2 February 2024: Food Empire Holdings Ltd (FEH SP), Yankuang Energy Group Co. Ltd. (1171 HK), Adobe Inc (ADBE US)

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

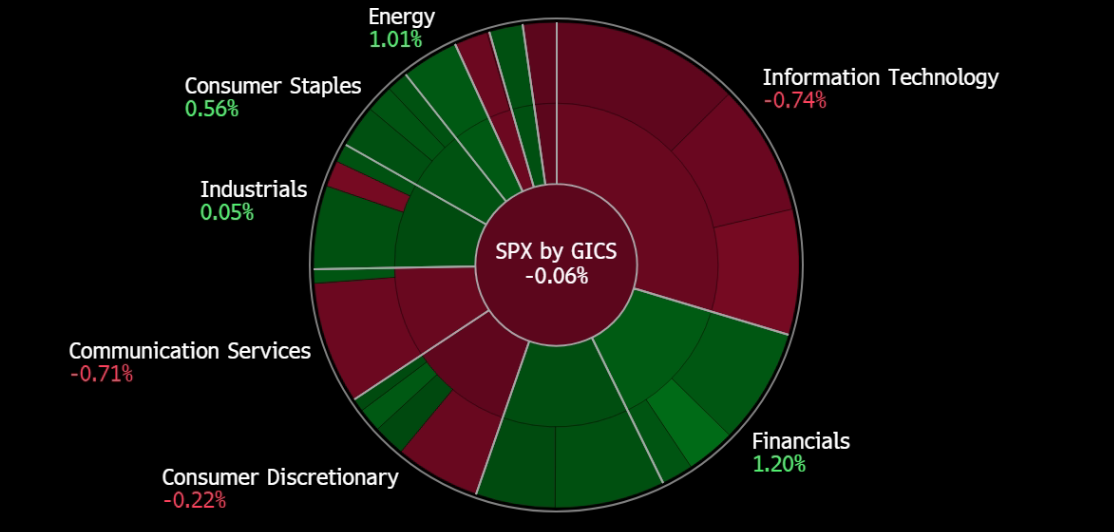

United States

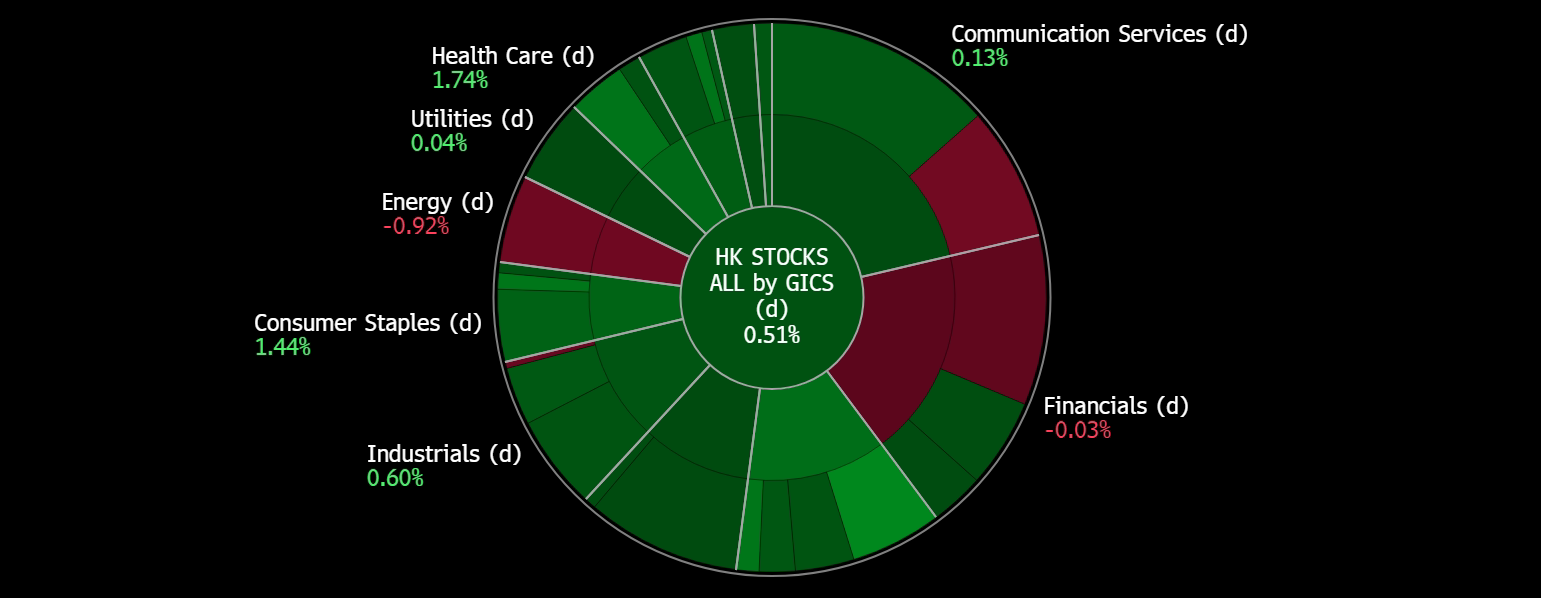

Hong Kong

News Feed |

1. China employment pressure ‘worsening’ this year in absence of solutions to shore up jobs |

5. Global Fund Exodus From China Stocks Hits Record Sixth Month |

Food Empire Holdings Ltd (FEH SP): A growing empire

- BUY Entry – 1.35 Target– 1.45 Stop Loss – 1.30

- Food Empire Holdings Limited manufactures and markets instant beverage products, frozen convenience food, confectionery and snack food. The Company exports its products to markets such as Russia, Eastern Europe, Central Asia, the Middle East and Indochina.

- Expansion Plans. Food Empire is constantly seek opportunities to spearhead itself in a different market, mainly focusing on acquisitions. The company is currently exploring several new markets where they can grow its business, before diving into expanding its business into these new markets to prevent incurring additional losses. The company also recently proposed a dual primary listing on the main board of the stock exchange of Hong Kong Ltd. This can potentially help Food Empire to generate more capital to grow their business internationally.

- Resilient consumer demand. Consumer demand remained relatively steady despite ongoing geopolitical tensions worldwide, in a high-interest-rate environment. Demand for coffee remained strong across the company’s key markets. However, Russia saw a slight decline in revenue mainly due to the depreciation of the Russian Ruble against the US dollar.

- Completion of Malaysia’s NDC plant. The company expects its NDC plant in Malaysia to commence operation in 1Q24, pending approval and clearance from the Malaysian government. The new plant is expected to begin commercial production in the coming months but would still require more time to ramp up to full capacity. This plant would increase the production capacity for the group to generate more revenue.

- 3Q23 results review. 3Q23 revenue decreased by 1.6% YoY to US$106.8mn from US$108.6mn. Net profit fell 30.6% YoY to US$15.7mn from US$22.6mn. Net profit margin fell by 6.1 percentage points to 14.7% in 3Q23, compared with 20.8% in 3Q22.

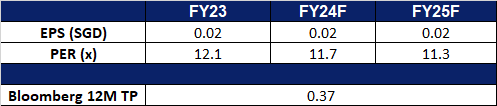

- Market Consensus. We have a fundamental coverage with a BUY recommendation and a TP of S$1.45. Please read the full report here.

(Source: Bloomberg)

Jumbo Group Ltd (JUMBO SP): Welcome more Chinese

Jumbo Group Ltd (JUMBO SP): Welcome more Chinese

- RE-ITEREATE BUY Entry – 0.265 Target– 0.285 Stop Loss – 0.255

- Jumbo Group Ltd is a seafood restaurant group offering multiple dining concepts catering to all types of consumers. The Company offers restaurants in Singapore, China, and Japan.

- Mutual visa exemption. Starting on 9 February, Singapore and China will implement a 30-day visa-free arrangement, allowing ordinary passport holders from both countries to enter without a visa for up to 30 days. The agreement, signed on 25 January, aligns with the Chinese New Year holidays. China has similar comprehensive visa exemption arrangements with at least 22 countries, and this initiative aims to enhance travel between Singapore and China, particularly as the Chinese New Year falls on 10 February this year.

- Chinese tourism expected to rise. Despite weaker-than-expected consumer sentiment, analysts and survey data forecast a continued recovery of overseas travel by Chinese tourists in 2024. While China’s economic data suggests consumer caution, there is a notable rise in enthusiasm for travel and socializing in restaurants and bars. McKinsey predicts a shift from goods to services spending, contributing to the recovery of international travel. A forecast by Singapore-based China Trading Desk anticipates a 50% rise in international travel by Chinese tourists in 2024, reaching 62% of pre-pandemic levels. Singapore is expected to benefit from this tourism recovery, being the most popular destination among surveyed respondents. The impending 30-day mutual visa exemption arrangement between Singapore and China is seen as a positive development for boosting tourism. Jumbo is set to benefit from the increase in travellers and the shift to services spending.

- 2H23 results review. 2H23 revenue increased by 40.7% to S$92.8mn from S$66mn. Earnings rose 52% YoY to S$6.7mn from S$4.4mn due to a recovery in its sale of food and beverages sector. Cost of sales rose 46.5% to S$32.6mn, in tandem with revenue. In China, 2H23 revenue rose 15.3% to S$12.7mn due to the end of the country’s zero-Covid-19 policy in December 2022. In Taiwan, Jumbo’s top-line contributions rose 17.5% to S$1.9mn.

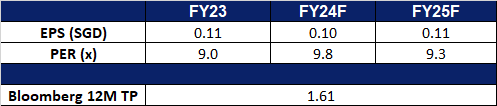

- Market Consensus.

(Source: Bloomberg)

Yankuang Energy Group Co. Ltd. (1171 HK): A freezing winter

- BUY Entry – 15.4 Target – 17.0 Stop Loss – 14.6

- Yankuang Energy Group Co Ltd is a China-based international comprehensive energy company engaged in coal and coal chemical industry. The Company operates in five segments. The Coal Mining segment is engaged in underground and open-cut mining, preparation and sale of coal and potash mineral exploration. The Smart Logistics segment provides railway transportation services. The Electricity and Heating Supply segment provides electricity and related heat supply services. The Equipment Manufacturing segment is engaged in the manufacture of comprehensive coal mining and excavating equipment. The Chemical Products segment is engaged in the production and sale of chemical products. The coal products mainly include thermal coal, pulverized coal injection (PCI), and coking coal. The coal chemical products mainly include methanol, ethylene glycol, acetic acid, ethyl acetate and crude liquid wax, among others. The Company distributes products in the domestic market and to overseas markets.

- Seasonality is driving record-high thermal coal imports. In December of the previous year, China’s thermal coal imports set a new record at 34.26 million tonnes, marking a 7% increase from November and a substantial 46% rise compared to the same month in 2022. The surge in fossil fuel imports was primarily driven by significant temperature drops across various regions, prompting heightened domestic demand for increased heating through devices and coal boilers. For the entire year of 2023, China’s thermal coal imports reached 353.65 million tonnes, a remarkable 62% surge from the previous year.

- China reinstates coal tariffs. At the start of 2024, China has reinstated tariffs on coal imports. The reinstated tariffs include a 6% levy on coal for electricity and heating and a 3% tariff on coking coal used in steelmaking. Russia, South Africa, Mongolia, and the United States will be impacted by these tariffs, while Indonesia and Australia remain exempt due to free trade agreements with China. The implementation of these tariffs is likely to drive up domestic coal production and demand as there is less competition from foreign coal companies. This allows domestic producers like Yankuang Energy to extend their competitive edge in the Chinese market.

- More coal use. Recently, China has initiated tests for producing ethanol using coal, as opposed to traditional crops like corn or sugar cane. This innovative approach enables China to generate “millions of tonnes” of grains annually, serving as valuable food resources.

- 3Q23 earnings. Revenue fell by 28.01% YoY to RMB40.34bn in 3Q23, compared to RMB56.03bn in 3Q22. Net profit fell 52.43% YoY to RMB4.52bn, compared to RMB9.49bn in 3Q22. Basic EPS fell by 55.36% YoY to RMB0.58, compared to RMB1.30 in 3Q22.

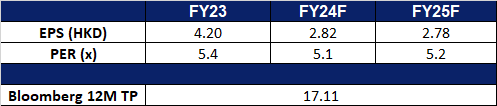

- Market consensus.

China’s thermal coal imports 2020-2023

(Source: General Administration of Customs)

(Source: Bloomberg)

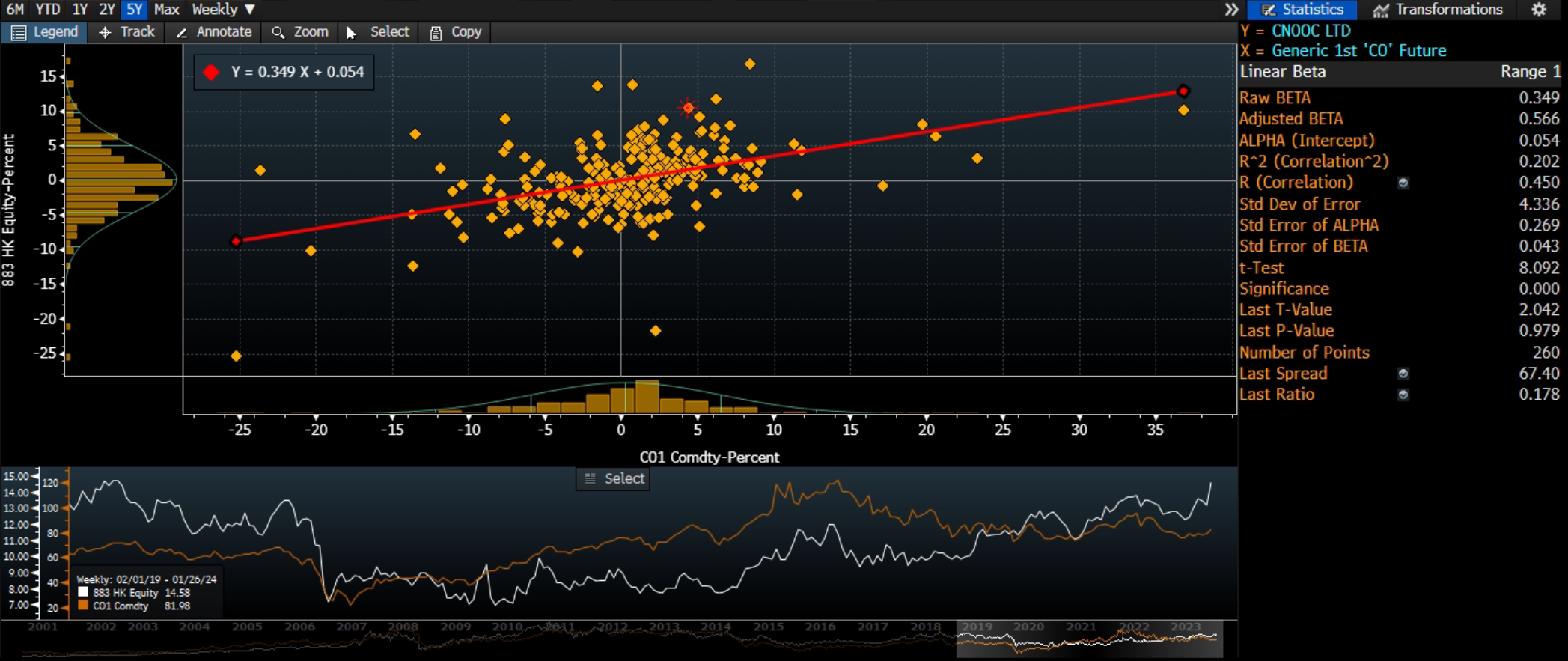

CNOOC Ltd. (883 HK): 2024 Record Targets

- RE-ITEREATE BUY Entry – 14.3 Target – 15.5 Stop Loss – 13.7

- CNOOC Ltd is a China-based investment holding company principally engaged in the exploration, production and sales of crude oil and natural gas. The Company operates three segments. Exploration and Production segment is engaged in conventional oil and gas business, shale oil and gas business, oil sands business and other unconventional oil and gas businesses. Trading segment is engaged in entrepot trade of crude oil in overseas areas. Corporate segment is engaged in headquarter management, assets management, research & development, and other businesses. The Company mainly operates businesses in China, Canada, the United Kingdom, Nigeria, and Brazil, among others.

