14 July 2022: Stocks making the biggest moves

Market Movers | Trading Dashboard

United States

Top Sector Gainers

| Sector | Gain | Related News |

| Precious Metals | +1.79% | Gold Price turns positive above $1730, potential reversal? Gold Fields Limited(GFI US) |

| Beverages: Alcoholic | +1.55% | Sector Update: Consumer Stocks Hanging On For Wednesday Advance Ambev SA (ABEV US) |

| Motor Vehicles | +1.15% | Tesla Stock Gets 2 New Buy Ratings in a Single Day Tesla Inc (TSLA US) |

Top Sector Losers

| Sector | Loss | Related News |

| Managed Health Care | -2.23% | Analysis: Bruised investors seek shelter in U.S. healthcare stocks UnitedHealth Group Inc (UNH US) |

| Tobacco | -1.92% | N/A Philip Morris International Inc (PM US) |

| Life/Health Insurance | -1.73% | China Stock Market Expected To Open In The Red On Thursday China Life Insurance Co Ltd (LFC US) |

- Twitter Inc (TWTR US) climbed 7.9% after the firm filed suit against Elon Musk after he terminated his $44 billion deal to buy the company. Twitter said that Musk’s conduct during his pursuit of the social network amounted to “bad faith.”

- Unity Software Inc (U US) shares tumbled 17.5% after the interactive software company announced a merger agreement with app software company ironSource in a $4.4 billion all-stock transaction. Unity also cut its full-year revenue guidance. Shares of ironSource Ltd (IS US) soared 47.1% on the news.

- Stitch Fix Inc (SFIX US) surged 13.6% after Bill Gurley of Benchmark Capital, who also sits on the board of the clothing company, announced that he’d bought 1 million shares of the stock, adding to his previous stake of 1.22 million shares. Gurley paid an average price of $5.43 per share for the stock, according to an SEC filing.

- DigitalOcean Holdings Inc (DOCN US) dropped 3.5% after Goldman Sachs issued a double downgrade to sell from buy. DigitalOcean could get hit with slowing demand, particularly from consumers overseas, the firm said.

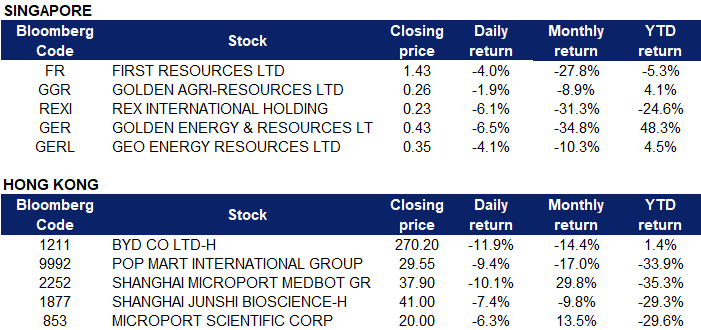

Singapore

- First Resources Ltd (FR SP) and Golden Agri-Resources Ltd (GGR SP) shares fell 4.0% and 1.9% respectively yesterday. Malaysian palm oil futures tumbled below the MYR 4,000-per-tonne mark, closing in on its lowest level since June 2021, amid rising inventories, weak export demand from Malaysia, and increasing production from top producer Indonesia. On top of that, Malaysia’s palm oil stocks in end-June rose to their highest in seven months while production climbed 5.8% to 1.55 million tonnes, also at a seven-month high. Rising output from Indonesia is also adding to the bearish outlook.

- Rex International Holding Ltd (REXI SP) shares fell 6.1% yesterday. Oil edged up on Wednesday, a day after settling below $100 a barrel for the first time since April, and gains were limited by a U.S. supply report showing rising inventories and caution ahead of U.S. inflation data. Despite a tight physical oil market, investors have sold oil futures on worries that aggressive rate hikes to stem inflation will slow economic growth and hit oil demand. Renewed COVID-19 curbs in China have weighed on the market this week.

- Golden Energy & Resources Ltd (GER SP) and Geo Energy Resources Ltd (GERL SP) shares fell 6.5% and 4.1% respectively yesterday. China’s coal imports fell 33% in June from a year ago, with traders turning down expensive overseas cargoes in favour of domestic ones with capped prices as COVID-19 restrictions and higher renewables output dented demand for coal-fired power. China imported 18.98 million tonnes of coal last month, compared to 28.93 million tonnes in June 2021, data from the General Administration of Customs showed on Wednesday. The decline in coal imports came after Beijing’s rigorous regulation of domestic coal prices. It capped thermal coal with a heating value of 5,500 kilocalories at northern Chinese ports at 770 yuan ($114.60) a tonne under long-term contracts and at around 1,200 yuan for spot shipments.

Hong Kong

Top Sector Gainers

Sector | Gain | Related News |

Electric Equipment | +5.01% | Xinjiang Goldwind Science & Tech Co Ltd (2208 HK) |

Airline Services | +1.86% | Hong Kong weighs conditional quarantine-free travel by November China Southern Airlines Company Limited (1055 HK) |

Telecomm. & Networking Equipment | +1.49% | Yangtze Optical Fibre and Cable JSC Ltd (6869 HK) |

Top Sector Losers

Sector | Loss | Related News |

Property Management & Agency | -1.28% | China property bond plunge ensnares investment-grade giant Vanke A-Living Smart City Services Co Ltd (3319 HK) |

Telecomm. Services | -1.16% | China has 428m 5G mobile users and 1.7m 5G base stations: Ministry Citic Telecom International Holdings Ltd (1883 HK) |

Agricultural, Poultry & Fishing Production | -1.08% | Global Pork Exports Set to Plunge With China Taking In 39% Less COFCO Joycome Foods Ltd (1610 HK) |

- Dongfang Electric Corp Ltd (1072 HK) shares rose 12.6% yesterday. According to a research report released by CICC, investment in the power grid has increased steadily, and there is still nearly 400 billion yuan to be invested during the year; centralised and distributed new energy is driving the upgrading and transformation of the power grid; and digitalization of the power grid continues to improve. China’s installed wind power capacity in the first five months of this year increased by 39% year-on-year, according to data from the National Energy Administration. According to HSBC Research’s forecast the installed wind power capacity for fiscal years 2022-2025 has been raised from 50, 55, 60 and 65 GW to 55, 60, 65 and 70 GW, mainly due to government policies on large-scale renewable energy projects on wind and solar bases. The support is believed to be beneficial to the installed capacity of wind power, coupled with the resumption of bidding for offshore wind farms, and the sustainable return of wind power projects.

- Xinjiang Goldwind Science & Technology Co Ltd (2208 HK) shares rose 9.2% yesterday. On July 12, results regarding the procurement and commissioning of anchor cages, towers, wind turbines and ancillary equipment for the first phase of the 80MW offshore wind power project in Tra Vinh Dongcheng, Vietnam were announced, and Goldwind won the bid. It is reported that the project plans to install 17 Goldwind GW155-4.7MW wind turbines, with a total capacity of 80MW, and a 220KV booster station. The entire wind farm is scheduled for commercial operation until June 30, 2023.

- Helens International Holdings Co ltd (9869 HK) shares rose 8.3% yesterday. Catering stocks continued yesterday’s rebound. CITIC Construction Investment pointed out that in the second half of the year, as economic activities begin to rise, the recovery of the catering industry will accelerate, and the banquet consumption scene will gradually return to normal.

- China Traditional Chinese Medicine Holdings Co Ltd (0570 HK) shares fell 16.9% yesterday. The company released a performance forecast for the first half of 2022 on the evening of the 12th, which mentioned that according to the six months ended June 30, 2022, the company’s net profit is expected to drop by 50% year-on-year. The announcement also disclosed the reasons for the poor performance in the first half of the year, mainly due to the implementation of the national standard for traditional Chinese medicine formula granules has greatly increased production cost, and the terminal price increase has not been fully implemented.

- CIFI Holdings (Group) Co Ltd (0884 HK) shares fell 13.2% yesterday. On July 11, CIFI Holdings Group announced that on July 11, 2022, Shanghai Fengxu, an indirect non-wholly-owned subsidiary of the company (as the seller), and Lingyu International’s indirect wholly-owned subsidiary Shanghai Lingai (as the purchaser) entered into a sale and purchase agreement for the sale of properties at a consideration of RMB186 million. These properties were developed and have been held by the Group as investment properties for rental income. The Board considers the sale of these properties a good opportunity for the Group to realise its investment in these properties and simplify its business operations under the current market conditions.

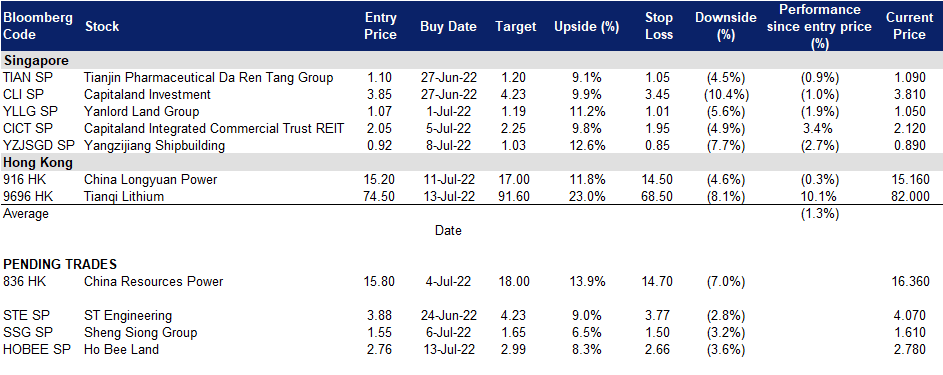

Trading Dashboard Update: Add Tianqi Lithium (9696 HK) at HK$74.5.