30 November 2023: Wealth Product Ideas

Fund Name (Ticker) | iShares Blockchain and Tech ETF (IBLC US) |

Description | The iShares Blockchain and Tech ETF seeks to track the investment results of an index composed of U.S. and non-U.S. companies that are involved in the development, innovation, and utilization of blockchain and crypto technologies. |

Asset Class | Equity |

30-Day Average Volume (as of 27 Nov) | 6,944 |

Net Assets of Fund (as of 28 Nov) | US$10,312,333 |

12-Month Trailing Yield (as of 31 Oct) | 1.70% |

P/E Ratio (as of 27 Nov) | 23.29 |

P/B Ratio (as of 27 Nov) | 2.09 |

Management Fees (Annual) | 0.47% |

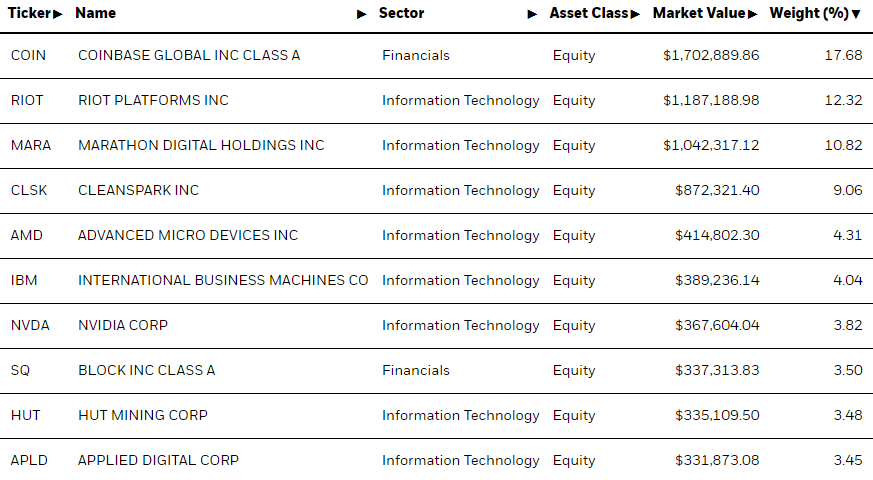

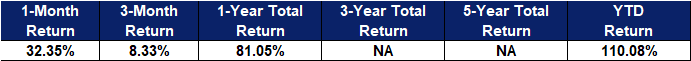

Top 10 Holdings

(as of 27 November 2023)

- BUY Entry –20.24 Target – 25.00 Stop Loss – 17.5

- Pending approval for Bitcoin ETFs. Bitcoin is currently priced at around $38,000 and is poised for a potential breakout as market participants anticipate approvals for Spot Bitcoin ETFs. The US SEC’s shift in stance, seeking public feedback on Franklin Templeton’s ETF application, has fuelled optimism. Recent data reveals a significant Bitcoin outflow from exchanges, around $1 billion in the last two weeks, signalling a shift away from exchange platforms. Analysts highlight the increasing reserves of stablecoins, specifically $15.23 billion in Tether, held in the top 10 USDT exchange wallets, indicating buying power and anticipation of rising demand for Bitcoin. Delays in SEC decisions on spot Bitcoin ETFs, including Franklin Templeton and Hashdex, lead analysts to speculate a strategic move, possibly paving the way for collective approvals by the 10 January 2024, deadline. Bloomberg ETF analyst James Seyffart and colleague Eric Balchunas suggest coordinated approvals. Commercial litigator Joe Carlasare indicates a potential approval shift to March 2024, given extended comment periods. Currently, 12 spot Bitcoin ETFs await SEC decisions, with varied final decision dates, primarily in March.

