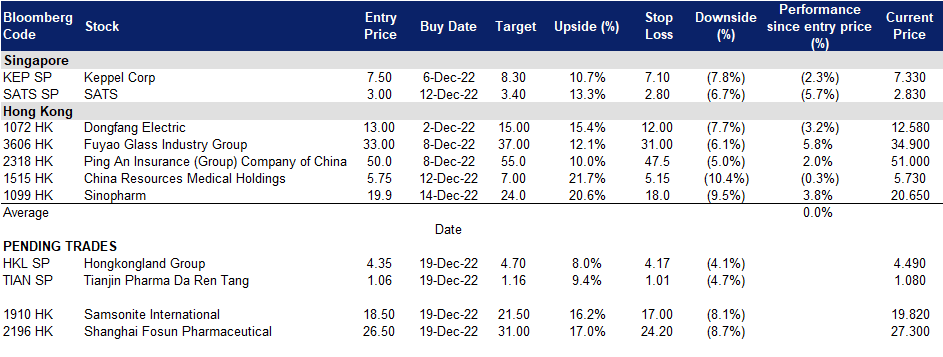

19 December 2022: Tianjin Pharmaceutical Da Ren Tang Group Corp Ltd (TIAN SP), Samsonite International S.A. (1910 HK)

Singapore Trading Ideas | Hong Kong Trading Ideas | Market Movers | Trading Dashboard

Tianjin Pharmaceutical Da Ren Tang Group Corp Ltd (TIAN SP): Panic buying of drugs in China

- Entry – 1.06 Target – 1.16 Stop Loss – 1.01

- Tianjin Pharmaceutical Da Ren Tang Group Corporation Limited produces and sells traditional Chinese medicine, western medicine, health products, and healthcare instruments. The Company also manufactures gene-related biopharmaceutical products. Tianjin Pharmaceutical markets its products under the Great Wall, Cypress, and Health brand names. The Group’s businesses cover a wide range of products including Chinese patent medicine, Chinese medicinal drinks, Chinese medicinal raw materials, biotechnology medicine, chemical raw material medicine and preparations, and nutritional and health products. It has over 800 medicinal products in over 20 types of formulations.

- Surge in Covid cases. With the new Year coming up and pent-up frustrations from the strict Covid-zero policy, many residents will take this opportunity to leave their homes and provinces to physically interact with others. Additionally, with the current lack of need for testing, Covid-infected patients may not be aware and spread the virus. These factors will lead to a sharp increase in Covid numbers in sporadic parts of China, causing hospitals to be overcrowded and a shortage of medicinal supplies.

- China opening up. Although China has eased its Covid-zero policy, the reopening of its economy has resulted in huge excess demand for medical supplies. In fact, most pharmaceutical stores have been wiped clean of Covid-related medical supplies by Chinese residents in most provinces. As such we believe that the company which produces such medicinal products is an excellent buy in China’s current environment. This overdemand means that these pharmaceutical companies can potentially ramp up capacity in the near term.

- The company’s A-shares (600329 CH) are trading at 26.9x currently, while SG-listed shares are trading at 7.0x. The average of the historical 5-year PE is 7.7x.

(Source: Bloomberg)

Hongkong Land Holdings Ltd (HKL SP): China easing Covid restrictions

Hongkong Land Holdings Ltd (HKL SP): China easing Covid restrictions

- Entry – 4.35 Target – 4.70 Stop Loss – 4.17

- Hongkong Land is a major listed property investment, management and development group. The Group owns and manages over 850,000 sq. m. of prime office and luxury retail property in key Asian cities, principally Hong Kong, Singapore, Beijing and Jakarta. The Group also has a number of high-quality residential, commercial and mixed-use projects under development in cities across China and Southeast Asia, including a 43% interest in a 1.1 million sq. m. mixed-use project in West Bund, Shanghai.

- Easing COVID measures. On 8 December, it was reported that Hong Kong may further loosen Covid-related restrictions. The government is considering scrapping its outdoor mask mandate and easing test requirements for inbound travelers. The Chinese government also recently announced that they would allow Covid patients with mild symptoms to isolate at home and drop the requirement for people to show negative tests when traveling between regions.

- Yuan strengthening. China’s onshore and offshore yuan is strengthening against the US dollar. The implementation of China’s policies would stabilise economic growth, restoring market confidence and supporting the yuan. With the Chinese economy expected to open up gradually in the coming year, the yuan will likely appreciate against the US dollar.

- Property sector supporting policy. On 23 November, China’s central bank and Banking and Insurance Regulatory Commission jointly announced 16 measures to ensure the stray and sound development of the housing sector. Additionally, they also urged financial institutions to support real estate financing through various channels. By providing financing to property developers, it can help to stabilise the housing market and prevent risks from spreading beyond the real estate sector. These new policies will also help to boost homebuyer confidence and help to release reasonable housing demand.

