KGI DAILY MARKET MOVERS – 27 July 2021

IPO Watch: Robinhood Markets | Market Movers | Trading Dashboard

IPO Watch

Robinhood Markets Inc (HOOD US): Could HOOD’s IPO signal the market peak

- Key dates: Robinhood is expected to start trading on Thursday, 29th July 2021.

- Pioneer of commission-free trading. Robinhood is amongst the pioneers that offer commission-free trading. Its mission is to make trading available for everyone, especially retail investors and beginners given the app’s streamlined and easy-to-use interface.

- Fast growing user base. Robinhood sports an increasing user base compared to other brokerage apps (e.g. Webull, Coinbase, E-trade). It had a whopping total of 18 million downloads as of January 2021, with a record high of 3 million downloads in January 2021 itself.

- IPO for the masses. Robinhood is reserving 20%-35% of shares to be sold in an initial public offering for its customers, enabling retail investors to participate in IPOs.

- And enough for insti investors. Notable bookrunners and investors include Goldman Sachs, JP Morgan and Salesforce Ventures.

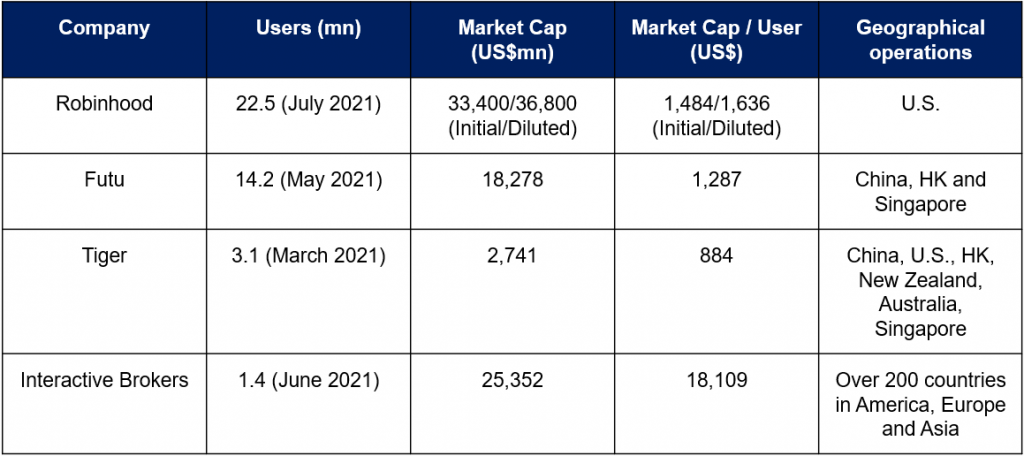

- Comparative peers among the commission free online brokers (Market Cap/User): Futu Holdings US$1,287, Tiger Brokers US$884, Interactive Brokers US$18,109 VS Robinhood US$1,484/US$1,636 (Initial/Diluted Market Cap).

- Priced for perfection. Robinhood’s Price/TTM Sales ratio at ~24-27x, which is fairly priced when compared to Futu Holdings who sports a PS ratio of 26.3x. Both are relatively expensive when compared to traditional brokers, such as Interactive Brokers Group with a PS ratio of 3.2x

- Overall recommendation: We expect huge trading volumes on IPO day as Robinhood is a big name in the market that has drawn a significant amount of controversy and hype. Possible upside/downside swing due to negative sentiments. We would consider to long Futu Holdings over Robinhood.

- Risks: Increasing number of competitors, hence customer retention might be challenging; Previously encountered crypto trading outage on platform, credibility might be underpinned should similar technology errors occur again; client support might not be strong due to short-squeeze incident in January 2021.

Comparison table between commission free online brokers

Market Movers

United States

- Hasbro (HAS US) shares climbed 12% to $103.72 on Monday, outperforming some of its competitors; with Nintendo (NTDOY US) falling 0.93% to $67.99, and Activision (ATVI US) falling 1.49% to $90.14. The maker of popular toy brands such as Play-Doh, Nerf and Monopoly released solid second-quarter earnings, reporting that revenue had jumped 54% from the prior year period. Hasbro announced adjusted net earnings of $1.05 per share, beating analyst estimates.

- Aon (AON US) shares soared 8% on Monday, after news of the insurance broker and Willis Towers Watson (WLTW US) agreeing to terminate their $30 billion merger agreement and end their litigation with the U.S. Department of Justice (DOJ). In June, the DOJ had sued to block the deal, citing that it would harm reinsurance broking competition and lead to higher prices. Willis Towers Watson however, saw its stock fall 8.8%.

- Moderna (MRNA US) declined 3.7% on Monday after a New York Times report said the U.S. Food and Drug Administration (FDA) requested that vaccine makers, including Moderna, expand their clinical trials for COVID-19 vaccines in adolescents aged 5-11 years old. However, the company confirmed that it still expects to file for emergency use authorization for the age group by winter 2021/early 2022.

- Bitcoin stocks Coinbase (COIN US) and Riot Blockchain (RIOT US) surged on Monday as bitcoin rallied above the $40,000 level. Last week, Tesla CEO Elon Musk said that they might start accepting Bitcoin as a form of payment again, while Twitter CEO Jack Dorsey said they were looking to integrate the cryptocurrency into its operations. Amazon also hinted that it might be about to enter the crypto world with a job listing for a “Digital Currency and Blockchain Product Lead”.