- Record 2024 Output and Capex Targets. CNOOC has recently increased its 2024 production target by approximately 8% to a record 700-720 million barrels of oil equivalent (BOE), accompanied by a surge in annual capital spending to unprecedented levels. Around 69% of the total output in 2024 is expected to stem from domestic production. New domestic production sources this year will include oilfields off China’s Bohai Bay, deep-sea natural gas operations in the South China Sea, and onshore coalbed methane projects. Additionally, the company anticipates robust production growth from the Mero-3 project in Brazil. In terms of Capital Expenditure, CNOOC’s 2024 budget ranges from 125 billion yuan ($17.43 billion) to 135 billion yuan, with exploration, development, and production accounting for approximately 16%, 63%, and 19% of the total, respectively.

- Commencement of production. CNOOC recently announced that its Mero2 Project has begun production. The project consists of 16 development wells which are planned to be commissioned, including 8 production wells and 8 injectors. The Floating Production Storage and Offloading (FPSO) used in the project also has a designed storage capacity of approximately 1.4million barrels, one of the largest FPSO in the world. This project is expected to bring an additional 180,000 barrels of crude oil per day for the company.

- Construction of underground oil reserve. CNOOC recently started construction in Ningbo, China, on its largest commercial underground oil reserve project. The oil reserve is designed with a capacity of 3 million cubic meters, encompassing crude oil caverns, along with surface crude oil storage, transportation, and other supporting facilities. The project would be receiving a total investment of around 3bn yuan and is scheduled to be completed by 2026. Upon completion, the oil reserve would provide a steady supply of crude oil to surrounding cities and provinces.

- 3Q23 earnings. Revenue rose by 5.48% YoY to RMB114.8bn in 3Q2023, compared to RMB108.8bn in 3Q22. Net profit fell 8.23% YoY to RMB33.4bn, compared to RMB36.4bn in 3Q22. Basic EPS fell by 7.78% YoY to RMB0.71, compared to RMB0.77 in 3Q22.

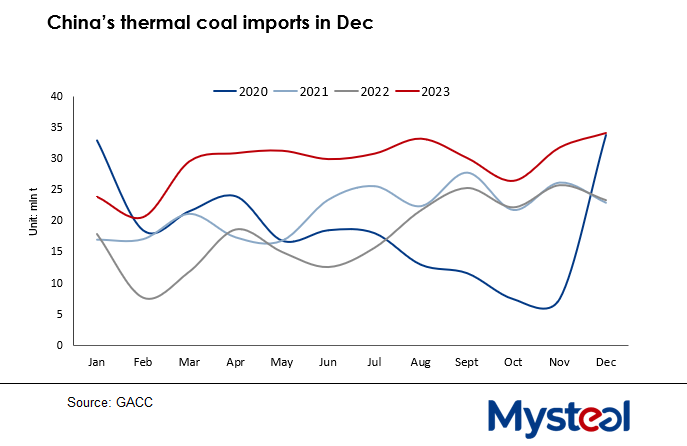

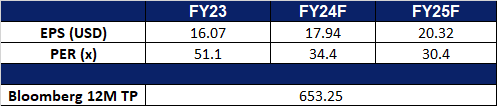

- Market consensus.

Share price and Brent crude oil price correlation

(Source: Bloomberg)

(Source: Bloomberg)

Adobe Inc (ADBE US): A lagging AI-themed stock

- BUY Entry – 612 Target – 650 Stop Loss – 593

- Adobe Inc. develops, markets, and supports computer software products and technologies. The Company’s products allow users to express and use information across all print and electronic media. Adobe offers a line of application software products, type products, and content for creating, distributing, and managing information.

- Artificial intelligence application layer explodes. The artificial intelligence application layer explodes. Artificial intelligence stands at the forefront of the upcoming technological revolution, with distinct leaders emerging in various application domains. Microsoft dominates the office software realm, while Adobe leads in drawing and editing applications. The current surge of start-ups focused on short video and drawing artificial intelligence indicates a rapid evolution in this sector, suggesting it could be the first to achieve mature applications of AI.

- Abandoned the acquisition of Figma. In December of 2023, Adobe decided to halt its $20bn acquisition of Figma due to regulatory pressures from the EU and British authorities. This announcement was well-received by the market. While technological revolutions often spark waves of mergers and acquisitions among related startups, the subsequent return to market rationality often reveals overvaluations in many target companies. Therefore, the termination of Adobe’s acquisition of Figma may ultimately be beneficial for the company, allowing it to judiciously allocate cash toward acquisitions or stock buybacks.

