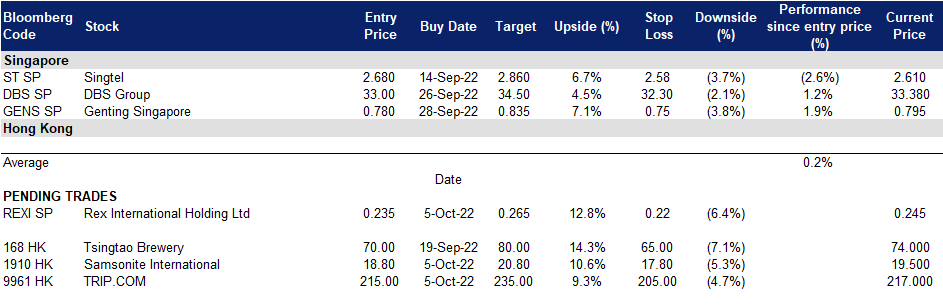

5 October 2022: Rex International Holding Ltd (REXI SP), Samsonite International S.A. (1910 HK)

Singapore Trading Ideas | Hong Kong Trading Ideas | Market Movers | Trading Dashboard

Rex International Holding Ltd (REXI SP): Incoming large oil output cut

- Entry – 0.235 Target – 0.265 Stop Loss – 0.220

- Rex International Holding Limited operates as an independent oil exploration and production company. It operates through Oil and Gas, and Non-Oil and Gas segments. The company offers Rex Virtual Drilling, a liquid hydrocarbon indicator, which uses seismic data to search for oil. The company is involved in the oil and gas exploration and production activities with a focus in Oman and Norway.

- Oil rebounds. Oil prices rose on renewed concerns about supply tightness. There are expectations that the Organization of the Petroleum Exporting Countries and its allies, known collectively as OPEC+, will cut output by more than 1 million barrels per day at their meeting on Wednesday, 5 October.

- Dollars pull back and commodities rebound. US dollar index pulled back to below 112 on Tuesday after reaching a 20-year high of near 115 last week. Commodities are inversely related to US dollars. The short-term correction of the dollar index provides relief rebound opportunities for global commodities.

- Ukraine War. Following the invasion of Ukraine, some countries have made the decision to stop buying Russian oil, imposed sanctions on Russia and G7 is planning to place a price cap on Russian oil purchases. Thus causing the price of oil sold by Russia to be significantly cheaper than oil from other sources, attracting more oil purchases from Asian countries such as India and China.

- Updated market consensus of the EPS growth in FY22/23 is -52.4%/368.4% YoY respectively, which translates to 9.0x/1.9x forward PE. Current PER is 4.6x. Bloomberg consensus average 12-month target price is S$0.47.

(Source: Bloomberg)

DBS Group Holdings Ltd (DBS SP): Tailwinds from rate hikes

DBS Group Holdings Ltd (DBS SP): Tailwinds from rate hikes

- RE-ITERATE BUY Entry 33.0 – Target – 34.5 Stop Loss – 32.3

- DBS Group Holdings Limited and its subsidiaries provide a variety of financial services. The company offers mortgage financing, lease and hire purchase financing, nominee and trustee, funds management, corporate advisory and brokerage services. DBS Group also is the primary dealer of Singapore government securities. DBS Bank Ltd operates as a bank offering wealth management, personal, and business banking services. DBS Bank serves customers worldwide.

- Housing loan rate adjustments. After the recent rate hike from the United States Federal Reserve, DBS announced that it would temporarily cease its fixed-rate home loans as the loan rates on these packages are being reviewed. The bank however continues to offer floating rate packages which are pegged to the SORA. By putting a pause on fixed-rate home loan packages in this volatile interest rate market, they are mitigating their risks and passing them on to their borrowers.

- Benefiting from higher Interest rates. With the constant rise in interest rates, DBS will be able to increase its margins when lending money to borrowers. Additionally, by taking advantage of the difference between the interest paid out to lenders and the interest earned from short-term investments, their profits will grow.

- Expansion of services. With the rapid boom of the cryptocurrency sector and the surge in the volume of crypto transactions carried out on its members-only platform, DBS recently expanded access to its crypto trading services. It announced the roll-out of self-directed crypto trading on DBS digibank, enabling 100,000 of the bank’s wealth clients who are accredited investors to trade cryptocurrencies on the DBS Digital Exchange (DDEx) at their convenience. These clients will be able to trade four cryptocurrencies – Bitcoin, Bitcoin Cash, Ether and Ripple – on DDEx with a minimum investment of S$500.

- The updated market consensus of the EPS growth in FY22/23 is 15.2%/18.7% YoY, respectively, translating to 11.1×/9.4x forward PE. The current PER is 12.8x. Bloomberg consensus average 12-month target price is S$39.31.

