05 April 2024: Bumitama Agri Ltd (BAL SP), Xiaomi Corp. (1810 HK), First Solar Inc (FSLR US)

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

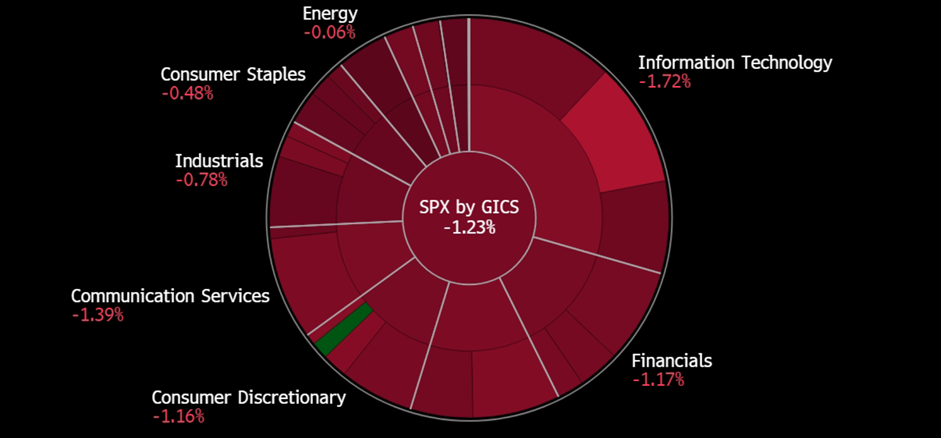

United States

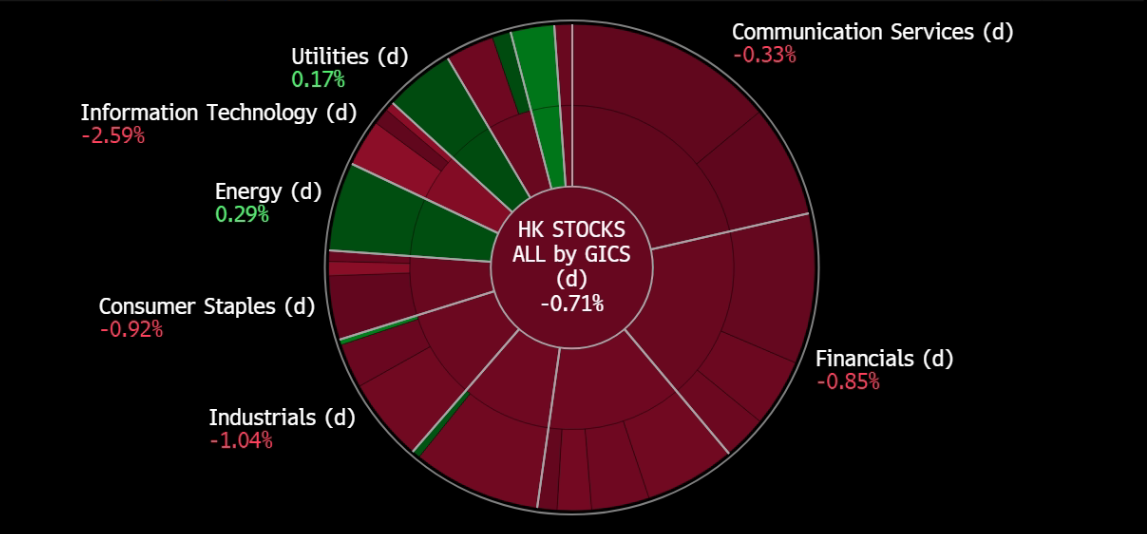

Hong Kong

Bumitama Agri Ltd (BAL SP): Palm oil rally

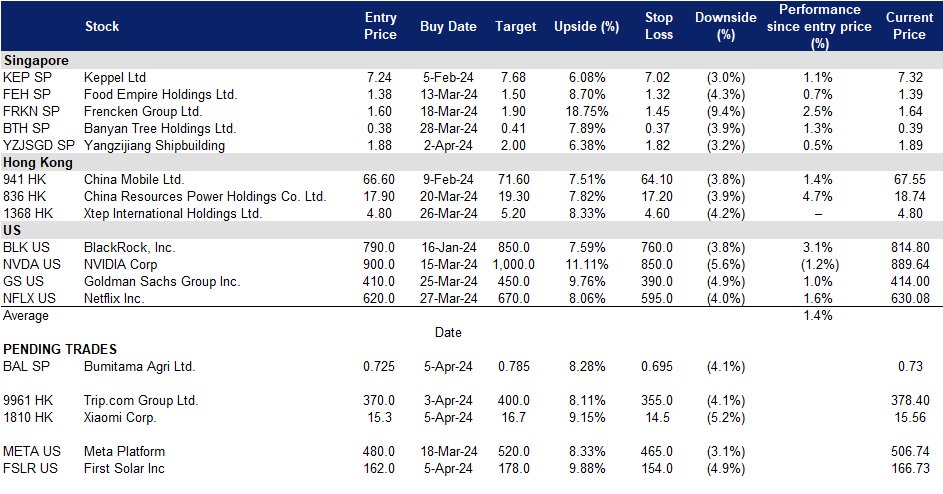

- Entry – 0.725 Target– 0.785 Stop Loss – 0.695

- Bumitama Agri Ltd. produces CPO and PK, with its oil palm plantations located in Indonesia. The Company’s primary business activities are cultivating and harvesting our oil palm trees, processing FFB from its oil palm plantations, its plasma plantations and third parties into CPO and PK and selling CPO and PK in Indonesia.

- Palm oil prices continue to rise. Malaysian palm oil futures has been rallying since the start of 2024, from around MYR 3,700/T since Jan, to its current level of around MYR 4,450/ T, hitting a new high since June 2022. This rally in palm oil prices are driven by current low stockpiles which led to a mini rally in palm oil prices. Palm oil inventory in Malaysia for February dropped to just over 1.9 mn tonnes from 2.0mn tonnes in January. Demand for palm oil also has remained strong, especially from the largest importer India, where inclement weather has prompted higher imports of edible oils. On cargo surveyors’ data, shipments of Malaysian palm oil products for March were seen rising between 11.77% and 29.2%, according to Intertek Testing Services, AmSpec Agri Malaysia, and Societe Generale de Surveillance.

