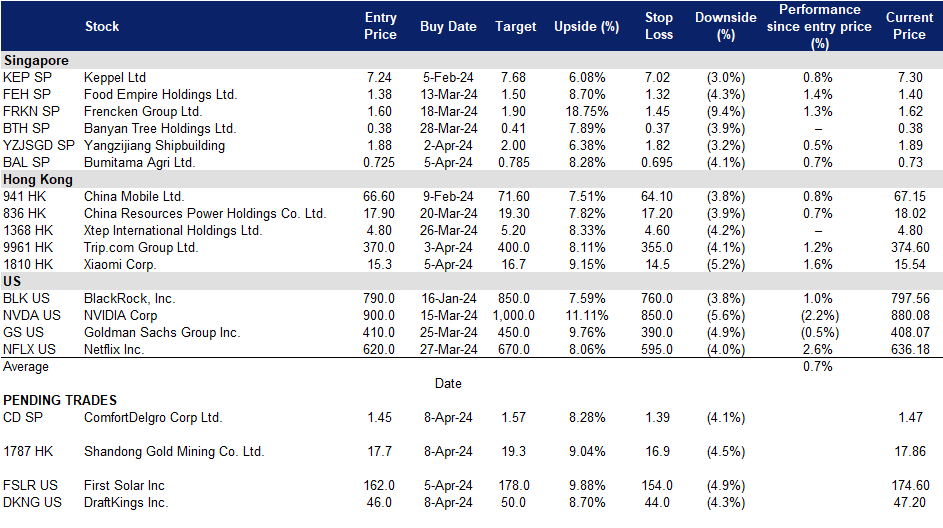

08 April 2024: ComfortDelGro Corp Ltd (CD SP), Shandong Gold Mining Co. Ltd. (1787 HK), DraftKings Inc (DKNG US)

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

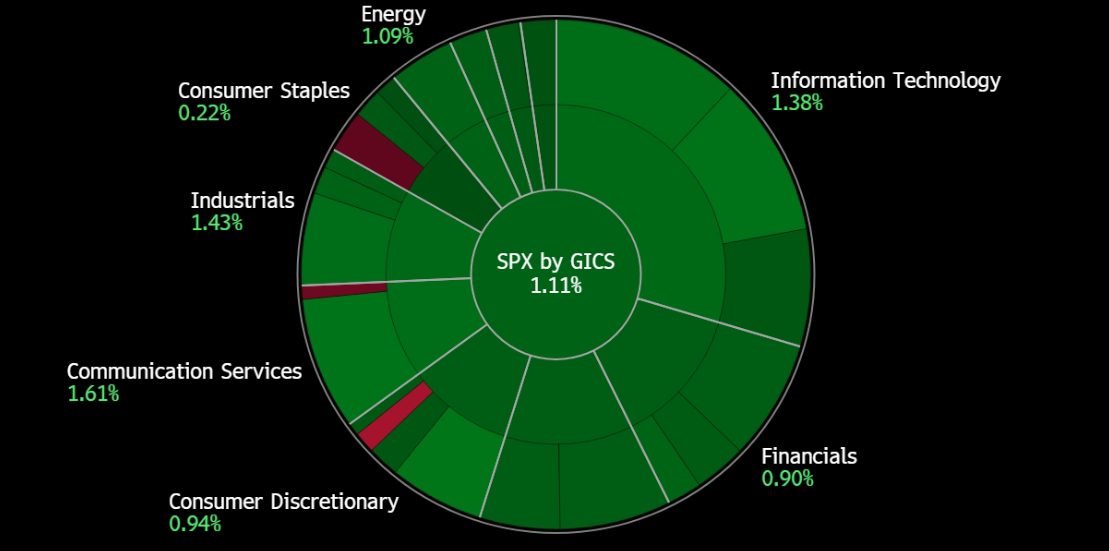

United States

|

News Feed |

|

4. Apple asks US appeals court to reverse Apple Watch import ban |

|

5. Biggest gold miners are missing out on bullion’s record run |

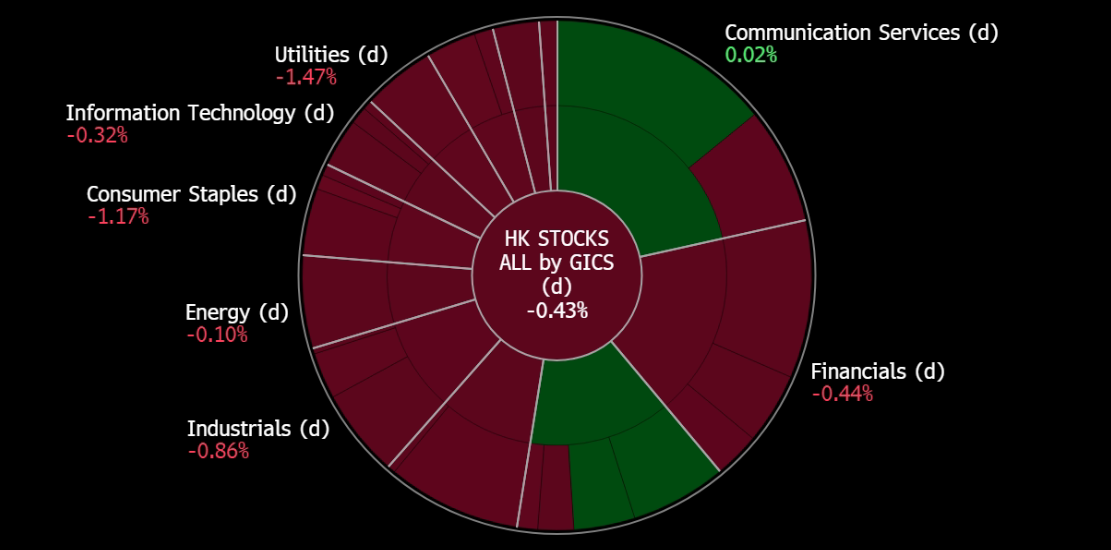

Hong Kong

ComfortDelGro Corp Ltd (CD SP): Upbeat overseas expansion

- Entry – 1.45 Target– 1.57 Stop Loss – 1.39

- ComfortDelGro Corporation Limited provides land transportation services. The Company offers bus, taxi, rail, car rental and leasing, automotive engineering services, inspection and testing services, driving center, insurance broking services, and outdoor advertising.

- Regulatory changes in Singapore. The Land Transport Authority (LTA) is introducing new standards for taxi and ride-hailing operators to enhance service reliability and reduce operational costs. Operators must notify LTA, passengers, and drivers within an hour of any incidents affecting service provision. Taxi operators will see lower operating costs through changes like extending the lifespan of non-electric cabs and reducing inspection frequency for newer taxis. Regulatory tweaks aim to balance the regulatory burden between taxis and private-hire cars. While concerns over driver earnings persist, the proposed changes aim to stabilize the transport sector and maintain a balance between taxis and private-hire cars. These new standards will bolster ComfortDelGro’s efforts to enhance its Taxi & Private Hire segment in Singapore, aligning with the increasing demand for personal transportation services.

- Secured contracts in Manchester. Metroline Limited, a subsidiary of ComfortDelGro, has secured contracts valued at £422mn to operate four public-bus franchises in the UK for five years. Awarded by the Greater Manchester Combined Authority, the contracts include options for two one-year extensions. Metroline will operate 232 services with 420 buses and over 1,350 employees, doubling its services and representing a 30% increase over its London portfolio. ComfortDelGro’s track record positions it well to fulfill these contracts, according to its managing director Cheng Siak Kian. This move aligns with ComfortDelGro’s strategy to strengthen its core public transportation businesses and solidify its reputation as a leading multi-modal transport operator.

- Acquisition of A2B. Shareholders of Australian taxi network operator A2B voted overwhelmingly in favour of ComfortDelGro’s acquisition, with 97.7% of votes cast supporting the deal. ComfortDelGro proposed to acquire all shares in A2B Australia for A$1.45 per share, totaling A$165.1 million. The transaction is expected to be finalized in April 2024 pending court approval. Upon completion, A2B’s 8,000-vehicle network will complement ComfortDelGro’s global taxi fleet of 21,300 vehicles. ComfortDelGro’s managing director sees A2B as a strategic fit to expand the company’s point-to-point offerings and strengthen its presence in the Australian market. This acquisition aligns with ComfortDelGro’s strategy to grow and defend its core transport businesses, which contributed to a 4.2% revenue increase and a 76.5% net profit growth in H2 FY2023. Additionally, ComfortDelGro has been expanding its global presence through acquisitions and joint ventures, such as the recent acquisition of CMAC Group and securing contracts for metro lines in Paris and Stockholm.

- FY23 results review. FY23 revenue rose by 2.6% YoY to S$3,880.3mn, compared to S$3,780.8mn in FY22. Net profit inclined 4.3% YoY to S$180.5mn, compared to S$173.1mn in FY22. FY23 earnings would have risen 26.6% YoY, excluding the one-off gain of S$30.5mn from its sale of its Alperton property in London in FY22. The taxi and private hire business had a 59.5% YoY jump in operating profit to S$106.7mn in FY23. Basic EPS rose to S$8.33 in FY23 compared to S$7.99 in FY22. FY23 total dividend amounted to 6.66 sing cents per share.

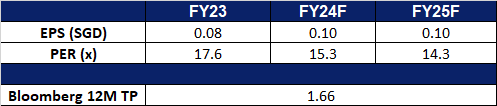

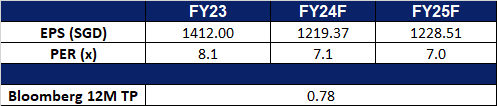

- Market Consensus

(Source: Bloomberg)

Bumitama Agri Ltd (BAL SP): Palm oil rally

- RE-ITERATE Entry – 0.725 Target– 0.785 Stop Loss – 0.695

- Bumitama Agri Ltd. produces CPO and PK, with its oil palm plantations located in Indonesia. The Company’s primary business activities are cultivating and harvesting our oil palm trees, processing FFB from its oil palm plantations, its plasma plantations and third parties into CPO and PK and selling CPO and PK in Indonesia.

- Palm oil prices continue to rise. Malaysian palm oil futures has been rallying since the start of 2024, from around MYR 3,700/T since Jan, to its current level of around MYR 4,450/ T, hitting a new high since June 2022. This rally in palm oil prices are driven by current low stockpiles which led to a mini rally in palm oil prices. Palm oil inventory in Malaysia for February dropped to just over 1.9 mn tonnes from 2.0mn tonnes in January. Demand for palm oil also has remained strong, especially from the largest importer India, where inclement weather has prompted higher imports of edible oils. On cargo surveyors’ data, shipments of Malaysian palm oil products for March were seen rising between 11.77% and 29.2%, according to Intertek Testing Services, AmSpec Agri Malaysia, and Societe Generale de Surveillance.

- Expectation of strong demand for palm oil amidst stagnant supply. The outlook for the palm oil market in 2024 appears optimistic, as indicated by Malaysia’s Plantation and Commodities Minister. Strong demand is anticipated from key export destinations such as India, China, and the European Union. However, projections suggest that crude palm oil (CPO) production in Indonesia is likely to remain largely unchanged at 49 million tonnes in 2024 compared to the previous year. This stability is attributed to factors like adverse weather conditions and a slower pace of re-planting activities. As a result, palm oil supply is expected to remain constrained in the first quarter of 2024, primarily due to seasonally lower production levels and recent inclement weather hampering harvesting operations.

- Expected increased demand from Ramadan fasting period. The ongoing Ramadan fasting period and preparations for the Eid-al Fitr festival is likely to indirectly spur a higher demand for palm oil as families and communities gather for elaborate meals. This upsurge in food preparation naturally leads to a higher demand for cooking oil, and palm oil is a popular choice due to its versatility and affordability.

- FY23 results review. FY23 revenue declined by 2.4% to IDR15,442bn, compared to IDR15,829bn in FY22. Net profit declined 13.8% YoY to IDR2,931bn, compared to IDR3,398bn in FY22. Basic EPS fell to IDR 1,412 in FY23 compared to IDR1,618 in FY22.

- Market Consensus

(Source: Bloomberg)

Shandong Gold Mining Co. Ltd. (1787 HK): Record Gold Prices

- BUY Entry – 17.70 Target – 19.30 Stop Loss – 16.90

- Shandong Gold Mining Co., Ltd. is a China-based company principally engaged in the mining, processing and sales of gold. The Company operates two segments. The Gold Mining segment is engaged in the mining of gold ore. The Gold Refining segment is engaged in the production and sales of gold. The Company is also engaged in the distribution of other metals extracted during the gold ore smelting process, such as silver, copper, iron, lead and zinc. The Company conducts its businesses in domestic and overseas markets.

