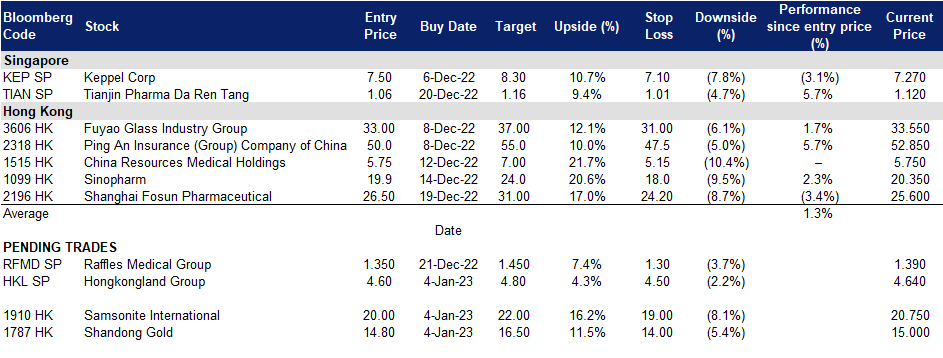

4 January 2023: Hongkong Land Holdings Ltd (HKL SP), Shandong Gold Mining Co., Ltd. (1787 HK)

Singapore Trading Ideas | Hong Kong Trading Ideas | Market Movers | Trading Dashboard

Hongkong Land Holdings Ltd (HKL SP): Recovery has kick-started

- BUY Entry – 4.60 Target – 4.80 Stop Loss –4.50

- Hongkong Land is a major listed property investment, management and development group. The Group owns and manages more than 850,000 sq. m. of prime office and luxury retail property in key Asian cities, principally Hong Kong, Singapore, Beijing and Jakarta. The Group also has a number of high quality residential, commercial and mixed-use projects under development in cities across China and Southeast Asia, including a 43% interest in a 1.1 million sq. m. mixed-use project in West Bund, Shanghai.

- Updates on Hong Kong’s reopening of the border. Hong Kong government is working to resume quarantine-free travel with mainland China by as early as January 8th which is also the first date that China fully drops all the COVID quarantine measures. The rebound of visitor arrivals in Hong Kong in 4Q22 was promising. In November 2022, the number of tourist arrivals increased to more than 113,000 from 80,000+ in October. The property market is expected to recover along with the influx of visitors, especially those from China.

- Hong Kong’s property market to bottom out. Recent studies showed that Hong Kong’s home sales value in 11M22 fell 40% YoY to HK$107bn, the lowest level since 2008. The full-year total number of units sold is expected to be lower than 11,000 in 2022. The poor performance was due to restrictive lockdown measures and the ensuing exodus of residents. However, reopening borders and normalising international travel will help recovery in the housing market. Meanwhile, the retail sector is expected to recover faster as the number of tourist arrivals will increase throughout 2023.

- Updated market consensus of the EPS growth in FY23/24 is 11.0%/4.5% YoY respectively, which translates to 11.2x/10.7x forward PE. Current PER is 13.2x. Bloomberg consensus average 12-month target price is S$4.84.

Raffles Medical Group Ltd (RFMD SP): Increasing healthcare demand

Raffles Medical Group Ltd (RFMD SP): Increasing healthcare demand

- RE-ITERATE Entry – 1.35 Target – 1.45 Stop Loss – 1.30

- Raffles Medical Group is a leading integrated private healthcare provider in the region, operating medical facilities in thirteen cities in Singapore, China, Japan, Vietnam and Cambodia. The Group is the first Asian member of the Mayo Clinic Care Network. RafflesMedical clinics form one of the largest networks of private family medicine centres in Singapore. RafflesHospital, the flagship of Raffles Medical Group, is a private tertiary hospital located in the heart of Singapore offering a wide range of specialist medical and diagnostic services for both inpatients and outpatients.

- Surge in Covid cases. With China easing its Covid restrictions and Covid cases surging in China, Raffles Medical will benefit from this as their medical facilities will be visited by Chinese residents. Raffles Medical has a total of 3 hospitals and 4 clinics located around China. Additionally, they have 3 online stores serving 3 districts in China.

- Increase in tourism. With worldwide borders being opened up, the pent-up demand for travel is finally being satisfied. With an influx of tourist into Singapore, healthcare providers are expecting a wave of travellers requiring pre-departure PCR test in the coming months. With a 15 – 20% increase in PCR demand in the month of November, these numbers are expected to rise even higher as measures are continually relaxed.

- Rise in demand for services. Singapore is currently facing a surge in foreign demand in the healthcare sector, with many foreigners opting for treatment in Singapore. As Singapore opens up its borders, foreign patients return to seek treatment at RafflesHospital. Singapore residents who postponed their elective surgeries also returned for treatment.

- 3Q22 results. Raffles Medical reported strong 3Q results ended in September, with a net profit growth of S$98.2 million, up 57.3% YoY. For the period, revenue grew 6.5% YoY to S$199.5 million while net profit surged by 62.1% YoY to S$38.3 million.

- Updated market consensus of the EPS growth in FY22/23 is 29.4%/-8.0% YoY respectively, which translates to 24.0x/26.2x forward PE. Current PER is 24.8x. Bloomberg consensus average 12-month target price is S$1.61.

Shandong Gold Mining Co., Ltd. (1787 HK): Gold is coming back

- Buy Entry –14.8 Target – 16.5 Stop Loss – 14.0

- Shandong Gold Mining Co., Ltd. is a China-based company principally engaged in the mining, processing and sales of gold. The Company operates two segments. The Gold Mining segment is engaged in the mining of gold ore. The Gold Refining segment is engaged in the production and sales of gold. The Company is also engaged in the distribution of other metals extracted during the gold ore smelting process, such as silver, copper, iron, lead and zinc. The Company conducts its businesses in domestic and overseas markets.

- Gold to shine. An inflationary recession has been increasingly a market consensus theme in 2023. The 2023 global economic growth projections were lowered several times during 2022. The latest forecast from IMF in December 2022 was 2.7%. The global economy lacks growth engines from the major economies such as the US, China, EU and Japan lack. Meanwhile, geopolitical risks are expected to remain high. Safe haven assets will be favoured this year.

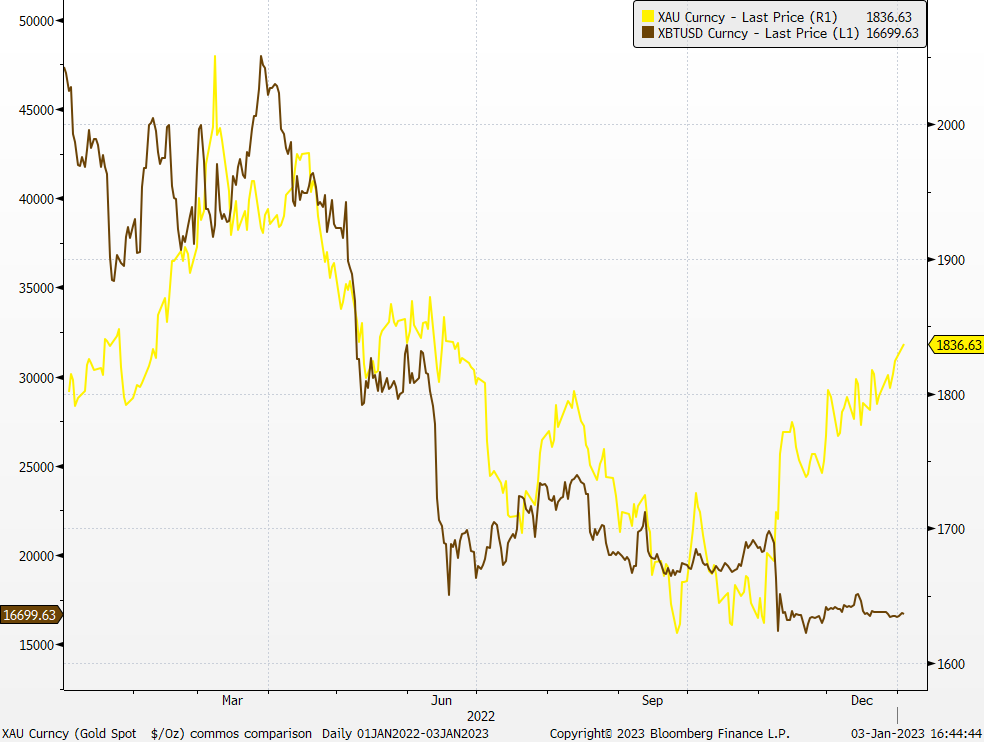

- Crypto’s doom could be gold’s boom. The recent rally of gold price coincided with the plunge in the bitcoin price due to the failure of FTX. The inflexion point in December has broken the positive correlation between gold and bitcoin, implying an influx of fund flows from cryptocurrencies. Gold price continues to recover, and it was trading at around US$1,835/oz, a high since June 2022.

Gold and Bitcoin price comparison

- 3Q22 earnings update. Operating income jumped by 71.7% YoY (after adjustment) to RMB10bn. Net profit attributable to owners of the company jumped by 90.0% YoY (after adjustment) to RMB137.0mn.

- The updated market consensus of the EPS growth in FY23/24 is 68.9%/20.4% YoY respectively, translating to 26.4x/21.9x forward PE. The current PER is 40.7x. Bloomberg consensus average 12-month target price is HK$15.5.

(Source: Bloomberg)

Samsonite International S.A. (1910 HK): Short-term pains for long-term gains

Samsonite International S.A. (1910 HK): Short-term pains for long-term gains

- RE-ITEREATE Buy Entry –20.0 Target – 22.0 Stop Loss – 19.0

- Samsonite International S.A. is a Hong Kong-based company principally engaged in the design, manufacture, sourcing and distribution of luggages, business and computer bags, outdoor and casual bags, travel accessories and slim protective cases for personal electronic devices. The Company operates its business through three segments. The Travel Bag segment is engaged in travel products with suitcases and carry-ons of three main categories, including hard-side, soft-side and hybrid luggages. The Casual Bags segment is engaged in daily use, including different types of backpacks, female and male shoulder bags and wheeled duffel bags. The Business Bags segment is engaged in business use, including rolling mobile office bags, briefcases and computer bags.

- China to see peak of the current COVID wave by February 2023. China has further lifted COVID measures since early November, and ensuing COVID outbreaks spread across cities with dense populations. However, most cities release a timetable of peak estimates before or during the Chinese New Year period. Meanwhile, China is expected further to lift the quarantine restrictions for inbound tourists in 1Q23. Accordingly, China’s tourism sector is expected to recover quickly in 2023.

- Global tourism to continue to recover in 2023. According to the Economist Intelligence Unit Tourism in 2023 report, the global tourism arrivals will increase by 30% YoY in 2023, following growth of 60% YoY in 2022, but will remain below pre-COVID levels. Meanwhile, EIU also expects international arrivals to recover back to 2019 levels in 2024.

- 3Q22 results review. Net sales jumped by 42.0% (+54.7% constant currency) YoY to US$790.9mn. Operating profit jumped by 140% YoY to US$121.8mn. Profit attributable to the equity shareholders arrived at US$58.2mn in 3Q22 compared to a loss of US$5.2mn in 3Q21. The turnaround of the business and financials was due mainly to the effects of the COVID-19 pandemic on demand for the Group’s products moderated in most countries due to the continued rollout and effectiveness of vaccines leading governments in many countries to further loosen socialdistancing, travel and other restrictions, which has led to the continuing recovery in travel. However, the Chinese government reinstated travel restrictions and social distancing measures in an effort to combat further outbreaks of COVID-19, which has slowed the Group’s net sales recovery in China.

- The updated market consensus of the EPS growth in FY22/23/24 is 1,244.4%/46.3%/18.2% YoY respectively, translating to 19.0×/12.9x/10.9x forward PE. The current PER is 10.9x. Bloomberg consensus average 12-month target price is HK$27.42.

(Source: Bloomberg)

United States

Top Sector Gainers

| Sector | Gain | Related News |

| Retail Trade | +1.02% | US retail sales spiked 7.6% in holiday weeks Amazon.com, Inc (AMZN US) |

| Communications | +0.79% | Shaw Communications falls as court stay on Rogers deal sparks uncertainty Verizon Communications Inc (VZ US) |

| Technology Services | +0.56% | Stocks close lower on first trading day of 2023, hurt by slumping Apple, Tesla Meta Platforms Inc (META US) |

Top Sector Losers

| Sector | Loss | Related News |

| Energy Minerals | -4.1% | Oil dives 4%, trade choppy on worries about China, global economy Exxon Mobil Corp (XOM US) |

| Consumer Durables | -2.94% | Tesla’s Rout Deepens as Analysts Trim Targets on Demand Concerns Tesla Inc (TSLA US) |

| Health Services | -1.77% | US health insurers to withstand high inflation & interest rates in 2023: Fitch UnitedHealth Group Inc (UNH US) |

Hong Kong

Top Sector Gainers

Sector | Gain | Related News |

Gamble | +3.56% | Macau casinos seek brighter outlook after worst year since 2004 MGM China Holdings Ltd (2282 HK) |

Precious Metal | +3.21% | Gold firms, focus shifts to Fed meeting minutes Zijin Mining Group Co Ltd (2899 HK) |

Electricity Supply | +2.76% | How China’s solar panel price war could drive renewable energy installations globally Huaneng Power International Inc (902 HK) |

Top Sector Losers

Sector | Loss | Related News |

Petroleum & Gases | -2.73% | Oil slides on worries on China, IMF slow-growth expectations CNOOC Limited (883 HK) |

Alcoholic Drinks & Tobacco | -1.11% | China’s sudden reopening sits awkwardly with long-held zero-Covid narrative Budweiser Brewing Company APAC Ltd (1876 HK) |

Property Development | -0.71% | China home prices fall at faster pace in December, extending decline for sixth straight month China Resources Land Ltd (1109 HK) |

Trading Dashboard Update: No stock additions/deletions.

(Source: Bloomberg)

(Source: Bloomberg)