- Expectation of strong demand for palm oil amidst stagnant supply. The outlook for the palm oil market in 2024 appears optimistic, as indicated by Malaysia’s Plantation and Commodities Minister. Strong demand is anticipated from key export destinations such as India, China, and the European Union. However, projections suggest that crude palm oil (CPO) production in Indonesia is likely to remain largely unchanged at 49 million tonnes in 2024 compared to the previous year. This stability is attributed to factors like adverse weather conditions and a slower pace of re-planting activities. As a result, palm oil supply is expected to remain constrained in the first quarter of 2024, primarily due to seasonally lower production levels and recent inclement weather hampering harvesting operations.

- Expected increased demand from Ramadan fasting period. The ongoing Ramadan fasting period and preparations for the Eid-al Fitr festival is likely to indirectly spur a higher demand for palm oil as families and communities gather for elaborate meals. This upsurge in food preparation naturally leads to a higher demand for cooking oil, and palm oil is a popular choice due to its versatility and affordability.

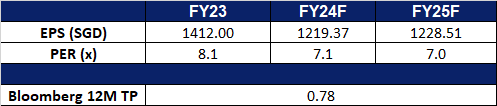

- FY23 results review. FY23 revenue declined by 2.4% to IDR15,442bn, compared to IDR15,829bn in FY22. Net profit declined 13.8% YoY to IDR2,931bn, compared to IDR3,398bn in FY22. Basic EPS fell to IDR 1,412 in FY23 compared to IDR1,618 in FY22.

