KGI DAILY MARKET MOVERS – 26 August 2021

Market Movers | Trading Dashboard

Market Movers

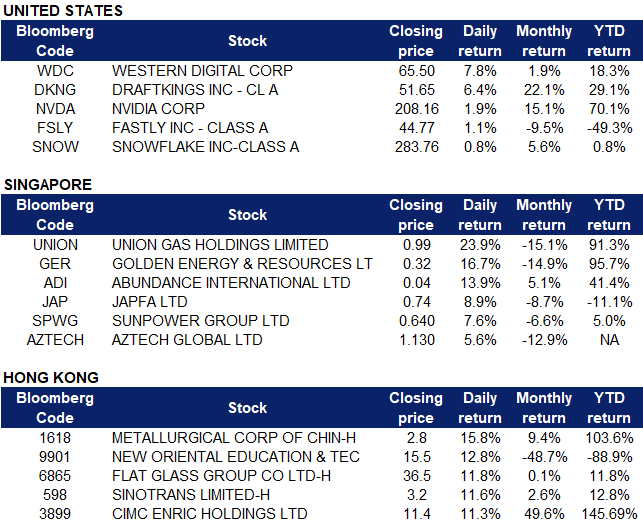

United States

- Western Digital (WDC US) stock surged 7.8% on a Wall Street Journal report that the company is in “advanced” talks to merge with Kioxia Holdings (formerly Toshiba Memory), a move that would potentially bring in approximately a third of the flash memory market under one company, according to a person familiar with the matter. The deal may be reached by mid-September if negotiations are successful.

- DraftKings (DKNG US) shares closed 6.45% higher after ARK Invest founder Cathie Woods bought over $60 million in shares. Woods reported that she added over 1 million shares total to three of the ETFs she manages, and now holds about $846 million worth of DraftKing shares.

- NVIDIA (NVDA US) stock climbed 1.93% after the company announced an agreement with the U.S. Department of Energy to build the largest GPU-based supercomputer at the Argonne National Laboratory which will run on NVIDIA’s accelerated computing platform. The Polaris supercomputer, to be built by Hewlett Packard, will supercharge research and discovery.

- Shares of computing company Fastly (FSLY US) jumped as much as 3.5% before closing 1.1% higher on Wednesday, marking several days of incremental gains, with the stock rising 10% higher in the past five days.The company announced on Tuesday that its web application firewall will be offered on the Amazon Web Services (AWS) marketplace for both public and private cloud services.

- Snowflake (SNOW US) fell more than 2% in after-hours trading on Wednesday after the company released second quarter results. The cloud-computing company reported a loss of 64 cents per share with revenue of $272.2 million which missed analyst expectations of a loss of 15 cents with revenue of $256.5 million.

Singapore

- Union Gas Holdings Limited (UNION SP) Shares jumped by 23.9% yesterday, sharply rebounding from the sell-off over the last 2 weeks when its RSI fell below 30. Union Gas announced yesterday that it has made a strategic S$75.0mn complementary acquisition to become one of Singapore’s major integrated LPG players. The company expects the acquisition to have a positive impact on its business and financial performance and increase its resilience and ability to navigate different economic cycles due to the control of an integrated supply chain and broader customer base. Read here for the full announcement.

- Golden Energy Resources Limited (GER SP) Shares rose by 16.7% yesterday, after the broad sell-off over the last 2 weeks shortly before the company announced its 1H21 results on 13 August. We initiated with an OUTPERFORM recommendation and a TP of S$0.64, representing an upside of 103%. Upside catalysts include further diversification into base metals that will be utilised for clean energy uses, such as copper, cobalt, zinc and nickel, as well as a favourable coal price that is providing a windfall for coal producers. All these point to a bright outlook for Golden Energy in the next couple of years. Read here for the article published by The Edge and here for our initiation report published yesterday.

- Abundance International Limited (ADI SP) Shares rose by 13.9% yesterday on higher-than-average trading volume, likely driven by a technical rebound supported by the 50 day moving average. There was no company specific news yesterday. Shares declined approximately by 37% over the last 2 weeks following the company’s announcement of its 1H21 results on 11 August. The company returned to profitability in 1H2021 on the back of its chemical chemicals trading business. The company looks to further expand this segment via suitable corporate actions.

