5 October 2023: Wealth Product Ideas

Trade Idea: American Airlines (AAL US)

- Despite promising financial results in 2Q2023, the company’s share price remains near its yearly low, primarily due to the surge in aviation fuel prices.

- Fuel prices have increased by 10.08% since mid-August 2023, posing a significant impact on the company’s profit margins. Fuel expenses account for 27% of the company’s operating costs.

- AAL has demonstrated resilience in the face of significant fuel price hikes during the 2nd and 3rd quarters of 2022, indicating the potential for considerable profits despite elevated fuel costs.

- AAL holds a slight pricing advantage over its competitors Delta and United Airlines, suggesting the possibility of increasing prices to offset heightened fuel expenses.

- The management is actively working on debt reduction, successfully decreasing total debt by USD 387 million in 2Q2023. AAL has achieved nearly two-thirds of its target to trim down total debt by USD 15 billion by the end of 2025.

- As of the end of the last quarter, AAL’s total available liquidity stands at approximately USD 14.9 billion.

- The company’s net debt to adjusted EBITDAR ratio has improved from 6.7 times in 4Q2022 to 3.7 times in 2Q2023, in line with industry norms.

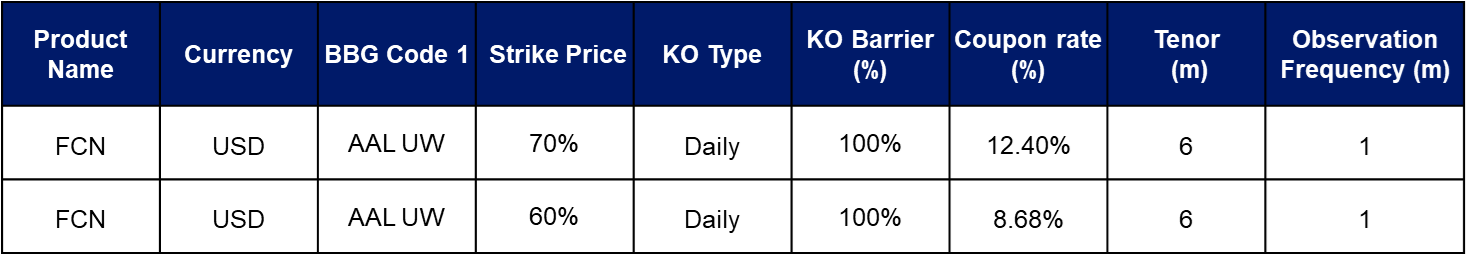

- Given the recent surge in Credit Default Swap (CDS) spreads, investors may consider Credit Linked Notes (CLN) for higher yields and Fixed Coupon Notes (FCN) with downside protection.

Note: Pricing provided is indicative only. For updated pricing, please contact us directly.

Payout Scenarios:

Investors receive corresponding interest payments every month and;

- KO Early Redemption: Principal + KO returns (KO event occurs only when the closing price of all underlying securities is higher than the knock-out price)

-

Maturity Redemption: If no KO event occurs, the payout will be:

- If the final price of all underlying is higher than or equal to the strike price, investors will receive 100% cash return on their principal, along with the final interest.

- If the final price of one or more underlying is lower than the strike price, investors will receive 100% of their principal in the form of shares of the worst-performing stock and will also receive the final interest.

(Source: Bloomberg)