SP): Benefiting from “World of Winners”

- BUY Entry 4.50 – Target – 4.80 Stop Loss – 4.35

- Hongkong Land is a major listed property investment, management and development group. The Group owns and manages more than 850,000 sq. m. of prime office and luxury retail property in key Asian cities, principally Hong Kong, Singapore, Beijing and Jakarta. The Group also has a number of high quality residential, commercial and mixed-use projects under development in cities across China and Southeast Asia, including a 43% interest in a 1.1 million sq. m. mixed-use project in West Bund, Shanghai.

- Improving tourism sector sentiments. Cathay Pacific will provide 80,000 free round-trip air tickets to Hong Kong for residents throughout Southeast Asia as part of the “World of Winners” campaign sponsored by Airport Authority Hong Kong, which offers 500,000 free tickets to global visitors. The objective of this initiative is to support the “Hello Hong Kong” campaign of the Hong Kong Tourism Board, which aims to welcome tourists back to the city following the lifting of travel restrictions. This would definitely be an additional and effectively booster to drive tourism demand for Hong Kong.

- Removal of COVID-19 mask mandates. Hong Kong announced recently that the city will lift its COVID-19 mask mandate. This decision is aimed at attracting visitors and business and resuming normal life, more than three years after strict regulations were initially put in place in the financial hub. This shows confidence and strength in that the country is emerging from the pandemic. This is bound to drive the level of tourism within Hong Kong as well, as more activities resume as per pre-pandemic times.

- FY22 results review. Underlying profit fell 20% YoY to S$776mn in FY22 from S$966mn in FY21.Net profit came in at US$203 million for the year, after including net non-cash losses of US$573.4 million due to lower valuations of the group’s investment properties.

- Updated market consensus of the EPS growth in FY23/24 is 14.8%/5.2% respectively, which translates to 11.5x/10.9x forward PE. Current PER is 13.5x. Bloomberg consensus average 12-month target price is S$5.19.

(Source: Bloomberg)

Yangzijiang Shipbuilding (BS6 SP): Benefitting from positive US data

Yangzijiang Shipbuilding (BS6 SP): Benefitting from positive US data

- RE-ITERATE Entry – 1.32 Target – 1.45 Stop Loss – 1.25

- Yangzijiang Shipbuilding Holdings Limited builds a wide range of ships. The Company produces a wide range of commercial vessels, mini bulk carriers, multi-purpose cargo vessels, containerships, chemical tankers, offshore supply vessels, rescue and salvage vessels, and lifting vessels.

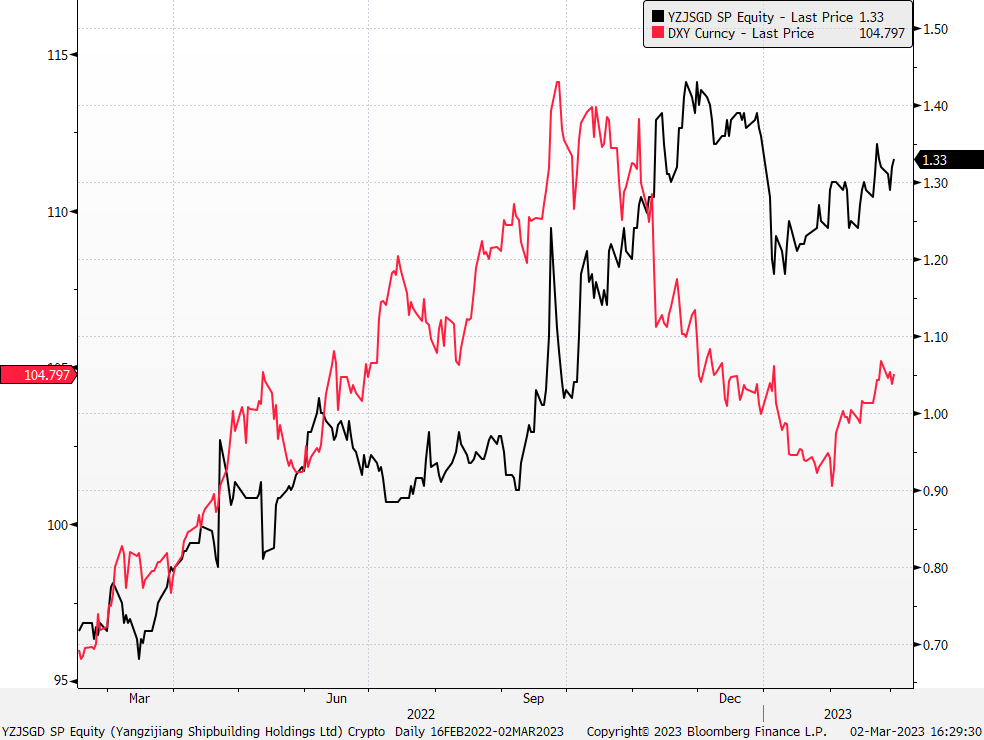

- Benefitting from a stronger US Dollar. Following the most recent US strong nonfarm payroll data for the month of January, the US dollar index saw a rebound with the positive results. Yangzijiang Shipbuilding Holdings Limited, whose financial results, as well as operations, which are mainly denominated in USD, can benefit from the appreciate of the US dollar in upcoming months.

Share price and dollar index comparison

(Source: Bloomberg)

- Dropping Iron Ore and Steel prices. Hard commodities, such as iron ore and steel, saw a price decline following the appreciation of the US dollar. This allows the company to find opportunities in lowering their cost of production, whereby iron ore and steel make up a key component of the production of a ship.

- Visibility on secured contracts. As of 3Q22, the company’s total order book value reached US$10.27bn which extended the company’s top line visibility to mid-2025. This allows the company to have a confirmed and visible stream of revenue for the upcoming years.

- Company Outlook. The company’s outlook is positive in the upcoming months, with the rebound of the U.S. dollars as economic pressure starts to ease. There is also clear visibility on the company’s revenue stream given that its’ order book are filled till mid-2025. The re-opening of China’s economy also allows the company to re-accelerate the production of its business. This suggests that the company’s performance is likely to continue to improve in the near future.

- The updated market consensus of the EPS growth in FY23/24 is 23.02%/6.83% YoY respectively, which translates to 8.35x/7.82x forward PE. Current PER is 10.28x. FY23F/24F dividend yield is 4.18%/4.33% respectively. Bloomberg consensus average 12-month target price is $1.54.

ANTA Sports Products Ltd (2020 HK): Rise of Athleisure

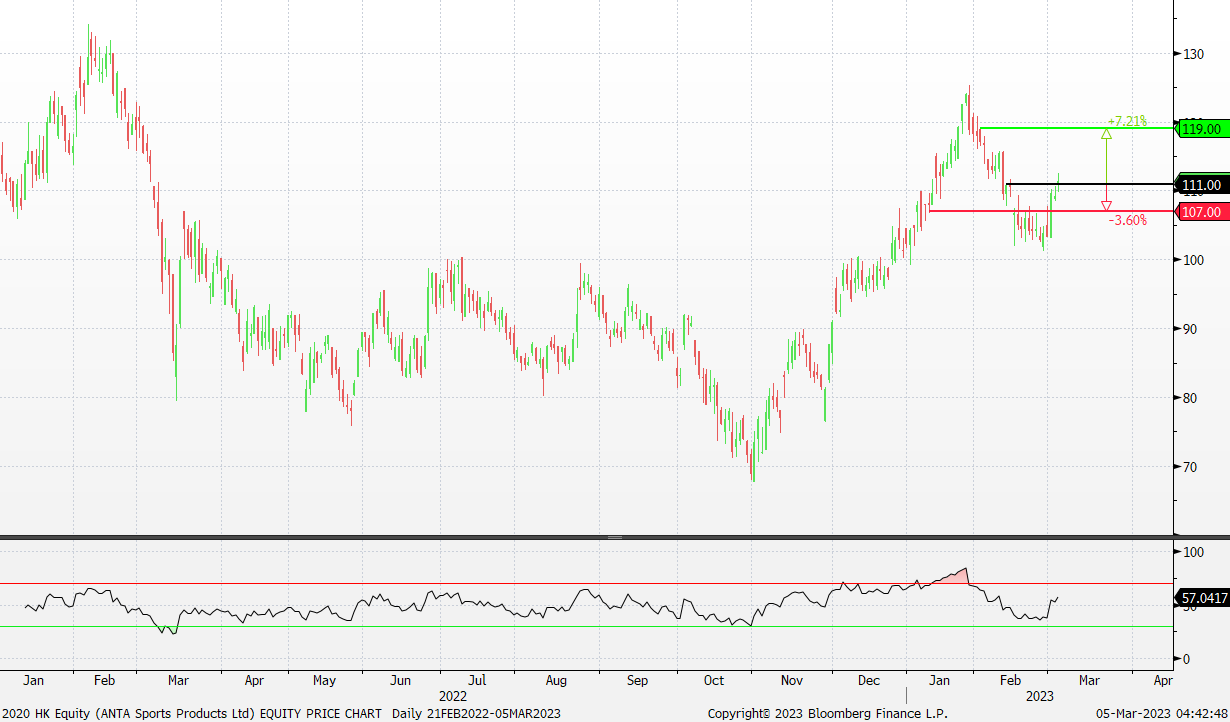

- BUY Entry – 111 Target – 119 Stop Loss – 107

- ANTA Sports Products Limited is principally engaged in the manufacture and trading of sporting goods, including footwear, apparel and accessories in the Mainland China. The Company focuses on sportswear market in China with a brand portfolio, including ANTA, ANTA KIDS, FILA, FILA KIDS and NBA. Through its subsidiaries, the Company is also engaged in the manufacture of shoe sole. The Company’s subsidiaries include Anta Enterprise Group Limited, Motive Force Sports Products Limited and REEDO Sports Products Limited.

- Boosting consumer spending. There was robust recovery seen in consumer spending during the holiday period. However, the government will need to continue to boost consumption in order to drive its economic growth. With the government’s support and pent up consumption demand, Chinese residents per capita consumption expenditure is expected to increase 8% to 12% YoY while retail sales of consumption goods to rise between 7% to 11%.

- PMI improving. China’s official manufacturing purchasing managers’ index increased to 52.6 in February, surpassing the expected 50.5 and the January reading of 50.1. The National Bureau of Statistics also reported a rise in non-manufacturing PMI to 56.3, the highest level since June 2022. These figures indicate further growth in China’s factory activity.

- Athleisure demand strong. China’s sportswear market remains robust, with Anta reporting 20-25% retail growth (excluding Fila) in 2022 and strong sales during the Chinese New Year period. The market is projected to grow with a compound annual growth rate of over 9%, presenting opportunities for both athleisure and luxury brands. Both the lifestyle changes during the pandemic and increasing fitness trend have contributed to the popularity of athleisure being worn in people’s daily lives.

- 1H22 earnings. Revenue in 1H22 was RMB25,965mn , up 13.8% YoY from RMB22,812mn. Profit attributable to the shareholders reduced by 10.0% to RMB3.77bn.

- The updated market consensus of the EPS growth in FY23/24 is 28.7%/22.7%, respectively, which translates to 28.0x/22.8x forward PE. Current PER is 35.4x. Bloomberg consensus average 12-month target price is HK$128.82.

