KGI DAILY MARKET MOVERS – 13 April 2021

IPO WATCH

Coinbase (COIN US): The largest American cryptocurrency exchange is about to get bigger

- COIN is one of the top 3 cryptocurrency exchanges in the world, boasting 56 million verified users and over US$200 billion of crypto assets (>10% of the entire crypto market cap).

- As the first major cryptocurrency exchange to be listed on the US markets, COIN has received major investor attention, especially after February’s cryptocurrency rout where Bitcoin surpassed the US$50,000 mark.

- COIN’s catalysts include further positive price action in major cryptocurrencies, which will lead to rising interest in the asset class. Specifically, rising institutional interest in the crypto asset class can drive up COIN, as it is the largest of few regulated cryptocurrency exchanges in the US.

- Private market transactions of COIN’s shares indicate a US$100bn initial market cap, near US$400/share, while modified COIN futures on the FTX exchange have continued rising and are now beyond a US$130bn market cap valuation. We see room for US$150bn (US$600/share) on its first day of trading.

- COIN is expected to start trading on Wednesday, 14 April.

Grab (AGC US): The next South-east Asian giant to list in the US

- Grab runs one of the largest ride sharing and food delivery services, focusing on the ASEAN region, with a potential digital banking business in Singapore partnered with Singtel.

- A Financial Times article last week detailed a POTENTIAL reverse merger with Altimeter Growth Corp (AGC US) at US$35bn valuation. AGC now trades around US$14, indicating US$49bn market valuation by the market.

- We see Grab earning a premium as it expects to break-even on its food delivery business, now over half the group’s sales in 2020, by 2021. There is also the embedded value of its digital banking business, while Doordash (DASH US) and Sea Group (SE US) serve as examples that valuation can still stay elevated if growth stays.

- We expect sustained retail and institutional interest in Grab, given that Sea Group (SE US) was one of the top performers of the US market last year. We see US$12.5 – 17 as the short-term trading range for AGC.

MARKET MOVERS

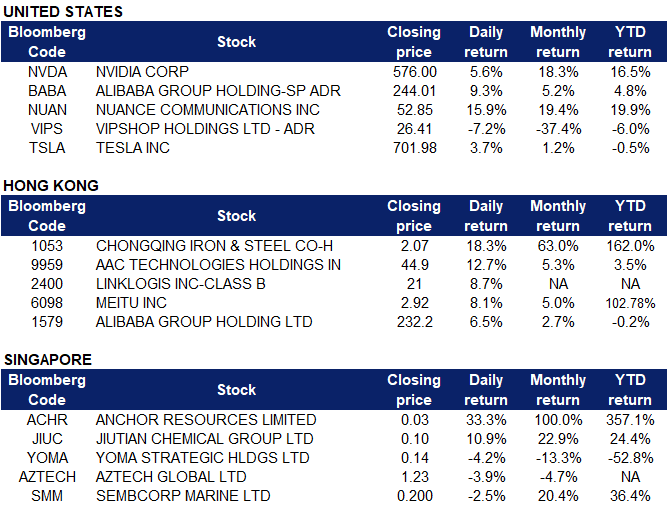

United States

- Nvidia (NVDA US) closed above the US$600 mark after announcing Grace, their first data center CPU which will compete with Intel (INTC US) and AMD (AMD US). Both

- Alibaba Group Holdings (BABA US) continued its climb in the US market, closing above US$240 as investors largely treated the US$2.8 billion antitrust fine as a sign that the worst is over.

- Nuance Communications Inc (NUAN US) spiked behind Microsoft’s announcement to acquire the AI powered speech recognition company at US$56/share, valuing the company at around US$19.6 billion.

- Vipshop Holdings (VIPS US), ViacomCBS (VIAC US) and other Bill Hwang related stocks continued visiting new lows. Amongst affected stocks, year-to-date returns of those with positive earnings (Vipshop, ViacomCBS, Discovery, etc.) are still positive, while those with negative earnings (Farfetch, FuboTV) tend to have negative year-to-date returns.

- Tesla (TSLA US) closed above US$700 after a flurry of analyst reports were released yesterday, including an upgrade from Hold to Buy by Canaccord Genuity with a US$1,071 price target citing an “Apple-esque ecosystem of energy products”.

Earnings Watch: Major banks report earnings through the week. JP Morgan, Wells Fargo and Goldman Sachs (Wednesday); CitiGroup, Bank of America, TSMC, Pepsi Co (Thursday); Ehang, Morgan Stanley (Friday)

Hong Kong

- Chongqing Iron & Steel Company Limited (1053 HK) Shares jumped for the fifth consecutive day after a positive profit alert was announced. Net profit attributable to shareholders was estimated to surged by 25,880.66% YoY to RMB1.08bn in 1Q21. Net profit excluding non-recurring gains and losses attributable to shareholders surged by 421,343.87% YoY to RMB1.07bn in 1Q21.

- AAC Technologies Holdings Inc. (2018 HK). The company announced a positive profit alert for 1Q21. Consolidated profit attributable to owners of the company is expected to increase by between 960% and 1040% YoY to between RMB510mn to RMB550mn. Goldman Sachs upgraded TP to HK$58 from HK$38 and changed its rating to BUY from SELL.

