KGI DAILY MARKET MOVERS – 6 April 2021

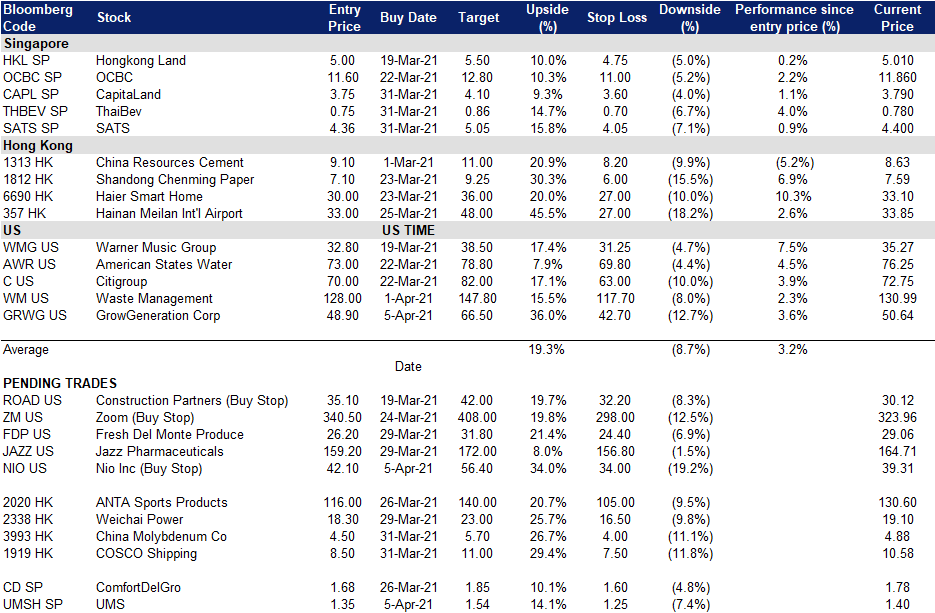

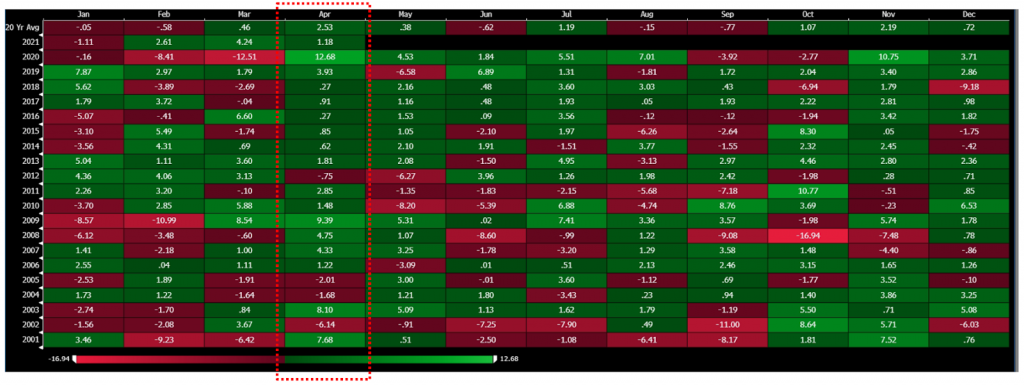

April Seasonality for S&P 500 Index Futures

April has historically been the best month over the past 20 years

US president Biden announced details of the US$2.25tn infrastructure plan last week. Fundamentals are improving faster-than-expected as non-farm payroll in March beat expectations while the job market showed the best recovery since June 2020.

Both manufacturing and services PMI beat market expectations, signaling that the economic recovery is on track. The positive sentiment has resumed in US equity markets as macro data provides a boost amid an accommodative monetary policy. The S&P 500 index managed to climb above 4,000 last week for the first time. According to consensus estimates, the average TP of the S&P 500 is 4,100 with a higher bound of 4,400 and a lower bound of 3,800.

S&P 500 Index Monthly Returns – 2001-2020

S&P 500 Index March 2020 – April 2020

MARKET MOVERS

Singapore

- Sembcorp Marine (SMM SP) hit a 7-month high, rising 16% yesterday, after it earlier announced a S$1.1 billion UK wind farm contract with GE Renewable Energy’s Grid Solutions, the largest contract win since its demerger from parent Sembcorp Industries in 2020. SMM currently trades at 0.7x P/B, 40% below its 5-year P/B average of 1.2x.

- Samudera Shipping Line (SAM SP) +13% after Lim & Tan initiated coverage with a BUY recommendation and target price of S$0.49. The company is benefitting from the recent boom in the container shipping industry, while its net cash accounts for 50% of its market cap.

- The Place Holdings (THEPLACE SP) gained 11% yesterday and bringing its one week gains to 40% after it recently gave an update on its Tianjie Yuntai Wanrun Property, which has been changed from commercial to residential with effect from 23 March 2021. In addition, the land-use rights assigned have been increased from the existing 40 years to 70 years. Shares have risen by 11x from the low of S$0.01 in August 2020.

- Rex International (REXI SP) gained as traders rotated back into small-mid cap stocks and as the company remains the only profitable and oil producing stock listed on SGX. We think Rex’s current valuations have not fully factored in the higher oil prices which have gained more than 170% from April last year.

- SPH (SPH SP) is still in play, gaining 6% yesterday and 26% week-on-week following the announcement of its strategic review. SPH currently trades at 0.8x P/B vs its 5-year average of 1.2x P/B. Analysts consensus 2 BUYS, 1 HOLD, 0 SELL. Consensus BUY TP S$1.74-S$2.09

Hong Kong

The Hong Kong market is closed from 2 to 6 April. Trading resumes on Wednesday, 7 April.

United States

- Facebook (FB US) reached a new high as FAANG stocks gained on Monday trading, leading the NASDAQ up. NASDAQ is now just 1.5% below its all-time high.

- Marathon Patent (MARA US) reached a new high after announcing their 1Q21 Bitcoin mining haul and updating their expected receival schedule for miners. Marathon currently has about 6,800 active miners and expects to reach 103,120 miners by March 2022, with expected hash rate to increase more than 14x from current levels.

- Farfetch Ltd (FTCH US) had the highest daily loss % after Credit Suisse is reportedly looking to unload another 11 million shares as part of a US$2.3bn block trade into the market. Archego-related stocks mostly closed lower as fears over additional block trade sales remain.

- General Motors (GM US) closed at a new high above the US$60 resistance behind an analyst upgrade from Wells Fargo. GM is highly touted to restructure successfully into the electric vehicle space, with a US$27bn capex commitment by 2025 to AI and EV developments to meet its goal of selling only zero-emission vehicles by 2035.

- Occidental Petroleum Corp (OXY US) fell the most out of S&P 500’s oil stocks as oil prices plunged the most in nearly 2 weeks with growing delays of Europe’s reopening, news of potential Iran oil supply, and OPEC’s decision to phase in production increases.

- Trading Dashboard: Include GrowGeneration at US$48.9.

Earnings Watch: Paychex (Tuesday); WD-40 (Thursday); Jinko Solar, Jiayin Group (Friday)

Trading Dashboard