7 February 2022: Nanofilm Technologies (NANO SP), PC Partner Group Ltd (1263 HK)

Singapore Trading Ideas | Hong Kong Trading Ideas | Market Movers | Trading Dashboard

SINGAPORE

Nanofilm Technologies (NANO SP): New year shopping

- BUY Entry – 2.98 Target – 3.50 Stop Loss – 2.80

- NANO provides advanced coating solutions to products such as smartphones, smartwatches, computers and automotive. The company serves many Fortune 500 companies with its special proprietary advanced materials and nano-fabrication capabilities.

- Shopping for bargains. Shares of NANO are down 55% from their peak of S$6.67 in July 2021. A combination of disappointing 1H2021 results and the recent tech sell-off has now bought NANO’s shares near to its IPO price of S$2.59. The sell-off looks overdone in our view, and we argue that value is now starting to appear.

- Looking ahead. The sell-off is likely pricing in the weak 2021 results. However, looking past the current weakness and higher operating costs due to expansion plans, both topline and bottom line growth is expected to accelerate to around 19-27% per annum in 2022 and 2023. There is potential for growth to surprise on the upside as it ramps up production at its new Shanghai plant.

- Consensus estimates. There are 5 BUYS / 2 HOLDS / 2 SELLS and an average 12-month target price of S$3.76, implying a 25% from the last close price. While EPS is forecasted to only increase by 7% in FY2021F, consensus expects it to accelerate to 27% YoY in FY2022F and 19% YoY in FY2023F, bringing FY2021/22/23F P/E to 31x / 25x / 21x. NANO is due to report its full-year earnings on Friday, 25 Feb.

Wilmar International Ltd (WIL SP): Palm oil prices to the moon

- RE-ITERATE BUY Entry – 4.38 Target – 4.80 Stop Loss – 4.16

- Wilmar is Asia’s leading agribusiness group that encompasses the entire value chain of the agricultural commodity business, from cultivation and milling of palm oil and sugarcane, to processing, branding and distribution of a wide range of edible food products in consumer, medium and bulk packaging, animal feeds and industrial agri-products such as oleochemicals and biodiesel.

- Supply constraints. Palm oil prices hit another record high last week due to supply constraints. Indonesia, the world’s largest producer and exporter of palm oil, has imposed a new rule that made it mandatory for producers to sell 20% of their output to domestic consumers at a fixed price.

- Resilient palm oil prices expected in 2022. Palm oil prices are likely to remain above MYR 4,700 (US$1,124) per ton over the next six months, according to LMC International. In addition, it will still take another 12 months for Southeast Asia’s palm oil production to recover to end-2019 levels, after supply from Indonesia and Malaysia declined in 2020 and 2021.

- Aggressive share buy-backs. The company bought back S$57mn worth of shares in 4Q2021, bringing total share buybacks for the full-year 2021 to around S$131mn.

- Positive consensus estimates. Wilmar currently has 13 BUY recommendations and an average 12M TP of S$6.05, implying a 38% upside potential from the last closing price.

Crude Palm Oil Futures – 5 years historical chart. Still trading near all-time highs due to supply constraints.

HONG KONG

PC Partner Group Ltd (1263 HK): Bearish sentiment is about done

- BUY Entry – 12.0 Target – 15.0 Stop Loss – 10.5

- PC Partner Group Limited is an investment holding company principally engaged in the electronics and personal computer (PC) parts and accessories businesses. Its main business include the design, development and manufacturing of video graphics cards for desktop PCs, the provision of electronics manufacturing services, as well as the manufacturing and trading of other PC related product components. The Company is also engaged in the provision of technical support services through its subsidiaries. Its primary products are video graphics cards, motherboards and mini-PCs. Its primary brands include ZOTAC, Inno3D and Manli. Its businesses are mainly conducted in Mainland China, Hong Kong, Macau, Korea and the United States of America.

