13 March 2025: Investment Product Ideas

SPDR Gold MiniShares Trust (GLDM US)

- Second Largest After GLD & IAU, Strong Liquidity. GLDM ranks as the third largest gold trust ETF, offering relatively strong liquidity among gold investment options.

- Invests in Physical Gold. This ETF tracks the LBMA Gold Price PM and differs from gold mining stock ETFs, which are exposed to both gold price fluctuations and corporate operational risks. As a result, GLDM is less volatile than gold mining stock ETFs Gold trust ETFs are commonly used as hedging tools against inflation and market volatility, making them suitable for investors seeking stability amid economic uncertainty.

- Lower Expense Ratio. With a 0.1% expense ratio, GLDM is among the lowest cost ETFs in its category, offering a cost-effective investment option.

Fund Name (Ticker) | SPDR Gold MiniShares Trust (GLDM US) |

Description | SPDR Gold MiniShares Trust is an ETP incorporated in the USA. The investment objective of the Trust is for the Shares to reflect the performance of the price of gold bullion, less the Trust’s expenses. The Trust holds gold and is expected from time to time to issue Baskets in exchange for deposits of gold and to distribute gold in connection with redemptions of Baskets. |

Asset Class | Commodity |

30-Day Average Volume (as of 11 Mar) | 3,235,001 |

Net Assets of Fund (as 11 Mar) | $11,432,331,826 |

12-Month Yield | N.A. |

P/E Ratio | N.A. |

P/B Ratio | N.A. |

Expense Ratio (Annual) | 0.10% |

Top Holdings

(as of 11 March 2025)

(Source: Bloomberg)

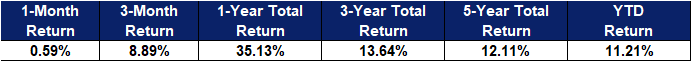

VanEck Gold Miners ETF (GDX US)

- Invests in Global Large Cap Gold Miners. This ETF primarily holds stocks of mid to large-cap gold mining companies engaged in exploration, extraction, and production.

- High Return Potential. Gold miners’ profitability depends on prevailing gold prices, making their stocks highly correlated with spot gold However, mining companies also face operational and extraction costs, leading to occasional divergences between stock prices and gold prices This ETF carries higher volatility, making it appealing for investors seeking greater return potential.

- High Liquidity. As one of the largest gold mining stock ETFs, it offers strong market liquidity.

Fund Name (Ticker) | VanEck Gold Miners ETF (GDX US) |

Description | VanEck Gold Miners ETF is an exchange traded fund incorporated in the USA. The ETF tracks the performance of the NYSE Arca Gold Miners Index. The ETF invests in materials stocks of all cap sizes across the globe. Its largest allocation is in North American companies, principally those domiciled in Canada. |

Asset Class | Commodity |

30-Day Average Volume (as of 11 Mar) | 18,737,494 |

Net Assets of Fund (as of 10 Mar) | $13,761,709,000 |

12-Month Yield (as of 11 Mar) | 0.962% |

P/E Ratio (as of 11 Mar) | 22.87x |

P/B Ratio (as of 11 Mar) | 2.05x |

Expense Ratio (Annual) | 0.51% |

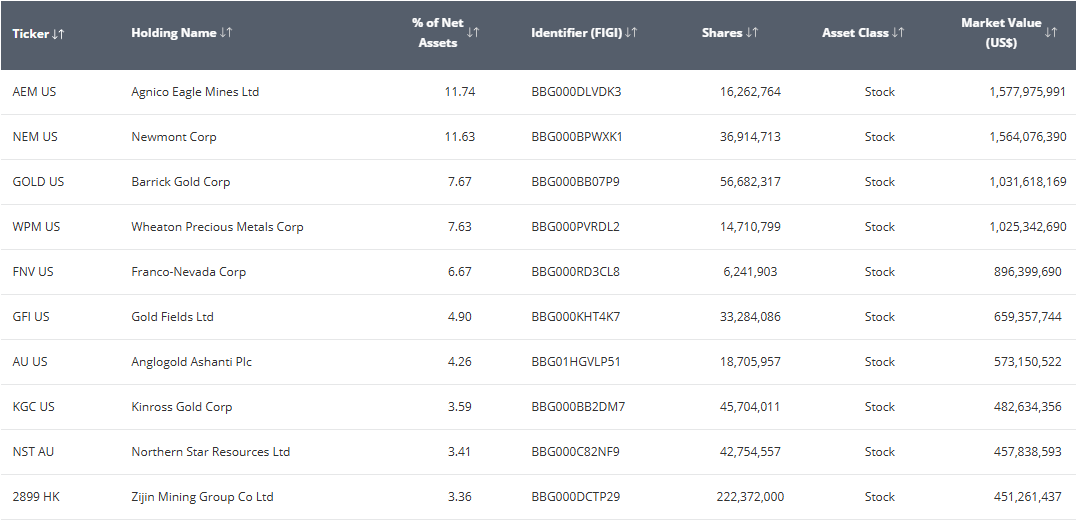

Top 10 Holdings

(as of 10 March 2025)

(Source: Bloomberg)