- Bitcoin halving. Bitcoin prices have recently witnessed a consistent uptrend, surging from around $27,000 to over $38,000, marking its highest value since May 2022. The periodic Bitcoin halving which leads to a slow-down in mining output is expected to be in April 2024. In other words, the supply of Bitcoin after the halving date will be less. Based on the previous two halvings, Bitcoin experienced bull cycles for 18 months (Previous two halving dates: 9 July 2016 and 11 May 2020). Notably, the upward momentum historically initiates 6 months before the halving date, suggesting that the current Bitcoin upcycle may have already commenced.

(Source: Bloomberg)

(Source: Bloomberg)

Fund Name (Ticker) | CSOP Bitcoin Futures ETF (3066 HK) |

Description | The investment objective of the ETF is to provide investors with capital appreciation primarily through actively managed exposure to Bitcoin Futures. The ETF does not invest directly in Bitcoin. There is no assurance that the ETF will achieve its investment objective. |

Asset Class | Futures |

30-Day Average Volume (as of 28 Nov) | 1,451,727 |

Net Assets of Fund (as of 28 Nov) | USD$56,957,039 |

12-Month Trailing Yield | NA |

P/E Ratio | NA |

P/B Ratio | NA |

Management Fees | 1.99% |

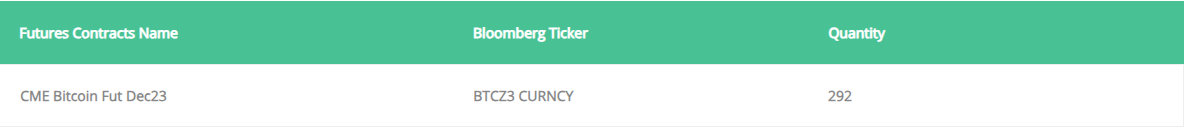

Futures Contracts Holdings

(as of 28 Nov 2023)

- BUY Entry – 15.70 Target – 17.00 Stop Loss – 15.05

- Grace period remains unchanged. Despite recent crypto exchange scandals, the one-year grace period for cryptocurrency exchanges in Hong Kong will remain unchanged, according to the CEO of Hong Kong’s Securities and Futures Commission. The grace period allows crypto exchanges to operate without a virtual asset service provider (VASP) license until June 2024. Recent scandals involving unlicensed exchanges, such as JPEX and Hounax, have led to significant losses exceeding $100 million. While new regulations require exchanges to apply for a VASP license, there is currently no intention to modify the grace period or other measures.

- Retail crypto trading in Hong Kong. Interactive Brokers has partnered with Hong Kong-based crypto exchange OSL to introduce retail crypto trading for its Hong Kong clients. This service allows retail investors to access digital asset trading through a unified platform powered by OSL. Users can hold Bitcoin or Ether in their personal accounts alongside traditional assets, with trades incurring commissions of 0.20% to 0.30% of the transaction value. Zodia Custody, a crypto security firm owned by Standard Chartered, recently expanded its services to Hong Kong, catering to the institution-driven crypto demand in the market. OKX, the world’s third-largest cryptocurrency exchange, has applied for a virtual asset trading platform (VATP) license in Hong Kong, becoming the first major exchange to do so under the city’s new legal regime. Meanwhile, Binance-linked HKVAEX is in the preparation stage for its license application. OSL Digital Securities and HashKey are the only two licensed virtual asset trading platform operators in Hong Kong as of now. Despite Hong Kong’s early issuance of crypto exchange licenses, recent scandals have slightly impacted the industry’s momentum.

- Following the ETF trend. However, Hong Kong’s Securities and Futures Commission (SFC) is considering allowing retail investors to purchase spot crypto Exchange Traded Funds (ETFs). SFC’s Chief Executive Officer had expressed openness to innovative technology that enhances efficiency and customer experience, provided new risks are addressed. This move follows a progressive stance by Hong Kong regulators, with the SFC tightening regulations in January but updating them in October to broaden investor access to spot-crypto and ETF investing. The updated policy requires investors to pass a knowledge test and meet net worth requirements, and issuers of listed crypto products must publish risk disclosure statements. The SFC emphasises adapting policies to the evolving crypto ecosystem while ensuring investor safeguards.

(Source: Bloomberg)