- AMD reached another record sales in 4Q21. Previously, AMD (AMD US) announced its 4Q21 earnings. Revenue jumped by 48.8% YoY and 11.9% QoQ to US$4.8bn. GPM topped at above 50% for the first time, up 5.6 ppts YoY and 1.9 ppts QoQ. Adjusted net profit jumped by 98.0% YoY and 4.4% QoQ to US$997.2mn. FY22F guidance is upbeat; the company expects its sales to grow by 31% YoY to US$21.5bn with GPM of approximately 51%.

- Bitcoin price reclaimed the US$40,000 territory. Last Friday’s non-farm payroll showed that the economic recovery in the US is on track, reinforcing expectations of aggressive rate hikes and Fed balance sheet reduction. However, cryptocurrencies reacted positively to the better-off economic conditions. The correction since November has been pricing in the tightening monetary policies in 2022. Therefore, a short-term technical rebound is expected.

- Graphic card demand remains strong in 2022. The demand for graphic cards will be less driven by the crypto mining activities but more by cloud computing. Metaverse development will continue to roll out in 2022 as the leading technology giants explore strategic direction and new applications.

- The company’s valuation is attractive. The stock is currently trading at only 4.1x PE.

Ping An Insurance (Group) Company of China, Ltd. (2318 HK): Too big to fail

- BUY Entry – 60 Target – 69 Stop Loss – 57

- Ping An Insurance (Group) Company of China, Ltd. is a personal financial services provider. The Company provides insurance, banking, investment, and Internet finance products and services. The Company operates its businesses through four segments. The Insurance segment provides life insurance and property insurance, including term, whole-life, endowment, annuity, automobile and health insurance. The Banking segment is engaged in loan and intermediary businesses with corporate customers and retail business. The Assets management segment is engaged in security, trust and other assets management businesses, including investment, brokerage, trading and asset management services. The Internet Financing segment is engaged in the provision of Internet finance products and services.

- Nightmare is gone. 2021 is the third worst year for the China insurance giant, following the 2008 global financial crisis and 2011 European debt crisis. The main reason for the sharp sell-off is due to the large investment exposure to the property sector which is overleveraged and hammered by regulations. However, authorities have started to ease the tightening measures on the property sector by the end of 2021. Entering 2022, China has adopted a counter-cycle monetary policy by further lowering key rates, which is totally opposite to the western countries’ rate hike cycle. With the property sector, especially the market leaders’ survival, Ping An’s investment will recover gradually.

- Ping An was experiencing the HSBC moment. Investors should focus on the core business fundamentals of Ping An. Similar to HSBC whose shares were hammered during the China-US trade tensions, Ping An’s shares once plunged to below book value, which has never happened since its listing. Negative sentiment pushed prices down to oversold levels.

- Core business slowed down in 2021 but saw a turnaround in December. The gross premium income in 2021 dropped by 4.64% YoY to RMB760.3bn. However, the December gross premium income beat expectations and grew by 1.63% YoY and 38.3% MoM.

- Updated market consensus of the estimated net profit growth in FY22/23 is 25.9%/12.6% respectively, which translates to 6.3x/2.6x forward PE. The current PE is 7.3x. The FY22/23 dividend yield is expected to be 4.8%/5.3% respectively. Bloomberg consensus average 12-month target price is HK$79.95.