- 4Q23 results. Revenue increased to US$5.05bn, an increase of 11.5% YoY, exceeding expectations by US$30mn. Non-GAAP earnings per share were $4.27, beating expectations by $0.13. Revenue in the first quarter of FY24 is expected to be US$5.1bn to US$5.15bn, compared with market expectations of US$5.15bn. Non-GAAP earnings per share were between $4.35 and $4.40, compared with consensus expectations of $4.27.

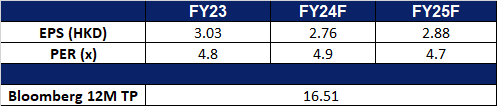

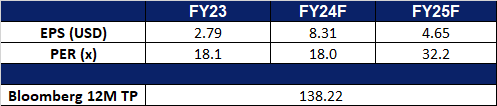

- Market consensus.

(Source: Bloomberg)

Airbnb Inc (ABNB US): International growth prospects

- RE-ITEREATE BUY Entry – 148 Target – 160 Stop Loss – 142

- Airbnb, Inc. operates an online marketplace for travel information and booking services. The Company offers lodging, home-stay, and tourism services via websites and mobile applications. Airbnb serves clients worldwide.

- Cross-currency bookings. Airbnb is planning to increase the guest service fee for cross-currency bookings starting 1 April, adding up to 2% for guests paying in a different currency. This move, aimed at supporting the company’s international growth strategy, could potentially generate $200mn to $500mn in incremental profit in 2025. While there might be a high-single-digit impact on 2025 EBITDA if users shift to local currency payments, Airbnb views this adjustment as aligning its fees with industry practices and enhancing flexibility for new products, features, and policies.

- Establishment of a housing council. Airbnb established the Airbnb Housing Council in the United States, aiming to find “sensible, long-term” solutions to increase housing supply and collaborate with cities on the challenges of home sharing. Chaired by Stephanie Rawlings-Blake, former Mayor of Baltimore, the council will involve leading independent housing organizations to advise Airbnb on policies, initiatives, and partnerships for housing growth. The council will work on balancing the benefits of home sharing with community needs, addressing housing affordability challenges. Airbnb aims to leverage the council’s expertise to identify new policy ideas and initiatives in collaboration with communities, hosts, and guests.

- 3Q23 results. Revenue rose 18.1% YoY, to US$3.4bn. GAAP EPS beat estimates by US$4.53 at US$6.63. Expect nights booked growth to moderate in Q4 compared to Q3. For 4Q23, the company expects to deliver revenue of US$2.13bn to US$2.17bn, a YoY growth between 12% and 14%.

- Market consensus.

(Source: Bloomberg)

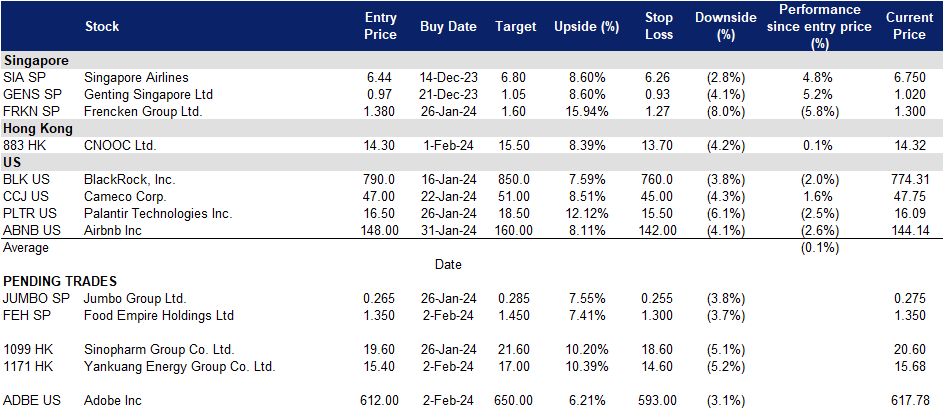

Trading Dashboard Update: Take profit on Yangzijiang Shipbuilding (YZJSGD SP) at S$1.73. Add CNOOC Ltd (883 HK) at HK$14.3 and Airbnb Inc (ABNB US) at US$148.0.