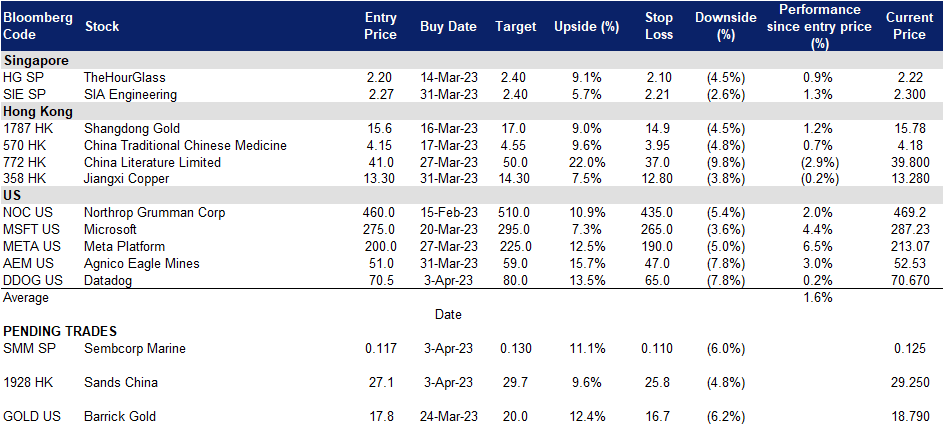

5 April 2023: Sembcorp Marine Ltd (SMM SP), Datadog, Inc. (DDOG US)

Singapore Trading Ideas | Hong Kong Trading Ideas |United States Trading Ideas | Sector Performance | Trading Dashboard

Sembcorp Marine Ltd (SMM SP): Oil rebound

- RE-ITERATE BUY Entry 0.117 – Target – 0.130 Stop Loss – 0.111

- Sembcorp Marine Ltd offers engineering solutions for the offshore, marine, and energy industries. The Company provides rigs and floaters, repairs and upgrades, offshore platforms, and specialized shipbuilding. Sembcorp Marine serves customers worldwide.

- Oil rebound. Crude oil rebounded last two weeks with the recession fears tapered. Brent recovered from the recent low of US$70/bbl to near US$80/bbl, and WTI recovered from below US$65/bbl to above US$75/bbl. According to Reuters, crude oil production from OPEC declined by 70,000 bbls/d in March compared to February.

- New projects acquired. On March 30, Sembcorp Marine has won a multi-billion-dollar contract with GE Renewable Energy’s Grid Solutions to construct and deliver three high-voltage direct current (HVDC) electrical transmission systems for offshore wind farms in the Netherlands. The deal is worth €6 bn (S$8.68 bn), and construction is set to commence in Q3 2024 at Sembcorp Marine’s Singapore and Batam yards; marking the company’s third HVDC offshore platform project.

- Merger complete. Sembcorp Marine has completed its merger with Keppel Offshore & Marine (Keppel O&M) in a S$4.5 billion deal on 28 February 2023, with a total order book of about S$18bn. The combined group is expected to be better positioned to capture growth opportunities in the face of falling oil prices and the global transition to renewable energy. With the merger, the enlarged Sembcorp Marine will benefit from greater synergies from the broader geographical footprint, larger operational scale, and enhanced capabilities.

- FY22 results review. Revenue rose 4.6% YoY to S$1,947mn from S$1,862mn the prior year. Net loss declined by 78.0% YoY to -S$261mn from -S$1,171mn in FY21. With positive EBITDA for 2H22, the FY22 EBITDA was -S$7mn a 99% decrease YoY from the previous -S$1,028mn.

- Updated market consensus of the EPS in FY23/24 is 0.0/0.4 SG cents respectively. Bloomberg consensus average 12-month target price is S$0.14.