Samsonite International S.A. (1910 HK): Price pulled back to Pre-covid levels

- RE-ITEREATE Buy Entry – 18.8 Target – 20.8 Stop Loss – 17.8

- Samsonite International S.A. is a Hong Kong-based company principally engaged in the design, manufacture, sourcing and distribution of luggages, business and computer bags, outdoor and casual bags, travel accessories and slim protective cases for personal electronic devices. The Company operates its business through three segments. The Travel Bag segment is engaged in travel products with suitcases and carry-ons of three main categories, including hard-side, soft-side and hybrid luggages. The Casual Bags segment is engaged in daily use, including different types of backpacks, female and male shoulder bags and wheeled duffel bags. The Business Bags segment is engaged in business use, including rolling mobile office bags, briefcases and computer bags.

- Tailwinds of Asia tourism. Japan will fully reopen to foreign tourists from 11th October onwards. Tourists will no longer need a visa to enter the country. Taiwan will reopen its borders from 13 October onwards. Arrivals will be asked to self-monitor for seven days. From 26 October, travellers arriving in Hong Kong will no longer have to go into mandatory hotel quarantine.

- July air travel recovery continued to recover. According to IATA, the total demand for air travel in July 2022 (measured in revenue passenger kilometers or RPKs) was up 58.8% YoY. Global traffic was at 75.6% of pre-Covid levels. July domestic air travel was up 4.1% YoY. Overall, July domestic traffic was 86.9% of July 2019. International RPKs rose 150.6% YoY in July. July 2022 international RPKs reached 67.9% of July 2019 levels.

- 1H22 results review. Net sales jumped by 58.9% (+66.9% constant currency) YoY to US$1,270.2mn. Operating profit arrived at US$159.9mn compared to a loss of US$86.4mn during the same period last year. Profit attributable to the equity shareholders arrived at US$56.3mn in 1H22 compared to a loss of US$142.5mn in 1H21. The turnaround of the business and financials was due mainly to the continued easing of COVID restrictions and the ensuing recovery of both domestic and overseas travel. North America, Latin America, and Europe saw a strong recovery. But the slowdown in China dragged the accelerated recovery in Asia.

- The updated market consensus of the EPS growth in FY22/23/24 is 1,222.2%/42.9%/20.3% YoY respectively, translating to 18.4×/12.8x/10.7x forward PE. The current PER is 16.4x. Bloomberg consensus average 12-month target price is HK$25.17.

(Source: Bloomberg)

TRIP.COM (9961 HK): Japan, Taiwan, and Hong Kong reopen

TRIP.COM (9961 HK): Japan, Taiwan, and Hong Kong reopen

- Buy Entry – 215 Target – 235 Stop Loss – 205

- Trip.com Group Limited, formerly Ctrip.com International, Ltd., is a travel service provider in China that provides accommodation booking, transportation ticketing, package tours and corporate travel management. The company aggregates hotel and transportation information to help leisure and business travellers make reservations. The company helps leisure travellers book travel packages and guided tours and helps corporate clients manage their travel needs. The company also offers a range of travel-related services to meet the different booking and travel needs of leisure and business travellers, including visitor reviews, attraction tickets, travel-related financial services, car services, travel insurance services and passport services. The company also offers package tours for independent leisure travellers, including tour groups, semi-tour groups and private groups, as well as package tours that require different transportation arrangements (such as cruise, buses or self-driving).

- Tailwinds of Asia tourism. Japan will fully reopen to foreign tourists from 11th October onwards. Tourists will no longer need a visa to enter the country. Taiwan will reopen its borders from 13 October onwards. Arrivals will be asked to self-monitor for seven days. From 26 October, travellers arriving in Hong Kong will no longer have to go into mandatory hotel quarantine.

- 2Q22 results review. Net revenue dropped by 32% YoY and 2% QoQ to RMB4.0bn due to the continued disruptions resulting from the COVID-19 resurgence in China. Gross profit dropped by 35.0% YoY and 0.2% QoQ to RMB3.0bn. Net profit attributable to company shareholders was RMB69mn compared to a net loss of RMB647mn during the same period in 2021 due mainly to effective cost control.

- Updated market consensus of the EPS in FY22/23 is RMB1.55/RMB7.14 respectively, which translates to 121.0x/26.3x forward PE. Bloomberg consensus average 12-month target price is HK$262.31.

United States

Top Sector Gainers

| Sector | Gain | Related News |

| Consumer Durables | +4.16% | Job openings plunged by more than 1.1 million in August General Motors Company (GM US) |

| Producer Manufacturing | +4.12% | U.S. manufacturing nearly brakes; price pressures abating Deere & Company (DE US) |

| Consumer Services | +3.96% | Japan’s tourism restart stirs hope of service-sector recovery -PMI Airbnb Inc (ABNB US) |

- Twitter Inc (TWTR US) Shares jumped 22.24% after Elon Musk was proposing to go ahead with his original offer of US$44 billion to take Twitter private, a securities filing showed on Tuesday.

- Norwegian Cruise Line Holdings Ltd (NCLH US) Shares jumped 16.84%. On October 3, Norwegian made the final move to remove Covid restrictions. The cruise line announced the removal of all Covid-19 testing, masking and vaccination requirements as of October 4, 2022.