Singapore

- OIO Holdings Limited (OIO SP) shares surged by 28.6% yesterday, even though there was no company specific news. Besides the company’s core business units which provides FinTech and Mechanical and Engineering services, it also provides digital wallets and cryptocurrency investment opportunities to investors following the acquisition of Moonstake. Investors could have bought in OIO’s shares due to the rebound in Bitcoin, which rose as far as 12.5% to hit US$39,850, its highest since mid-June. As reported by CNA, the rebound was due to positive news on the currency after Elon Musk commented that Tesla would likely resume accepting bitcoin. In addition, Jack Dorsey also commented last week that the digital currency is a “big part” of Twitter’’s future. This could have led investors’ to be bullish in the cryptocurrency and to long OIO’s stocks.

- Accrelist Limited (ACC SP) shares rose by 26.3% on higher-than-average trading volume early in yesterday’s trading session. Most recent company news was on 21 July where Accrelist announced that it has launched its 7th local clinic at Raffles City Shopping Centre, following the opening of its Serangoon Central clinic in April 2021. A.M Aesthetics generated revenue of S$6.3mn for the financial year ended 31 March 2021, an increase of S$1.3mn or 26.0% from S$5.0 mn for the financial year ended 31 March 2020.

- Raffles Medical Group Limited (RFMD SP) shares rose by 9.1% and closed at a 52-week high yesterday after a positive earnings announcement. The group achieved 42.4% YoY growth in revenue and 138.4% YoY growth in profit after tax. In addition to the strong results, the group also announced its business updates, which point to an optimistic end to FY2021 and beyond, which could have boosted investors’ confidence in the stock. The group has expanded its operations beyond air-border screening and pre-event testing to include vaccination centres, pre-departure swabbing of cruise passengers, as well as operating dedicated PCR testing centres to conduct tests for those exposed to new COVID-19 clusters as they emerge. In addition, the enhanced Raffles Connect telemedicine platform has now been expanded to include specialist services and is also accessible by foreign patients. Lastly, the group’s business in China is beginning to return to normal, with both Raffles Hospital Chongqing and Raffles Hospital Beijing continuing to see improved patient loads amidst an improving operating environment.

- Golden Energy and Resources Limited (GER SP) shares rose by 4.1% yesterday and closed at a 52-week high after the company announced a positive profit guidance. In the announcement, the group expects to report a significant improvement in revenue and earnings for 1H21 as compared to 1H20 based on the preliminary assessment of the group’s unaudited financial results. This is primarily due to higher average selling prices arising from an increase in coal prices, as reflected in the Indonesian Coal Index 4 (ICI4). Golden Energy’s 1H21 earnings results is expected to be announced on or around 13 August 2021.

- Nanofilm Technologies Limited (NANO SP) shares rose by 4% yesterday. Nanofilm was among the top five companies outside the STI which received the highest institutional inflows between the four trading sessions spanning 16 July to 22 July. In addition, the company published positive news last week, announcing that it will enter the hydrogen energy business via a S$140mn JV with Temasek. Jefferies, a brokerage firm, also initiated a BUY (TP S$6.50) on Nanofilm upon its entry into the hydrogen energy business.

- SGX Fund Flows (16-22 July). STI stocks with highest net institutional inflows: CapitaLand, SGX, Ascendas REIT, Keppel Corp and Frasers Logistics & Commercial Trust. Highest insti inflows outside the STI: AEM, Netlink NBN Trust, Frencken Group, Nanofilm Technologies and Tianjin Zhong Xin Pharmaceutical.

Hong Kong

- Semiconductor Manufacturing International Corporation (981 HK) Hua Hong Semiconductor Limited (1347 HK). The semiconductor sector jumped, bucking a massive sell-off in the broader market caused by fresh regulatory clampdown on the private education business. The outperformance of semi stocks is likely due to funds flocking to the sectors that are less subject to regulatory risks.

- Dongyue Group Ltd (189 HK) shares closed at an all-time high. The company’s main product PVDF saw a sharp jump in prices over the past three months. The average selling prices increased from RMB10,000-12,000/tonne to RMB18,000-20,500/tonne. PVDF is one of the raw materials for lithium batteries, accounting for around 2% of the overall battery costs.

- Shimao Services Holdings Limited (873 HK) shares closed at a 4-month low. Morgan Stanley updated the coverage of the property management sector, reducing the rating from OVERWEIGHT to NEUTRAL as deleveraging and tightening liquidity continues to impact market sentiments. The 60% EPS growth of the sector has likely been priced in. The bank expects some property management companies to report lower profit margins in 1H21.

- New Oriental Education & Technology Group Inc (9901 HK) shares continued to plunge to another 52-week low. China announced a broad set of reforms for private education companies, seeking to decrease workloads for students and overhaul a sector. The new regulations, released over the weekend, ban companies that teach school curriculums from making profits, raising capital or going public. They can no longer offer tutoring related to the school syllabus on weekends or during vacations. They also are not allowed to give online or academic classes to children under the age of six, a segment of the population that had increasingly been pushed to start studying early.

- Trading Dashboard: Fuyao Glass (3606 HK) was added at HK$49.75. KWG Living (3913 HK) was cut loss at HK$7.45.

Trading Dashboard

Related Posts: