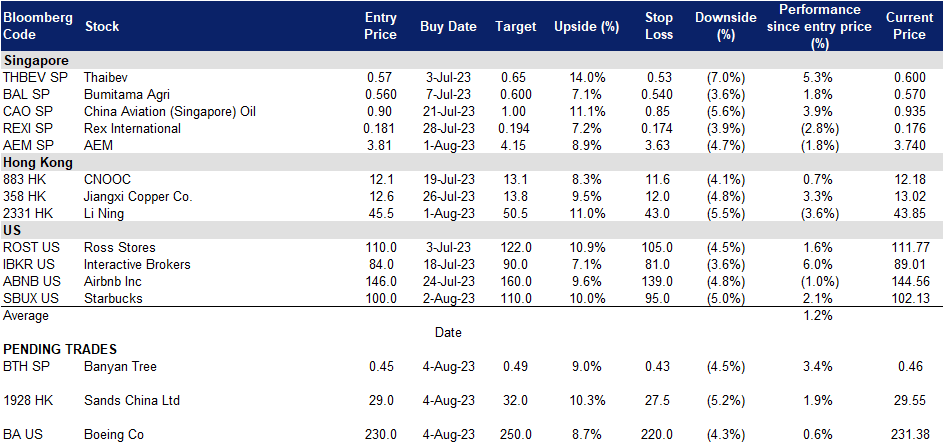

04 August 2023: Banyan Tree Holdings Ltd. (BTH SP), Sands China Ltd. (1928 HK), Boeing Co (BA US)

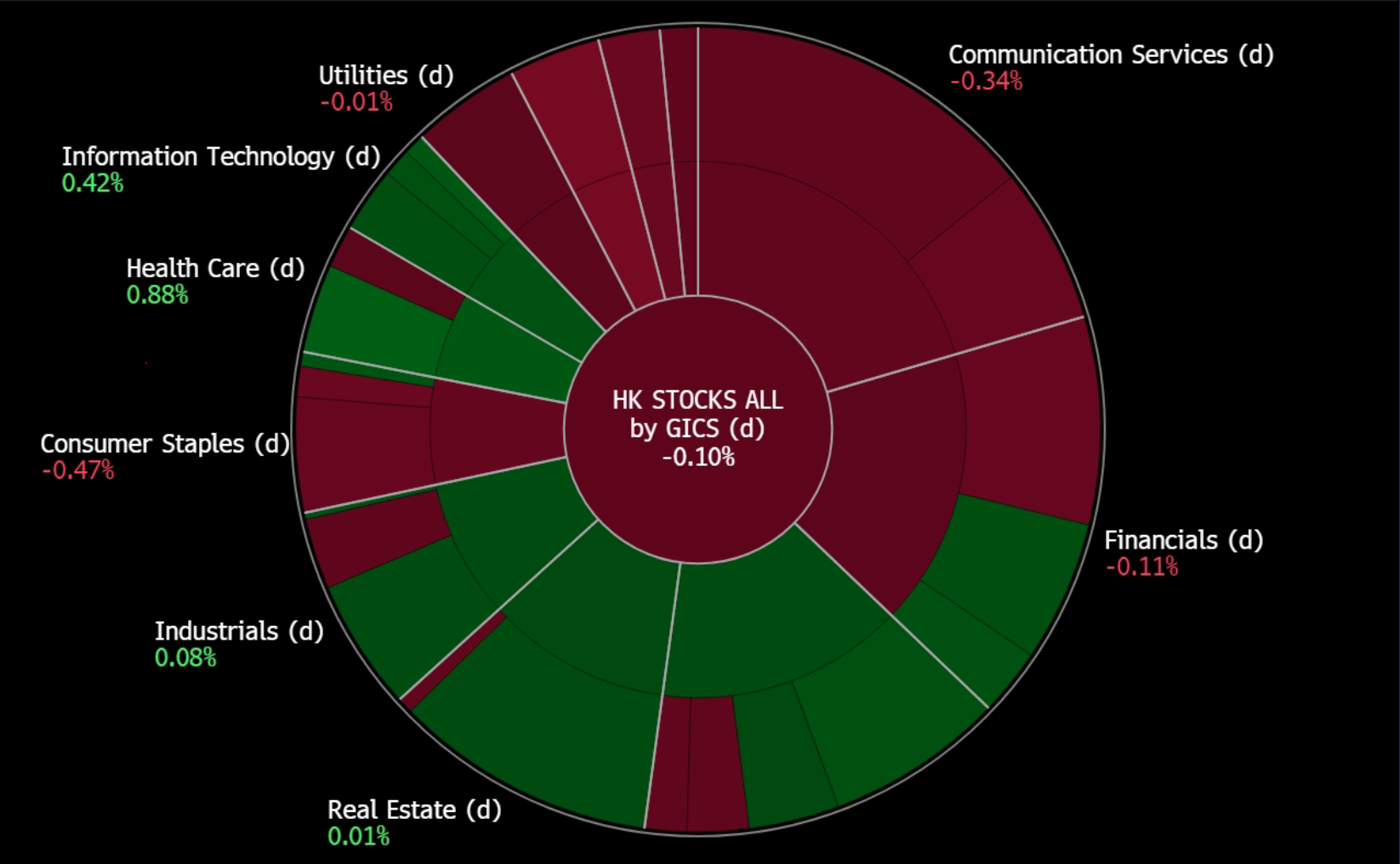

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

United States

Hong Kong

Banyan Tree Holdings Ltd. (BTH SP): Tourism revival

- BUY Entry 0.445 – Target – 0.485 Stop Loss – 0.425

- Banyan Tree Holdings Limited operates as a holding company. The Company, through its subsidiaries, owns and manages hotel groups. The Company focuses on hotels, resorts, spas, galleries, golf courses, and residences, as well as provides investments, design, construction, and project management services. Banyan Tree Holdings serves customers worldwide.

- 70th property milestone. The Banyan Tree Group has reached a significant milestone with the addition of its 70th property to its portfolio. This growth is evident through recent hotel debuts in Vietnam and Japan, including Angsana Ho Tram, Dhawa Ho Tram, Folio Sakura Shinsaibashi Osaka, and Homm Stay Yumiha Okinawa. The group has plans for further expansion, with additional properties set to open in Vietnam, Japan, Indonesia, China, and Thailand. With the company’s growing presence and commitment to strengthening connections between travel destinations, we remain optimistic about the group’s continued growth in the reviving tourism sector.

