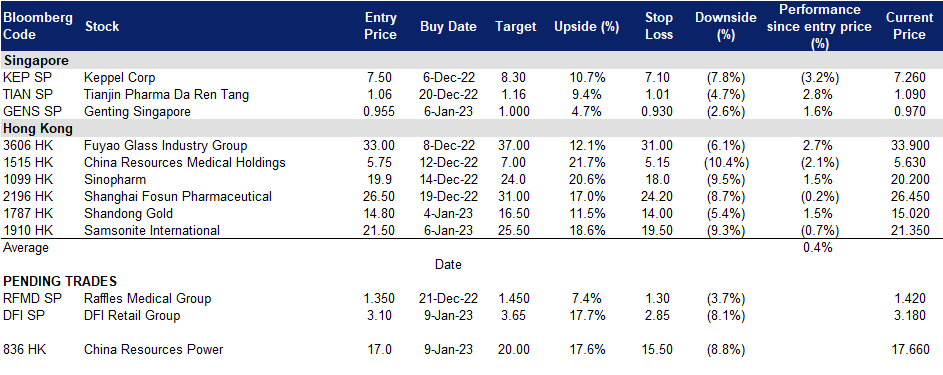

9 January 2023: DFI Retail Group Holdings Ltd (DFI SP), China Resources Power Holdings Company Limited (836 HK)

Singapore Trading Ideas | Hong Kong Trading Ideas | Market Movers | Trading Dashboard

DFI Retail Group Holdings Ltd (DFI SP): Year of recovery

- BUY Entry – 3.10 Target – 3.65 Stop Loss – 2.85

- DFI Retail Group Holdings Limited operates as a retailer in Asia. The company operates through five segments: Food, Health and Beauty, Home Furnishings, Restaurants, and Other Retailing. It primarily operates supermarkets and hypermarkets under the Wellcome, Yonghui, CS Fresh, MarketPlace, Giant, Hero, Mercato, Oliver’s, 3hreesixty, San Miu, Jasons, and Lucky brands; and convenience stores under the 7-Eleven brand. The company also operates health and beauty stores under the Mannings, Guardian, and GNC brands; and home furnishings stores under the IKEA brand, as well as restaurants under the Maxim’s brand.

- Hong Kong-mainland China border reopens. The border reopened on 8th January after a three-year lockdown. The winter of Hong Kong’s retail sector is expected to be over. Tens of thousands of mainlanders will visit Hong Kong for vaccinations and medicines procurement. The influx of visitors will drive retail sales in Hong Kong, revitalising the sector which was badly hit by the pandemic over the past three years.

- Regional retail sector to recover further in 2023. As China reopened its borders, it is expected to see a sharp pent-up demand for overseas travelling. After three-year lockdowns in China, Chinese residents will favour Southeast countries as the destinations as the tour expenditures are relatively affordable. Hence, retail sales in Thailand, Malaysia, Singapore, and other popular tourist countries in the region are expected to further grow, boosted by Chinese tourist consumption.

- 1H22 results review. Total sales mildly edged up by 1% YoY to US$14bn. Loss attributable to shareholders was US$58mn compared to a net profit of US$17mn in 1H21.

- Updated market consensus of the EPS growth in FY23/24 is 523.3%/42.5% YoY respectively, which translates to 21.3x/15.0x forward PE. Current PER is 149.9x. Bloomberg consensus average 12-month target price is S$2.99.

Genting Singapore Ltd (GENS SP): Greet Chinese visitors

Genting Singapore Ltd (GENS SP): Greet Chinese visitors

- RE-ITERATE BUY Entry – 0.955 Target – 1.000 Stop Loss – 0.920

- Genting Singapore is best known for its award-winning flagship project Resorts World Sentosa, one of the largest fully integrated destination resorts in South East Asia. Genting Singapore is one of the constituent stocks of the FTSE Straits Times Index. The principal activities of Genting Singapore and its subsidiaries are in developing, managing and operating integrated resort destinations including gaming, hospitality, MICE, leisure and entertainment facilities.

- Pent-up demand for travel. Singapore’s international visitor arrivals fell slightly to 816,250 in November after hitting a record of 816,758 tourists in October, according to the Singapore Tourism Board’s latest figures. China has scrapped the international travel restrictions, and residents in China now are free to go overseas. Singapore is one of the popular attractions and will see a surge of Chinese visitors in 2023.

- RWS 2.0 expansion. Genting Singapore’s $4.5 billion mega expansion of RWS is proceeding expeditiously as planned. RWS will add two new zones to Universal Studios Singapore – Minion Park and Super Nintendo World – as well as a new oceanarium. The Oceanarium will be three times the size of the SEA Aquarium and encompass a research and learning centre. RWS will also refurbish the Hard Rock Hotel Singapore, Hotel Michael and Festive Hotel, which have around 1,200 rooms in all, in phases from the second quarter of 2022 through 2023. Festive Hotel will be refashioned into a business-leisure and work-vacation hotel, while the Resorts World Convention Centre will be refurbished.

- 3Q22 results. Genting reported a significant improvement in its 3Q results ended in September. For the period, earnings reached $135.8 million, versus $60.7 million in the year-earlier; revenue in the same quarter was $519.7 million, more than double $251.5 million in 3QFY2021, led by increases in both gaming and non-gaming revenue. Non-gaming revenue soared 144.3% YoY to S$137.3 million.

- Updated market consensus of the EPS growth in FY23/24 is 59.6%/10.1% YoY respectively, which translates to 20.5x/18.6x forward PE. Current PER is 64.5x. Bloomberg consensus average 12-month target price is S$0.98.

(Source: Bloomberg)

China Resources Power Holdings Company Limited (836 HK): Power the economic revitalisation

- Buy Entry – 17.0 Target – 20.0 Stop Loss – 15.5

- China Resources Power Holdings Company Limited is a Hong Kong-based investment holding company principally engaged in the investment, development and operation of power plants. The Company operates through three segments. Thermal Power segment is engaged in the investment, development, operation and management of coal-fired power plants and gas-fired power plants, as well as the sales of heat and electricity. Renewable Energy segment is engaged in wind power generation, hydroelectric power generation and photovoltaic power generation, as well as the sales of electricity. Coal Mining segment is engaged in the mining of coal mines, as well as the sales of coal. The Company mainly operates businesses in China.

- Year of economic revitalisation. China has abandoned zero-covid policies by the end of 2022. Meanwhile, the authority released guidelines to expand domestic consumption in 2023, easing the crackdowns on several key sectors including real estate, technology, and education. On the other hand, China will continue to rely on infrastructure expansion to drive its economic growth, and one of the subsectors that are supported by policies is renewable energy. There are two tailwinds for the power sector, inorganic growth from clean energy (wind and solar) demand and margin improvement.

- Resumption of Australian coal import. In the first week of 2023, the National Development and Reform Commission is reported to hold talks with four state-owned importers over the partial lifting of the import ban on Australian thermal and coking coal. It is positive for the power sector as there will be more supply during the spring re-stocking period, and the seasonal increase in coal prices during the summer season will be mitigated accordingly. Therefore, the power sector will not see a sharp margin compression during the peak season in mid-year.

- November operation updates. Total net generation of subsidiary power plants in 11M22 increased by 3.9% YoY to 166,051,785MWh, among which, subsidiary wind farms increased by 10.5% YoY to 31,718,587MWh, subsidiary photovoltaic plants increased by 18.2% YoY to 1,243,941MWh.

- 1H22 earnings review. Turnover grew by 17.78% YoY to HK$50.4bn. The increase was mainly attributable to a YoY increase of 23.9% in the average on-grid tariffs (tax exclusive) of subsidiary coal-fired power plants and a YoY increase of 19.9% in the average sales price of heat supply of subsidiary coal-fired power plants. Net profit attributable to shareholders of the company dropped by 22.46% YoY to HK$4.4bn. The fall in net profit was due to the increase in operating expenses resulted from higher raw material costs.

- The updated market consensus of the EPS growth in FY23/24 is 37.8%/17.6% YoY, respectively, translating to 7.5×/6.4x forward PE. The current PER is 98.2x. FY23F/24F dividend yield is 5.4%/6.5% respectively. Bloomberg consensus average 12-month target price is HK$20.51.

Samsonite International S.A. (1910 HK): Chase the upward momentum

Samsonite International S.A. (1910 HK): Chase the upward momentum

- RE-ITERATE Buy Entry –21.5 Target – 25.5 Stop Loss – 19.5

- Samsonite International S.A. is a Hong Kong-based company principally engaged in the design, manufacture, sourcing and distribution of luggages, business and computer bags, outdoor and casual bags, travel accessories and slim protective cases for personal electronic devices. The Company operates its business through three segments. The Travel Bag segment is engaged in travel products with suitcases and carry-ons of three main categories, including hard-side, soft-side and hybrid luggages. The Casual Bags segment is engaged in daily use, including different types of backpacks, female and male shoulder bags and wheeled duffel bags. The Business Bags segment is engaged in business use, including rolling mobile office bags, briefcases and computer bags.

- China to see a peak of the current COVID wave by February 2023. China has further lifted COVID measures since early November, and ensuing COVID outbreaks spread across cities with dense populations. However, most cities release a timetable of peak estimates before or during the Chinese New Year period. Meanwhile, China is expected further to lift the quarantine restrictions for inbound tourists in 1Q23. Accordingly, China’s tourism sector is expected to recover quickly in 2023.

- Global tourism to continue to recover in 2023. According to the Economist Intelligence Unit Tourism in 2023 report, the global tourism arrivals will increase by 30% YoY in 2023, following growth of 60% YoY in 2022, but will remain below pre-COVID levels. Meanwhile, EIU also expects international arrivals to recover back to 2019 levels in 2024.

- 3Q22 results review. Net sales jumped by 42.0% (+54.7% constant currency) YoY to US$790.9mn. Operating profit jumped by 140% YoY to US$121.8mn. Profit attributable to the equity shareholders arrived at US$58.2mn in 3Q22 compared to a loss of US$5.2mn in 3Q21. The turnaround of the business and financials was due mainly to the effects of the COVID-19 pandemic on demand for the Group’s products moderated in most countries due to the continued rollout and effectiveness of vaccines leading governments in many countries to further loosen socialdistancing, travel and other restrictions, which has led to the continuing recovery in travel. However, the Chinese government reinstated travel restrictions and social distancing measures in an effort to combat further outbreaks of COVID-19, which has slowed the Group’s net sales recovery in China.

- The updated market consensus of the EPS growth in FY23/24 is 43.9%/16.3% YoY respectively, translating to 14.4x/12.4x forward PE. The current PER is 12.3x. Bloomberg consensus average 12-month target price is HK$27.42.

United States

Top Sector Gainers

| Sector | Gain/ Loss | Related News |

| Electronic Technology | +3.59% | Apple reportedly delays mixed reality headset launch and cancels iPhone SE 4 Apple Inc. (AAPL US) |

| Non-Energy Minerals | +3.48% | Copper price rises on China-led demand hopes BHP Group Ltd (BHP US) |

| Transportation | +3.19% | FedEx Freight adds returns to home delivery portfolio Unit Parcel Service, Inc. (UPS US) |

Top Sector Losers

| Sector | Gain/ Loss | Related News |

| Health Services | +0.47% | Data center used by UnitedHealth Group sold for $90M UnitedHealth Group Inc. (UNH US) |

| Health Technology | +1.11% | J&J’s consumer health unit Kenvue prepares to leave the nest with IPO filing Johnson & Johnson (JNJ US) |

| Technology Services | +1.49% | Salesforce co-CEO Marc Benioff hints at more potential layoffs after this week’s job cuts Microsft Corp. (MSFT US) |

Hong Kong

Top Sector Gainers

|

Sector |

Gain/ Loss |

Related News |

|

Petroleum & Gases |

+4.46% |

Increased Chinese Crude Buying Spooks European Oil Traders China National Offshore Oil Corporation (0883 HK) |

|

Environmental Energy Materials |

+3.46% |

Big Solar Panel Manufacturers Boost Production as Costs Fall Xinyi Solar Holdings Ltd. (0968 HK) |

|

Software |

+3.22% |

IoT Platforms and Software Market to Reach $9.4 Billion by 2026 SenseTime Group Inc. (0020 HK) |

Top Sector Losers

|

Sector |

Gain/ Loss |

Related News |

|

Airline Services |

-2.81% |

Cathay Pacific ramps up flights between Hong Kong and China as borders reopen Cathay Pacific (0293 HK) |

|

Gamble |

-1.71% |

Good news for casinos as Macao eases travel restrictions Galaxy Entertainment Group Ltd. (0027 HK) |

|

Alcoholic Drinks & Tobacco |

-1.42% |

Budweiser APAC (1876 HK) |

Trading Dashboard Update: Add Genting Singapore (GENS SP) at S$0.955 and Samsonite International (1910 HK) at HK$21.5.

(Source: Bloomberg)

(Source: Bloomberg)

(Source: Bloomberg)

(Source: Bloomberg)