(Source: Bloomberg)

Cathay Pacific Airways Ltd (293 HK): Free air tickets

Cathay Pacific Airways Ltd (293 HK): Free air tickets

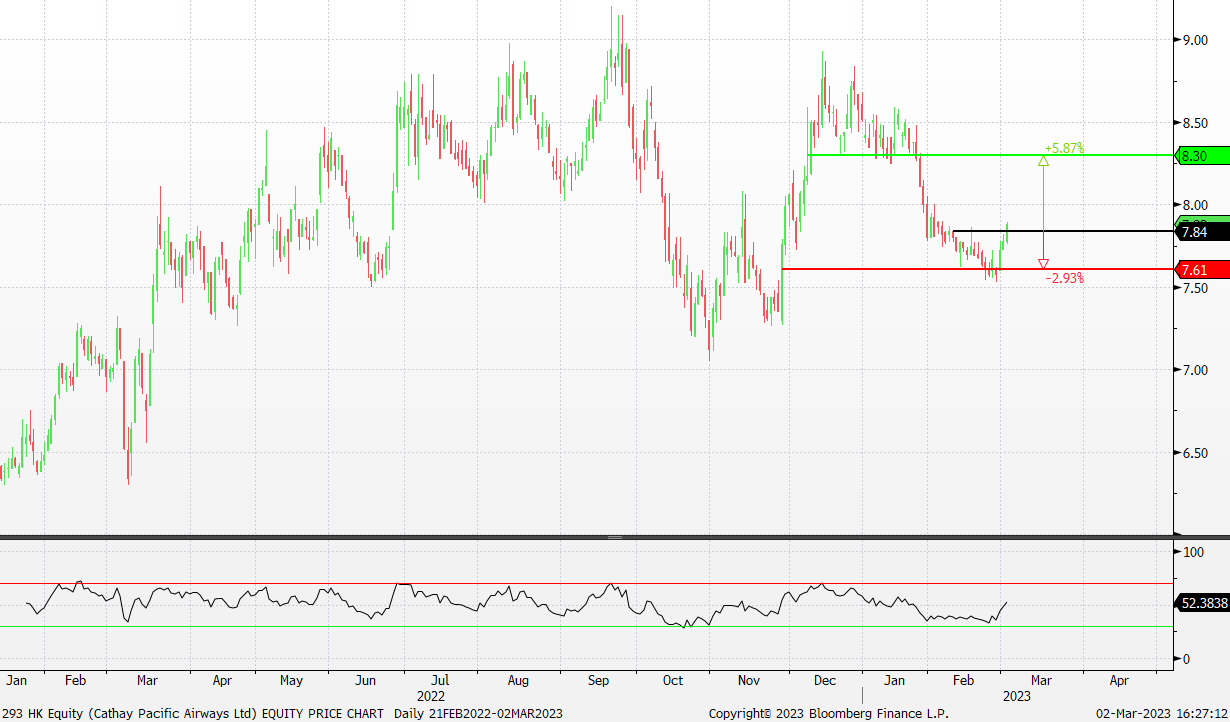

- RE-ITERATE BUY Entry – 7.84 Target – 8.30 Stop Loss – 7.61

- Cathay Pacific Airways Ltd is a company mainly engaged in the provision of international passenger and cargo air transportation. Together with its subsidiaries, the Company operates business through its four operating segments. The Cathay Pacific and Cathay Dragon segment provides full service international passenger and cargo air transportation under the Cathay Pacific and Cathay Dragon brands. The Air Hong Kong segment provides express cargo air transportation offering scheduled services within Asia. The HK Express segment provides a low-cost passenger air transportation offering scheduled services within Asia. The Airline Services segment provides supporting airline operations services include catering, cargo terminal operations, ground handling services and commercial laundry operations.

- Promoting tourism. The Hong Kong Tourism Board launched the “Hello, Hong Kong” campaign offering 500,000 air tickets and over a million Hong Kong Goodies visitor consumption vouchers to attract visitors, businesses, and investors to the city after Covid-19 curbs. Part of this initiative is the HKIA’s “World of Winners” Tickets Giveaway Campaign to stimulate air traffic and promote the recovery of Hong Kong’s aviation industry, tourism, and economy. Majority of the tickets will be distributed in phases by three home-based airlines, Cathay Pacific Airways, Hong Kong Express and Hong Kong Airlines, through their respective channels in major passenger markets by different mechanisms such as lucky draw, first-come-first-served, “Buy 1 or more – Get 1 Free”, or games. Additionally, some tickets will be provided to travel trade and government bodies for promoting tourism in Hong Kong. Around 80,000 tickets will be given away to Hong Kong residents in summer 2023, and some tickets will be given away in the Guangdong-Hong Kong-Macao Greater Bay Area. A total of more than 700,000 tickets will be given away across various markets through different channels. The distribution of the tickets will be 65% through airlines and their agents, with the remaining reserved for tourism-related sectors to support inbound tourism and promote Hong Kong.

- “World of Winners” in Singapore. The Tickets Giveaway Campaign will be rolled out in phases with the first phase starting from 1 March 2023 at Southeast Asia market. Cathay Pacific is offering 12,500 round-trip air tickets to tourists from Singapore between noon on 2 March and 11:59pm on 8 March.

- 1H22 earnings. Revenue in 1H22 was HK$18,551mn , up 17.0% YoY from HK$15,854mn. Loss attributable to the shareholders reduced by 33.9% from HK$7,565mn to HK$4,999mn.

- The updated market consensus of EPS in FY23/24 is HK$0.54/HK$0.67 respectively, which translates to 14.7x/11.8x forward PE. Bloomberg consensus average 12-month target price is HK$9.54.

(Source: Bloomberg)

Barrick Gold Corporation (GOLD US): Safe haven

- BUY Entry – 16.4 Target – 18.0 Stop Loss – 15.6

- Barrick Gold Corporation engages in the exploration, mine development, production, and sale of gold and copper properties. It has ownership interests in producing gold mines that are located in Argentina, Canada, Côte d’Ivoire, the Democratic Republic of Congo, the Dominican Republic, Mali, Tanzania, and the United States.

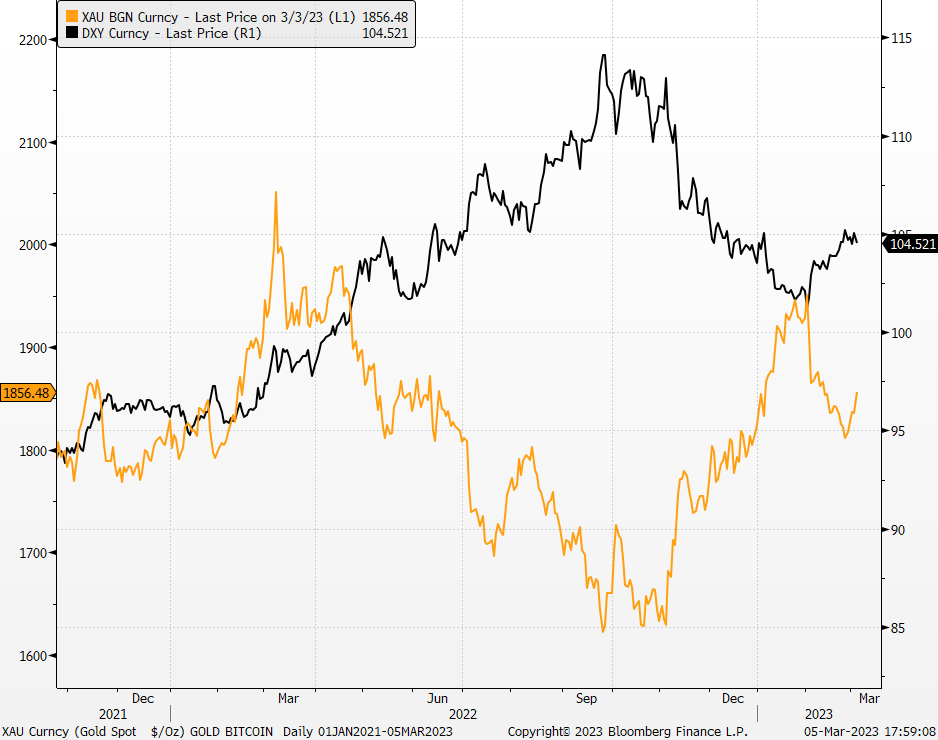

- Better outlook for gold price in 2023. There are several factors impact gold prices, and the key ones are the trend of the US dollars and global geopolitical risk. The broad market has expected that US dollars peaked at last year as inflation has been on a downswing. Even though recent macro data such as January CPI and core PCE price were higher than expected, both showed overall prices were declining. The market still expects Fed to cut rate by the end of after the peak in 3Q23. On the other hand, geopolitical tensions remain high and probably escalate anytime as China-US confrontations are more frequent. Gold is the good old safe haven.

Gold price and Dollar index trend

(Source: Bloomberg)

(Source: Bloomberg)

- Mixed 4Q23 results. Revenue dropped by 16.3% YoY to US$2.77bn, missing estimates by US$20mn. Non-GAAP net loss per share was US$0.13. 4Q22 gold and copper production was 1.12mn oz and 96mn pounds, respectively. Gold and copper prices averaged at US$1,728/oz and US$3.81/pound respectively.

- US$750mn share buyback. The company authorized a share buyback program of up to US$750mn in 2023, compared to US$1.6bn of dividends and buybacks in 2022.

- The updated market consensus of the EPS growth in FY23/24 is 8.8%/24.2%, respectively, which translates to 20.3x/16.3x forward PE. Current PER is 19.5x. Bloomberg consensus average 12-month target price is US$21.6.

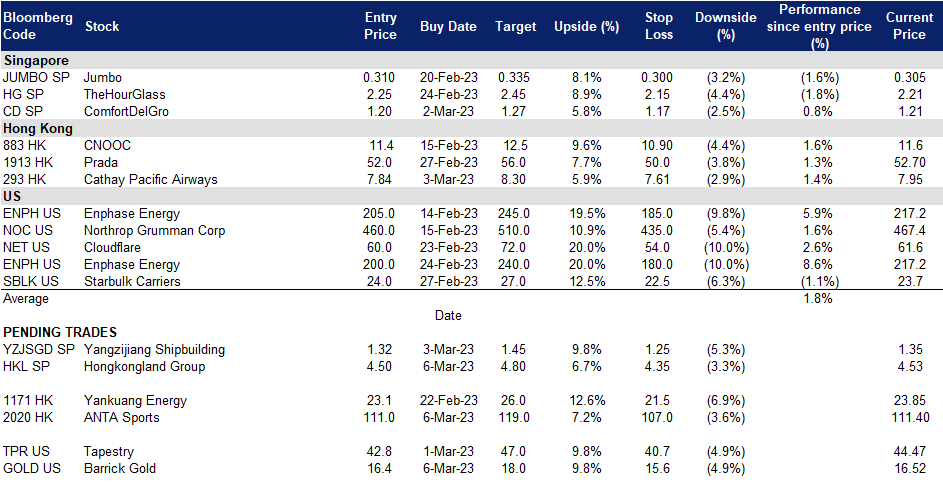

Star Bulk Carriers Corp. (SBLK US): Recovering shipping activites

- RE-ITEREATE BUY Entry – 24.0 Target – 27.0 Stop Loss – 22.5

- Star Bulk Carriers Corp., a shipping company, engages in the ocean transportation of dry bulk cargoes worldwide. The company’s vessels transport a range of major bulks, including iron ores, coal, and grains, as well as minor bulks, such as bauxite, fertilizers, and steel products.

