In the Spotlight: Hang Seng Index

Change is in the air

The Hang Seng Index (HSI) will be undergoing changes that will see the weighting of financial firms and state-owned enterprises reduced, while increasing exposure to China’s growing technology companies. There are around US$38bn of funds that follow the Hang Seng group of indexes, according to data compiled by Bloomberg.

Three new additions to make 58 companies in the index by 7 June 2021. On 7 June, HSI will add three companies to bring the total to 58 in the index. In an interesting turn of events, Xinyi Solar Holdings (968 HK) will be added, together with BYD Co (1211 HK) and Country Garden Services Holdings (6098 HK).

Xinyi Solar was a surprise given its smaller market capitalisation, and basically highlights the new direction for the HSI. Constituents will be based on industry groups, regardless of market capitalisation, and will be selected from financials, information technology, consumer discretionary and staples, property and construction, telecommunications and utilities, energy, materials, industrials and conglomerates, and finally healthcare.

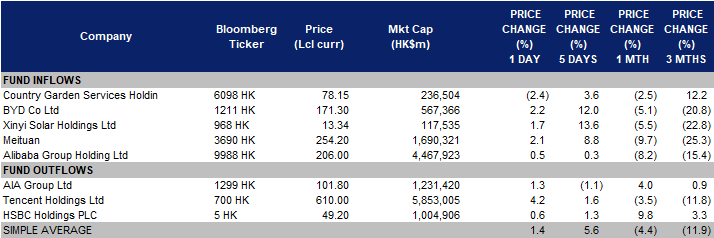

Biggest beneficiaries in our view. Meituan (3690 HK) and Alibaba (9988 HK), will see the biggest increase in weighting. Meituan’s weight will increase from around 4.3% to around 7.7%, while Alibaba’s will rise from 5.6% to around 7.3%. The maximum cap of 8% for each stock in the index, down from 10% previously for primary listing and 5% for secondary listings, means that Tencent’s (700 HK) weight will drop from 9.4% to 8.0%, and AIA (1299 HK) from 10.2% to 8.0%.

In a nutshell, Meituan, Alibaba, Country Garden Services and BYD will see inflows of between HK$1.6bn to HK5.8bn for each company based on their weightings. Xinyi Solar, given its smaller market size, should have inflows of around HK$0.8bn. There should be around HK$2-4bn of outflows from Tencent and AIA but we think this will not impact their share price in a big way given their sizes.

Stocks to trade

Related Posts: