3 November 2022: Wealth Product Ideas

|

Fund Name (Ticker) |

iShares U.S. Aerospace & Defense ETF (ITA) |

|

Description |

The iShares U.S. Aerospace & Defense ETF seeks to track the investment results of an index composed of U.S. equities in the aerospace and defense sector. |

|

Asset Class |

Equity |

|

30-Day Average Volume (as of 1 Nov) |

537,607.00 |

|

Net Assets of Fund (as of 1 Nov) |

$4,055,184,509 |

|

12-Month Trailing Yield (as of 30 Sep) |

1.07% |

|

P/E Ratio (as of 31 Oct) |

26.86 |

|

P/B Ratio (as of 31 Oct) |

3.30 |

|

Management Fees |

0.39% |

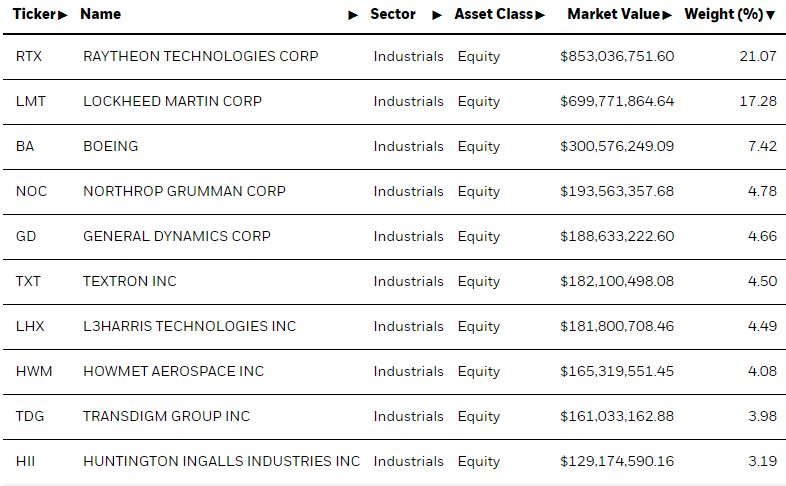

Top 10 Holdings

(As of October 31, 2022)

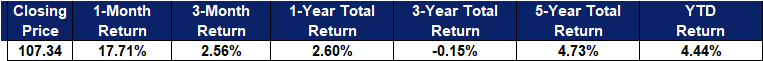

- BUY Entry – 105 Target – 115 Stop Loss – 100

- The Russian-Ukraine War has led to an increase in European arms expenditure and members of NATO will also increase their defence budgets in the following years.

- Geopolitical tension is gradually escalating, which will lead to an increase in arms sales from the United States to East Asia and Europe.

|

Fund Name (Ticker) |

iShares Global Clean Energy ETF (ICLN) |

|

Description |

The iShares Global Clean Energy ETF (ICLN) seeks to track the investment results of an index composed of global equities in the clean energy sector. |

|

Asset Class |

Equity |

|

30-Day Average Volume (as of 1 Nov) |

9,540,648.00 |

|

Net Assets of Fund (as of 1 Nov) |

$4,799,437,178 |

|

12-Month Trailing Yield (as of 30 Sep) |

1.40% |

|

P/E Ratio (as of 31 Oct) |

27.09 |

|

P/B Ratio (as of 31 Oct) |

2.24 |

|

Management Fees |

0.40% |

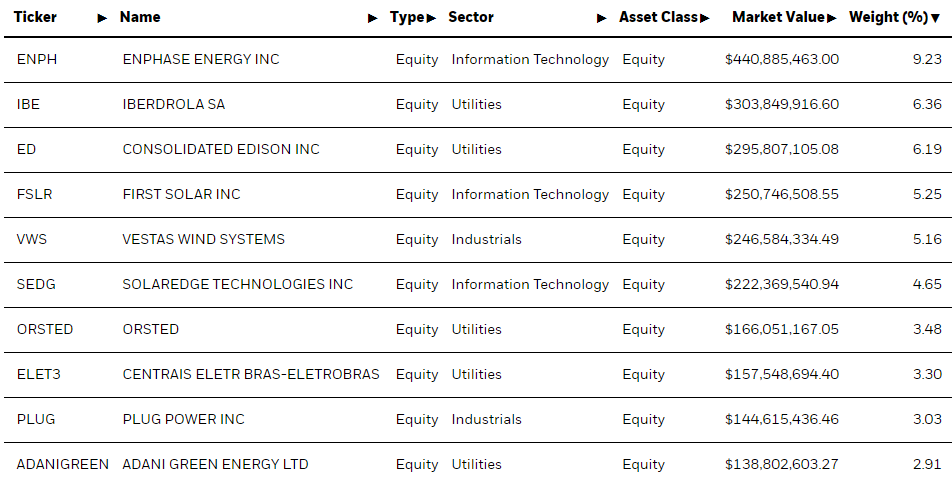

Top 10 Holdings

(As of October 31, 2022)

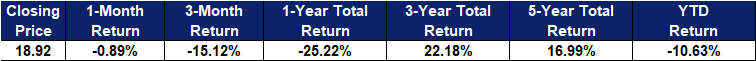

- BUY Entry – 18.5 Target – 23.5 Stop Loss – 16.0

- Inflation Reduction Act of 2022

- Under the FY2022 Budget Reconciliation bill, the United States will invest approximately $300 billion in Deficit Reduction and $369 billion in Energy Security and Climate Change programs over the next ten years, to reduce carbon emissions.

- It is estimated that by 2030, carbon emissions will be reduced by about 40 percent.

- With the Inflation Reduction Act (IRA), solar deployment is expected to increase by 40%, or 62 GW DC, over baseline projections through 2027.

- ESG-themed ETFs

- Within the next 10 years, expanding access to clean energy will remain a priority, and major economies in Europe, America and Asia will continue to increase investments and construct infrastructure in support of clean energy.

Source: Bloomberg

Source: Bloomberg

Source: Bloomberg