28 July 2022: Stocks making the biggest moves

Market Movers | Trading Dashboard

United States

Top Sector Gainers

| Sector | Gain | Related News |

| Technology Services | +5.83% | U.S. tech roars in post-Fed rally as bond yields slump Microsoft(MSFT US) |

| Consumer Durables | +3.69% | US automakers face union push to ease inflation’s bite on wages Ford Motors(F US) |

| Electronic Technology | +3.62% | Apple nabs key Lamborghini executive to work on its electric car Apple. (AAPL US) |

Top Sector Losers

| Sector | Loss | Related News |

| NA | NA | NA |

- Microsoft (MSFT US) shares rose 6.7% as it gave an upbeat sales forecast, easing investor concerns about growth. It now expects revenue and operating income to increase at a double-digit pace for FY23F. FX fluctuations will cut FY23F topline by about 4%, tempering worries that the strong USD would have an even bigger impact on the value of overseas sales. MSFT said it was attracting more large deals to its Azure cloud-computing software and moving clients to pricier versions of Office cloud programmes. Meanwhile, its expenses will decelerate as the pace of hiring slows. MSFT believes that turbulent economic picture will lead some customers to gravitate to Microsoft’s products and to cloud software more generally because it can help them control what they’re spending on technology.

- Alphabet (GOOG US) jumped 7.7% after it reported 2Q22 revenue that met expectations, reflecting its resilience amid slowing growth in advertising. Google’s sales gains indicate the company’s advertising business, especially its search ads, may be positioned to weather a crunch in marketing spending, which has affected smaller competitors including Snap Inc. (SNAP US) and Twitter Inc (TWTR US). By contrast, Google’s ad sales beat analysts’ expectations. The company is nevertheless remaining cautious, and temporarily paused hiring.

- T-Mobile (TMUS US) gained 5.2% as it raised its subscriber growth forecast for the second time this year as its relatively cheaper plans lured customers reeling from decades-high inflation. The company expects to add between 6 million and 6.3 million net monthly-bill paying subscribers in 2022, up from a prior forecast of 5.3 million to 5.8 million. Unlike its rivals AT&T Inc (T US) and Verizon Communications Inc (VZ US), T-Mobile’s decision not to raise prices for its wireless plans has helped it add more customers in a price-conscious market. The carrier added 723,000 subscribers in the second quarter, much above FactSet estimates of 573,100.

- Boeing Co (BA US) managed to eke out a 0.1% gain even as it cut estimates for 737 MAX deliveries this year and warned that supply-chain constraints have capped its ability to ramp up jet production despite “significant” demand. The comments on an earnings call underscored challenges the planemaker faces despite a dramatic improvement in cash flow in the quarter through June. Boeing said it aims to stabilise 737 production rate at 31 a month despite nagging supply chain problems. It expects supply issues and uncertainties in China will keep MAX deliveries this year closer to the “low 400s” than an earlier estimate of about 500.

- Humana (HUM US) fell 2.8% even as it boosted its annual profit forecast on Wednesday, helped by lower-than-expected demand for non-urgent medical procedures. Analysts said the raise to the outlook by roughly 25 cents was cautious and could disappoint investors after second-quarter profit beat Wall Street estimates by $1 per share. HUM said a lack of COVID-19 related costs was partly responsible for the forecast raise, but it still expects some expenses from COVID in the rest of the year. Separately, HUM said it will restructure its organisation into two distinct units as it looks to simplify the company’s overall organisation. The move will slim the firm down into separate units it will call Insurance Services and CenterWell, building on Humana’s recent acquisition of Kindred amid the push for care at home.

Singapore

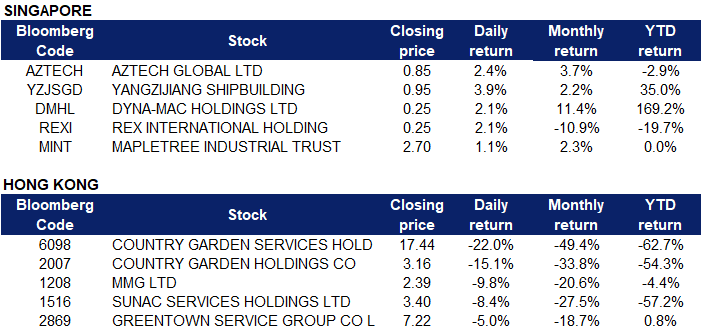

- Aztech Global Ltd (AZTECH SP) continued to rise, notching a 2.4% gain yesterday. Recall, Aztech Global reported a 79% surge in net profit to S$29m in 2Q22, thanks to “strong production volume and shipment” of Internet of Things and data communication devices, according to the company’s interim financial statement on Monday. This has brought the net profit to S$42.8m for 1H22, a 45.7% jump compared to the same period last year, despite ongoing challenges posed by the Covid-19 pandemic and supply chain disruptions.

- Yangzijiang Shipbuilding (YZJSGD SP) shares rose 3.89% on reports that Chinese yards are playing catch-up on newbuilding deliveries delayed by Covid. Shipbroker, Clarksons noted that since March, disruptions due to Covid-19 restrictions, notably the Shanghai lockdown contributed to lower volumes from Chinese yards. This is set to change in 2H22 and the industry looks set to get back on track with regards to customer orders.

- Dyna-Mac Holdings Ltd (DMHL SP), and Rex International Holding Ltd (REXI SP) shares rose 2.1% and 2.1% respectively yesterday. Oil prices held steady with WTI notching a 1.4% gain to US$94.33/bbl in Asian trade. Media reported that there was a large draw this week for crude oil of 4.037 million barrels vs the estimate of only 1.121 million barrels in the US. The build comes as the Department of Energy released 5.6 million barrels from the Strategic Petroleum Reserves in the week ending July 22, to 474.5 million barrels. US crude inventories have shed some 65 million barrels since the start of 2021, with a 2 million barrel loss since the start of 2020, according to API data.

- Mapletree Industrial Trust (MINT SP) rose 1.1% as the Street maintained their bullishness on the REIT after it posted a strong set of results for 1QFY23. The REIT had reported a DPU of 3.49cents (+4.2% YoY) on distributable income of S$92.1m (+11.4% YoY). It also reported stronger GRI and NPI as it booked contributions from its newly acquired data centres in the US. In Singapore, it saw positive rental reversions amidst better occupancy rates. Nonetheless, the street is concerned about potential headwinds coming in the form of inflation and higher interest rates. There are currently 11/5/0 BUY/HOLD/SELL calls on the REIT, with average TP of S$2.89.

Hong Kong

Top Sector Gainers

Sector | Gain | Related News |

Commercial Vehicle | +0.98% | CMS carries out world’s first 36K maintenance on DF engine CSSC Offshore and Marine Engineering Group Co Ltd (317 HK) |

Software | +0.36% | JD, Baidu Among Firms That May Follow Alibaba’s Listing Move SenseTime Group Inc (20 HK) |

Alcoholic Drinks & Tobacco | +0.26% | BofAS Trims CHINA RES BEER (00291.HK) TP to $75, Rating Buy China Resources Beer Holdings Co Ltd (291 HK) |

Top Sector Losers

Sector | Loss | Related News |

Property Management & Agency | -3.73% | China property sales could plunge by one-third, analysts say, as crisis deepens Country Garden Services Holdings Co Ltd (6098) |

Precious Metal | -1.75% | Gold Steadies as Investors Await Another Big Fed Rate Increase Zijin Mining Group Co Ltd (2899 HK) |

Electronic Component | -1.50% | NA Aac Technologies Holdings Inc (2018 HK) |

- Country Garden Services Holdings Co Ltd (6098 HK) and Country Garden Holdings Co Ltd (2007 HK) shares fell 22.0% and 15.0% respectively yesterday. Country Garden Holdings announced a share placement plan. The company will place out 870mn shares at HK$3.25. The placing shares represent approximately 3.76% of the issued share capital of the company as at the date of the announcement and approximately 3.62% of the issued share capital of the company as enlarged by the issue of the placing shares.

- Sunac Services Holdings Ltd (1516 HK) and Greentown Service Group Co Ltd (2869 HK) Shares fell 8.36% and 5.00% respectively yesterday as the property management sector weakened. CITIC Securities stated in a report that property management companies need to prove their indenpendency to walk out of the wood.

- MMG Limited (1208.HK) Shares fell 9.81% yesterday. Previously, the company released the 2Q22 production report. The total copper production (copper cathode plus copper in concentrate) dropped by 52% YoY to 44,514 tonnes. The lower production was due to a community protest at Las Bambas leading to an operational shut of more than 50 days.

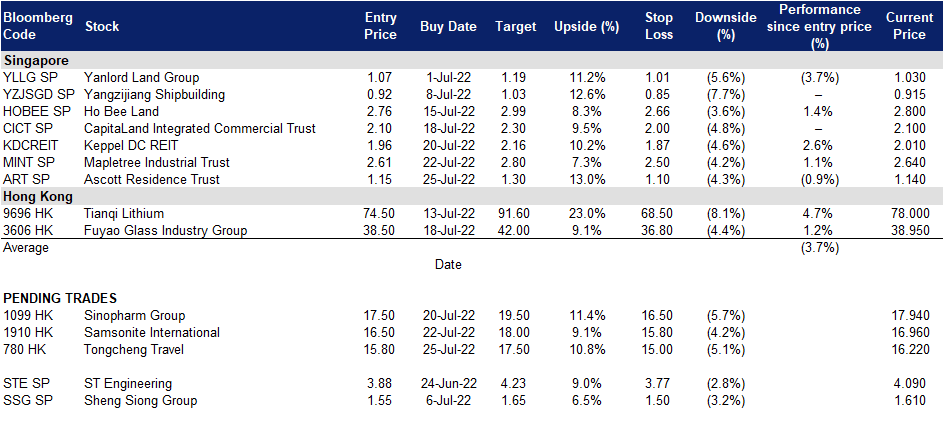

Trading Dashboard Update: Add StarHub (STH) at S$1.27.