18 January 2024: Wealth Product Ideas

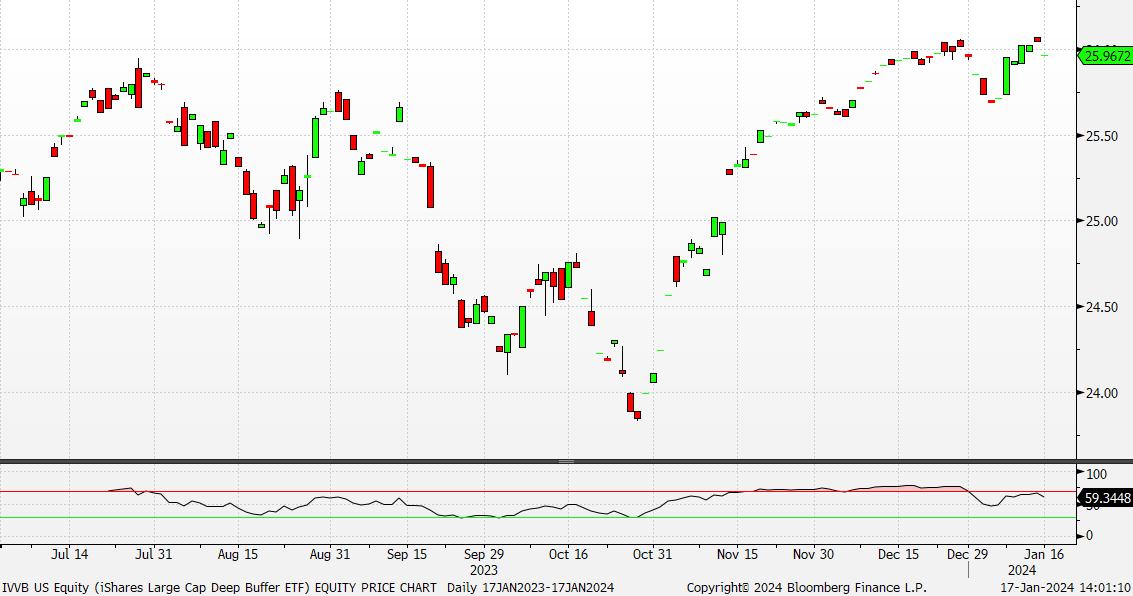

ETF Ideas – Positioning for Correction

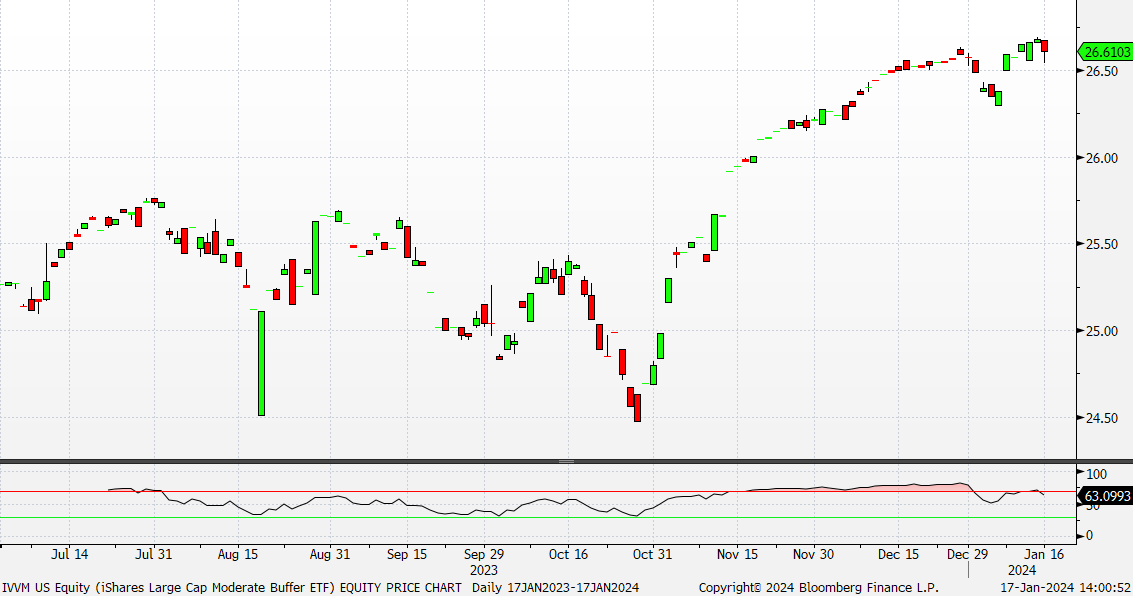

- US stocks and bonds have rallied strongly in Nov-Dec as markets priced in a more dovish Fed policy outlook and interest rate cuts in 2023.

- However, the sharp rally has left stocks/bonds in overbought territory and vulnerable to a correction or consolidation in the near term.

- Investors may consider buffered ETFs like iShares Large Cap Moderate Buffer ETF (IVVM) and iShares Large Cap Deep Buffer ETF (IVVB) to help cushion against the downside.

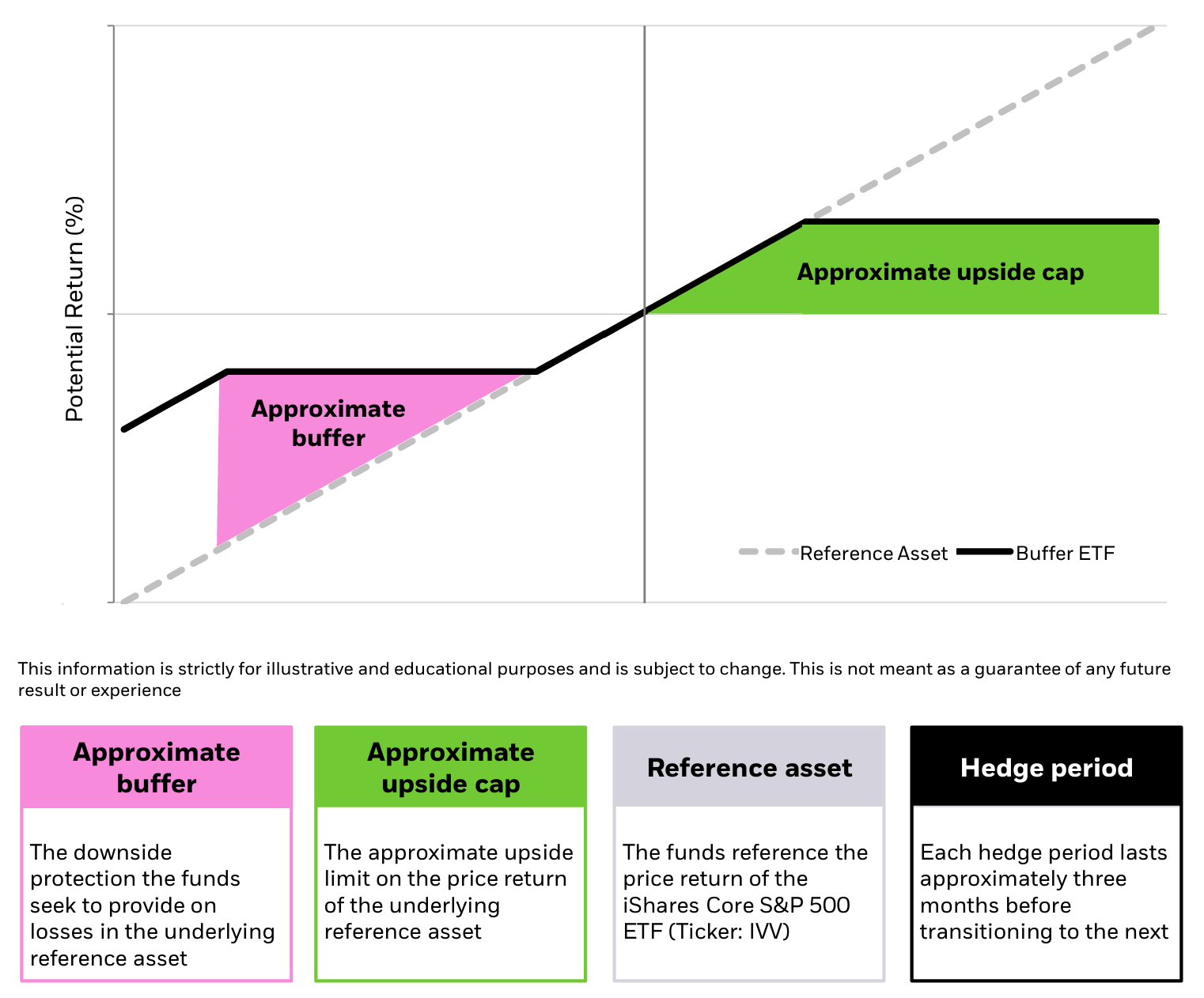

- These ETFs hold S&P 500 ETFs (IVV) but also incorporate built-in options strategies to provide an explicit downside buffer.