- Updated market consensus of the EPS growth in FY22/23 is -10.6%/10.3% YoY respectively, which translates to 12.0x/10.9x forward PE. Current PER is 12.7x. Bloomberg consensus average 12-month target price is S$5.17.

(Source: Bloomberg)

Samsonite International S.A. (1910 HK): Short-term pains for long-term gains

- Buy Entry – 18.5 Target – 21.5 Stop Loss – 17.0

- Samsonite International S.A. is a Hong Kong-based company principally engaged in the design, manufacture, sourcing and distribution of luggages, business and computer bags, outdoor and casual bags, travel accessories and slim protective cases for personal electronic devices. The Company operates its business through three segments. The Travel Bag segment is engaged in travel products with suitcases and carry-ons of three main categories, including hard-side, soft-side and hybrid luggages. The Casual Bags segment is engaged in daily use, including different types of backpacks, female and male shoulder bags and wheeled duffel bags. The Business Bags segment is engaged in business use, including rolling mobile office bags, briefcases and computer bags.

- China to see peak of the current COVID wave by February 2023. China has further lifted COVID measures since early November, and ensuing COVID outbreaks spread across cities with dense populations. However, most cities release a timetable of peak estimates before or during the Chinese New Year period. Meanwhile, China is expected further to lift the quarantine restrictions for inbound tourists in 1Q23. Accordingly, China’s tourism sector is expected to recover quickly in 2023.

- Global tourism to continue to recover in 2023. According to the Economist Intelligence Unit Tourism in 2023 report, the global tourism arrivals will increase by 30% YoY in 2023, following growth of 60% YoY in 2022, but will remain below pre-COVID levels. Meanwhile, EIU also expects international arrivals to recover back to 2019 levels in 2024.

- 3Q22 results review. Net sales jumped by 42.0% (+54.7% constant currency) YoY to US$790.9mn. Operating profit jumped by 140% YoY to US$121.8mn. Profit attributable to the equity shareholders arrived at US$58.2mn in 3Q22 compared to a loss of US$5.2mn in 3Q21. The turnaround of the business and financials was due mainly to the effects of the COVID-19 pandemic on demand for the Group’s products moderated in most countries due to the continued rollout and effectiveness of vaccines leading governments in many countries to further loosen socialdistancing, travel and other restrictions, which has led to the continuing recovery in travel. However, the Chinese government reinstated travel restrictions and social distancing measures in an effort to combat further outbreaks of COVID-19, which has slowed the Group’s net sales recovery in China.

- The updated market consensus of the EPS growth in FY22/23/24 is 1,244.4%/46.3%/18.2% YoY respectively, translating to 19.0×/12.9x/10.9x forward PE. The current PER is 10.9x. Bloomberg consensus average 12-month target price is HK$27.42.

(Source: Bloomberg)

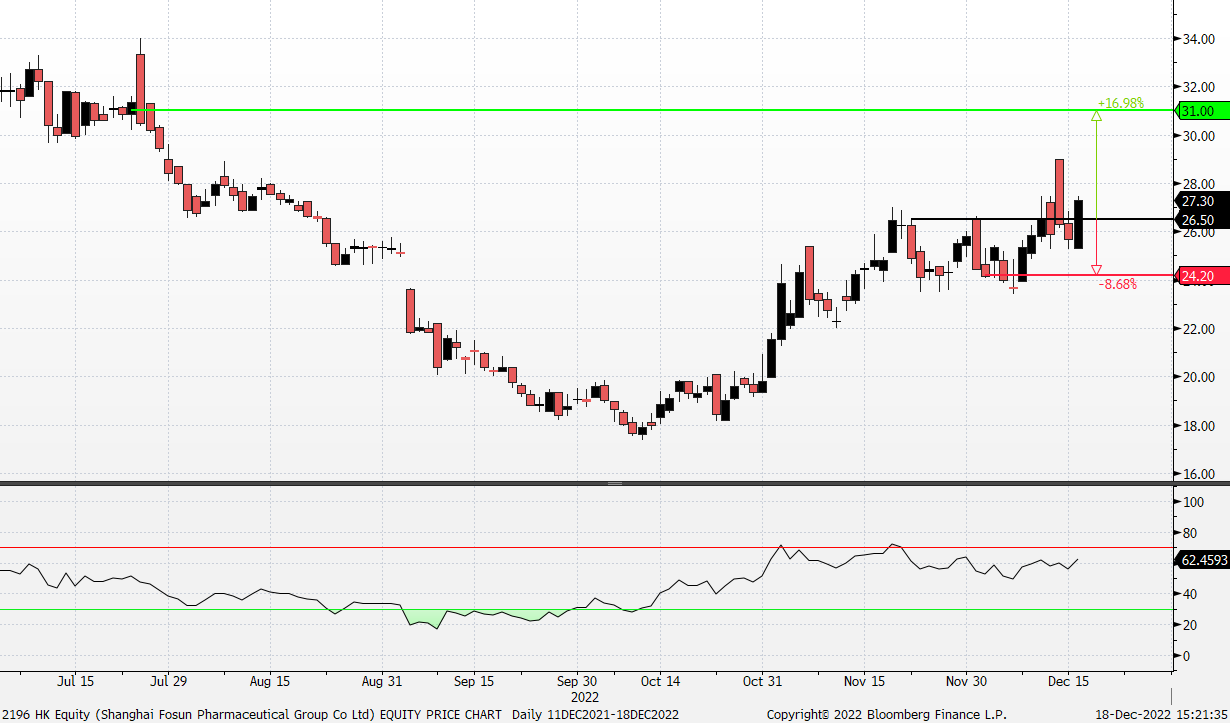

Shanghai Fosun Pharmaceutical (Group) (2196 HK): COVID oral drugs are in demand

Shanghai Fosun Pharmaceutical (Group) (2196 HK): COVID oral drugs are in demand

- Buy Entry – 26.5 Target –31.0 Stop Loss – 24.2

- Shanghai Fosun Pharmaceutical (Group) Co., Ltd. is a China-based company, principally engaged in the research and development, production and distribution of pharmaceuticals. The Company’s products are mainly applied in the treatment of metabolism and digestive tract system, cardiovascular system, central nervous system, blood system, anti-tumor and anti-infection diseases. The Company is also engaged in medical equipment and medical diagnosis business, as well as the provision of medical services. It distributes its products primarily in domestic and overseas markets.

- Exclusive commercial partner of Chinese COVID oral drug. With rising COVID infections, China is seeing panic buying of flu and fever medicine. However, those are not effective for COVID treatment. There are two approved effective oral drugs, Paxlovid and Azvudine, and the latter is developed by the Chinese company Genuine Biotech. Fosun Pharmar is the exclusive partner of Azvudine. In the near term, China is expected to allow both drugs to be sold online. The respective price of Paxlovid and Azudine is RMB2,980 (30 tablets) and RMB310 (35 tablets).

- 3Q22 earnings review. 3Q22 operating revenue edged up by 1.72% YoY to RMB10.3bn. 3Q22 net profit attributable to shareholders decreased by 16.2% YoY to RMB907.0mn. 9M22 operating revenue increased by 16.9% YoY to RMB31.6bn. 9M22 net profit attributable to shareholders increased by 15.5% YoY to RMB2.5bn.

- The updated market consensus of the EPS growth in FY22/23/24 is -13.4%/30.7%/15.4% YoY respectively, translating to 15.3×/11.7x/10.1x forward PE. The current PER is 16.5x. Bloomberg consensus average 12-month target price is HK$38.19.

United States

Top Sector Gainers

| Sector | Gain | Related News |

| Precious Metals | +0.49% | Gold Price Forecast: XAU/USD rebounds ahead of United States data, Federal Reserve talk Newmont Corporation (NEM US) |

| Trucks/Construction/Farm Machinery | +0.22% | EMEA Engineering and Construction Backlog Offsets Supply Pressure Deere & Co (DE US) |

Top Sector Losers

| Sector | Loss | Related News |

| Motor Vehicles | -3.21% | Tesla stock is in the midst of its worst-ever drawdown Tesla Inc (TSLA US) |

| Real Estate Investment Trusts | -2.60% | Blackstone’s real estate fund for wealthy prompts SEC queries, investor scrutiny Prologis Inc (PLD US) |

| Apparel/Footwear | -1.94% | PCE inflation, FedEx, Nike results lead into the holidays: What to know this week Nike Inc (NKE US) |

Hong Kong

Top Sector Gainers

Sector | Gain | Related News |

Alteernative Energy | +6.23% | China’s renewable energy capacity expands in Jan-Nov Xinyi Energy Holdings Ltd (3868 HK) |

Investments & Assets Management | +2.12% | China’s Growth to Pick Up in 2023 on Stimulus, CCTV Reports ESR Group Ltd (1821 HK) |

Petroleum & Gases | +2.00% | China’s largest LNG reserve base begins supplying gas CNOOC Ltd (883 HK) |

Top Sector Losers

Sector | Loss | Related News |

System Applications & IT Consulting | -1.31% | GDS Holdings Ltd (9698 HK) |

Semiconductors | -1.28% | US-China chip war: How the technology dispute is playing out Semiconductor Manufacturing International Corp (981 HK) |

Software | -1.16% | U.S. slaps restrictions on Chinese chipmaker and other companies over national security worries SenseTime Group Inc (0020 HK) |

Trading Dashboard Update: Take profit on China Oilfield Services (2883 HK) at HK$9.36.