14 December 2023: Wealth Product Ideas

Product: Interest Rate Differential Structured Product – Steepener

(Issuer Callable)

- Steepener is a type of financial product that benefits the client when the interest rate curve steepens.

- As the U.S. Federal Reserve is nearing the end of its rate-hiking cycle, short-term interest rates are expected to begin to decline.

- Considering the high fixed coupon in the first year and the inverse floating rate return thereafter, along with the yield spread between 30 years and 2 years, now is the best time to introduce this product.

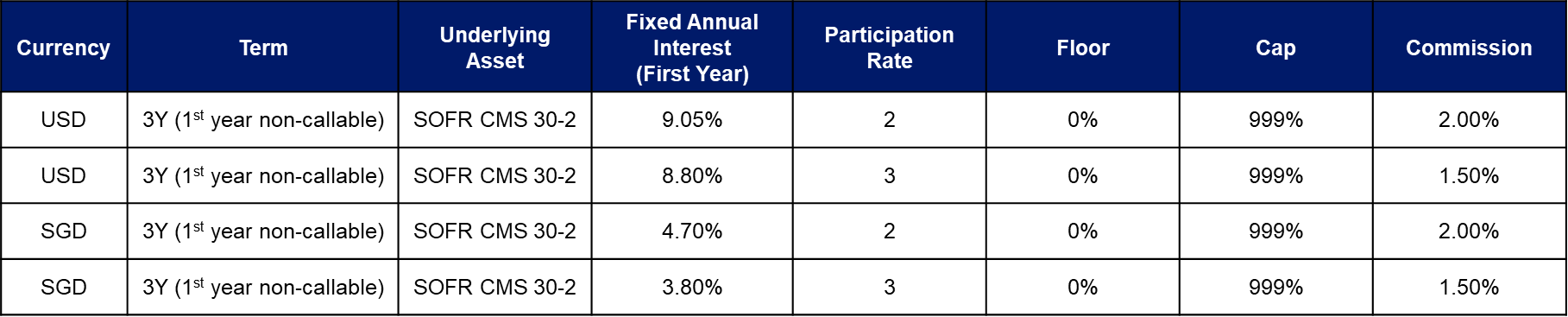

*Quotes provided are for reference only. Please contact us for latest pricing.

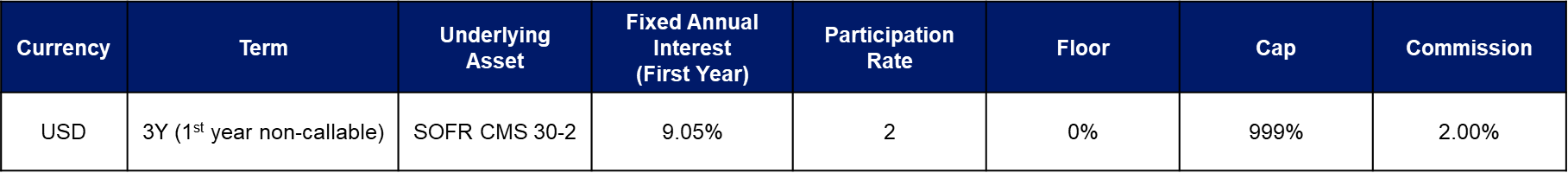

Illustrative Example

*Quotes provided are for reference only. Please contact us for latest pricing.

Product Features:

- Capital Protection: Unless the issuer defaults, the investor’s principal will be fully protected upon maturity.

- Term: 3 years (issuer has the right to redeem after the first year)

- Underlying Asset: Interest rate differential between the 30-year and 2-year rates of USD SOFR

- Fixed Return (1st year): Investors will receive a fixed annual return of 9.05%, regardless of the performance of the underlying asset.

- Variable Return (from 2nd year onwards): Annual return will be calculated based on twice the spread between the 30-year and 2-year SOFR rates (participation rate of 2), with a minimum return rate (floor) of 0.00% per year and a maximum return rate (cap) of 999.00% per year.

Risk Factors:

- Market Risk: The actual return after the first year depends on the interest rate differential between the 30-year and 2-year SOFR. If the spread is not as high as expected, the return may be lower than expected or even zero.

- Issuer Risk: The return of principal is subject to the credit risk of the issuer. If the issuer defaults, investors may not be able to recover their principal.