(Source: Bloomberg)

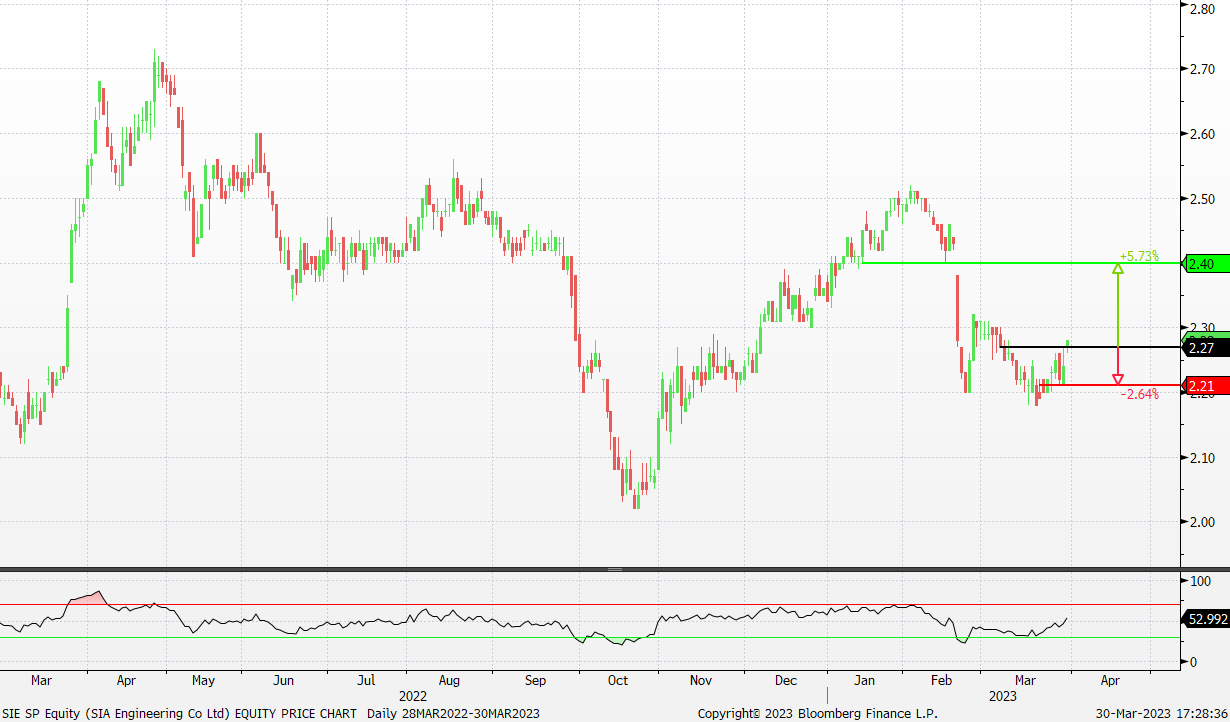

SIA Engineering Co Ltd (SIE SP): Continuous service

- RE-ITERATE BUY Entry 2.27 – Target – 2.40 Stop Loss – 2.21

- SIA Engineering Co Ltd provides airframe and component overhaul services, line maintenance and technical ground handling services. The Company also manufactures aircraft cabin equipment, refurbishes aircraft galleys, repairs and overhauls hydromechanical aircraft equipment.

- S$1.14bn agreement. SIA Engineering announced on March 29th its new service agreement with Singapore Airlines, which replaces the previous agreement signed in April 2019. The new agreement, effective from April 1st, 2023, has a two-year term and an option to extend for an additional year. With this new agreement, SIA Engineering is expected to generate S$1.14 billion in revenue over the three-year term.

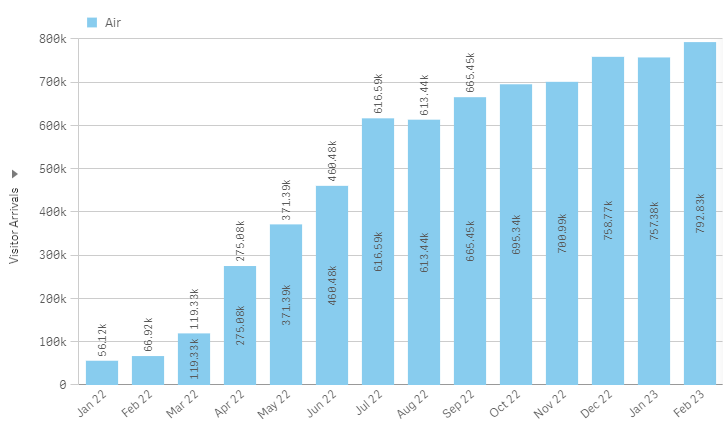

- Recovery in flight traffic. Based on recent data from the Singapore Tourism Board (STB), Singapore’s international visitor arrivals in February reached a new record high of 957,605 since the pandemic began. However, it is worth noting that these figures still fall below the pre-pandemic levels of 1.7 million visitors recorded in January 2020. With projected international visitor arrivals to Singapore ranging from 12mn to 14mn in 2023 and full tourism recovery expected by 2024, flight activities will continue to recover alongside the increasing tourism demand.

Visitor Arrivals by Air Travel trend

(Source: Singapore Tourism Analytics Network)

- Development of new talents. Through signing the Memorandum of Understanding (MOU), SIA Engineering Company (SIAEC) will collaborate with seven Institutes of Higher Learning (IHLs) to curate training curricula for industry-relevant skills, provide structured internships and industry attachments, increase employment placement opportunities, and engage in interdisciplinary projects and research with IHL students and academic staff. This partnership is an extension of SIAEC’s existing programs to support lifelong learning and ensure a continuous talent pipeline.

- 3Q22 results review. Revenue rose 48.6% YoY to S$208.1mn. Net profit declined by 61.4% YoY to S$12.8mn from S$33.2mn in 3Q21.

- Updated market consensus of the EPS in FY23/24 is -5.56%/66.47% respectively, which translates to 40.0x/24.3x forward PE. Current PER is 34.11x. Bloomberg consensus average 12-month target price is S$2.63.

(Source: Bloomberg)

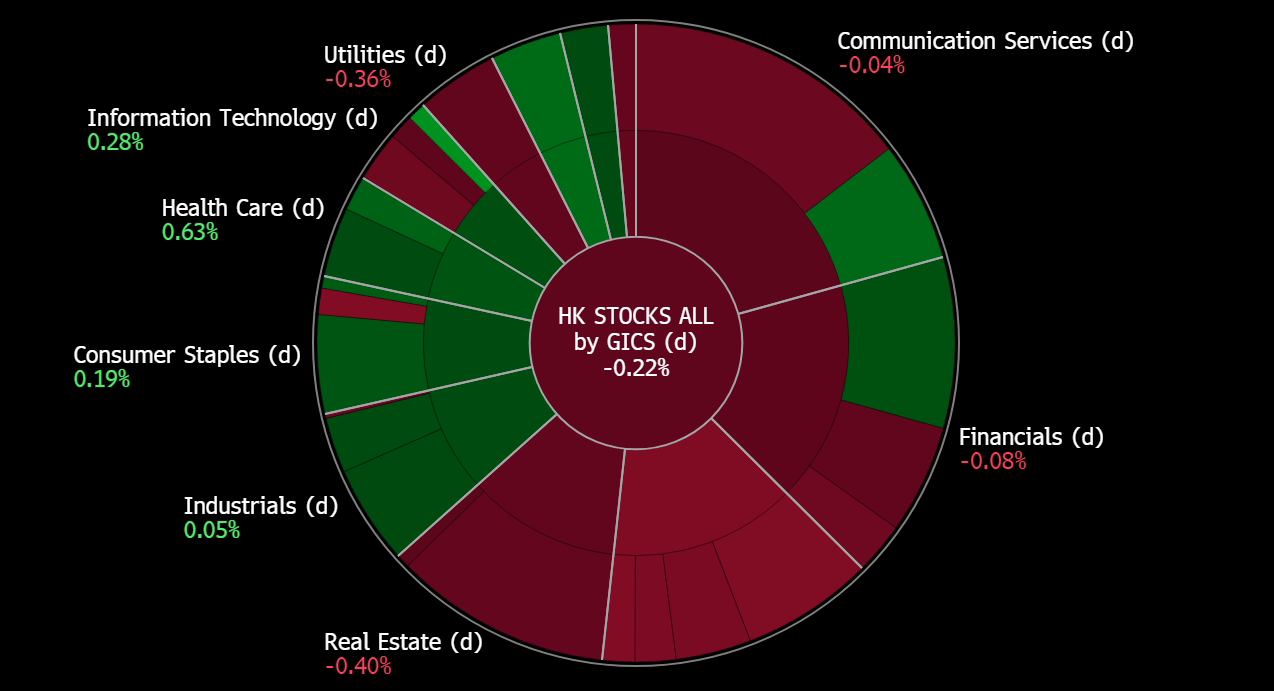

The Hong Kong market is closed today in observance of a public holiday (Qingming festival). Trading resumes on Thursday, 6 April.

