10 May 2022: Stocks making the biggest moves

| Market Movers | Trading Dashboard

United States

Top Sector Gainers

| Sector | Gain | Related News |

| Food: Major Diversified | +1.5% | N/A Walmart (WMT US) |

| Food Retail | +1.2% | Kroger (KR) Gains As Market Dips: What You Should Know Kroger (KR US) |

| Home Improvement Chains | +1.1% | Home Depot, Lowe’s rebound from steep-selloff Home Depot (HD US) |

Top Sector Losers

| Sector | Loss | Related News |

| Oil & Gas production | -10.3% | Oil prices close 6% lower to start the week as Saudis lower prices, China exports slump Conoco Phillips (COP US) |

| Motor Vehicles | -7.5% | Rivian shares down more than 17% following report of Ford sell-off Rivian (RIVN US) |

| Internet Retail | -6.2% | Nasdaq ends with 4.3% loss as US stock market plunge continues Amazon (AMZN US) |

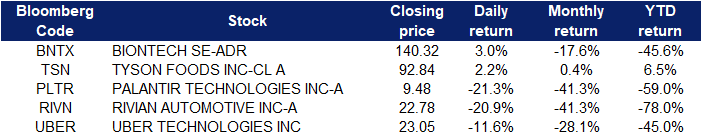

- BioNTech (BNTX US) shares rose 3% after posting a better-than-expected first-quarter report. BioNTech earned $14.24 per share on revenue of $6.37 billion. Analysts polled by Refinitiv expected a profit of $9.16 per share on revenue of $4.34 billion.

- Tyson Foods (TSN US) shares gained 2.2% on the back of better-than-expected quarterly results. Tyson reported earnings of $2.29 per share on revenue of $13.12 billion. Analysts had expected a profit of $1.91 per share on revenue of $12.85 billion, according to Refinitiv.

- Palantir (PLTR US) shares dropped 21.3% after its first-quarter earnings came in below expectations. The company reported 2 cents of adjusted earnings per share on $446 million of revenue. Analysts surveyed by Refinitiv expected 4 cents of earnings per share on $443 million of revenue. Palantir’s second-quarter guidance for revenue and adjusted operating margin was also below expectations, according to StreetAccount.

- Rivian (RIVN US) shares fell 20.9% following a CNBC report that Ford Motor will sell 8 million shares as the insider lockup for the stock is set to expire. Ford currently owns 102 million shares of Rivian. Ford shares fell 4%.

- Uber (UBER US) shares dropped 11.6% after CEO Dara Khosrowshahi revealed plans to slash marketing and incentives spending and treat hiring as a “privilege,” according to an email to employees obtained by CNBC. “It’s clear that the market is experiencing a seismic shift and we need to react accordingly,” he said.

Singapore

- Dyna-Mac Holdings Ltd (DMHL SP) shares extended their rally and rose 3.2% yesterday. On Wednesday (May 4), the company said it obtained a firm contract with a provisional sum of S$180 million from a long-time repeat customer. The new order win brings the company’s net order book to-date to a record high of S$641.1 million, with deliveries stretching into 2024, the company said in a bourse filing.

- Civmec Ltd (CVL SP) shares rose 2.3% yesterday. In a report on Friday (May 6), analyst Eric Ong initiated coverage on Civmec with a “buy” call and target price of S$1, noting that the counter trades at an “undemanding” 10 times the brokerage’s estimates for FY2023 earnings, which represents a 15% discount to Civmec’s peers listed in Australia. The counter is also attractive given its positive earnings profile and the enhanced clarity of its naval shipbuilding segment, the analyst added.

- Jiutian Chemical Group Ltd (JIUC SP) shares rose 2.0% yesterday. CGS-CIMB raised its target price on Jiutian Chemical Group to S$0.17 from S$0.09, after hiking its earnings per share (EPS) estimates for the chemical company by 7.4% to 41.9% for FY2022 to FY2024. The research team maintained an “add” rating on the Catalist-listed company, noting that it has a strong net cash position and that the industry cycle remains favourable, CGS-CIMB said in an analyst report on Thursday (May 5).

- RH Petrogas Ltd (RHP SP) and Rex International Holding Ltd (REXI SP) shares lost 3.4% and 2.9% respectively yesterday. Oil prices slipped on Monday, along with stock markets in Asia, sparked by weak China data and fears a global recession could dampen oil demand, with investors eying European Union talks on a Russian oil embargo that could tighten global supplies. Saudi Arabia, the world’s top oil exporter, lowered crude prices for Asia and Europe for June on Sunday.

Hong Kong

Top Sector Gainers

| Sector | Gain | Related News |

| Public Transport | +1.30% | Hong Kong Speeds Reopening at Bars, Beaches as Covid Eases Kwoon Chung Bus Holdings Ltd (306 HK) |

| Nonferrous Metal | +1.20% | Russia’s lost alumina supply from Ukraine is now coming from China Aluminum Corporation of China Limited (2600 HK) |

Top Sector Losers

Sector | Loss | Related News |

Airline Services | -4.22% | Xi Jinping sends warning to anyone who questions China’s zero-Covid policy China Southern Airlines Co Ltd (1055 HK) |

Dairy Products | -3.80% | Powder purchases drive China’s Q1 dairy imports China Youran Dairy Group Ltd (9858 HK) |

Automobiles & Components | -3.36% | U.S.-listed Chinese EV maker Nio proposes a secondary listing of its shares in Singapore NIO Inc. (9866 HK) |

- Aluminum Corporation of China Limited (2600 HK) Shares fell 8.88% near a 52-week low last Friday after the company was added to the US SEC list for possible delisting. Previously, BlackRock reduced holdings by 16.16mn shares at the average price of HK$3.57.

- Sihuan Pharmaceutical Holdings Group Ltd (460 HK) Shares fell 9.48% and closed near a 52-week low last Friday. There was no company-specific news. The biotechnology sector plunged following the overnight US market plummet.

- Country Garden Services Holdings Co Ltd (6098 HK) Shares fell 9.94% last Friday. There was no company-specific news. The property management sector continued to weaken. China’s authority reiterated its zero-covid policy amid rising covid cases in multiple cities. The expectation of a turnaround in the real estate sector faded again.

- China Resources Beer Holdings Co Ltd (291 HK) Shares fell 10.31% and closed near a 52-week low last Friday. The brewery sector plunged due to the reiteration of the zero-covid policy. China’s authority vowed to insist on the most draconian measures to fight covid.

- NIO Inc (9866 HK) Shares fell 11.47% last Friday. The company announced that it was planning a secondary share listing in Singapore. Previously, the company was included in the US SEC list of possible delisting.

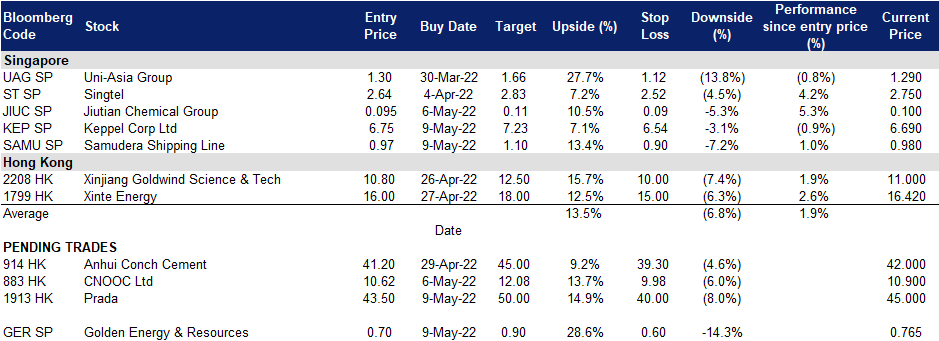

Trading Dashboard Update: Cut loss on OxPay Financial Ltd (OPFL SP) at S$0.18; Add Keppel Corp (KEP SP) at S$6.75, Samudera Shipping (SAMU SP) at S$0.97.