KGI DAILY MARKET MOVERS – 22 July 2021

Market Movers | Trading Dashboard

Market Movers

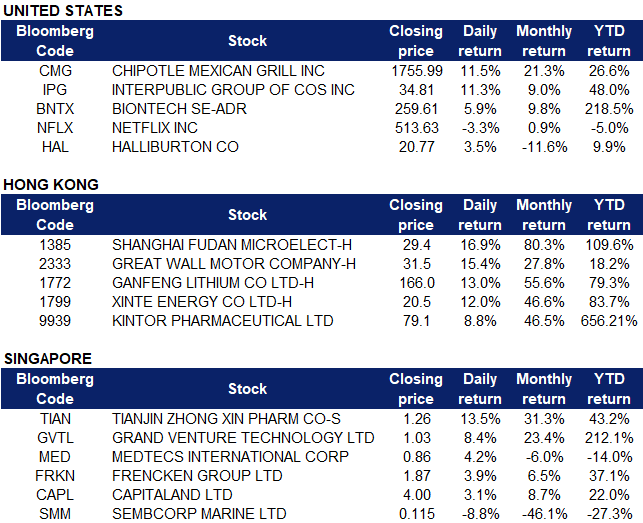

United States

- Chipotle Mexican Grill (CMG US) finished higher by nearly 12% on Wednesday, taking the company to a new all-time record high of $1,755.99, the biggest daily gain since April 2020. Chipotle’s gains came after strong second-quarter earnings results. The fast-food chain saw revenue climbing 38.7% to $1.89 billion, as restaurant sales climbed 31.2%. Chipotle stock has jumped higher since last year as its digital-ordering infrastructure helped maintain sales during the pandemic.

- Interpublic Group of Companies (IPG US). The global advertising and marketing services company reported better-than-expected second-quarter 2021 results. IPG’s revenue increased 22.5% year over year to $1.85 billion, while adjusted EPS hit $0.70 which beat estimates by $0.27. Shares of Interpublic have gained 33% so far this year, compared to 8% increase of the industry it belongs to.

- BioNTech (BNTX US) jumped on Wednesday following news of BioNTech and Pfizer (PFE US) signing a letter of intent with South African drugmaler The Biovac Institute to manufacture their COVID-19 vaccine for distribution within African Union member countries. Biovac is expected to produce over 100 million doses annually for distribution. COVID-19 vaccine related stocks also continued to enjoy momentum due to concerns about the new delta variant which now accounts for 83% of all new COVID-19 cases in the U.S., as stated by the Centers for Disease Control and Prevention (CDC).

- Netflix (NFLX US) shares fell as much as 4.8% on Wednesday after the media-streaming company released its second-quarter earnings report. Netflix earned $2.97 a share on sales of $7.34 billion in the second quarter. Analysts had expected Netflix to earn $3.18 a share on sales of $7.32 billion. For the third quarter, Netflix forecast that it would add 3.5 million new subscribers, nearly 2 million below analyst estimates.

- Halliburton (HAL US). The drilling oil and gas wells company climbed after receiving a Goldman Sachs upgrade to BUY as analysts affirmed price target at $26 per share. This upgrade comes a day after Halliburton beat Wall Street’s second-quarter earnings expectations. Company profit rose to $227 million, or $0.26 per share, up from $170 million, or $0.19 per share, seen in the previous quarter. That was higher than the market expectations of $0.22 per share.

Singapore

- Tianjin Zhong Xin Pharmaceutical Group Corporation Limited (TIAN SP). Shares rose by 13.5% yesterday, closing at its highest since 2018. This follows the recent rally of its A-share counterpart which gained 17% over the past five days. The Singapore listed shares of Tianjin currently trades at 1.0x historical P/B and 9x historical P/E, which is a steep discount to healthcare-related stocks listed in both Singapore and China. Year-to-date, its A-shares have gained 70% compared to the 43% gains of its SGX-listed shares.