MARKET MOVERS

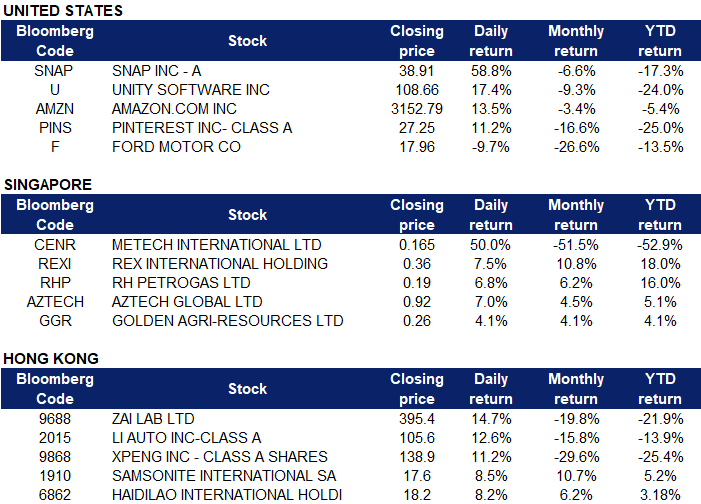

United States

Top Sector Gainers

| Sector | Gain | Related News |

| Internet Retail | +9.5% | Amazon results boost Nasdaq, shares climb Amazon (AMZN US) |

| Packaged Software | +2.8% | Microsoft’s Nadella says Activision buy pushes it further into the metaverse Microsoft (MSFT US) |

| Casinos/Gaming | +2.5% | MGM Resorts (MGM) Reports Next Week: Wall Street Expects Earnings Growth MGM Resorts (MGM US) |

Top Sector Losers

| Sector | Loss | Related News |

| Homebuilding | -4.4% | Mortgage Rates Hit 3.76% This Week — Their Highest Since March 2020 D.R. Horton (DHI US) |

| Chemicals | -2.2% | From Kisses to Kleenex, consumer-product makers plot additional U.S. price hikes Kraft Heinz (KHC US) |

| REITS | -1.0% | 10-Year Treasury Yield Surges Above 1.9%, Highest Since 2019 Prologis (PLD US) |

- Snap Inc (SNAP US) shares surged 58.8% on Friday after reporting earnings for the fourth quarter which beat analyst estimates on earnings, revenue and user growth. The report marks Snap’s first profitable quarter on a net income basis as a public company. It also provided a Q1 guidance range of $1.03 billion to $1.08 billion, higher than the $1.01 billion analysts anticipated, according to Refinitiv. It expects daily active users between 328 million and 330 million in the first quarter, beating analyst estimates of 327.8 million, according to StreetAccount.

- Unity Software Inc (U US) shares surged 17.4% on Friday after the fourth-quarter adjusted loss at the videogame developer tools maker was narrower than Wall Street expected and the company issued a 2022 sales outlook that was higher than estimates. For the fourth quarter, Unity reported sales of $315.9M, up 43% from the same period last year and beat consensus by $20.15M. Basic and diluted non-GAAP net loss per share was $0.05, compared to basic and diluted non-GAAP net loss per share of $0.10 in the fourth quarter of 2020. Unity also said it has strong growth opportunities over decades in the future based on interactive real-time 3D gaming.

- Amazon.com Inc (AMZN US) shares rose 13.5% on Friday, following a stellar quarterly report. The company said its investment in electric vehicle company Rivian gained almost $12 billion in the fourth quarter. Amazon Web Services delivered almost 40% year-over-year growth in the fourth quarter, beating Wall Street estimates. Amazon also announced it would increase the price of Prime to $139 from $119 for annual memberships. The cost of a monthly Prime membership will also rise to $14.99 from $12.99.

- Pinterest (PINS US) shares rose 11.2% on Friday after the company announced its financial results for the quarter and year ended December 31, 2021. Q4 revenue grew 20% year over year to $847 million, while global monthly active users (MAUs) decreased 6% year over year to 431 million. The company’s current expectations is that Q1 revenue will grow in the high teens percentage range year over year and non-GAAP operating expenses to grow around 10% quarter-over-quarter in Q1. “As we look ahead to 2022, we plan to further invest in our business as we scale the distribution of Idea Pins through our creator-led content efforts and enhance our core Pinner experience and shopping to make Pinterest the destination for inspiration and action on the internet.” said Ben Silbermann, CEO and co-founder of Pinterest.

- Ford Motor Company (F US) shares slid 9.7% on Friday after the company’s fourth-quarter earnings significantly missed Wall Street’s expectations. Ford generated $35.3 billion in revenue compared to consensus estimates of $35.5 billion, while EPS was 26 cents compared to consensus estimates of 45 cents. The automaker’s fourth-quarter net income swung to a $12.3 billion profit from a $2.8 billion loss during the last three months of 2020. That included an $8.2 billion gain on its investment in electric vehicle start-up Rivian Automotive. While the automaker hit its annual earnings guidance for 2021, it missed production targets analysts were expecting due to supply chain problems, including an ongoing shortage of semiconductor chips, Ford CFO John Lawler told media during a call Thursday.

Singapore

- Metech International Ltd (CENR SP) shares surged 50% on Friday, after the company reported its semi-annual results. Metech generated revenue of S$3.6mn for the 6 months ended 31 December 2021, a YoY increase of 46.9% while gross profit surged 209% to S$108k. Gross profit margin improved to 3% for the 6 months ended 31 December 2021, compared to the previous period. However, the company still maintains its loss-making position.

- Rex International Holdings Ltd (REXI SP) and RH Petrogas Ltd (RHP SP) shares gained 7.5% and 6.8% respectively yesterday, in tandem with the rise in oil prices. US crude prices hit $91 per barrel for the first time since 2014, extending its upward momentum to levels not seen since 2014, while Brent crude futures extended gains above $92 per barrel, hitting fresh seven-year highs and bringing more than 17% year-to-date gains. Frigid weather across the US disrupted some oil production in the Permian Basin region while further increased geopolitical tensions in Eastern Europe and the Middle East supported prices. Meanwhile, OPEC+ agreed on Wednesday to increase oil output by 400,000 barrels per day in March, as widely expected.

- Aztech Global Ltd (AZTECH SP) shares gained 7% on Friday, after UOB Kay Hian added Aztech Global and Thai Beverage shares to its alpha picks for the month of February. In a strategy note on Thursday (Feb 3), the brokerage said that Aztech was added with a target price of S$1.55 as its share price correction presented a good buying opportunity due to its strong order book and intact operations. Analyst John Cheong finds the company’s current trading price unjustified, as it is trading at 7 times its price-to-earnings ratio, compared to its peers trading at above 10x.

- Golden Agri-Resources Ltd (GGR SP) shares rose 4.1% on Friday. Malaysian palm oil futures fell to MYR 5500 per tonne but still remained close to an all-time high of MYR 5700 per tonne, boosted by mounting concerns over supply and following a rise in prices of other vegetable oils and crude oil. Indonesia, the world’s biggest palm oil producer, implemented a new rule that made it mandatory for palm oil producers to sell 20% of their output to domestic consumers at fixed prices. Also, Indonesia’s palm oil exports are projected to fall 3% to 33.21mn tonnes this year.

Hong Kong

Top Sector Gainers

| Sector | Gain | Related News |

| Household Appliances | +3.15% | M Stanley Foresees Near-term Support for TECHTRONIC IND; Peers’ 2022 Bright Rev. Outlook Shows Positive Demand Techtronic Industries Co Ltd (669 HK) |

| Alcoholic Drinks & Tobacco | +3.06% | Economic Watch: Chinese ring in Year of the Tiger with special shopping spree Tsingtao Brewery Co. Ltd. (168 HK) China Resources Beer Holdings Co Ltd. (291 HK) |

| Insurance | +2.52% | China:Giant life insurers see reshuffle in rankings AIA Group Ltd (1299 HK) Ping An Insurance (Group) Co. of China Ltd. (2318 HK) |

Top Sector Losers

| Sector | Loss | Related News |

| Software | -0.29% | China’s software sector revenue, profit grow in 2021 Kingdee International Software Group Co. (268 HK) Kingsoft Corporation Limited (3888 HK) |

| Footwears | -0.25% | Chinese sportswear shares jump as Winter Olympics kick off Xtep International Holdings Limited (1368 HK) Yue Yuen Industrial (Holdings) Ltd (551 HK) |

| Cosmetics & Personal Care | -0.15% | NA L’Occitane International S.A.(973 HK) Hengan International Group Company Ltd (1044 HK) |