- AMC Entertainment Holdings Inc (AMC US) Shares jumped 16.13.81%. There was no company-specific news. Meme stocks jumped along with the broad market embracing a relief rally starting on Monday.

- Coinbase Global Inc (COIN US) Shares jumped 13.58% after Bitcoin regained the US$20,000 territory.

- Shopify Inc (SHOP US) Shares jumped 13.66%. The E-commerce sector surged on Poshmark’s buyout agreement.

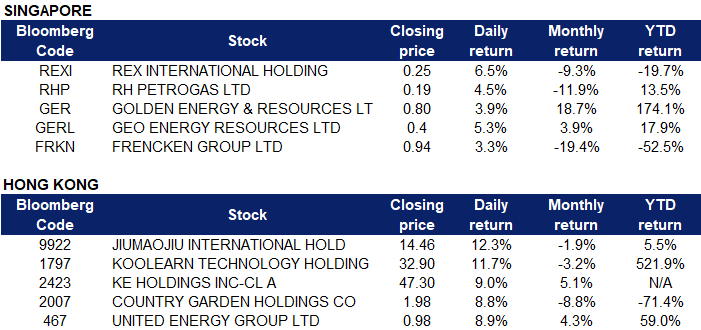

Singapore

- Rex International Holding Ltd (REXI SP) and RH PetroGas Ltd (RHP SP) surged 6.5% and 4.5% respectively, tracking a jump in crude prices as sources said the Organisation of the Petroleum Exporting Countries and its allies are considering their biggest output cut since the start of the COVID-19 pandemic.

- Golden Energy & Resources Ltd (GER SP) and Geo Energy Resources Ltd (GERL SP) climbed 3.9% and 5.3% yesterday respectively. US coal prices surged past $200 for the first time as a global energy crunch drives up demand for the fossil fuel. Spot prices for coal from Central Appalachia rose to $204.95 a ton for the week ending Sept. 30, the highest in records dating to 2005. Coal prices began surging as economies around the world recovered from pandemic lockdowns, driving up demand for electricity faster than coal miners and natural gas producers could boost supply for power plants. That was exacerbated when Russia’s war in Ukraine upended energy markets, and power-plant demand for coal and natural gas has continued to rise amid record summer heat.

- Frencken Group Ltd (FRKN SP) rose 3.3% yesterday. Singapore stocks gained, after global markets finished on an uptrend. The Dow Jones Industrial Average rose 765.38 points, or 2.66%, to 29,490.89; the S&P 500 gained 92.81 points, or 2.59%, at 3,678.43; and the Nasdaq Composite added 239.82 points, or 2.27%, at 10,815.44.

Hong Kong

Top Sector Gainers

Sector | Gain | Related News |

Textile & Apparels | +7.17% | China’s textiles & apparel exports at $220 bn in Jan-Aug 2022 Texhong Textile Group Ltd (2678 HK) |

Restaurants & Fast Food Shops | +1.48% | Chinese resort city slaps ‘golden week’ tourists with new Covid-19 restrictions Jiumaojiu International Holdings Ltd (9922 HK) |

Telecomm. Services | +1.45% | Official 5G Services were Started by China Broadnet in June China Telecom Corp Ltd (728 HK) |

Top Sector Losers

Sector | Loss | Related News |

Insurance | -2.19% | Ping An Insurance (Group) Company of China, Ltd (2318 HK) |

Gamble | -1.79% | Macau Casinos See Another Dismal Month as China Lockdowns Widens Sands China Ltd (1928 HK) |

Securities | -1.45% | China’s securities market facilitates financing for sci-tech innovation CITIC Securities Co Ltd (6030 HK) |

- Jiumaojiu International Holdings Ltd (9922 HK) surged 12.3% yesterday. On the evening of 3 October, Jiumaojiu International announced the termination of its 1.1 billion yuan acquisition of Guangzhou International Financial City project, the real estate project of Country Garden.

- Koolearn Technology Holding Ltd (1797 HK) climbed 11.7% yesterday. A total of 24 investment banks have given Koolearn Technology a buy rating in the past 90 days, and the average target price in the past 90 days is 29.04. The latest research report of Cinda Securities gave Koolearn Technology an overweight rating.

- KE Holdings Inc (2423 HK) rose 9.0% yesterday. According to the Beijing Marathon website, KE Holdings will be organising a 30,000 participant marathon on November 6 this year. Registration for the marathon is open from 4 October to 7 October.

- Country Garden Holdings Co Ltd (2007 HK) inched up 8.8% yesterday. In the news, the central bank announced that starting from 1 October 2022, the interest rate of the first personal housing provident fund loan will be lowered by 0.15 percentage points, and the interest rates of less than 5 years (including 5 years) and more than 5 years will be adjusted to 2.6% and 3.1% respectively.

- United Energy Group Ltd (467 HK) grew 8.9% yesterday. Oil prices inched higher in early Asian trade on Tuesday (Oct 4), on expectations that OPEC+ may agree to a large cut in crude output when it meets on Wednesday.

Trading Dashboard Update: No stock addtions/deletions.