- Gold prices all time high. Gold prices rose past $2,320 an ounce last Friday, touching a new record high and building on the gains for the third straight week. The precious metal has been supported by US interest rate cut bets, speculative buying and central bank purchases, amid strong US job growth in March. The country’s economy added the most jobs in 10 months, while jobless rate dropped below forecasts, indicating the continued tightness in the labor market and supporting the case for the interest rates to remain restrictive longer.

- Continued global geopolitical tension and economic uncertainties. The ongoing Israle-Hamas conflict is likely to continue escalate regional tensions. Recently, suspected Israeli warplanes bombed Iran’s embassy in Syria on Monday in a strike that Iran said killed seven of its military advisers, including three senior commanders, marking a major escalation in Israel’s war with its regional adversaries. Red sea attacks by the Houthis, as well as the recent Baltimore bridge incident, has caused more uncertainty in the global economy. Rising global geopolitical tensions and economic uncertainties lead to the pursuit of safe haven assets such as gold.

- Increasing controlling stake of Gold Mine in Inner Mongolia. Shandong Gold Mining, recently announced that it plans to buy a controlling stake in the operator of a gold mine in China’s northeastern Inner Mongolia Autonomous Region. The company will be acquiring a 70% stake in Baotou Changtai Mining for RMB471mn (US$66mn). The acquisition will bring Shandong Gold over 16 tons of new proven gold resource holdings, which may grow to more than 20 tons as the exploration progresses this year. This also marks the third gold mine acquisition that Shandong Gold and its controlled companies announced this year.

- FY23 results. Total revenue increased by 17.8% YoY to RMB59.3bn in FY23, compared to RMB50.3bn in FY22. Gross profit increased by 39.9% to RMB6.63bn in FY23, compared to RMB6.17bn in FY22. Net profit increased by 108.5% YoY to RMB2.82bn in FY23, compared to RMB1.35bn in FY22.

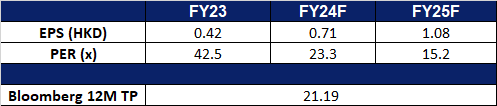

- Market Consensus.

(Source: Bloomberg)

Xiaomi Corp. (1810 HK): Strong EV orders

- RE-ITERATE BUY Entry – 15.30 Target – 16.70 Stop Loss – 14.60

- Xiaomi Corp. is a China-based investment holding company principally engaged in the research, development and sales of smartphones, Internet of things (IoTs) and lifestyle products, the provision of Internet services, and investment business. The Company mainly conducts its businesses through four segments. The Smartphone segment is engaged in the sales of smartphones. The IoT and Lifestyle product segment is engaged in the sales of other in-house products, including smart televisions (TVs), laptops, artificial intelligence (AI) speakers and smart routers; ecosystem products, including IoT and other smart hardware products, as well as certain lifestyle products. The Internet service segment is engaged in the provision of advertising services and Internet value-added services. The Others segment is engaged in the provision of repair services for its hardware products. The Company distributes its products in domestic market and to overseas markets.

- Strong orders for new EV. Xiaomi recently entered China’s EV market, launching the Xiaomi’s Speed Ultra (SU7). The company announced that it has received over 100,000 orders for its new EVs, with 88,898 pre-orders for the car in the first 24 hours of sales. The company has just started deliveries of its first batch of 5,000 cars to its customers, and highlighted to new potential buyers of its sedan that they could face wait times of four to seven months, a sign of strong interest. The car was priced under $30,000 for the base model, making it a very attractive price point for consumers. Furthermore, Xiaomi’s smartphone expertise also provided the company with an edge in smart dashboard, which is a featured prized by Chinese consumers.

- Sufficient cash reserves. Xiaomi’s new EV is priced under $30,000, the company may see a loss on each vehicle it sells in the meantime, However, the company, leveraging on its main smartphone business, has a strong cash reserve of over US$15mn to help to cope with tight competition in the EV space. This strong cash position would allow the company to slowly gain market share and return to profitability for its EV business.

- Further Integration of new operating system. Xiaomi announced recently that it will be extending its new operating system, the Xiaomi HyperOS to more Xiaomi and Redmi devices. HyperOS is expected to power not only smartphones but also smart home devices and even electric vehicles like the new Xiaomi SU7. With the launch of the new Xiaomi SU7 EV, customers can expects to gain a seamless experience in a new smart ecosystem between the EV and their phones. This shift into a new operating system also marks a strategic move of the company’s vision into creating a seamless smart ecosystem, “Human x Car x Home”. This ecosystem is bound to entice consumers to purchase Xiaomi’s other products as well.

- FY23 earnings. Total revenue fell 3.2% YoY to RMB271.0bn in FY23, compared to RMB280.0bn in FY22. Gross profit increased by 20.8% to RMB57.5bn in FY23, compared to RMB47.6bn in FY22. Net profit increased by 598.2% YoY to RMB17.5bn in FY23, compared to RMB2.50bn in FY22.

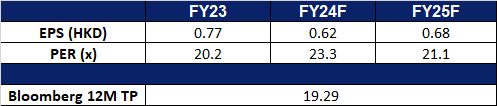

- Market consensus.

(Source: Bloomberg)

DraftKings Inc (DKNG US): Expanding market footprints

- BUY Entry – 46 Target – 50 Stop Loss – 44

- DraftKings Inc. operates as a daily fantasy sports contest and sports betting company. The Company allows users to enter daily and weekly fantasy sports-related contests and win money based on individual player performances in American sports. DraftKings serves customers in the United States.

- Eyeing entry to Brazil. DraftKings and MGM Resorts International are among the companies eyeing entry into Brazil’s newly regulated online gambling market, one of the world’s top 10 betting markets. Brazil relaxed its online gambling laws in 2018, and a 2023 law established the regulatory framework for fixed-odds sports betting and virtual online gaming services. Over 130 companies, including DraftKings and MGM, have expressed interest in obtaining a Brazilian license. Both companies are exploring potential opportunities in Brazil’s market.

- Horse racing partnership. DraftKings has secured a partnership with the New York Racing Association (NYRA), making them the official betting partner of Saratoga Race Course and the Belmont Stakes Racing Festival. They will also serve as the presenting sponsor of the Travers. The highlight of the partnership is the 155th running of the US$1.25mn DraftKings Travers on 24 August, which will feature five Grade 1 events and national television coverage on FOX. Additionally, DraftKings’ advance deposit wagering offering, DK Horse, will be prominently featured throughout the Belmont Stakes Racing Festival, including as the presenting sponsor of the US$500,000 DK Horse Acorn. This collaboration aims to expand the reach of horse racing to a broader audience of fans and bettors.

- Launch of responsible gaming association. Seven major online betting operators in the United States have formed the Responsible Online Gaming Association (ROGA), aiming to promote responsible online gaming through research, education, and awareness efforts. The members, including BetMGM, DraftKings, and FanDuel, have pledged US$20mn towards initiatives such as academic research and creating a responsible gaming certification program. Representing over 85% of the legal online sports betting and iGaming market, ROGA aims to enhance consumer protections and provide easier access to responsible gaming tools. Led by industry veteran Dr. Jennifer Shatley, ROGA’s launch coincides with Problem Gambling Awareness Month and follows recent sports betting scandals highlighting the importance of responsible gaming measures.

- 4Q23 earnings review. Revenue was US$1.23bn, rising 43.9% YoY, missing expectations by US$10mn. Non-GAAP earnings per share were US$0.29, beating expectations by US$0.11. DraftKings is raising its FY24 revenue guidance to a range of US$4.65bn to US$4.90bn from the range of US$4.50bn to US$4.80bn. The Company now expects FY24 adjusted EBITDA of between US$410mn and US$510mn.

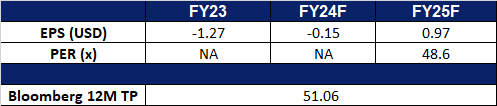

- Market consensus.

(Source: Bloomberg)

First Solar Inc (FSLR US): Next sector to benefit from the AI wave

- RE-ITERATE BUY Entry – 162 Target – 178 Stop Loss – 154

- First Solar, Inc. designs and manufactures solar modules. The Company uses a thin film semiconductor technology to manufacture electricity-producing solar modules.

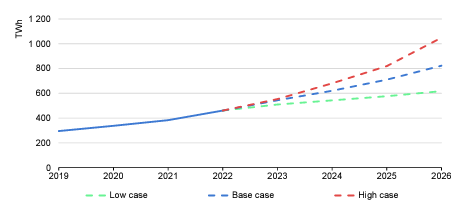

- Doubled electricity demand from data centres towards 2026. The 2024 IEA electricity report shows that global electricity demand from data centres, cryptocurrencies, and artificial intelligence (AI) is projected to nearly double by 2026, reaching between 620 and 1,050 terawatt-hours (TWh), with a base case of just over 800 TWh, up from 460 TWh in 2022. This surge in demand, driven by the expansion of digitalization, poses challenges and opportunities for various regions. In the United States, data centre electricity consumption is forecasted to rise rapidly, with Virginia’s data centre sector becoming a significant economic driver. China anticipates doubling its data centre electricity demand by 2030, while the European Union aims to bolster sustainable practices in data centres to align with decarbonization goals. In Ireland, data centres are expected to consume almost one-third of the country’s electricity by 2026. Efforts to enhance energy efficiency and regulatory measures are underway globally to mitigate the environmental impact of escalating electricity consumption in data centres. First Solar stands to benefit from the projected surge in electricity demand as solar energy can help these data centres to mitigate the environmental impact of escalating electricity consumption by providing renewable and sustainable power sources, thus contributing to the reduction of carbon emissions and promoting greener operations.

Global electricity demand from data centres, AI and cryptocurrencies

(Source: IEA electricity 2024 report)

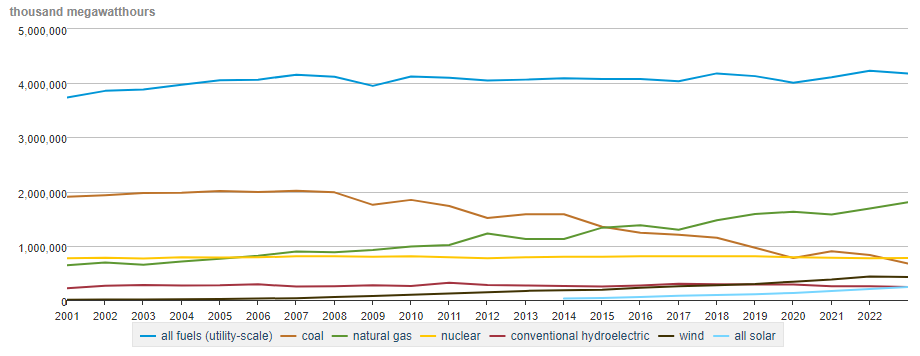

- Solar demand to grow. In the coming years, solar panel installations are predicted to substantially increase in the United States to meet the soaring electricity demand, driven particularly by data centres, electric vehicles, and heating/cooling systems. This surge comes as legacy power plants retire, and solar emerges as a cost-effective and rapid solution. Solar energy, being one of the fastest-growing energy sources in the US, is expected to expand significantly despite challenges like permitting delays and increased capital costs. In response to the growing demand, solar companies plan to boost their manufacturing capacity, buoyed by tax incentives under President Biden’s Inflation Reduction Act.

Net electricity generation in the United States

(Source: US Energy Information Administration)

- 4Q23 earnings review. Revenue was US$1.16bn, rising 16.0% YoY, missing expectations by US$160mn. GAAP earnings per share were US$3.25, beating expectations by US$0.13. The company issued FY24 guidance for revenue of US$4.4B to US$4.6B and EPS US$13 to US$14, compared to analyst consensus estimates of US$4.56B of revenue and EPS of US$13.26. FSLR also forecast full-year sales volumes of 15.6 to 16.3 GW, gross margin of US$2bn to US$2.1bn, and operating income of US$1.5bn to US$1.6bn on sales volume of 15.6 to 16.3 GW, which includes anticipated Section 45X tax credits of US$1bn to US$1.05bn and US$85mn to US$95mn of production start-up expense; year-end net cash balance is projected at US$900mn to US$1.2bn.

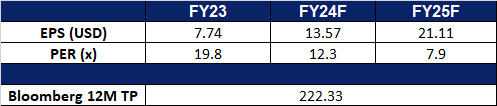

- Market consensus.

(Source: Bloomberg)

Trading Dashboard Update: Add Bumitama Agri Ltd. (BAL SP) at S$0.725, Trip.com Group Ltd. (9961 HK) at HK$370, and Xiaomi Corp. (1810 HK) at HK$15.40.