- Zai Lab Ltd (9688 HK) shares surged 14.7% on Friday. The Global LAG 3 Inhibitor Market Research Report 2022-2028 was released last week which featured Zai Lab as a key player in the industry. LAG-3 is a member of the immunoglobulin superfamily (IgSF) and exerts a wide variety of biologic impacts on T cell function. The receptor is considered as a promising target in cancer immunotherapy. Studies have demonstrated that LAG-3 has synergistic action with PD-1 and PD-L1. There are more than 100 ongoing clinical trials for 35 drugs, which are evaluating the role of LAG-3 inhibitors in a wide range of cancers. The drug is expected to gain entry into the market by 2022, which will revolutionise the paradigm of cancer treatment. Apart from this, several preclinical studies are also evaluating the role of LAG-3 in other therapeutic indications including diabetes, multiple sclerosis, HIV, Parkinson, and other autoimmune disorders.

- Li Auto Inc (2015 HK) shares gained 12.6% on Friday. Li Auto announced that the company delivered 12,268 Li Li ONE units in January 2022, an increase of 128.1% from January 2021. Since its launch, the cumulative delivery of Li Li ONE has reached 136,356 units. In 2022, Li Auto will continue to invest in research and development to provide users with safer, more convenient and more comfortable products and services, said Shen Yanan, co-founder and president of the company.

- Xpeng Inc (9868 HK) shares gained 11.2% on Friday. Xpeng announced that in January 2022, the company delivered a total of 12,922 smart electric vehicles, a YoY increase of 115%, and exceeded the monthly delivery threshold of 10,000 vehicles for the fifth consecutive month. Xpeng plans to use the Spring Festival shutdown period to carry out technical renovations of the Xpeng Zhaoqing base from the end of January to the beginning of February 2022. Once the renovation is complete, it is expected to accelerate the delivery of the large number of orders on hand brought in from 2021 into 2022, and more effectively meet the expected growth in 2022.

- Samsonite International S.A. (1910 HK) and Haidilao International Holding Ltd (6862 HK) shares gained 8.5% and 8.2% respectively on Friday. Reopening concept stocks rose collectively on Friday, in light of the Spring Festival Holiday season. According to the statistics of the Ministry of Culture and Tourism, the passenger flow in cultural venues of major cities increased. A total of 137mn domestic tourism trips were made across the country, which recovered 71.5% compared to the same period of the Spring Festival Holiday Season in 2019. It was also reported that domestic tourism revenue was RMB 167.849bn.

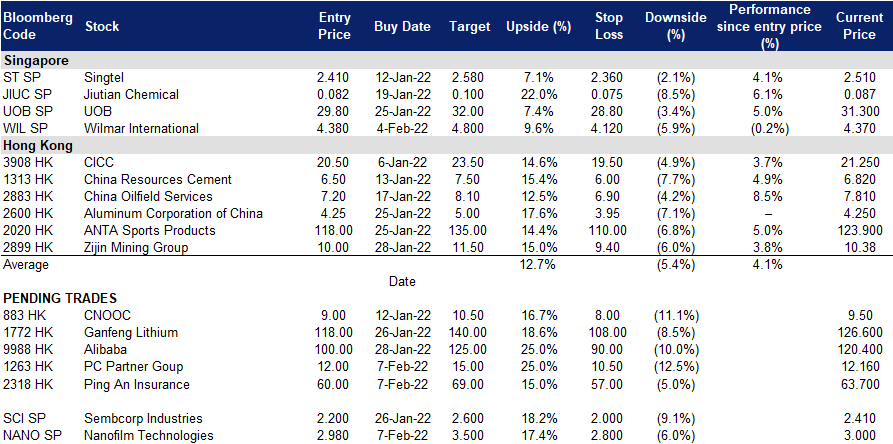

Trading Dashboard

Trading Dashboard Update: Add Wilmar International (WIL SP) at S$4.38. Take profit on Rex International (REXI SP) at S$0.36 and Frencken (FRKN SP) at S$.180.

(Click to enlarge image)