7 September 2023: Wealth Product Ideas

FCN Theme – Navigating Volatility with Resilient Swiss Titans

- The theme focuses on investing in Swiss companies that can withstand potential economic downturns.

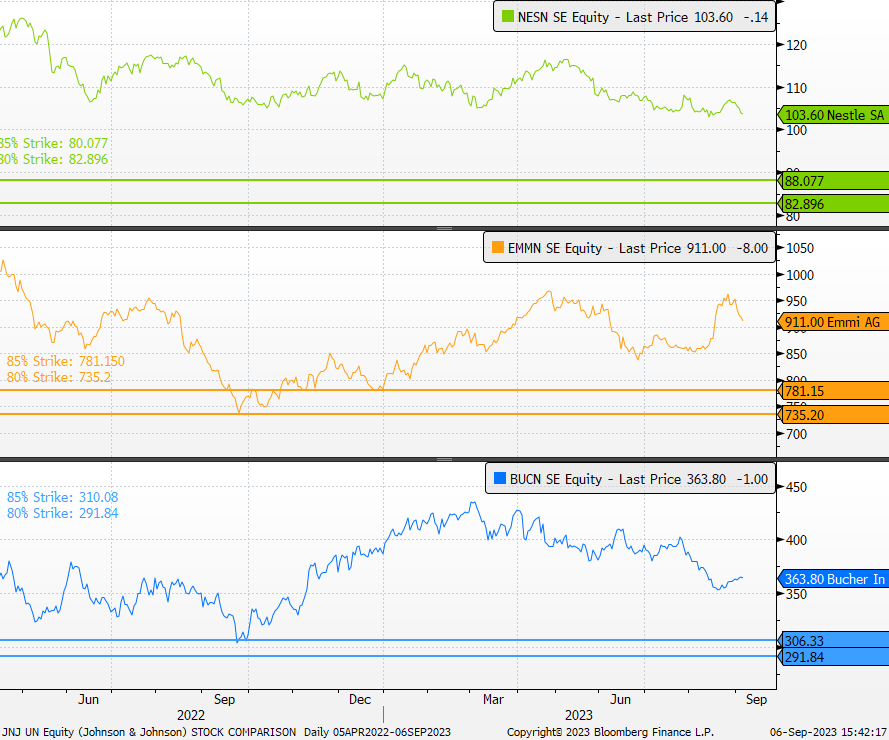

- Nestlé is highlighted as a company with consistent mid-single-digit organic growth, improving margins, and return on invested capital (ROIC). It focuses on high-return sectors and optimizes working capital for stability.

- Emmi, a Swiss leader in milk products, excels in essential categories like cheese and yoghurt. It has achieved productivity gains and maintains a cost structure aligned with the European Union, enhancing its resilience.

- Bucher, through technological advancements and acquisitions, sustains growth and margins even in mature markets.

- This trade idea promotes foresight by investing in Swiss defensive titans, providing stability in uncertain economic times.

- A diversified portfolio of such resilient companies offers stability and reflects prudence in navigating evolving financial landscapes.

Note: Pricing provided is indicative only. For updated pricing, please contact us directly.

Payout Scenarios:

Investors receive corresponding interest payments every month and;

- KO Early Redemption: Principal + KO returns (KO event occurs only when the closing price of all underlying securities is higher than the knock-out price)

- Maturity Redemption: If no KO event occurs, the payout will be:

- If the final price of all underlying is higher than or equal to the strike price, investors will receive 100% cash return on their principal, along with the final interest.

- If the final price of one or more underlying is lower than the strike price, investors will receive 100% of their principal in the form of shares of the worst-performing stock and will also receive the final interest.

(Source: Bloomberg)