28 January 2022: Sembcorp Industries (SCI SP), Alibaba Group Holding Ltd (9988 HK)

Singapore Trading Ideas | Hong Kong Trading Ideas | Market Movers | Trading Dashboard

IPO PERFORMANCE

Novo Tellus Alpha Acquisition (NTAA): Dragged by the Fed

- NTAA closed 2.8% lower at S$4.86 on its IPO debut yesterday, underperforming its two other SG-listed SPAC peers.

- The weaker-than-expected performance was likely due to the overall sell-off in the technology space following a much more hawkish FOMC meeting. Shares of SGX-listed technology-related names fell as much as 6% yesterday, with Frencken, UMS and AEM leading the losers.

Performance of the first three SPACS to list on SGX

SINGAPORE

Rex International Holdings Ltd (REXI SP): Oil on the run

- BUY Entry – 0.325 Target – 0.360 Stop Loss – 0.310

- Rex International Holding Limited operates as an independent oil exploration and production company. It operates through Oil and Gas, and Non-Oil and Gas segments. The company offers Rex Virtual Drilling, a liquid hydrocarbon indicator, which uses seismic data to search for oil. The company is involved in the oil and gas exploration and production activities with a focus in Oman and Norway.

- Oil prices remain upbeat. WTI crude futures held above $87 per barrel yesterday after hitting a fresh 7-year high of $87.95 in the previous session, while Brent crude futures held above $89 per barrel yesterday after surging above $90 in the previous session for the first time in seven years. Markets remained concerned over Russia-Ukraine tensions. Adding to the tighter market conditions, the latest EIA report showed that crude stockpiles fell for the third week in a row to 31.7 million barrels, getting close to the 30 million barrel-level that traders watch as a warning sign for low inventories.

- Joining the big guys. The company announced yesterday that it has obtained approval-in-principle from SGX for the transfer of listing from the Catalist Board to the Mainboard. The board believes that the Mainboard Listing would provide the company with a wider platform to reach out to a larger investor base. This could potentially facilitate greater access to equity and debt markets, if applicable, to maximise the group’s growth potential.

- Norway: Second leg of production for Rex, transformational for Lime Petroleum (LPA, Rex’s 90%-owned subsidiary) . LPA’s acquisition of a 33.8% interest in the Brage Field was its most significant transaction of 2021, as it fulfils LPA’s ambition to transition from pure-play exploration to a full cycle exploration and production company on the Norwegian Continental Shelf, and to establish recurring cash flow, as well as develop and drive further value in LPA’s existing portfolio.

Sembcorp Industries (SCI SP): Don’t be mean, be green

- RE-ITERATE BUY Entry – 2.15 Target – 2.50 Stop Loss – 2.00

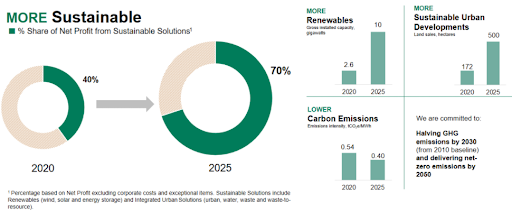

- SCI is a leading provider of sustainable solutions in Asia. The group has a target for its sustainable solutions portfolio to make up 70% of the group’s net profit by 2025, up from 40% in 2020. What this means is that the group targets to achieve a 30% CAGR for its renewable energy portfolio by 2025, and for gross installed renewable energy capacity to increase from 2.6GW at the end of 2020, to 10GW by 2025.

- The only green play in town. SCI is the only pure-play green energy stock listed in Singapore. The group generates 56% of 2020 profits from Gas & Thermal power, 29% from Waters & Others, and 15% from Renewable power. In terms of geographical focus, 29% of net profit is contributed from China, 27% from Singapore and the rest of Southeast Asia, and 27% from India.

- Market leader. SCI is a leading renewables player in Singapore with about 280MWp of solar capacity. The group offers the full suite of solutions including ground-mounted, rooftop and floating solar PV systems. In India, SCI achieved the highest wind capacity under self-operations of any independent power producer in the country.

- Positive consensus estimates. Analysts are generally bullish on the stock with 9 BUYS and 2 HOLD recommendations. There is a 12m TP of S$2.62 which implies a 19% total return from the last close price. Valuations are decent at around 1.0x FY2022F P/B against a forecasted 10.5% FY2022F ROE.

SCI’s path to a sustainable future by 2025

HONG KONG

Alibaba Group Holding Ltd (9988 HK): Upcoming 4Q21 result is the watershed event

- BUY Entry – 100 Target – 125 Stop Loss – 90

- Alibaba Group Holding Ltd is a holding company that provides the technology infrastructure and marketing reach to help merchants, brands and other businesses to leverage the power of new technology to engage with users and customers to operate. The Company operates four business segments. The Core Commerce segment provides China retail, China wholesale, International retail, International wholesale, Cainiao logistics services and local consumer services through Taobao Marketplace and Tmall. The Cloud Computing segment provides complete suite of cloud services, including database, storage, network virtualization services, big data analytics and others. The Digital Media and Entertainment segment provides consumer services beyond the core business operations. The Innovation Initiatives and Others segment is to innovate and deliver new services and products.

- Headwinds or noises. The recent negative news for the e-commerce giant was that the US government has started reviewing its cloud business to determine whether it poses a risk to US national security. However, Alibaba’s cloud services are mainly located in China. Given that US financial institutions have substantial holdings in the company, the US government is not expected to impose sanctions on Alibaba or put it in the entity list.

- Technology re-rating amidst the rate hike cycle. The worst start of 2022 for the US market was driven by the Federal Reserve’s more aggressive than expected rate hike and balance sheet reduction. Technology companies’ shares have been hammered and under selling pressure. However, Chinese technology peers have already re-rated due to policy and geopolitical risks. Comparatively, Chinese companies are less impacted from the sell-off given that downside is limited. YTD, China has recorded more ETF fund inflows than the US.

- Growth is the anchor for valuation. Investors have been averaging down into BABA’s shares since its downturn in 2021 given cheap valuations. We use PEG as a simple valuation metric. Based on Bloomberg estimates, BABA EPS is expected to drop by 20.64% YoY in FY22 and rebound by 13.0% YoY in FY23. Its FY23F PER is at 12.35x. The PEG is about 0.95x, which is lower than the US big tech giants’ averages of between 1.0x and 2.0x.

- Updated market consensus of the EPS growth in FY22/23 are -20.64%/12.99% YoY respectively, which translates to 14.0x/12.4x forward PE. Current PER is 16.8x. Bloomberg consensus average 12-month target price is HK$190.72.

Ganfeng Lithium Co Ltd (1772 HK): A stock with both growth and inflation-hedge features

- RE-ITERATE BUY Entry – 118 Target – 140 Stop Loss – 108

- GANFENG LITHIUM CO., LTD. is a China-based company principally engaged in the research, development, production and sales of deeply processed lithium products. The Company’s main products include lithium compounds, lithium metal and lithium batteries. The Company’s products are mainly used in electrical vehicles, chemicals and pharmaceuticals. The Company distributes its products in the domestic market and to overseas markets.

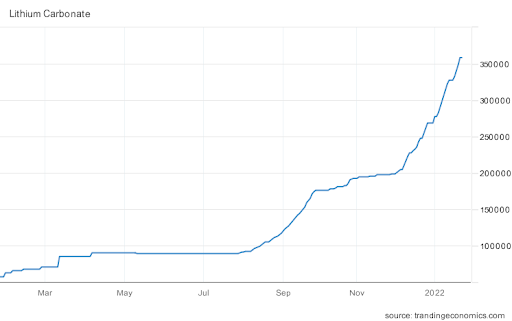

- Lithium carbonate reached another record high. Lithium carbonate prices in China rose to RMB358,500/tonne as of 25th January due to high global demand and tight supplies. Prices have jumped more than 25% YTD. China is expected to double the EV sales in 2022 to more than 5mn units. Meanwhile, battery producers rush to secure long-term supply contracts with lithium mining companies.

Lithium carbonate prices in China reached another record high (RMB/tonne)

- Positive FY21 earnings alert. The company announced the FY21 earnings alert. Net profit attributable to shareholders of the company jumped by between 368.45% and 436.76% YoY to between RMB4.8bn to RMB5.5bn. Net profit after deduction of non-recurring gains and losses jumped by between 621% and 795.04% YoY to between RMB2.9bn and RMB3.6bn.

- Technical breakout from the recent consolidation base. Share price has corrected by 41% from the peak of HK$185 in August 2021 to the low of HK$109 in December 2021. Driven by the positive earnings guidance, shares just broke out the consolidation of around HK$115 amidst the overall market downturn.

- Updated market consensus of the EPS growth in FY22/23 is 67.1%/20.6% YoY respectively, which translates to 23.6x/19.6x forward PE. Current PER is 44.3x. Bloomberg consensus average 12-month target price is HK$203.37.

MARKET MOVERS

United States

Top Sector Gainers

| Sector | Gain | Related News |

| Pharmaceuticals | +1.3% | NA |

| Oil & Gas Production | +1.2% | Oil Flirts With $91 Amid Fear Of Russia-Ukraine Conflict |

| Investment Managers | +1.1% | Blackstone reports record fourth-quarter earnings |

Top Sector Losers

| Sector | Loss | Related News |

| Motor Vehicles | -8.0% | Tesla’s Drop Wiped Out $100 Billion of Market Value in a Day |

| Semiconductors | -4.3% | Chipmakers Crash as Intel, Lam Research Outlooks Disappoint |

| Precious Metals | -2.7% | Gold price back below $1,800 on hawkish signals from Fed |

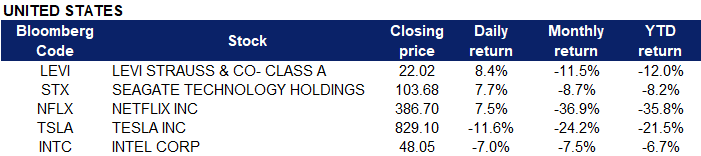

- Levi Strauss & Co (LEVI US) shares gained 8.6% yesterday after the apparel company issued an upbeat annual forecast amid strong demand for its jeans and jackets. Levi Strauss beat estimates on the top and bottom lines for the fourth quarter, earning an adjusted 41 cents per share, one cent above estimates. Levi is seeing no signs of a slowdown despite inflationary headwinds that led the company to raise prices by about 10 percent across a range of apparel items in the fiscal fourth quarter ended Nov. 28. The optimism stands in contrast to the recent trend of companies giving glum outlooks.

- Seagate Technology Holdings Plc (STX US) shares gained 7.7% yesterday after the disk drive maker issued an upbeat forecast and raised its long-term profit margin target. “Calendar 2021 was an outstanding year for Seagate. Compared with the prior calendar year, we grew revenue by 18% and more importantly, delivered free cash flow growth of 39%, which we are deploying effectively into our long-standing capital returns program,” said Dave Mosley, Seagate’s chief executive officer.

- Netflix Inc (NFLX US) shares gained 7.5% yesterday, after Investor William Ackman’s Pershing Square bought 3.1 million shares of the video streaming service, saying a recent sell-off in Netflix shares presented an attractive buying opportunity. Ackman said Netflix benefits from highly recurring revenues, adding the company has pricing power and delivers industry-leading content. He said these companies are high quality businesses that can withstand inflationary pressures because they are able to price their products to preserve profits.

- Tesla Inc (TSLA US) shares dipped 11.6% yesterday. Tesla reported an adjusted quarterly profit of $2.54 per share, 18 cents above estimates, with revenue also topping Wall Street forecasts. However, the company said it would not introduce any new models this year – including its Cybertruck – as it prioritises deliveries in the wake of ongoing supply chain issues.

- Intel Corp (INTC US) shares declined 7% yesterday even though the company beat estimates by 18 cents with adjusted quarterly earnings of $1.09 per share and revenue above analyst estimates. Overall profit was down from a year earlier, as the chipmaker ramped up spending on new production facilities and products. In addition, chief executive officer Patrick Gelsinger said on a conference call that he expected those constraints to persist this year and into next year as the “unprecedented demand” for chips continued.

Singapore

- Rex International Holdings Ltd (REXI SP) shares extended their gains and rose 3.1% yesterday. It was announced yesterday that Rex was approved by SGX for the transfer of listing from the Catalist to Mainboard. In addition, WTI crude futures held above $87 per barrel yesterday after hitting a fresh 7-year high of $87.95 in the previous session, while Brent crude futures held above $89 per barrel yesterday after surging above $90 in the previous session for the first time in seven years. Markets remained concerned over Russia-Ukraine tensions and adding to tight market conditions, OPEC+ is also expected to stick to their plan and ratify another modest production increase of 400,000 bpd next week. Moreover, the latest EIA report showed that crude stockpiles fell for the third week in a row to 31.7 million barrels, getting close to the 30 million barrel-level that traders watch as a warning sign for low inventories. Fellow peer, RH Petrogas Ltd (RHP SG) remained relatively flat with a slight decline of 0.6%.

- Sembcorp Industries Ltd (SCI SP) shares gained 1.3% yesterday. Recently, it was announced that Sembcorp Energy India, a wholly-owned subsidiary of Sembcorp Industries, has signed a long-term power purchase agreement (PPA) to supply 625 megawatts of power to power distribution companies in Andhra Pradesh in India. In addition, Sembcorp FY2021 results will be released on Wednesday, February 23 before trading hours.

- iFAST Corp Ltd (IFAST SP) shares plunged 7.5% yesterday after Citi reiterated ‘sell’ on iFAST as share price plummeted to an eight-month low. In a Jan 27 note, Tan and Kong reiterate their “sell” recommendation, which demurs from consensus calls. They have further trimmed their target price to $6.20 per share, down from $7.50 in a Jan 8 note. They continue to flag additional concerns, including ongoing pressure on platform margins, near-term earnings uncertainty after consolidating the loss-making BFC Bank, dilutive M&A if funds are raised in the equity market and execution risks in BFC Bank.

