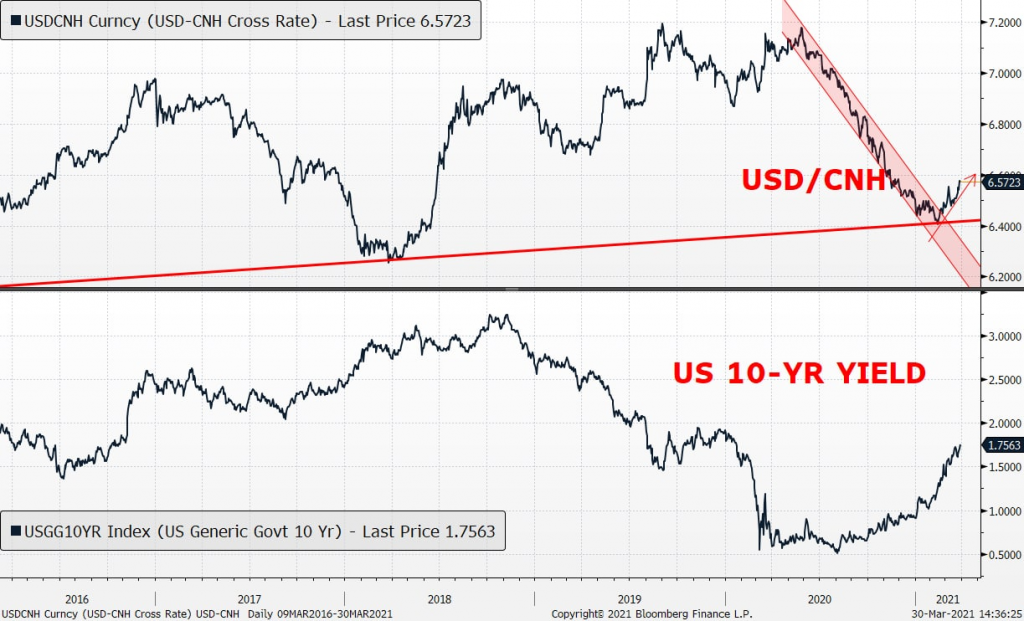

USD/CNH breaking to higher trading range

USD/CNH has been in a narrow range for more than 50 trading days, longer than similar patterns seen in 2018 and 2019. The pause in 2018 was followed by severe depreciation in CNH as the Fed delivered four rate increases, causing capital outflows. CNH weakness also followed the 2019 halt.

Options signal bearish momentum is growing for CNH too. The one-month options skew reveals traders are now more inclined to be positive for USD. That’s coming with waning yield support for CNH as rapid vaccinations and stimulus in the US accelerates economic growth to narrow the gap with China.

10-YR Treasury yields rose to as high as 1.745% in Asia, approaching the 14-month high of 1.754% touched earlier in March, which will likely keep the dollar’s upward momentum going.