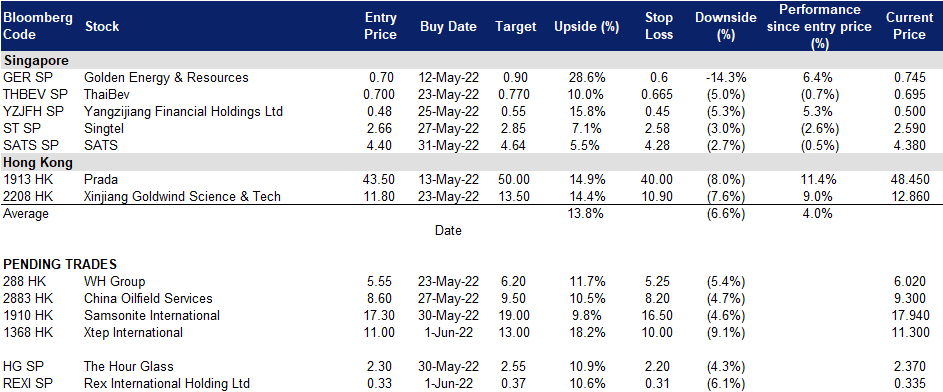

1 June 2022: Rex International Holding Ltd (REXI SP), Xtep International Holdings Ltd (1368 HK)

Singapore Trading Ideas | Hong Kong Trading Ideas | Market Movers | Trading Dashboard

Rex International Holding Ltd (REXI SP): More catalysts for oil

- BUY Entry – 0.330 Target – 0.365 Stop Loss – 0.310

- Rex International Holding Limited operates as an independent oil exploration and production company. It operates through Oil and Gas, and Non-Oil and Gas segments. The company offers Rex Virtual Drilling, a liquid hydrocarbon indicator, which uses seismic data to search for oil. The company is involved in the oil and gas exploration and production activities with a focus in Oman and Norway.

- Russian oil ban. Yesterday, European Union leaders agreed to pursue a partial ban on Russian oil, paving the way for a sixth package of sanctions to punish Russia and its president, Mr Vladimir Putin, for the invasion of Ukraine. The sanctions would forbid the purchase of crude oil and petroleum products from Russia delivered to member states by sea but include a temporary exemption for pipeline crude. This immediately covers more than two-thirds of oil imports from Russia, cutting a huge source of financing for its war machine. Officials and diplomats still have to agree on the technical details and the sanctions must be formally adopted by all 27 nations.

- Harvest time for oil & gas companies. On 28 Feb, Rex reported FY2021 net profit of US$78.9mn, a significant turnaround from the US$15.2mn loss in FY2020. This was on the back of US$67 per barrel average realised oil price in FY2021, almost double compared to US$34 it realised in FY2020.

- Positive consensus estimates. According to Bloomberg consensus estimates, the company currently has a rating of 3 BUYS, 0 HOLD and 0 SELL, with a 12M TP of S$0.58, representing approximately a 70.6% potential upside as of 31 May 2022.

- While we have a technical buy TP of S$0.365, we have a fundamental outperform rating and TP of S$0.54 based on DCF-backed valuations. Read our fundamental report here.

WTI Crude Prices – Broke the resistance levels of $115

(Source: Bloomberg)

The Hour Glass (HG SP): More tourists to visit Singapore

- RE-ITERATE BUY Entry – 2.30 Target – 2.55 Stop Loss – 2.20

- The Hour Glass Limited is a specialty luxury watch retail group with multi-brand and standalone boutiques in the Asia Pacific Region. The group also owns Watches of Switzerland, a watch retail chain in Singapore that deals in mid-tier to high-end Swiss timepieces.

- Stellar 2H22 results. The company announced its 2H22 results (YE March). Revenue increased by 23.8% YoY to S$561mn. Net profit attributable to the company shareholders jumped by 75% YoY to S$92.1mn. The company proposed a final dividend of 6 SG cents for the full FY22.

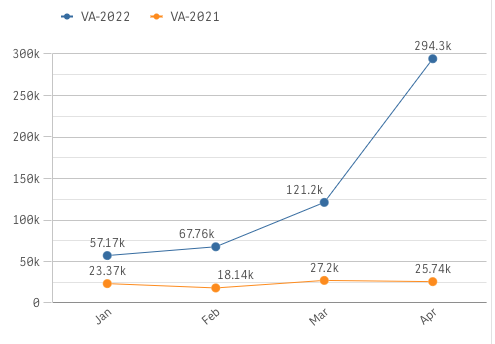

- Benefiting from the in-time reopening. Singapore has eased travelling restrictions since March. According to the Singapore Tourism Analytics Network, the number of visitor arrivals significantly improved in April, reflecting the onset of recovery of tourism. Therefore, we expect the ongoing recovery of tourism to uphold the upbeat outlook of the company.