- Linklogis Inc. (9959 HK). Shares closed higher for the second trading day after the IPO, whose price was HK$17.58. According to the closing price of HK$21, the market cap reached HK$40.4bn, implying a price-to-sale-ratio of 39.3x based on FY20 revenue.

- Meitu Inc (6098 HK). The company announced it purchased 175.68 units of Bitcoin with US$10mn. The company has accumulated US$100mn worth of bitcoins.

- Alibaba Group Holding Limited (9988 HK) The company settled the probe with the authority by paying a fine of RMB18.28bn, equivalent to 4% of FY19 revenue. Management shared that there were no other probes into the company.

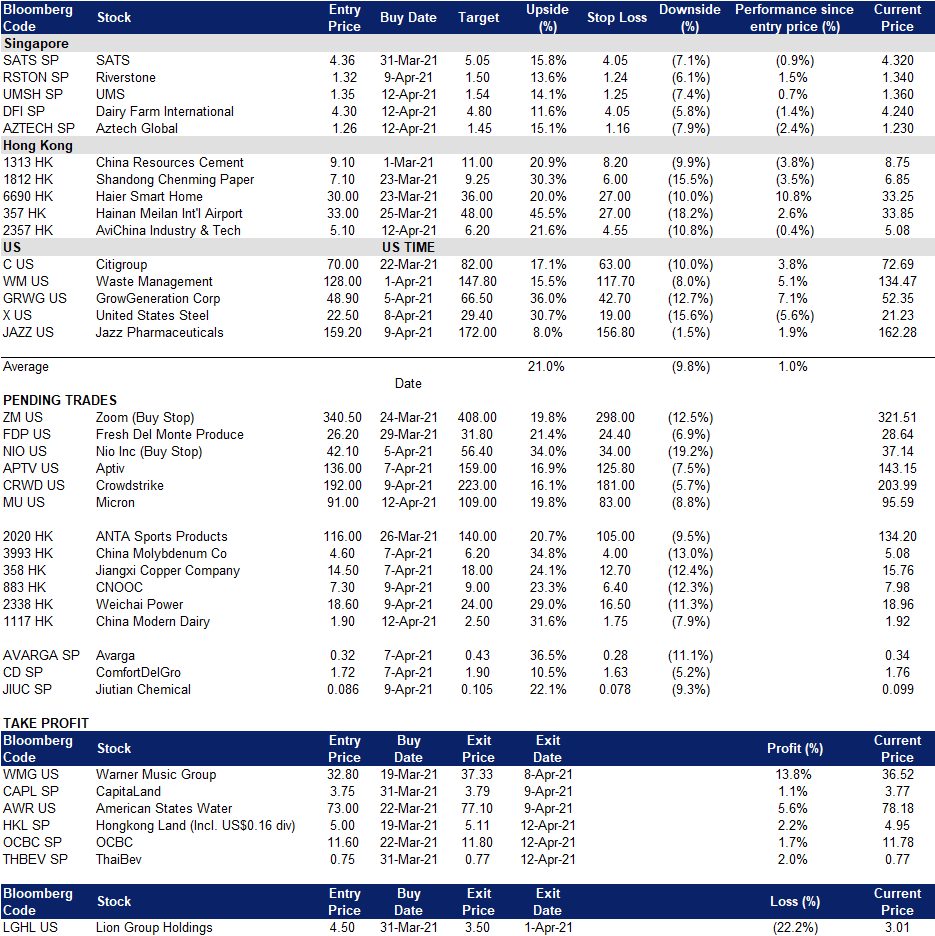

- Trading Dashboard: Added AviChina Industry & Tech (2357 HK) at 5.10

Singapore

- Jiutian Chemical (JIUC SP) rose 11% after CGS-CIMB reiterated its ADD recommendation and an unchanged target price of S$0.135, pegged to 5.7x FY202F P/E. Selling prices of its main product, DMF, trades in a strong uptrend and has increased 40% year-to-date and 120% YoY. Key catalyst will be its upcoming first quarter results to be announced in the last week of April.

- SGX (SGX SP). Total market turnover on the SGX reached S$38.75bn in March 2021, an increase of 50% from February 2021. Turnover for the Jan-Mar 2021 period rose 12% YoY to S$94.2bn. Total derivatives traded volume increased 31% month-on-month to 23.2mn contracts in March, the highest since July 2020. Quarter-on-quarter, derivatives volume was up 13% to 60.6mn contracts. Trading volumes for FX markets gained 27% month-on-month to 2.9mn contracts in March. SGX set monthly volume records for its USD/SGD, INR/USD and USD/INR (USD) futures in March, reflecting strong demand among institutional investors to risk-manage Asian currencies.

- The top five non-STI stocks to receive the highest net institutional and prop trading flows in 2021 YTD were SPH (SPH SP), Sembcorp Marine (SMM SP), Thomson Medical (TMG SP), UMS (UMSH SP) and iFAST (IFAST SP). The five stocks averaged a 2021 YTD total return of 71%.

- Trading Dashboard: Added UMS (UMSH SP) at 1.35, Dairy Farm (DFI SP) at 4.30 and Aztech Global (AZTECH SP) at 1.26.

TRADING DASHBOARD