- Japfa Limited (JAP SP). Shares rose by 8.9% yesterday after DBS raised its TP to S$1.05 from S$1.03 and maintained a BUY rating. The research house cites that Japfa may gain from tightening milk supply and rising demand for pasteurised products in China. DBS also highlighted Japfa’s cheap valuations of around 4x 2021 EV/EBITDA, a discount to regional peers’ average of 9x. Prior to yesterday’s surge, Japfa’s shares traded to the lowest level in more than 8 months after a disappointing 1H2021 result (announced on 29 July).

- Sunpower Group Limited (SPWG SP) Shares rose by 7.6% yesterday after DBS upgraded Sunpower’s TP to 70 Sing cents. The increase in TP estimate was made to reflect the better-than-expected topline growth for its green investments (GI) segment, even though margin and performance for its GI segment may be weighed down by increasing thermal coal prices, as management may partially share the higher costs with its customers. However, as Sunpower is currently trading near its price-to-book (P/B) mean of 1.39 times, which seems fair against 10.3% return on equity (ROE) for FY2022.

- Aztech Global (AZTECH SP) Shares surged after DBS reiterated its BUY call on Aztech. Street consensus remains positive with 4 BUYS and a 12m TP of S$1.82 (+60% upside). The company’s share fell to a post-IPO low of S$1.03 last week following the release of its 1H2021 results. While 1H2021 net profit more than doubled YoY, the cautious outlook it provided for 2H2021 was taken as an opportunity by some funds to pare positions.

Hong Kong

- Metallurgical Corporation of China Ltd. (1618 HK) Shares closed at a 52-week high. There was no company specific news. Previously, the company announced that the value of newly signed contracts during 7M21 amounted to RMB 703.3bn, representing an increase of 36% YoY. The company will announce 1H21 earnings on 30th August.

- New Oriental Education & Technology Group Inc. (9901 HK) Shares rebounded due to the jump in US-listed ADR. There is no company specific news, and hence, this could be a technical rebound.

- Flat Glass Group Co Ltd (6865 HK) There was no company specific news. Float glass 4.8/5mm prices remained at a record high of RMB3,152.4/tonne. Shares had been up for three consecutive trading days with an 18.26% gain.

- Sinotrans Ltd (598 HK) Shares closed at a 52-week high after it announced 1H21 results. Revenue jumped by 55% YoY to RMB61.7bn. Net profit attributable to shareholders of the company jumped by 78% YoY to RMB2.16bn. Credit Suisse raised the TP to HK$11.8 from HK$7.3 and maintained an OVERWEIGHT rating.

- CIMC Enric Holdings Ltd (3899 HK) Shares closed at a one-month high after it announced 1H21 results. Revenue jumped by 49.3% YoY to RMB7.9bn. Net profit attributable to shareholders of the company jumped by 78% YoY to RMB383.4mn. Shares had been up for three consecutive days with a 20% gain. Baltic Dry Index surged to another new high of 4201 points, up for 11 consecutive days.

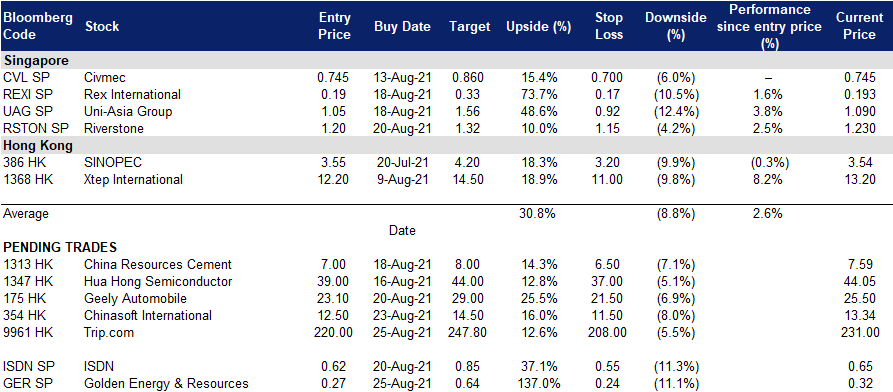

Trading Dashboard

Related Posts: