26 May 2022: Stocks making the biggest moves

Market Movers | Trading Dashboard

United States

Top Sector Gainers

| Sector | Gain | Related News |

| Specialty Stores | +3.9% | Dick’s shares rally despite lower forecast; company says outdoor hobbies will outlast pandemic Dick’s Sporting Goods Inc (DKS US) |

| Oil & Gas Production | +2.8% | Oil edges higher on tight supply, rising US refining activity ConocoPhillips (COP US) |

| Internet Retail | +2.3% | Stocks Close Higher After Fed Minutes Signal Commitment to Raising Rates Amazon.com Inc (AMZN US) |

Top Sector Losers

| Sector | Loss | Related News |

| Household/Personal Care | -1.2% | N/A Procter & Gamble Co (PG US |

| Food Retail | -0.5% | N/A Walmart Inc (WMT US) |

| Medical Specialities | -0.4% | N/A Thermo Fisher Scientific Inc (TMO US) |

- Nordstrom Inc (JWN US) shares of the department store soared 14% after the company reported fiscal first-quarter sales that came in ahead of analysts’ estimates. Nordstrom also hiked its financial outlook for the full year, citing momentum in the business.

- Wendy’s Co (WEN US) shares surged 9.8% after a filing revealed Trian, Wendy’s largest shareholder, is exploring a potential deal with the company. Trian, along with its partners, owns a 19.4% stake in the burger chain and said it was seeking a deal to “enhance shareholder value” that could include an acquisition or merger.

- Dick’s Sporting Goods Inc (DKS US) shares jumped 9.7%, despite the company cutting its outlook for the year, after the retailer topped earnings and revenue estimates for its fiscal first quarter. Dick’s CEO Lauren Hobart said she’s confident the company will be able to “adapt quickly” to uncertain macroeconomic conditions.

- Express Inc (EXPR US) shares rallied 6.7% after the apparel retailer reported better-than-expected quarterly results. Express lost an adjusted 10 cents per share. That’s narrower than the 15-cents-per-share loss expected by analysts, according to Refinitiv. Revenue also topped the consensus forecast, and Express raised its full-year comparable-sales outlook.

- Diamondback Energy Inc (FANG US) shares rose 4.4% after Barclays upgraded Diamondback to overweight from equal weight. Barclays said it sees “increasing cash returns” for Diamondback in the second half of the year.

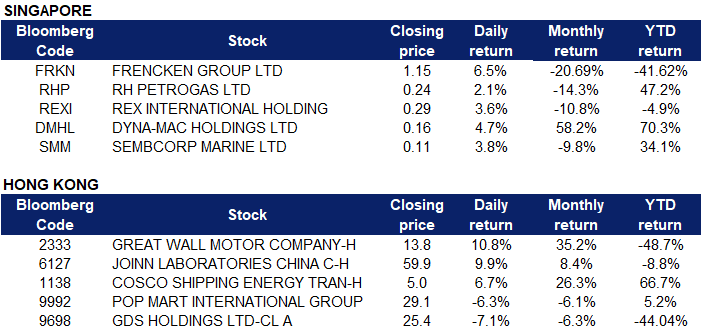

Singapore

- Frencken Holdings Ltd (FRKN SP) shares rose 6.5% yesterday. On May 19, Frencken Group’s non-executive non-independent chairman Gooi Soon Chai acquired 200,000 shares of the company at S$1.15 per share. With a consideration of S$230,000, this took his total interest in the integrated technology solutions company from 23.48% to 23.53%. Also, on May 19, Frencken Group president and executive director Dennis Au acquired 200,000 shares of the company at S$1.16 per share. This took his interest from 0.89% to 0.94%. His preceding acquisitions were between Mar 7 and 8, with 150,000 shares acquired at S$1.52 per share.

- Dyna-Mac Holdings Ltd (DMHL SP), RH Petrogas Ltd (RHP SP) and Rex International Holdings Ltd (REXI SP) shares rose 4.7%, 2.1% and 3.6% respectively yesterday. WTI crude futures jumped 1% to around $111 per barrel on Wednesday, erasing losses in the previous session, amid the prospect for even tighter global supplies and expectations of stronger demand. The new French foreign minister said Tuesday she was optimistic that those still opposed to a new EU sanctions package that would phase out Russian oil imports could be convinced, in a deal that threatens to tighten global supply further. Meanwhile, Brent crude futures jumped 1% toward $115 per barrel on Wednesday, rising for the fifth straight session.

- Sembcorp Marine Ltd (SMM SP) shares extended their rally and rose 2.8% yesterday. In a business update, Sembcorp Marine (SCM) announced that its cash flow and liquidity management have improved following the completion and successful deliveries of several projects in 1Q2022. As a result, the Group’s net debt/equity ratio has improved to 0.38 times at end 1Q2022 from 0.49 times at end 4Q2021. In March 2022, Sembcorp Marine secured a landmark contract from Maersk for the construction of a WTIV. The WTIV brings breakthrough design to the wind market with the vessel designed to operate at a high level of efficiency and to handle the next generation of larger wind turbines.

Hong Kong

Top Sector Gainers

Sector | Gain | Related News |

Infrastructure | +3.37% | China to further expand infrastructure investment Metallurgical Corporation of China Ltd (1618 HK) |

Environmental Energy Material | +1.79% | Tariffs on China Throw Shade on the U.S. Solar Industry Xinyi Solar Holdings Limited (968 HK) |

Precious Metal | +1.76% | Gold hovers near 2-week peak as dollar, US bond yields weaken China Gold International Resources Corp Ltd (2099 HK) |

Top Sector Losers

Sector | Loss | Related News |

Semiconductors | -1.62% | Semiconductor Manufacturing International Corp (981 HK) |

Property Development | -0.95% | China regulators vow to keep property sector credit growth stable Guangzhou R&F Properties Co Ltd (2777 HK) |

Industrial Goods | -0.94% | Kingboard Holdings Ltd (148 HK) |

- Great Wall Motor Co Ltd (2333 HK) Shares rose 10.79% and closed at a two-month high yesterday. Previously, Beijing planned to cut taxes on some passenger vehicles in a bid to boost economic activity. The increases come after state media reported Monday that Chinese officials in a recent State Council meeting planned to cut purchase taxes on some passenger vehicles for a certain period of time, waiving a total of 60 billion yuan ($9 billion) of taxes. The cuts would apply to internal combustion engine vehicles; new-energy vehicles in China aren’t currently subject to purchase taxes.

- Joinn Laboratories China Co Ltd (6127 HK) Shares rose 9.92% yesterday. The domestic number of new drugs approvals and contracts grew by 0.8% YoY. Among all, the company achieved the highest. Everbright Securities raised FY22F/23F net profit estimates and maintained a BUY rating.

- COSCO SHIPPING Energy Transportation Co., Ltd (1138 HK) Shares closed near a 52-week high. There was no company-specific news. Market analysts believe the tanker market is under the downturn currently. The new shipbuilding orders are at the historically low level, and there are quite a few numbers of scrapped ships. Therefore, the growth of supply of tankers will slow down in the next couple of years.

- GDS Holdings Ltd (9698 HK) Shares fell 7.14% yesterday. Pop Mart International Group Ltd (9992 HK) Shares fell 6.28% yesterday. There was no company-specific news for both counters. Growth stocks were hammered, following the sell-down in the US market overnight.

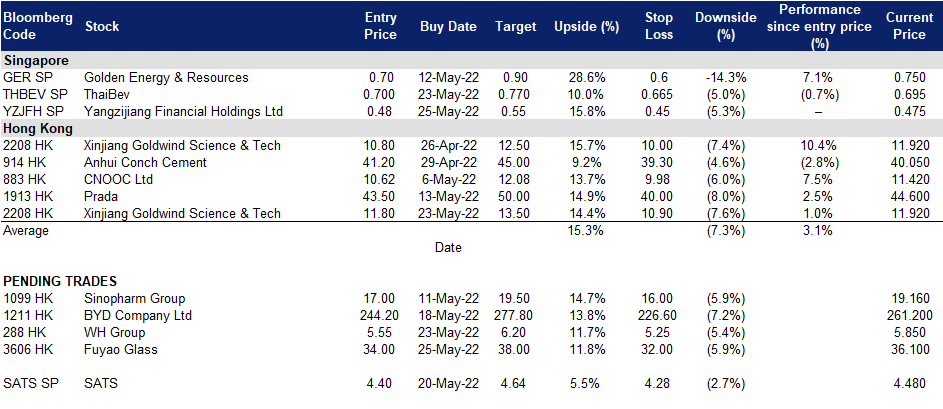

Trading Dashboard Update: Add Yanzijiang Financial Holdings (YZHFH) at S$0.475.