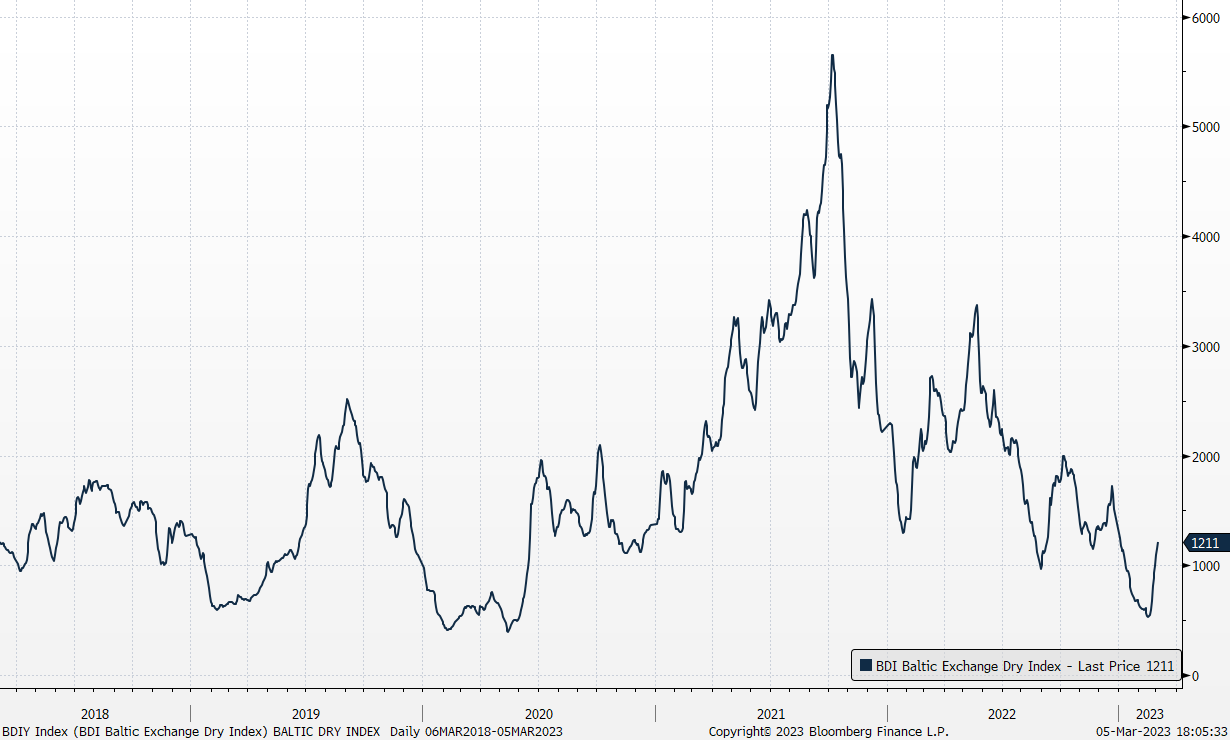

- Baltic Dry Index turning around. The supply chain disruptions have tapered substantially, and freight rates have been falling over the past few months. However, China is entering a period of seasonal replenishment of inventories, including coal, iron ore, copper, aluminium, and etc. In 2H23, the manufacturing and economic recovery is expected to accelerate. Currently, BDI is at 883, and the recent low was 530. The average from 2017-2019 is 1380.

Baltic Dry Index

(Source: Bloomberg)

(Source: Bloomberg)

- Tailwinds from Southeast Asia countries. India will continue to import more coal and other hard commodities as multinational companies move some of the supply chains to India. The ongoing supply chain reallocation to other Southeast Asia countries supports the shipping sector.

- 4Q22 earnings beat. Revenue dropped by 41.0% YoY to US$60.7mn. Non-GAAP EPS was US$0.9, beating estimates by US$0.07. The time charter equivalent (TCE) rate in 4Q22 was US$19,590 compared to $37,406 in 4Q21, which is indicative of the weaker market conditions prevailing during the recent quarter.

- The updated market consensus of the EPS growth in FY23/24 is -43.6%/34.0%, respectively, which translates to 7.3x/5.5x forward PE. Current PER is 4.5x. FY23F/24F dividend yield is 10.5%/16.9%, respectively. Bloomberg consensus average 12-month target price is US$27.98.

United States

|

News Feed |

|

3. Fed’s Daly Says More Rate Hikes Likely Needed to Cool Inflation |

|

4. Biden Closes In on Order to Restrict US Investment in China Tech |

Hong Kong

Trading Dashboard Update: Add Cathay PAcific Airways (293 HK) at HK$7.84.

(Source: Bloomberg)

(Source: Bloomberg)