- Frencken Group Ltd (FRKN SP) shares plunged 6.2% yesterday. On Wednesday, UOBKH cut Frencken’s target price by 21% on seasonal slowdown. UOB Kay Hian Research analyst Clement Ho is “not expecting any surprises” in Frencken Group’s upcoming 4QFY2021 results, to be released in the last week of February. While worldwide chip sales continue to be robust, the technology manufacturer should report slower q-o-q results owing to seasonality effects, adds Ho. In a Jan 25 note, Ho is maintaining “buy” on Frencken with a trimmed target price of $2.06 from $2.62 previously. Correspondingly, fellow peer, UMS Holdings Ltd (UMSH SP) shares declined 4.8% yesterday.

Hong Kong

Top Sector Gainers

| Sector | Gain | Related News |

| Property Investment | +2.59% | Analysis-Debt fears overshadow China’s infrastructure push to fight economic slowdown |

| Accessories & Leather Goods | +1.54% | Team tiger: Luxury brands usher in Chinese New Year with fun and fierce collections |

| Restaurants & Fast Food Shops | +1.00% | NA |

Top Sector Losers

| Sector | Loss | Related News |

| Biotechnology | -3.21% | China has rejected the world’s top mRNA vaccines. Now, it’s making its own |

| Automobile Retailing, Maintenance & Repair | -2.57% | Ford and JMC launch passenger vehicle JV in China |

| Property Management & Agency | -2.39% | Breakup Plans; China Property Stocks Tumble: Evergrande Update |

- Logan Group Company Limited (3380 HK) Shares closed at a 52-week low. The company announced that it issued a convertible bond worth HK$1.95bn. The expiry of the bond is on 4th August 2026, and the coupon rate is 6.95%. The initial conversion price is HK$7.25. Even though it successfully secured financing amid the weak market sentiment, the cost is higher than the previous bond issued half a year ago with a coupon rate of 4.7%. The recent issuance of CMBS also had a lower coupon rate of 5.2%.

- Bilibili Inc (9626 HK) Shares closed at a 52-week low. There was no company-specific news. Bank of America lowered the TP to HK$769 from HK$932 and maintained a BUY rating. The bank expects it to achieve 400mn monthly active users (MAU) in 2023, and the net MAU growth is comparable to what it achieved in 2021, reaching over 60mn this and next year. However, due to macro uncertainties, its advertisements and value-added services growth is lowered to 55% YoY and 43% YoY.

- Kingdee International Software Group Co. (268 HK), Alibaba Group Holding Ltd (9988 HK). Technology stocks were trading lower, following the sell-off in the US market after the FOMC meeting. Both Kingdee and Alibaba closed at a 52-week low.

- MicroPort Scientific Corporation (853 HK) Shares close at a 52-week low. There was no company-specific news. The downturn in the biotech sector continues as the rate hike cycle triggered the sector re-rating. Previously, the company announced that its 46.34%-owned subsidiary Endovascular MedTech (Group) Co., Ltd. reported 40% – 50% YoY growth in net profit attributable equity owners, representing RMB276.85mn to RMB295.94mn.

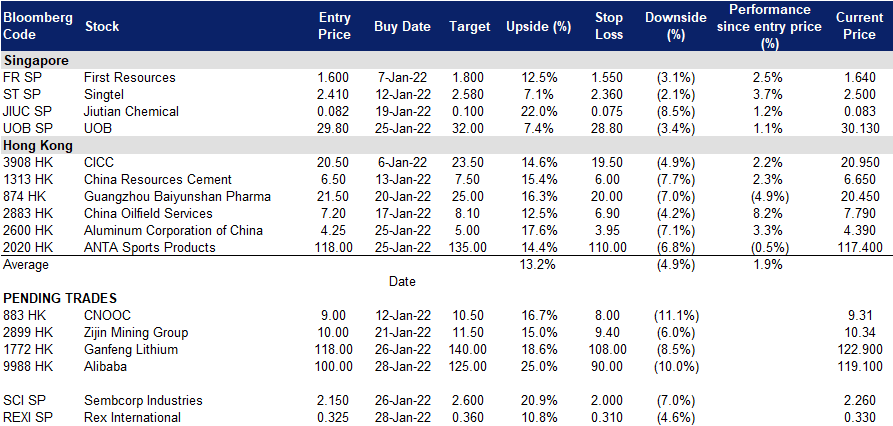

Trading Dashboard

Trading Dashboard Update: Cut loss on Nanofilm Technologies (NANO SP) at S$2.80.

(Click to enlarge image)