Visitor Arrivals (VA) YoY Trends

Source: Singapore Tourism Analytics Network

- Asia’s road to recovery. Geographically, Southeast Asia and Oceania (Australia and New Zealand) contribute over 80% to the company’s total revenue. Singapore registered strong growth in consumer spending power despite the ongoing pandemic, evident from the retail sales index for watches and jewellery maintaining at pre-covid level in March 2022. Thailand and Malaysia on the other hand, are expected to catch up in 2022 with the reopening of foreign borders.

- Technical buy TP of S$2.55 and a fundamental outperform rating with a TP of S$2.32. Our TP is based on a discounted cash flow, taking into account a WACC rate of 10.5% and terminal growth rate of 2%. The last closing price was above our TP, and we will give an update accordingly. Read our previous fundamental report here.

Xtep International Holdings Ltd (1368 HK): 618 shopping spree to shore up sales

- Buy Entry – 11.0 Target – 13.0 Stop Loss – 10.0

- Xtep International Holdings Ltd is a China-based company principally engaged in the design, development, manufacturing, sales, marketing and brand management of sports products, including footwear, apparel and accessories. The Company operates its businesses through three segments. The Mass Market segment’ signature brand is Xtep. The Athleisure segment’s signature brands are mainly K-Swiss and Palladium. The Professional Sports segment’s signature brands are Saucony and Merrell. The Company distributes its products both in the domestic market and to overseas markets.

- Two upcoming turnaround catalysts. Shanghai said on Sunday “unreasonable” curbs on businesses will be removed from June 1 as it looks to lift its COVID-19 lockdown, while Beijing reopened parts of its public transport as well as some malls and other venues as infections stabilised. June 18th is the upcoming shopping festival. The pent-up demand, as well as big sales promotions to drum up customers, will turn around the last two months’ gloomy retail sales.

- 1Q22 operational updates. Retail sell-through growth (including offline and online channels) grew by 30%-35% YoY. Retail discount level arrived at around 25%. Retail inventory turnover was around 4 months.

- The updated market consensus of the EPS growth in FY22/23 is 24.4%/25.1% YoY, respectively, translating to 21.2×/17.0x forward PE. The current PER is 26.4x. Bloomberg consensus average 12-month target price is HK$13.96.

(Source: Bloomberg)

Samsonite International S.A. (1910 HK): Summer vacation is coming

Samsonite International S.A. (1910 HK): Summer vacation is coming

- RE-ITERATE Buy Entry – 17.3 Target – 19.0 Stop Loss – 16.8

- Trip.com Group Limited, formerly Ctrip.com International, Ltd., is a travel service provider in China that provides accommodation booking, transportation ticketing, package tours and corporate travel management. The company aggregates hotel and transportation information to help leisure and business travellers make reservations. The company helps leisure travellers book travel packages and guided tours and helps corporate clients manage their travel needs. The company also offers a range of travel-related services to meet the different booking and travel needs of leisure and business travellers, including visitor reviews, attraction tickets, travel-related financial services, car services, travel insurance services and passport services. The company also offers package tours for independent leisure travellers, including tour groups, semi-tour groups and private groups, as well as package tours that require different transportation arrangements (such as cruise, buses or self-driving).

- 1Q22 results review. Net sales jumped by 67.7% YoY to US$576.6mn. Operating profit arrived at US$58.1mn compared to a loss of US$47mn during the same period last year. Profit attributable to the equity shareholders arrived at US$16.4mn in 1Q22 compared to a loss of US$72.7mn in 1Q21. The effects of the COVID-19 pandemic on demand for the company’s products moderated due to the continued rollout and effectiveness of vaccines leading governments in many countries to further loosen social-distancing, travel and other restrictions, which has led to the continuing recovery in travel.

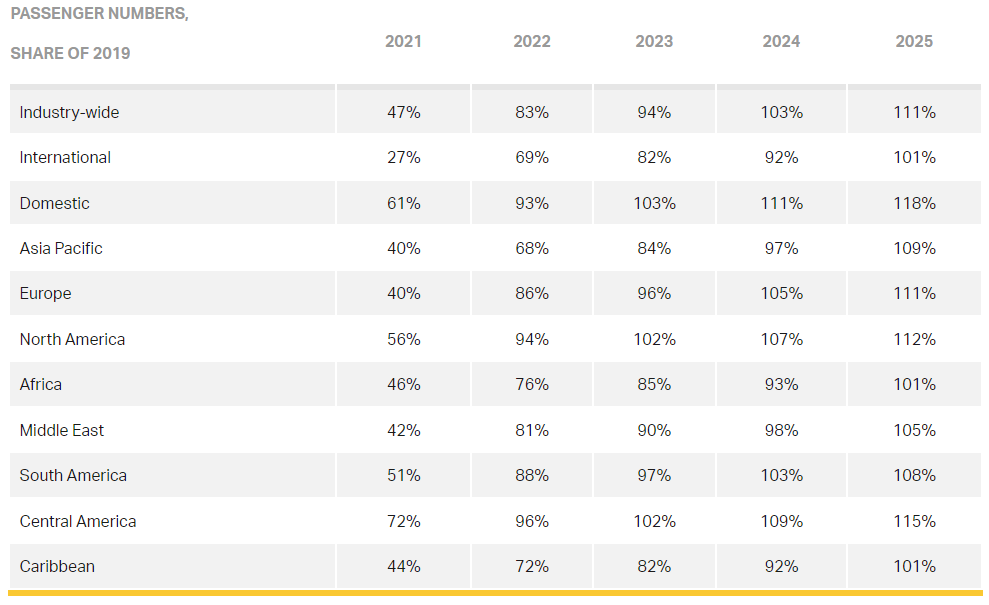

- Further recovery in the tourism sector. According to the IATA, the global economics air passenger traffic will continue to recover, indicating an enhancement in tourism. On average, the industry-wide air traffic volume will reach 83% of the 2019 level in 2022 compared to 47% of the pre-COVID level in 2021.

- The updated market consensus of the EPS growth in FY22/23 is 1,214%/37.0% YoY, respectively, translating to 16.5×/12.0x forward PE. The current PER is 30.3x. Bloomberg consensus average 12-month target price is HK$22.54.

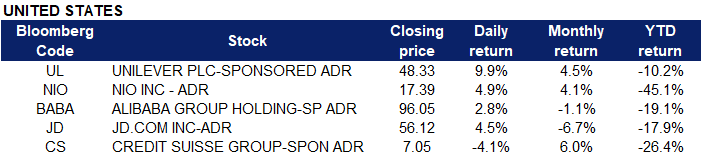

United States

Top Sector Gainers

| Sector | Gain | Related News |

| Internet Retail | +3.4% | China Is Lifting Covid Restrictions. Alibaba, JD.Com, and Other Stocks Are Rising. JD.com Inc (JD US) |

| Apparel/Footwear | +1.6% | N/A Nike Inc (NKE US) |

| Air Freight/Couriers | +1.2% | Alibaba-Backed ZTO Says Covid Disrupted China Express Deliveries In April; 1st Qtr Profit Rose ZTO Express (Cayman) Inc (ZTO US) |

Top Sector Losers

| Sector | Loss | Related News |

| Oilfield Services/Equipment | -3.0% | Opec mulls excluding Russia from oil-production deal: WSJ report Schlumberger N.V. (SLB US) |

| Precious Metals | -2.6% | Gold slips as yields, dollar climb; faces 2nd monthly drop Barrick Gold Corp (GOLD US) |

| Managed Health Care | -2.1% | N/A Unitedhealth Group Inc (UNH US) |

- Unilever Plc (UL US) shares jumped 9.9% after it named activist investor Nelson Peltz to its board. The CEO and founding partner of Trian Fund Management acquired a 1.5% stake in the company, and his new role will become effective July 20.

- Nio Inc (NIO US) shares jumped 4.9% following a note from Morgan Stanley that said the China-based electric vehicle maker could rebound as soon as the next 15 days. Analysts said Nio is set for a boost as China lifted some Covid restrictions over the weekend.

- Alibaba Group Holdings Ltd (BABA US), JD.com Inc (JD US). A slew of Chinese stocks listed in the U.S. rallied after the country’s Covid-19 lockdown measures eased. Alibaba jumped 2.8%, while JD advanced 4.5%.

- Credit Suisse Group (CS US) shares dropped 4.1% after Credit Suisse denied a Reuters report that it is deliberating ways to raise capital after its recent losses. The news report, citing two unnamed sources, said Credit Suisse is mulling over options including selling shares to existing shareholders or selling a business unit such as its asset management arm.

Singapore

- Kim Heng Ltd (KHOM SP) and RH Petrogas Ltd (RHP SP) shares rose 6.6% and 1.8% respectively yesterday. WTI crude futures jumped more than 2% toward $118 per barrel on Tuesday, hitting its highest since March 9, after EU leaders reached an agreement to ban 90% of Russian crude by the end of 2022, fueling concerns of an even tighter global market. The agreement resolves a deadlock with Hungary over the bloc’s toughest sanction yet on Moscow and would clear the way for other elements of a sixth package, including cutting Russia’s biggest bank from the SWIFT messaging system. However, some analysts suggested that oil price gains may be muted as the move has already been priced in by the markets.

- COSCO Shipping International Singapore Co Ltd (COS SP) and Samudera Shipping (SAMU SP) shares rose 7.6% and 4.5% respectively yesterday. There was no company specific news, however the gain in shipping shares was likely due to the reopening news of Shanghai and Beijing, which potentially spur more operations and shipping activities. Major Chinese cities Beijing and Shanghai began to relax Covid controls over the weekend as the local case count dropped. In Beijing, major shopping centres, including a luxury mall that temporarily closed a month ago due to Covid, announced they would reopen as of Sunday. Ride-hailing and most public transport resumed in the main business area, while more people were allowed to return to work. Some libraries, museums and gyms could reopen at half their capacity, if no Covid cases were found in the past seven days at a community level.

- Golden Agri-Resources Ltd (GGR SP) shares rose 1.8% yesterday. Palm oil futures were around MYR 6,250 per tonne in late May, the lowest in a week and well below record highs touched last month amid expectations that global supplies recover. The world’s top producer Indonesia has begun processing export licences and is expected to soon grant permits to palm oil producers, shortly after the government allowed the resumption of shipments of crude palm oil and its derivatives on May 23rd. The trade ministry said that Indonesia aims to export 1 million tonnes of palm oil, targeting producers to allocate 20% of output to remain in Indonesia under a policy of mandatory sales to the local market at a certain price level.

Hong Kong

Top Sector Gainers

Sector | Gain | Related News |

Environmental Energy Material | +3.69% | China Is on Track to Double Its Solar Panels From Last Year’s Record GCL Technology Holdings Ltd (3800 HK) |

Electricity Supply | +3.59% | Chinese Utilities Shares Rise on Easing Lockdowns, PMI Data Beat China Resources Power Holdings Co Ltd (836 HK) |

Biotechnology | +2.99% | Fosun releases data of first clinical trial in Chinese adults, showing robust results Akeso Inc (9926 HK) |

Top Sector Losers

Sector | Loss | Related News |

Footwears | -0.85% | China factory activity contracts again as lockdowns curb output Xtep International Holdings Ltd (1368 HK) |

Toys | -0.45% | China’s non-manufacturing PMI up in May Pop Mart International Group Ltd (9992 HK) |

Textile & Apparels | -0.32% | China factory activity contracts again as lockdowns curb output ANTA Sports Products Ltd (2020 HK) |

- GDS Holdings Ltd (9698 HK) Shares jumped 11.0% yesterday after the company achieved a strategic partnership with Shaoguan city regarding the “Eastern Data Western Calculation” project. There were 30 projects worth RMB120bn signed under the Shaoguan projects.

- Dongyue Group Ltd (189 HK) Shares rose 10.8% yesterday. There was no company-specific news. CITIC Securities raised its TP to HK$19 from HK$10.2, the demand for the company’s core product PVDF and the upstream product R142b was strong, and hence, the average selling prices went up substantially. Meanwhile, overseas orders of silicon plate were shifted to the domestic market.

- China Power International Dev. Ltd (2380 HK) Shares rose 10.2% yesterday. CGN New Energy Holdings Co Ltd (1811 HK) Shares rose 9.3% yesterday. There was no company-specific news for both companies. The power sector jumped on expectations that the easing of Covid-19 restrictions could further boost China’s economic activity.

- Smoore International Holdings Ltd (6969 HK) Shares rose 9.7% yesterday. There was no company-specific news. E-cigarette themed stocks jumped as the authorities released the notice of regulations of e-cigarette inspection and testing and related work previously.

Trading Dashboard Update: Add SATS Ltd (SATS SP) at S$4.40.