Datadog, Inc. (DDOG US): Cloud theme to catch up

- BUY Entry – 70.5 Target – 80.0 Stop Loss – 65.0

- Datadog, Inc. operates an observability and security platform for cloud applications in North America and internationally. The company’s products include infrastructure and application performance monitoring, log management, digital experience monitoring, continuous profiler, database monitoring, network monitoring, incident management, observability pipelines, cloud cost management, universal service monitoring, cloud security management, application security management. cloud SIEM, sensitive data scanner, and CI Visibility.

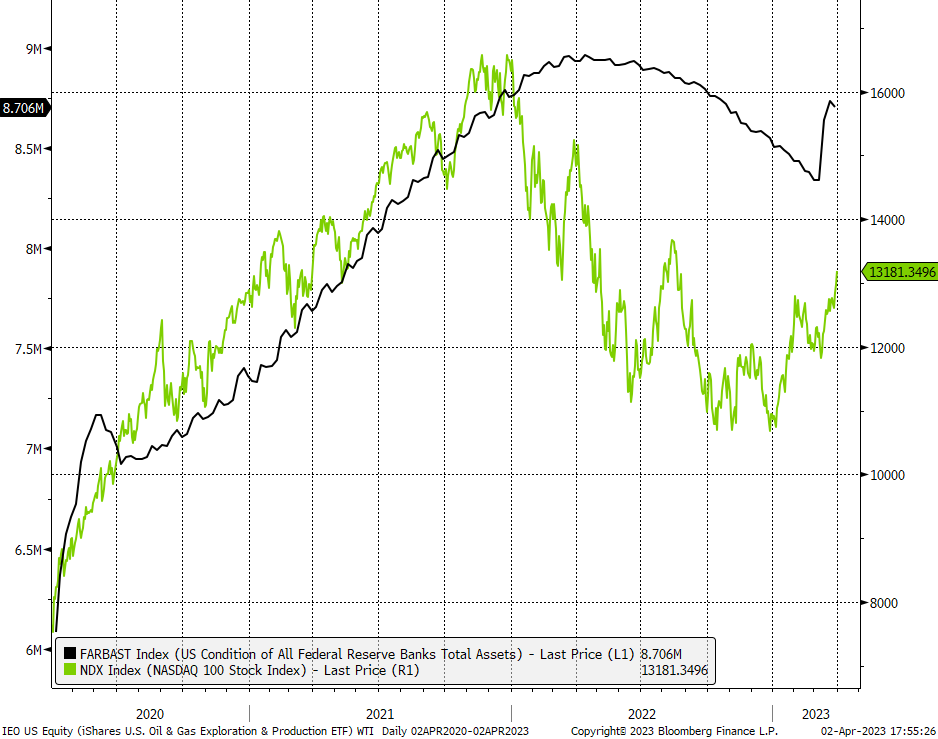

- Cloud theme is the next. The launch of ChatGPT led to investment hype on AI companies. However, the recent exponential of large language model development raised concerns about data and network security as ChatGPT enables individual programmers to advance their codings. Cloud platforms and service providers will upgrade their products and services to provide more secure data protection and counter cyber attacks.

- Second-tier tech companies to catch up. The February core PEC price index increased by 0.3% MoM, easing from January‘s 0.6% MoM rise. The tapering inflation reinforces the rate cut expectation in 2H23, benefiting technology companies’ higher valuation. Large-cap tech stocks outperformed amidst the banking crisis as the Fed reverted the QT and resumed QE, and second-tier tech counters are expected to catch up in April.

Fed total asset and NASDAQ 100 index

(Source: Bloomberg)

(Source: Bloomberg)

- 4Q22 earnings review. Revenue jumped by 43.8% YoY to US$469mn. Non-GAAP EPS was US$0.26. 1Q23 revenue guidance ranges between US$466mn and US$482.39mn. 1Q23 non-GAAP EPS is expected to be between $0.22 and $0.24.

- The updated market consensus of the EPS growth in FY23/24 is 8.3%/31.7%, respectively, which translates to 68.5x/52.0x forward PE. Bloomberg consensus average 12-month target price is US$104.07.