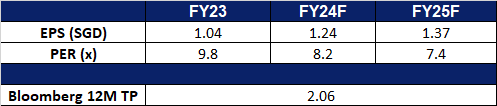

- Market Consensus

(Source: Bloomberg)

Yangzijiang Shipbuilding (YZJSGD SP): Taking advantage of the RMB and strong shipping demand

- RE-ITERATE BUY Entry – 1.88 Target– 2.00 Stop Loss – 1.82

- Yangzijiang Shipbuilding Holdings Limited builds a wide range of ships. The Company produces a wide range of commercial vessels, mini bulk carriers, multi-purpose cargo vessels, container ships, chemical tankers, offshore supply vessels, rescue and salvage vessels, and lifting vessels.

- Hedging against potential weakening RMB. The Federal Reserve held steady on interest rates after the March’s FOMC meeting, and it’s sticking with its forecast for three interest rate cuts in 2024. The recent US labour market data also showed the US economy remains strong, and is unlikely to deter the central bank from cutting rates. China’s economic recovery remains gloomy, and it will take longer to mitigate the impact of the property debt problem and rebuild confidence. Therefore, the RMB will weaken against the USD again once the previous positive expectations fail to be realised.

Share price and USD/RMB price trend comparison

(Source: Bloomberg)

- Strong orderbook providing earnings visbility. Yangzijiang has an outstanding order book of $14.5bn for 182 units of vessels at the end of 2023. A total of 97 newbuild orders totaling in $7.1bn were secured in 2023, surpassing its target of US$3 billion for 2023. Its strong order book also enables Yangzijiang earnings visibility up until 2027, with the latest delivery extending into 2028. Among all ordered vessels, 72 are containerships, 44 are oil tankers, 51 are bulk carriers, and 15 are LNG/LPG/LEG.

- Growth in container vessel and tanker demand in 2024. According to Clarkson, 350 newly built container vessels were delivered in 2023, totalling 2.21mn TEU. China delivered more than 200 units. Clarkson estimates that the total container shipping capacity will grow by 7% and 5% in 2024 and 2025 respectively. According to shipbroker Xclusiv, the tankers market is expected to grow in 2024, mainly driven by the Asian oil demand. Southeast Asia and China will see 3.2% and 2.9% growth in oil demand this year. From BIMCO’s 1Q2024 Shipping Market Overview & Outlook, the ongoing red sea attacks also continues to elevate the demand for ships, as ships continue to take longer routes via the Cape of Good Hope, resulting in a longer turn around time. BIMCO expects this to affect the shipping demand for the first half of 2024.

- FY23 results review. Revenue for FY23 increased by 16.5% YoY to RMB24.1bn, compared to RMB20.7bn in FY22. Net profit increased by 57.0% YoY to RMB4.10bn in FY23, compared to RMB2.61bn in FY22. NPM increased by 4.4ppts to 17.0% in FY23, compared 12.6% in FY22.

- Market Consensus

(Source: Bloomberg)

Xiaomi Corp. (1810 HK): Strong EV orders

- BUY Entry – 15.30 Target – 16.70 Stop Loss – 14.60

- Xiaomi Corp. is a China-based investment holding company principally engaged in the research, development and sales of smartphones, Internet of things (IoTs) and lifestyle products, the provision of Internet services, and investment business. The Company mainly conducts its businesses through four segments. The Smartphone segment is engaged in the sales of smartphones. The IoT and Lifestyle product segment is engaged in the sales of other in-house products, including smart televisions (TVs), laptops, artificial intelligence (AI) speakers and smart routers; ecosystem products, including IoT and other smart hardware products, as well as certain lifestyle products. The Internet service segment is engaged in the provision of advertising services and Internet value-added services. The Others segment is engaged in the provision of repair services for its hardware products. The Company distributes its products in domestic market and to overseas markets.

- Strong orders for new EV. Xiaomi recently entered China’s EV market, launching the Xiaomi’s Speed Ultra (SU7). The company announced that it has received over 100,000 orders for its new EVs, with 88,898 pre-orders for the car in the first 24 hours of sales. The company has just started deliveries of its first batch of 5,000 cars to its customers, and highlighted to new potential buyers of its sedan that they could face wait times of four to seven months, a sign of strong interest. The car was priced under $30,000 for the base model, making it a very attractive price point for consumers. Furthermore, Xiaomi’s smartphone expertise also provided the company with an edge in smart dashboard, which is a featured prized by Chinese consumers.

- Sufficient cash reserves. Xiaomi’s new EV is priced under $30,000, the company may see a loss on each vehicle it sells in the meantime, However, the company, leveraging on its main smartphone business, has a strong cash reserve of over US$15mn to help to cope with tight competition in the EV space. This strong cash position would allow the company to slowly gain market share and return to profitability for its EV business.

- Further Integration of new operating system. Xiaomi announced recently that it will be extending its new operating system, the Xiaomi HyperOS to more Xiaomi and Redmi devices. HyperOS is expected to power not only smartphones but also smart home devices and even electric vehicles like the new Xiaomi SU7. With the launch of the new Xiaomi SU7 EV, customers can expects to gain a seamless experience in a new smart ecosystem between the EV and their phones. This shift into a new operating system also marks a strategic move of the company’s vision into creating a seamless smart ecosystem, “Human x Car x Home”. This ecosystem is bound to entice consumers to purchase Xiaomi’s other products as well.

- FY23 earnings. Total revenue fell 3.2% YoY to RMB271.0bn in FY23, compared to RMB280.0bn in FY22. Gross profit increased by 20.8% to RMB57.5bn in FY23, compared to RMB47.6bn in FY22. Net profit increased by 598.2% YoY to RMB17.5bn in FY23, compared to RMB2.50bn in FY22.

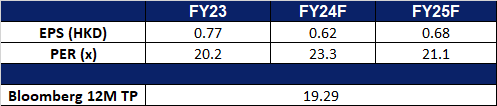

- Market consensus.

(Source: Bloomberg)

Trip.com Group Ltd. (9961 HK): More flights to capture higher travel demand

- RE-ITERATE BUY Entry – 370 Target – 400 Stop Loss – 355

- Trip.com Group Ltd is a China-based company mainly engaged in the operation of one-stop travel platform. The Company’s platform integrates a comprehensive suite of travel products and services and differentiated travel content. Its platform aggregates its product and service offerings, reviews and other content shared by its users based on their real travel experiences, and original content from its ecosystem partners to enable leisure and business travelers to have access to travel experiences and make informed and cost-effective bookings. Users come to its platform for any type of trip, from in-destination activities, weekend getaways, and short-haul trips, to cross-border vacations and business trips.

- Expectations of higher travel demand. The upcoming Qingming Festival Holidays, spanning from Thursday to Saturday, are driving a significant surge in the travel industry, with domestic tourists flocking to spring blossom tours and international visitors drawn by various initiatives. According to a report by Trip.com, bookings for flower-viewing spots during the holiday period have surged more than sixfold YoY, while inbound travel bookings have seen a remarkable 153% YoY increase. Major entry points such as Beijing Capital International Airport, Shanghai Pudong International Airport, as well as land ports in Hong Kong and Macao, are poised to experience a substantial uptick in both inbound and outbound tourist traffic. Additionally, the forthcoming summer season is anticipated to witness a rise in international travel, buoyed by relaxed visa policies, which are expected to lead to increased flights to destinations including Hungary, Austria, Spain, Malaysia, Thailand, and Singapore.

- More international flights for the summer season. China’s civil aviation sector is ramping up international passenger flights to cater to travelers as the summer season begins. With over 12,600 weekly international passenger flights by 122 Chinese and international airlines, connecting China to 66 countries, this season marks a substantial increase in connectivity, with more than 4,600 weekly freight flights operated by 67 airlines and connecting 46 countries have been approved. Moreover, the Civil Aviation Administration of China has announced the addition of one domestic and two foreign airlines operating international passenger flights this summer.

- Deepening partnerships to enhance service quality and quality of products. Trip.com Group Ltd has recently inked an extensive strategic partnership with Capital A Berhad. Under this collaboration, the two entities will join forces across various business segments, encompassing flights, accommodations, attractions and tickets, car-hailing services, and payment solutions. Through this alliance, both parties aim to enhance AirAsia’s footprint and diversify its product portfolio by leveraging Trip.com Group’s innovative tools such as merchandising and the Virtual Interline product. This initiative not only generates additional value for both organizations but also empowers AirAsia to streamline costs and deliver enhanced value propositions to its clientele.

- FY23 earnings. Total revenue rose 122% YoY to RMB44.56bn in FY23, compared to RMB20.06bn in FY22. Net profit increased to RMB10.0bn in FY23, compared to RMB1.38bn in FY22. Basic earnings per share rose to RMB15.19 in FY23, compared to RMB2.17 in FY22.

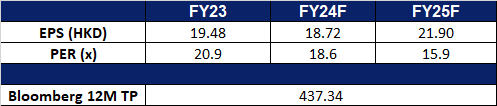

- Market consensus.

(Source: Bloomberg)

First Solar Inc (FSLR US): Next sector to benefit from the AI wave

- BUY Entry – 162 Target – 178 Stop Loss – 154

- First Solar, Inc. designs and manufactures solar modules. The Company uses a thin film semiconductor technology to manufacture electricity-producing solar modules.

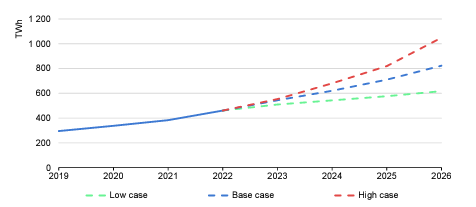

- Doubled electricity demand from data centres towards 2026. The 2024 IEA electricity report shows that global electricity demand from data centres, cryptocurrencies, and artificial intelligence (AI) is projected to nearly double by 2026, reaching between 620 and 1,050 terawatt-hours (TWh), with a base case of just over 800 TWh, up from 460 TWh in 2022. This surge in demand, driven by the expansion of digitalization, poses challenges and opportunities for various regions. In the United States, data centre electricity consumption is forecasted to rise rapidly, with Virginia’s data centre sector becoming a significant economic driver. China anticipates doubling its data centre electricity demand by 2030, while the European Union aims to bolster sustainable practices in data centres to align with decarbonization goals. In Ireland, data centres are expected to consume almost one-third of the country’s electricity by 2026. Efforts to enhance energy efficiency and regulatory measures are underway globally to mitigate the environmental impact of escalating electricity consumption in data centres. First Solar stands to benefit from the projected surge in electricity demand as solar energy can help these data centres to mitigate the environmental impact of escalating electricity consumption by providing renewable and sustainable power sources, thus contributing to the reduction of carbon emissions and promoting greener operations.

Global electricity demand from data centres, AI and cryptocurrencies

(Source: IEA electricity 2024 report)

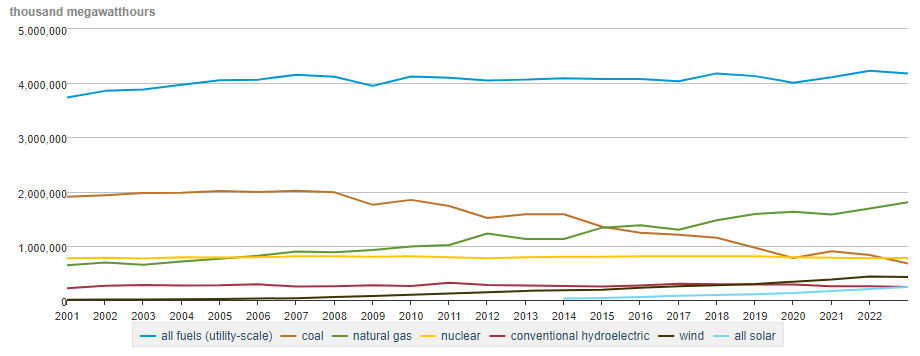

- Solar demand to grow. In the coming years, solar panel installations are predicted to substantially increase in the United States to meet the soaring electricity demand, driven particularly by data centres, electric vehicles, and heating/cooling systems. This surge comes as legacy power plants retire, and solar emerges as a cost-effective and rapid solution. Solar energy, being one of the fastest-growing energy sources in the US, is expected to expand significantly despite challenges like permitting delays and increased capital costs. In response to the growing demand, solar companies plan to boost their manufacturing capacity, buoyed by tax incentives under President Biden’s Inflation Reduction Act.

Net electricity generation in the United States

(Source: US Energy Information Administration)

- 4Q23 earnings review. Revenue was US$1.16bn, rising 16.0% YoY, missing expectations by US$160mn. GAAP earnings per share were US$3.25, beating expectations by US$0.13. The company issued FY24 guidance for revenue of US$4.4B to US$4.6B and EPS US$13 to US$14, compared to analyst consensus estimates of US$4.56B of revenue and EPS of US$13.26. FSLR also forecast full-year sales volumes of 15.6 to 16.3 GW, gross margin of US$2bn to US$2.1bn, and operating income of US$1.5bn to US$1.6bn on sales volume of 15.6 to 16.3 GW, which includes anticipated Section 45X tax credits of US$1bn to US$1.05bn and US$85mn to US$95mn of production start-up expense; year-end net cash balance is projected at US$900mn to US$1.2bn.

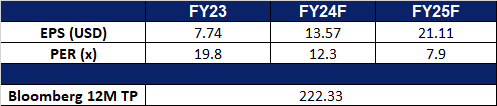

- Market consensus.

(Source: Bloomberg)

Goldman Sachs Group Inc (GS US): Fundamentals improving

- RE-ITERATE BUY Entry – 410 Target – 450 Stop Loss – 390

- The Goldman Sachs Group, Inc., a bank holding company, is a global investment banking and securities firm specializing in investment banking, trading and principal investments, asset management and securities services. The Company provides services to corporations, financial institutions, governments, and high-net-worth individuals.

- Potential cut in interest rates. On 20 March, the US Federal Reserve maintained its key interest rate but signalled three rate cuts in 2024 which could stimulate increased borrowing and investment activity, potentially benefiting Goldman. The lowered interest rates may encourage companies to issue debt, increasing underwriting opportunities for Goldman Sachs, and it will generate fees for facilitating such transactions. Additionally, the decline in interest rates could spur demand for various financial products and services offered, potentially boosting revenue for its trading desks. However, it’s worth noting that a decline in interest rates may also lead to a reduction in the net interest margin for Goldman Sachs.

- New fund in action. Goldman Sachs Asset Management raised approximately US$700mn for Union Bridge Partners I, a fund that invests alongside hedge funds and private credit firms. The closed-end fund, part of the firm’s External Investing Group, aims to allocate capital into high-conviction ideas from external managers. Co-investments have become popular in the hedge fund industry, offering flexibility amid tough capital-raising conditions. The fund has already deployed 40% of its raised capital across various sectors in North America and Europe.

- 4Q23 earnings review. Revenue rose by 6.9% YoY to US$11.32bn, beating estimates by US$360mn. GAAP EPS was US$5.48, beating estimates by US$1.55. In FY23, it reported net revenue of US$46.25bn and net earnings of US$8.52bn. Diluted EPS was US$22.87 for FY23.

- Market consensus.

(Source: Bloomberg)

Trading Dashboard Update: Take profit on Jiangxi Copper (358 HK) at HK$14.50 and Aluminium Corp of China (2600 HK) at HK$5.20.