- Grand Venture Technology Limited (GVTL SP), Frencken Group Limited (FRKN SP). Grand Venture shares rose by 8.4% yesterday and closed at an all-time high, whereas Frencken’s shares rose by 3.9%. It was published in The Business Times yesterday that various banks and brokerage houses continue to maintain a positive outlook on the STI and Singapore’s economy. Mr Adrian Loh, Head of Research at brokerage UOB Kay Hian highlighted that technology stocks could make interesting investments as these are largely immune to Covid-19 and were hotly traded in the first half of the year. He has also quoted both Grand Venture and Frencken in the article, which may have sparked investors’ interest in these stocks.

- Medtecs International Corporation Limited (MED SP). Shares rose by 4.2% yesterday, even though there was no company specific news. The buying interest could be due to positive expectations ahead of the company’s 1H 2021 results announcement that is estimated to be announced on 11th August. The recent rise in Covid-19 cases due to the delta variant could have further contributed to the positive sentiment over the stock.

- CapitaLand (CAPL SP) Shares are reacting positively to the company’s proposed restructuring, closing at its highest since 2013. CapitaLand shareholders are estimated to get an implied value of S$4.22 a share upon completion of the restructuring exercise, which we think may likely be by mid-September 2021. Each CapitaLand shareholder will get: a) shares in the newly listed asset management arm worth S$2.934 a share, b) a cash payout of S$0.951, and c) 0.155 units of its listed REIT business (CapitaLand Integrated Commercial Trust, or CICT). CapitaLand’s CEO and CFO will be presenting in a webinar this Friday at 7pm to talk about the restructuring. Those keen to join may sign up here.

- Sembcorp Marine Limited (SMM SP) Shares dipped by 8.8% yesterday and closed at its lowest in over 30 years. Shares continued to decline from last month due to a broad sell off following the company’s announcement of a proposed rights issue of SG$1.5bn at S$0.08 per share. SembMarine stated that the challenges faced by the group are real and severe, and have lasted longer than anticipated due to the protracted effects from COVID-19. If decisive actions are not taken on multiple fronts, it could have potentially serious consequences for all stakeholders. Shares of SembMarine are now trading near the latest target price updates by analysts: 12 Sing cents by UOB and a HOLD rating and 10 Sing cents by Macquarie with an UNDERPERFORM rating.

Hong Kong

- Shanghai Fudan Microelectronics Company (1385 HK). Shares closed at an all-time high after it announced a roadshow regarding the listing on the Shanghai STAR board. The company plans to issue 120mn A-shares, accounting for 14.73% of total shares outstanding.

- Great Wall Motor Company Limited (2333 HK). Shares closed at an all-time high after it announced a positive profit guidance. In 1H21, revenue is expected to grow 73% YoY to RMB 62.2bn; meanwhile net profit attributable to shareholders is expected to grow by 205.2 % YoY to RMB 3.5bn.

- Ganfeng Lithium Co Ltd (1772 HK). Shares closed at an all-time high. The lithium sector jumped as the outlook for EV demand remained positive. Industrial-grade lithium carbonate price was reported at RMB83,000/tonne, up 1.2% WoW, and battery-grade lithium carbonate price was at RMB89,000/tonne, up 1.1% WoW.

- Xinte Energy Co Ltd (1799 HK). The photovoltaic sector jumped as the 14th-Five-Year Plans at the provincial level were gradually released. 16 provinces confirmed more than 258 GW installed capacity for renewable projects.

- Kintor Pharmaceutical Limited (9939 HK). Shares closed at an all-time high after it announced that the Ministry of Public Health and Social Welfare (MSPBS) of Paraguay recently granted emergency use authorisation (EUA) for proxalutamide for the treatment of hospitalised patients with COVID-19 at the MSPBS hospitals. This is the first EUA obtained for proxalutamide globally. The first hospital to use proxalutamide under the EUA, Hospital Barrio Obrero (part of Paraguay’s MSPBS network) has reported promising initial results. Proxalutamide is a new-generation androgen receptor antagonist that is currently under development for the potential treatment of COVID-19 (including outpatients and inpatients), prostate cancer, and breast cancer.

Trading Dashboard

Related Posts: