KGI DAILY MARKET MOVERS – 8 July 2021

Market Movers | Trading Dashboard

Market Movers

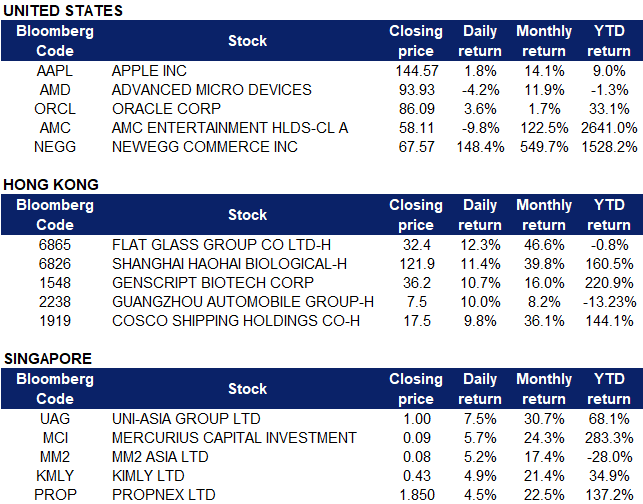

United States

- Apple Inc (AAPL US) brought the S&P and NASDAQ to new highs after new analyst reports highlighting better-than-expected iPhone sales ahead of the launch of iPhone 13.

- AMD and Xilinx (AMD US, XLNX US) fell the most amidst a broad rotation out of the semiconductor and semiconductor equipment sector on Wednesday.

- Oracle (ORCL US) climbed to a new high with its 4th straight daily gain as one of the contenders for the Pentagon cloud contract that will replace the scrapped JEDI deal.

- AMC and Gamestop (AMC US; GME US) fell alongside other meme stocks as momentum fades for the group. However, other retail favourites continue to emerge, such as Newegg Commerce (NEGG US), which shot up after running a product lottery to sell some of the latest NVIDIA RTX graphic cards at manufacturer suggested prices.

Singapore

- Uni-Asia Group (UAG SP). The company is riding on 10-year high dry bulk charter rates amid favourable supply-demand dynamics for handysize carriers. We upgraded our TP to S$1.42 (previously 0.91) as valuations remain attractive given the stronger-than-expected bulk carrier upcycle. Our new TP implies a 0.68x FY2021F P/B, which is still a conservative 30% discount to international peers who are trading above 1.0x P/B. Read our full report here.

- Mercurius Capital Investment Limited (MCI SP). Shares rose after the company received the listing and quotation notice (LQN) from SGX-ST for the listing of 27.3mn new ordinary shares at an issue price of 5.5 Sing cents per share in a private placement to existing investor Cheah Bee Lin, raising a total of S$1.5mn. Mercurius Capital states that the expected net proceeds from the placement will be used for business acquisition expenses (S$200k) in relation to its proposed acquisition of grocery businesses in Malaysia, repay borrowings (S$800k) and general working capital (S$485k).

- mm2 Asia Limited (MM2 SP). There was no company specific news. However, the rise in share price could be due to investors’ positive outlook on the company as a reopening theme. A possible turnaround event occurred in July which could boost top line growth. A 3-day Hong Kong Film Gala Presentation programme was held from 2 – 4 July in which mm2 collaborated with the Asian Film Awards Academy and Cathay Cineplexes to feature 6 Hong Kong films.

- GKE Corporation Limited (GKEC SP). Shares continued to rally the past week and closed at its highest since February 2021 on higher-than-average trading volumes.While there was no company-specific news, shares could have risen over optimism over its logistics and warehousing business. Earlier in June, SAC Capital initiated a buy rating and assigned a 16.3 Sing cents TP, citing the company’s strong 1H FY2021 results, with stellar results expected for the full year.

- Kimly Limited (KMLY SP) shares closed at its highest since 2017. There was no company specific news today. On 30 June, RHB maintained a BUY rating on Kimly and raised the TP to S$0.48 from S$0.42 previously. Kimly’s 1HFY2021 increased 14.2% YoY to $122.6mn while PATMI surged 106.2% YoY to S$21.7mn. Kimly may add another $9mn to its profit before tax (PBT) for FY2022 due to the acquisition of homegrown food business, Tenderfresh.

- Propnex Limited (PROP SP) shares rose likely due to the positive outlook on Singapore’s housing market. For the first six months of 2021, overall private residential prices increased by 4.3%, according to Leonard Tay, head of research at Knight Frank Singapore. Over the past 12 months, prices increased 7.3%, according to the URA price index. In May, PropNex also expanded to Cambodia, its fourth overseas market, after Indonesia, Malaysia and Vietnam. On 28 June, PropNex executive director Kelvin Fong Keng Seong acquired 44,600 shares of the company, for a consideration of S$66,900 at S$1.50 per share. This took his deemed interest in PropNex from 8.48% to 8.50%.

- Trading Dashboard: Add Uni-Asia Group (UAG SP) at S$0.93

Hong Kong

- Flat Glass Group Co Ltd (6865 HK). The photovoltaic sector jumped. Market expects the demand for solar panels will increase under the backdrop of carbon neutrality. Photovoltaic silicon material prices topped in China, implying a full year target of 160 GW installed capacity is achievable. The estimated photovoltaic installed capacities are 200GW, 280GW, 330GW, and 380GW from 2022 to 2025.

- Shanghai Haohai Biological Technology (6826 HK). There was no company specific news. The A-share (688366 CH) hit a limit up (+20%) and closed at an all-time high, which also pushed the H-share higher. Aesthetic healthcare sector has remained resilient despite weak market sentiment.

- Genscript Biotech Corp (1548 HK). Shares closed at an all-time high, following an 8.15% drop the day before. There was no company specific news. The technical rebound could be due to the positive outlook of the biotech sector and the intact fundamentals of the company.

- Guangzhou Automobile Group Co Ltd (1951 HK). Shares closed at a five-month high. The A-share (601238 CH) hit a limit up (+10%) and closed at a 52-week high. The electric vehicle sector remained resilient as the sector has less regulatory risks and minimal exposure to the ongoing China-US tension. The auto sector is one of the few fast growing sectors that investors are confident of.

- COSCO SHIPPING Holdings Co Ltd (1919 HK). Shares closed at a 52-week high as JP Morgan maintained an OVERWEIGHT rating and increased TP by 62.2% to HK$30. This was due to a positive outlook on 2H21’s freight rates, coupled with the strong demand and short supply for the shipping industry, caused by a ripple effect from the temporary suspension of Yantian Port. According to the World Container Freight Index, container prices were at an all-time high of US$ 6,297 as of 2 July 2021.

- Trading dashboard: Cut loss on Baidu (9888 HK) at HK$180. Cut loss on Hainan Meilan International Airport (357 HK) at HK$28

Trading Dashboard

Related Posts: