15 June 2023: Wealth Product Ideas

Fund Name (Ticker) | ETFMG Travel Tech ETF (AWAY) |

Description | The ETFMG Travel Tech ETF (AWAY™) is an exchange-traded fund (ETF) that tracks a portfolio of companies that are a subset of the global travel and tourism industry. These companies are engaged in the “Travel Technology Business” by providing technology via the internet and internet-connected devices to facilitate travel bookings and reservations, ride sharing and hailing, travel price comparison, and travel advice. |

Asset Class | Equity |

30-Day Average Volume (as of 13 June) | 44,873 |

Net Assets of Fund (as of 13 June) | US$17.79M |

12-Month Trailing Yield | 1.02% |

P/E Ratio | N.A. |

P/B Ratio (as of 13 June) | 4.284 |

Management Fees (Annual) | 0.75% |

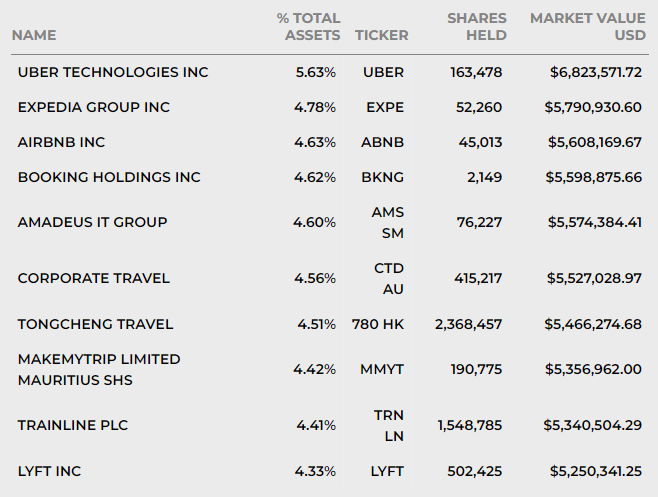

Top 10 Holdings

(as of 13 June 2023)

- BUY Entry –17.7 Target – 19.7 Stop Loss – 16.7

- Revenge travel. The relaxation of travel restrictions following the COVID-19 pandemic has sparked a significant increase in travel demand, with people eagerly seeking brief vacations abroad. This surge in demand is evident in popular tourist destinations like Thailand, which experienced a notable rise in tourist numbers. In the first half of 2023 alone, Thailand welcomed 11.4 million foreign tourists, surpassing the total of 11.15 million tourists who visited throughout the entirety of 2022, despite challenging macroeconomic conditions. These figures clearly indicate that there is a strong demand for tourism in 2023, as consumers are actively indulging in revenge spending on overseas travel.

- Incoming Travel Season. With the summer season on the horizon, numerous sought-after destinations in Southeast Asia and other parts of Asia, including Japan, are expecting a significant increase in tourist arrivals. China, in particular, has witnessed a surge in bookings for international trips as its economy reopens and consumers continue to unleash their pent-up desire for travel during the upcoming travel season. This surge in travel demand is further amplified by shopping festivals and events that have resumed after the pandemic. Consequently, we are witnessing a notable rise in the demand for overseas travel, driven by revenge spending on travel experiences.

- Generative Artificial Intelligence (AI) within the travel industry. The increasing prominence of AI) has revolutionized travel technology, leading to enhanced efficiency and a seamless experience for consumers when making travel plans or online bookings. Additionally, AI utilizes big data to effectively capture consumer preferences and demands, enabling travelers to make well-informed decisions regarding pricing and available products. As AI continues to advance, more and more consumers are likely to opt for online travel planning, which offers better pricing options and greater flexibility compared to traditional methods involving physical travel agents.

(Source: Bloomberg)

Fund Name (Ticker) | U.S. Global Jets ETF (JETS US) |

Description | The U.S. Global Jets ETF (JETS) provides investors access to the global airline industry, including airline operators and manufacturers from all over the world. |

Asset Class | Equity |

30-Day Average Volume (as of 13 June) | 2,596,951 |

Net Assets of Fund (as of 12 June) | USD$1,840,477,252 |

12-Month Trailing Yield | NA |

P/E Ratio (as of 31 May) | 4.31 |

P/B Ratio (as of 31 May) | 3.98 |

Management Fees | 0.60% |

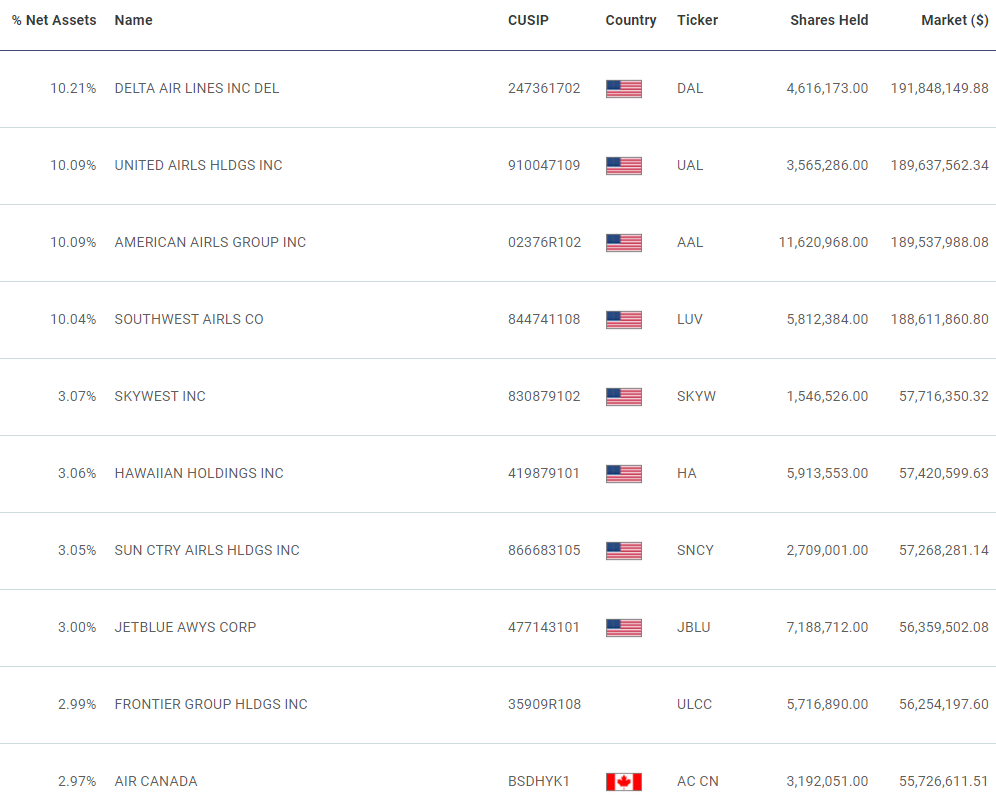

Top 10 Holdings

(as of 13 June 2023)

- BUY Entry – 20 Target – 23 Stop Loss – 18.5

- Demand for travel is on the rise. The airline industry is experiencing a remarkable resurgence in air travel demand, surpassing 90 percent of pre-pandemic levels. This revival extends beyond the United States, as global air travel demonstrates promising signs of recovery. Notably, the US aviation system is poised for an exceptional summer, with the Transportation Security Administration (TSA) already reporting passenger volumes exceeding pre-pandemic levels during the Memorial Day weekend, setting the stage for a potentially record-breaking season ahead. As a result, the industry has more than doubled its net profit forecast for this year. Carriers worldwide, including those in the Asia Pacific region, are witnessing a notable increase in both domestic and international travel, leading to a significant revision of the airline industry’s net profit forecast. The positive outlook is further bolstered by easing inflation and declining jet fuel prices, indicating sustained strong demand for air travel and the potential for moderating costs.

- Limited supply. The peak summer travel season is witnessing a surge in demand for air travel, but the industry is grappling with a shortage of supply. Factors such as a reduced number of airlines, a lack of staff including pilots and ground crew, and technological challenges have created limited available seats. As a result, prices have skyrocketed, benefiting airlines’ revenues while creating intense competition among travellers. Concerns about delays in aircraft delivery further compound the situation, prompting some airlines to focus on offering premium air travel options to meet the demand for luxury experiences.

(Source: Bloomberg)