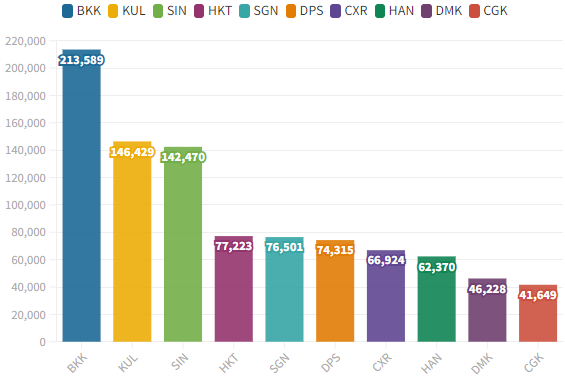

- Appeal to tourists. In June, Thailand’s economic recovery continued on track, supported by the expansion of the tourism sector due to an increase in foreign tourist arrivals. Thailand’s Tourism Authority (TAT) is concerned about the potential overcrowding of flight slots at international airports as the high tourism season approaches. This year the country has received more than 14mn foreign tourists, with 1.6mn visitors from China and 826k Indian tourists, contributing to the tourism revival. The resumption of flights is currently at over 70% of 2019 levels. To manage the influx of tourists, TAT suggests airlines consider using other international airports in popular tourist provinces. EVA Air and TAT have signed a letter of intent to increase the number of tourists flying to Thailand via EVA Air’s network, with plans to inaugurate a new route to Phuket.

Fastest growing airports by international seats – Thailand (Bangkok)

(Source: OAG)

- FY22 results review. Revenue for FY22 increased 23% to S$271.3mn, from S$221.2mn a year ago. Return to profitability in 2022, from the previous year’s loss after tax and minority interests of S$55.2mn to a profit of S$0.8mn.

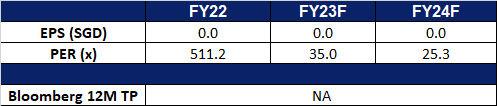

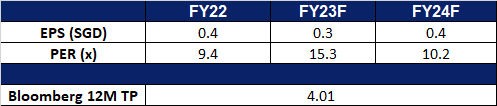

- Market consensus.

- Read the full fundamentals-based report here.

(Source: Bloomberg)

AEM Holdings Ltd (AEM SP): Positive signs from Intel

- RE-ITERATE BUY Entry 3.81 – Target – 4.15 Stop Loss – 3.63

- AEM Holdings Limited is a Singapore-based company, which offers application specific-intelligent system test and handling solutions for semiconductor and electronics companies serving computing, fifth generation (5G) and artificial intelligence (AI) markets. Its segments include Equipment systems solutions (ESS), System Level Test & Inspection (SLT-i), Micro-Electro-Mechanical Systems (MEMS), Test and Measurement Solutions (TMS) and Others.

- Intel showed an early sign of recovery. Last week, Intel released better-than-expected 2Q23 earnings. Revenue beat estimates by US$760mn though it dropped by 15.7% YoY to US$12.9bn. Non-GAAP EPS was US$0.13, beating estimates by US$0.16. Intel turned profitable after two prior consecutive loss-making quarters. The company guided 3Q23 adjusted EPS to be US$0.2, topping estimates of US$0.13. Its Client Computing segment delivered 17.5% QoQ growth and arrived at US$6.78bn due mainly to strong demand for Chromebooks and high-end notebooks. Data center & AI segment grew by 26.0% QoQ to US$4.00bn. The company’s foundry unit revenue surged 96.6% QoQ to US$232M. The turnaround in 2Q23 showed an early sign that the PC cycle was bottoming out.

- Legal dispute settled. AEM announced that it has agreed to pay US$20mn to settle a legal dispute with two American companies, Advantest America and Advantest Test Solutions. US$9mn and US$11mn would be paid in 2Q23 and 3Q24 respectively with internal resources. It is expected that the payment has a minimal impact on its operations.

- 1Q23 earnings review. Revenue fell by 41.7% YoY to S$152.7mn. Profit before tax fell by 69.8% YoY to S$19mn. The company guided its full-year revenue target to be S$500mn.

- Market Consensus.

(Source: Bloomberg)

Sands China Ltd. (1928 HK): Policy support for the tourism industry

- BUY Entry – 29 Target – 32 Stop Loss – 27.5

- Sands China Ltd. is an investment holding company principally engaged in the development and operation of integrated resorts in Macao. The Company operates many places, including gaming areas, meeting space, convention and exhibition halls, retail and dining areas and entertainment venues. The Company operates its business through six segments: The Venetian Macao, Sands Cotai Central, The Plaza Macao, Sands Macao, Ferry and Other Operations and The Parisian Macao. Through its subsidiaries, the Company is also engaged in the provision of high speed ferry transportation services. The Company’s subsidiaries include Cotai Ferry Company Limited, Hotel (Macau) Limited and Development Limited.

- 20 points measures to support tourism and more. The central government recently announced 20 measures to support tourism and boost consumption. China has seen a pick up in local tourism after the country lifted COVID-19 measures. Data also showed domestic flights in July having recovered to slightly more than their 2019 levels, and the movie box office is also above pre-pandemic levels. The new measures now encouraged employers to give more paid days off and for people to take off-peak vacations, as well as expand service-related consumption across different sector including tourism. The new measures also aims to promote rural consumption and put more efforts into rural tourism.

- Sands Shopping Carnival. Sands China Ltd. recently launched its 2023 Sands Shopping Carnival at The Venetian Macao, a luxury hotel owned by Sands China, featuring some 580 local SMEs. The carnivals spans over a week at the end of july, and aimed to spur economic growth and to offer a fun weekend destination hotspot for locals and tourists. The event saw over 110,000 visitors flocking to the the signature shopping event, with over 50% of the visitation coming from tourists.

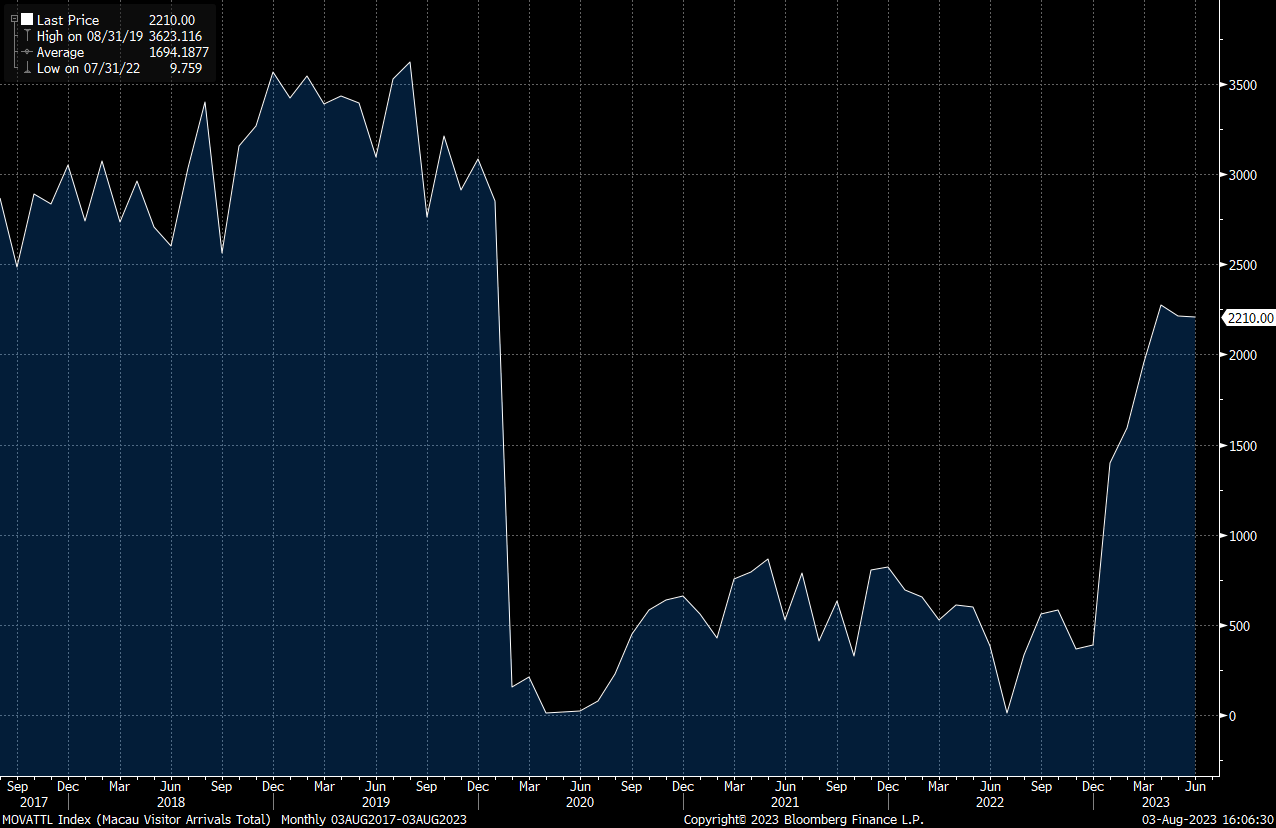

- Increase in tourist arrivals. Tourist arrivals in Macau jumped 480.6% from a year earlier to 2,210,000 in June 2023, and an increase by 467.6% in total tourist arrivals YTD. This increased level of tourism is expected to drive revenue growth for Sands China over the period.

Macau’s 5 years visitor arrival

(Source: Bloomberg)

- FY22 earnings. Revenue fell to US$1605mn, down 44.2% YoY from US$2,874mn in FY21. Net loss increased from US$900.3mn in FY21 to US$1,577.6mn in FY22. Adjusted EPS fell from -US$0.11 in FY21 to -US$0.19 in FY22.

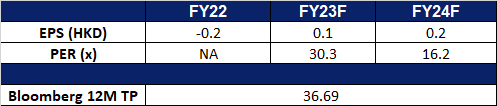

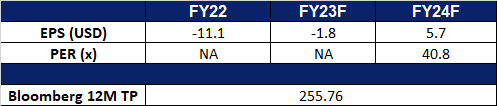

- Market Consensus.