(Source: Bloomberg)

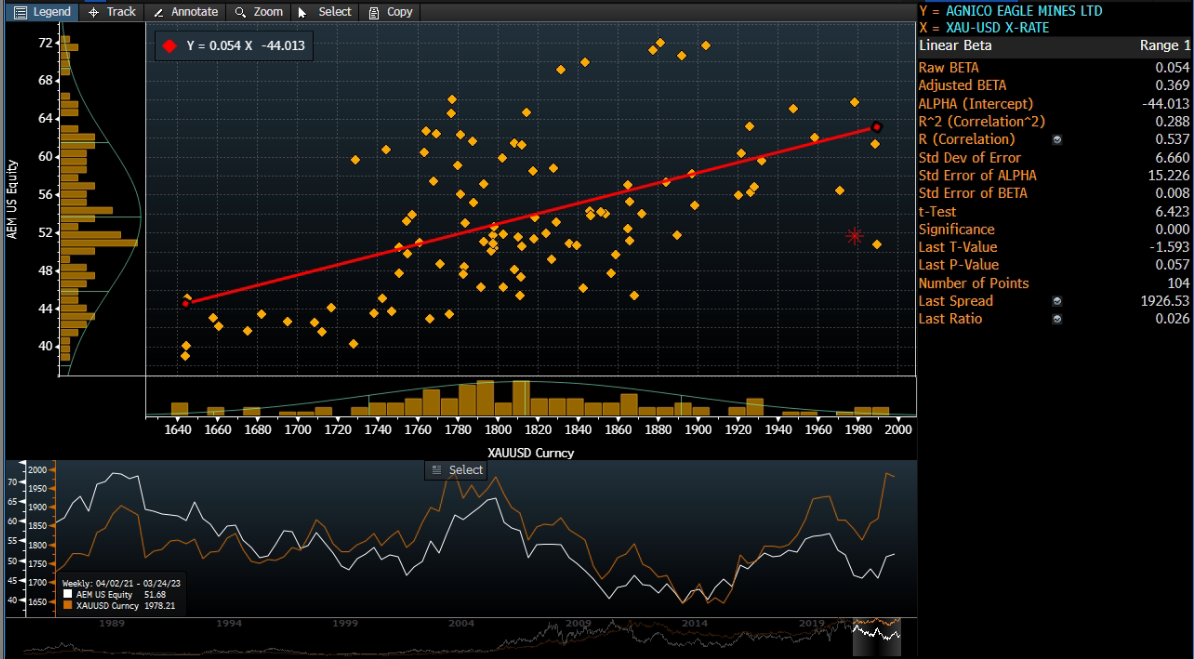

Agnico Eagle Mines Limited (AEM US): Gold back up

- RE-ITERATE BUY Entry – 51.0 Target – 59.0 Stop Loss – 47.0

- Agnico Eagle Mines Limited engages in the exploration, development, and production of mineral properties in Canada, Australia, Mexico, and Finland. The company primarily produces and sells gold deposits, as well as explores for silver, zinc, and copper deposits.

- Malfunction of the monetary system. The cent banking crisis in the US and Europe was due to liquidity concerns which led to a bank run. Though central banks reacted immediately to provide liquidity, the problem has not been resolved. Now, both the economy and markets are suffering from the backfire of decades of cheap credit. Central banks are confronting a dilemma between continual rate hikes to cool down inflation and pause/stop rate hikes from maintaining financial stability. The credibility of central banks is questioned, and investors’ confidence weakens gradually. Gold outshines on such a backdrop.

- Central banks are increasing gold reserves. According to Bloomberg, the People’s Bank of China raised its gold holdings by 30 tonnes in December 2022, and China’s central bank held a total amount of 2,010 tonnes of gold reserves as of January 2023. Russia increased its gold reserve by 1mn ounce to 74.9mn ounces as of February 2022. The Monetary Authority of Singapore’s bullion reserves rose to 6.4mn ounces at the end of January, up from 4.9mn ounces a month earlier.

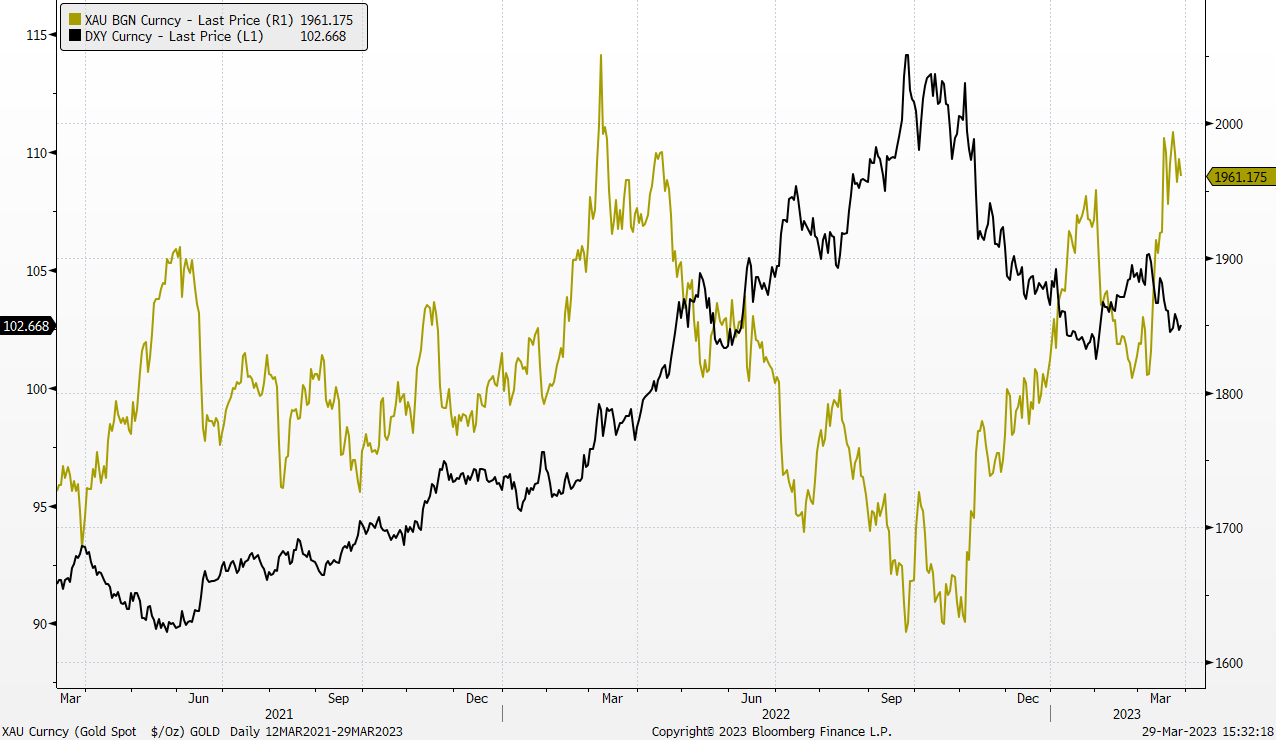

The Fed recently hiked rates by 25 basis points. The market expects the Fed to stop raising interest rates and begin to cut rates in the second half of 2023.

- Better outlook for gold price in 2023. There are several factors that impact gold prices, and the key ones are the trend of the US dollar and global geopolitical risk. The broad market has expected that US dollars peaked last year as inflation has been on a downswing. Even though recent macro data such as CPI and core PCE prices showed overall prices were declining. The US job market started showing some weaknesses as the unemployment rate rose to 3.6% in February. The market expects Fed to cut rates in 2H23. On the other hand, geopolitical tensions remain high and probably escalate anytime as China-US confrontations are more frequent. Gold is the good old safe haven.

Gold Price and Dollar Index Trend

(Source: Bloomberg)

(Source: Bloomberg)

- Mixed 4Q23 results. Revenue jumped by 45% YoY to US$1.38bn, missing estimates by US$40mn. Non-GAAP EPS was US$0.4, in line with estimates. The company guided gold production for 2023 to be 3.24mn to 3.44mn ounces, with total cash costs and all-in sustaining costs forecast at US$840-US$890/oz and US$1,140-US$1,190/oz, respectively.

- The updated market consensus of the EPS growth in FY23/24 is -8.9%/18.6%, respectively, which translates to 28.8x/24.3x forward PE. Bloomberg consensus average 12-month target price is US$59.83.

Agnico Eagle Mines VS Gold price

(Source: Bloomberg)

(Source: Bloomberg)

(Source: Bloomberg)

United States

Hong Kong

Trading Dashboard Update: Cut loss on Weilong Delicious Global (9985 HK) at HK$10.2. Add Datadog (DDOG US) at US$70.5.