- This buffer can help offset some losses if the expected consolidation plays out. The buffer re-sets each quarter.

- The opportunity is buffer ETFs can defend in a correction while still participating somewhat in further upside. However, these ETFs limit maximum gains.

iShares Large Cap Buffer ETFs

1. Product Overview

- Seeks to track the iShares Core S&P 500 ETF (IVV) while providing downside buffer protection against the first 5-20% of losses each quarter.

- Uses FLEX options to establish the downside buffer and upside cap each quarter. The buffer range is reset every 3 months.

- Offers convenient, liquid access to a defensive equity strategy that aims to participate in upside while limiting drawdowns.

- Expense ratio of 0.50%. Holdings are dominated by FLEX call and put options on IVV.

2. Key Benefits

- Outcome-oriented approach targets downside protection while allowing some equity upside participation.

- Can help mitigate volatility and smooth out returns compared to straight equity exposure.

- Downside buffer may help investors remain invested during volatile markets and avoid realizing losses.

- Can be used as part of an alternatives allocation to diversify traditional stock/bond exposure.

- Offers transparency and intraday liquidity compared to more complex buffered fund structures.

3. Ideal Investors

- Investors seeking equity exposure with defined downside risk management.

- Investors constructing alternatives portfolios or more defensive equity allocations.

- Long-term investors looking for enhanced risk-adjusted returns.

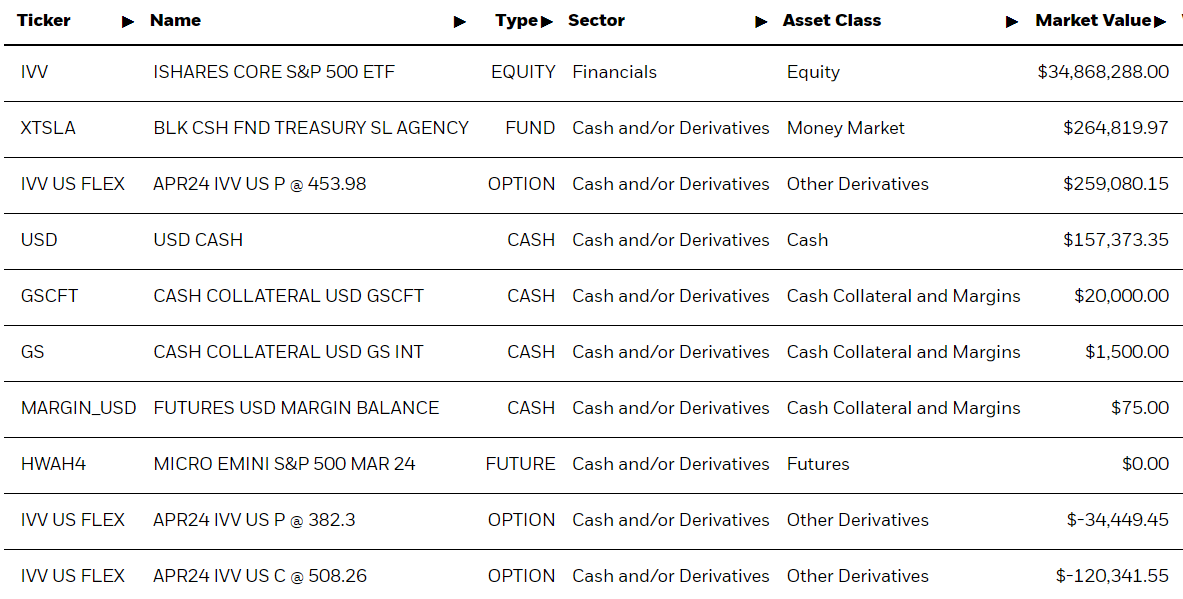

iShares Large Cap Buffer ETFs – Investment/ Portfolio Holdings

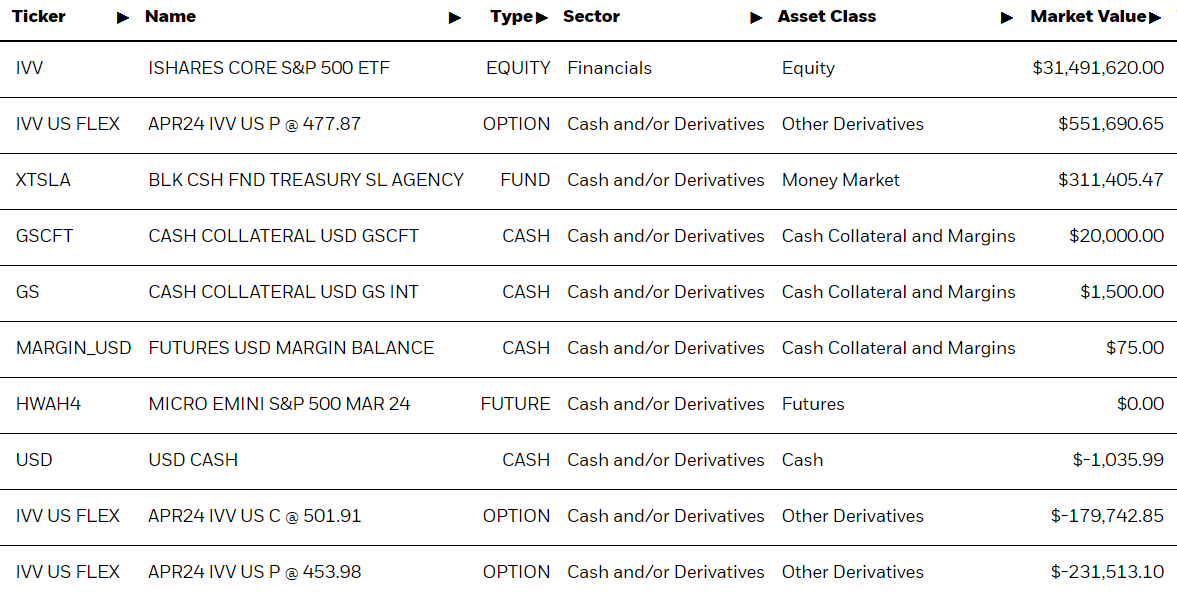

- FLEX Options – The fund invests in customized index call and put options contracts to generate the downside protection buffer and upside cap.

- IVV Holdings – The options derive their value from the iShares Core S&P 500 ETF (IVV), so the fund has a small allocation to IVV shares as its reference asset.

- Cash/Cash Equivalents – The remainder of the portfolio is invested in cash, cash collateral, and short-term fixed income like Treasury bills for liquidity and to support the options strategies.

Summary

- Majority is FLEX index options that create the buffer and cap.

- Small portion invested directly in IVV as the reference asset.

- Remaining amount in cash and short-term bonds for liquidity.

- This structure allows the fund to maintain S&P 500 exposure via IVV, while using the options to tactically add downside risk management. The cash supports the options implementation.

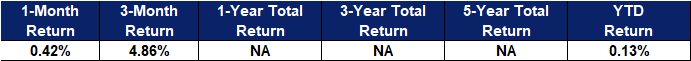

Fund Name (Ticker) | iShares Large Cap Moderate Buffer ETF (IVVM) |

Description | iShares Large Cap Moderate Buffer ETF seeks to track the share price return of the iShares Core S&P 500 ETF (the “Underlying ETF”) up to an approximate upside limit, while seeking to provide downside protection against approximately the first 5% of Underlying ETF losses over each calendar quarter. |

Asset Class | Large-cap Equity |

30-Day Average Volume (as of 17 Jan 2024) | 1,703.0 |

Net Assets of Fund (as of 16 Jan 2024) | US$31,894,510 |

12-Month Trailing Yield | N/A |

P/E Ratio (as of 17 Jan 2024) | 26.522 |

P/B Ratio (as of 17 Jan 2024) | 4.570 |

Management Fees (Annual) | 0.50% |

Top 10 Holdings

(as of 12 January 2024)

(Source: Bloomberg)

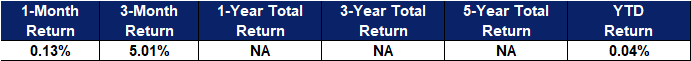

Fund Name (Ticker) | iShares Large Cap Deep Buffer ETF (IVVB) |

Description | iShares Large Cap Deep Buffer ETF seeks to track the share price return of the iShares Core S&P 500 ETF (the “Underlying ETF”) up to an approximate upside limit, while seeking to provide downside protection against approximately 5-20% of Underlying ETF losses over each calendar quarter. |

Asset Class | Large-cap Equity |

30-Day Average Volume (as of 17 Jan 2024) | 6990 |

Net Assets of Fund (as of 16 Jan) | US$35,329,678 |

12-Month Trailing Yield | N/A |

P/E Ratio (as of 17 Jan 2024) | 26.522 |

P/B Ratio (as of 17 Jan 2024) | 4.570 |

Management Fees (Annual) | 0.50% |

Top 10 Holdings

(as of 12 January 2024)

(Source: Bloomberg)