(Source: Bloomberg)

Li Ning Co. Ltd. (2331 HK): Sport galas

Li Ning Co. Ltd. (2331 HK): Sport galas

- RE-ITERATE BUY Entry – 45.5 Target – 50.5 Stop Loss – 43.0

- Li Ning Company Limited is principally engaged in brand development, design, manufacture and sale of sport-related footwear, apparel, equipment and accessories in the People’s Republic of China (the PRC). The Company is also engaged in the manufacture, development, marketing, distribution and sales of sports products under several other brands, including Double Happiness (table tennis), AIGLE (outdoor sports) and Lotto (sports fashion). Through its subsidiaries, the Company is also engaged in the provision of information technology services.

- Upcoming sport galas. China will be hosting the 31st FISU Summer World University Games in Chengdu from 28th July 2023 to 8th August 2023. The event will bring together student-athletes from across the globe and allow them to showcase their skills, forge friendships and realize their dreams. China will also be hosting the 19th Asian Games in Hangzhou, from 23rd September 2023 to 8 October 2023. Increasing sporting activities is likely to drive the demand for sporting apparel and goods, and Li Ning would be able to ride on the demand for these goods to drive sales volume.

- Increase R&D efforts to strengthen its supply chain. The company is significantly boosting its investment in the construction of its inaugural self-built intelligent plant. This strategic move marks a departure from outsourcing practices and aims to enhance control over costs and product quality in the fiercely competitive market. The company plans to allocate RMB 3.3bn for establishing its factory in the southwestern Guangxi Zhuang Autonomous Region, a substantial increase from the earlier budget of RMB 1.5bn. By making this transition to in-house manufacturing, Li Ning anticipates strengthening its ability to manage costs and ensure superior product quality, ultimately bolstering its reputation in the industry.

- FY22 earnings. Revenue rose to RMB25.8bn, up 14.3% YoY from RMB22.6bn in FY21. Net profit increased slightly from RMB 4.01bn in FY21 to RMB4.06bn in FY22, remaining at a healthy level of 15.7%.

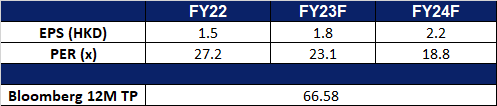

- Market Consensus.

(Source: Bloomberg)

Boeing Co (BA US): Strong travel demand

- BUY Entry – 230 Target – 250 Stop Loss – 220

- The Boeing Company, together with its subsidiaries, designs, develops, manufactures, sells, services, and supports commercial jetliners, military aircraft, satellites, missile defense, human space flight and launch systems, and services worldwide.

- Strong international travel demand. Airlines are experiencing a strong recovery in both domestic and international travel demand, leading them to expand flights between countries and anticipate further sales growth in the coming months. Domestic air travel has fully rebounded, and international traffic is nearing pre-pandemic levels, resulting in a higher demand for commercial planes and aviation personnel. The surge in travel demand during the previous quarter has fueled airlines’ predictions for an increase in international travel. As a result, airlines are looking to acquire more commercial planes to meet the needs of global travellers. Boeing’s management foresees significant growth in various markets, including the world fleet, aircraft services, and the global cargo aircraft fleet, driven by factors like passenger traffic growth and the increasing popularity of e-commerce.

- Secured US Navy contract. Boeing has been awarded a firm-fixed-price order worth approximately $115.14mn for initial spares and repair equipment for the MQ-25A Stingray aircraft. This order supports the readiness, maintainability, and reliability of the aircraft for its first deployment. The work is scheduled to be completed by July 2026, and the Naval Air Systems Command is the contracting activity.

- Increased production. Boeing reported a substantial backlog of $440bn, which includes more than 4,800 commercial planes. The 737 program is gradually increasing production and aims to produce 38 planes per month, with plans to reach 50 per month by 2025/2026. This year, the program intends to deliver 400-450 planes. The 787 program has also boosted production to four planes per month and aims to reach five per month in late 2023, eventually reaching 10 per month by 2025/2026. The program plans to deliver 70-80 planes this year.

- New deliveries. Boeing plans to commence delivery of its smallest and largest B737 MAX variants to customers in the coming year, with expectations for B737-7 certification in 2023 and first deliveries in 2024, and B737-10 certification flight testing in 2023 and first deliveries also in 2024. The delays are attributed to stricter FAA requirements after the MAX aircraft’s worldwide grounding. Southwest Airlines is the major customer for the B737-7, ordering 207, followed by other airlines with smaller orders. The B737-10 has gained popularity with 1,018 orders across 19 customers, and United Airlines is set to be its launch customer. The FAA emphasises safety as the priority for certification projects, refraining from discussing ongoing processes.

- 2Q23 earnings review. Revenue rose 18.4% YoY to $19.75bn, beating estimates by $1.16bn. Non-GAAP earning per share was -$0.82, $0.07 above expectations.

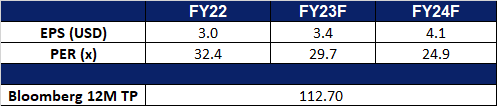

- Market consensus.

(Source: Bloomberg)

(Source: Bloomberg)

Starbucks Corp (SBUX US): BLACKPINK in your drink

Starbucks Corp (SBUX US): BLACKPINK in your drink

- RE-ITERATE BUY Entry – 100 Target – 110 Stop Loss – 95

- Starbucks Corporation is the premier roaster, marketer, and retailer of specialty coffee. The Company offers packaged and single-serve coffees and teas, beverage-related ingredients, and ready-to-drink beverages, as well as produces and sells bottled coffee drinks and a line of ice creams. Starbucks serves customers worldwide.

- Partnership with BLACKPINK. Starbucks recently unveiled an exclusive fan experience, exclusive to the Asia Pacific region, commencing on 25 July, featuring a BLACKPINK-themed Frappuccino and limited-edition merch collection. This collaboration with one of today’s biggest icons resonates with Starbucks’ dedication to uplifting customers and fans through meaningful connections, creating an unforgettable Starbucks Experience. The accompanying limited-edition merch collection boasts 11 drinkware styles and six lifestyle accessories in a striking pink and black color palette. The partnership, available at select Starbucks locations across Hong Kong, Indonesia, Korea, Malaysia, the Philippines, Singapore, Taiwan, Thailand, and Vietnam, aims to attract BLACKPINK fans, affectionately known as “Blinks,” capitalizing on the K-pop frenzy to potentially boost sales. Notably, this collaboration marks the first regional-scale partnership and menu item development for Starbucks, signifying their confidence in this collaboration with global icons.

- Expansion opportunity. Intense competition among global coffee chains like Starbucks and Costa, and local players such as Luckin Coffee and Manner Coffee, has driven a proliferation of coffee shops across countries, leading to a significant surge in coffee consumption. This trend is further fuelled by the growing demand for coffee makers and beans sourced internationally. Capitalising on immense growth prospects, Starbucks identifies substantial opportunities for expansion in China, where coffee consumption is on the rise due to increasing affluence and population. With rising coffee consumption in cities and a sizable middle-income consumer group, China remains a pivotal market for the coffee industry. Both global and domestic coffee chains are prioritising human connections, optimising performance, and investing in digital capabilities and innovation. In this pursuit, they are allocating more resources and manpower to penetrate smaller cities in China, aiming to tap into a larger consumer base while benefiting from lower costs in terms of management, labor, and rent compared to major cities. This strategic move enables large on-premise coffee brands to thrive and consolidate their presence in China’s rapidly evolving coffee landscape.

- Strength in its branding. Starbucks is poised to leverage the ongoing growth of the coffee industry and favorable customer preferences, ensuring continued success. Moreover, the company’s strong position is evident in its capacity to navigate potential economic downturns effectively. This resilience is attributed to its loyal membership program and a customer base that boasts relative affluence. These factors collectively fortify Starbucks’ market standing and reinforce its ability to thrive even in challenging economic conditions.

- 2Q23 earnings review. Revenue rose 14.5% YoY to $8.7bn, beating estimates by $270mn. Non-GAAP earnings per share was $0.74, $0.09 above expectations.

- Market consensus.

(Source: Bloomberg)

Trading Dashboard Update: Add Starbucks (SBUX US) at US$100. Cut loss on Seatrium Limited (STM SP) at S$0.136, Prada SPA (1913 HK) at HK$54.5, and Qualcomm Inc (QCOM US) at US$118.7.