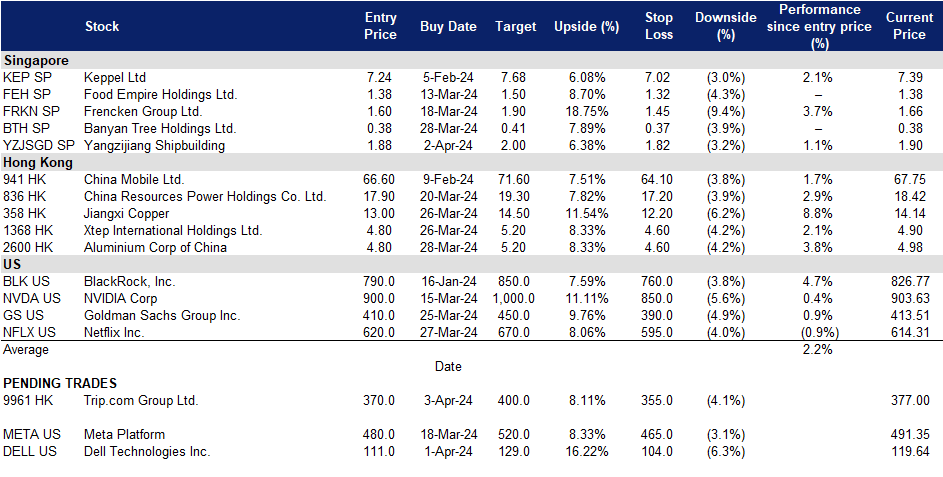

03 April 2024: Yangzijiang Shipbuilding (YZJSGD SP), Trip.com Group Ltd. (9961 HK), Dell Technologies Inc. (DELL US)

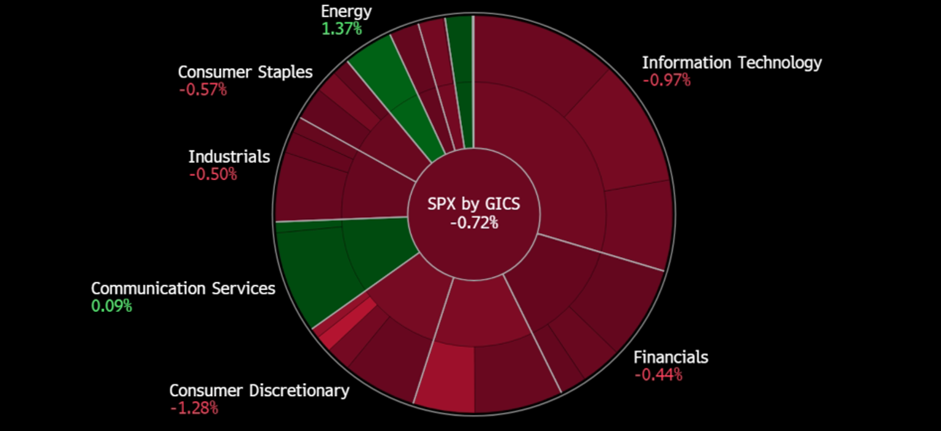

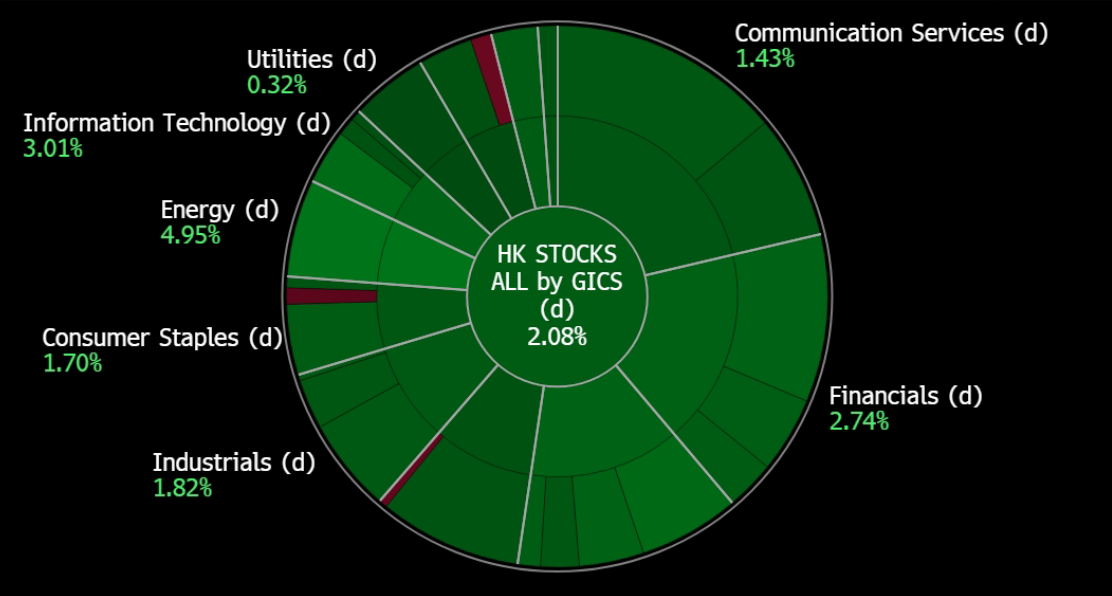

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

United States

Hong Kong

Yangzijiang Shipbuilding (YZJSGD SP): Taking advantage of the RMB and strong shipping demand

- RE-ITERATE BUY Entry – 1.88 Target– 2.00 Stop Loss – 1.82

- Yangzijiang Shipbuilding Holdings Limited builds a wide range of ships. The Company produces a wide range of commercial vessels, mini bulk carriers, multi-purpose cargo vessels, container ships, chemical tankers, offshore supply vessels, rescue and salvage vessels, and lifting vessels.

- Hedging against potential weakening RMB. The Federal Reserve held steady on interest rates after the March’s FOMC meeting, and it’s sticking with its forecast for three interest rate cuts in 2024. The recent US labour market data also showed the US economy remains strong, and is unlikely to deter the central bank from cutting rates. China’s economic recovery remains gloomy, and it will take longer to mitigate the impact of the property debt problem and rebuild confidence. Therefore, the RMB will weaken against the USD again once the previous positive expectations fail to be realised.

Share price and USD/RMB price trend comparison

(Source: Bloomberg)

- Strong orderbook providing earnings visbility. Yangzijiang has an outstanding order book of $14.5bn for 182 units of vessels at the end of 2023. A total of 97 newbuild orders totaling in $7.1bn were secured in 2023, surpassing its target of US$3 billion for 2023. Its strong order book also enables Yangzijiang earnings visibility up until 2027, with the latest delivery extending into 2028. Among all ordered vessels, 72 are containerships, 44 are oil tankers, 51 are bulk carriers, and 15 are LNG/LPG/LEG.

- Growth in container vessel and tanker demand in 2024. According to Clarkson, 350 newly built container vessels were delivered in 2023, totalling 2.21mn TEU. China delivered more than 200 units. Clarkson estimates that the total container shipping capacity will grow by 7% and 5% in 2024 and 2025 respectively. According to shipbroker Xclusiv, the tankers market is expected to grow in 2024, mainly driven by the Asian oil demand. Southeast Asia and China will see 3.2% and 2.9% growth in oil demand this year. From BIMCO’s 1Q2024 Shipping Market Overview & Outlook, the ongoing red sea attacks also continues to elevate the demand for ships, as ships continue to take longer routes via the Cape of Good Hope, resulting in a longer turn around time. BIMCO expects this to affect the shipping demand for the first half of 2024.

- FY23 results review. Revenue for FY23 increased by 16.5% YoY to RMB24.1bn, compared to RMB20.7bn in FY22. Net profit increased by 57.0% YoY to RMB4.10bn in FY23, compared to RMB2.61bn in FY22. NPM increased by 4.4ppts to 17.0% in FY23, compared 12.6% in FY22.

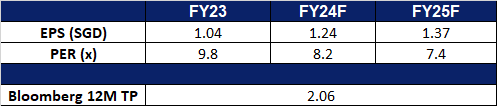

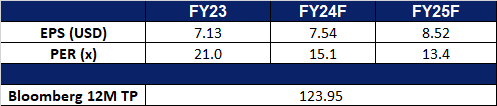

- Market Consensus

(Source: Bloomberg)

Banyan Tree Holdings Ltd (BTH SP): Doubling profits

- RE-ITERATE Entry – 0.380 Target– 0.410 Stop Loss – 0.365

- Banyan Tree Holdings Limited operates as a holding company. The Company, through its subsidiaries, owns and manages hotel groups. The Company focuses on hotels, resorts, spas, galleries, golf courses, and residences, as well as provides investments, design, construction, and project management services. Banyan Tree Holdings serves customers worldwide.

- Success in joint venture. Banyan Tree Residences Creston Hill, the inaugural luxury branded residences near Khao Yai National Park, celebrated the success of its presales phase valued at THB17bn. Managed by Banyan Tree in partnership with Creston Holding Ltd., the venture reflects a rising demand for upscale residences in Thailand. With presales surpassing THB1bn, its Managing Director anticipates increased interest with the unveiling of fully furnished display units. The project caters to the growing trend of luxury living amidst nature, appealing to permanent residents and holidaymakers. The strategic location, near the upcoming Motorway 6, enhances accessibility. The development offers 21 pool villas and 16 condominium buildings, designed to blend seamlessly with the serene landscape. Future phases will introduce additional villas and condominiums. Buyers benefit from Banyan Tree’s exclusive owner programme, “The Sanctuary Club,” granting privileges across global properties. Situated just 200km from Bangkok, Khao Yai offers diverse activities, making Creston Hill an ideal second home. The on-site sales gallery welcomes prospective buyers with exclusive promotions during the presales period.

- 30th anniversary new launches. Banyan Tree announced a robust pipeline of 19 new property openings. Under the new corporate brand umbrella, Banyan Group, the company expanded beyond its luxury offerings with brands like Angsana, Cassia, and Dhawa. New destinations include Japan, Saudi Arabia, Vietnam, and South Korea. Sustainability commitments include a 2030 Sustainability Roadmap aligned with UN targets. Laguna Lakelands in Phuket promises immersive living with nature-integrated development. New initiatives include Beyond, a digital companion for holistic experiences, and withBanyan, an experiential members program.

- FY23 results review. FY23 revenue inclined by 21% to S$327.9mn. Net profit rose significantly to S$31.7mn, compared to S$767,000 in FY22. FY23 operating profit more than doubled to S$90.1mn. It declared a final dividend of S$0.012 for FY23.

- Market Consensus

(Source: Bloomberg)

Trip.com Group Ltd. (9961 HK): More flights to capture higher travel demand

- BUY Entry – 370 Target – 400 Stop Loss – 355

- Trip.com Group Ltd is a China-based company mainly engaged in the operation of one-stop travel platform. The Company’s platform integrates a comprehensive suite of travel products and services and differentiated travel content. Its platform aggregates its product and service offerings, reviews and other content shared by its users based on their real travel experiences, and original content from its ecosystem partners to enable leisure and business travelers to have access to travel experiences and make informed and cost-effective bookings. Users come to its platform for any type of trip, from in-destination activities, weekend getaways, and short-haul trips, to cross-border vacations and business trips.

- Expectations of higher travel demand. The upcoming Qingming Festival Holidays, spanning from Thursday to Saturday, are driving a significant surge in the travel industry, with domestic tourists flocking to spring blossom tours and international visitors drawn by various initiatives. According to a report by Trip.com, bookings for flower-viewing spots during the holiday period have surged more than sixfold YoY, while inbound travel bookings have seen a remarkable 153% YoY increase. Major entry points such as Beijing Capital International Airport, Shanghai Pudong International Airport, as well as land ports in Hong Kong and Macao, are poised to experience a substantial uptick in both inbound and outbound tourist traffic. Additionally, the forthcoming summer season is anticipated to witness a rise in international travel, buoyed by relaxed visa policies, which are expected to lead to increased flights to destinations including Hungary, Austria, Spain, Malaysia, Thailand, and Singapore.

- More international flights for the summer season. China’s civil aviation sector is ramping up international passenger flights to cater to travelers as the summer season begins. With over 12,600 weekly international passenger flights by 122 Chinese and international airlines, connecting China to 66 countries, this season marks a substantial increase in connectivity, with more than 4,600 weekly freight flights operated by 67 airlines and connecting 46 countries have been approved. Moreover, the Civil Aviation Administration of China has announced the addition of one domestic and two foreign airlines operating international passenger flights this summer.

- Deepening partnerships to enhance service quality and quality of products. Trip.com Group Ltd has recently inked an extensive strategic partnership with Capital A Berhad. Under this collaboration, the two entities will join forces across various business segments, encompassing flights, accommodations, attractions and tickets, car-hailing services, and payment solutions. Through this alliance, both parties aim to enhance AirAsia’s footprint and diversify its product portfolio by leveraging Trip.com Group’s innovative tools such as merchandising and the Virtual Interline product. This initiative not only generates additional value for both organizations but also empowers AirAsia to streamline costs and deliver enhanced value propositions to its clientele.

- FY23 earnings. Total revenue rose 122% YoY to RMB44.56bn in FY23, compared to RMB20.06bn in FY22. Net profit increased to RMB10.0bn in FY23, compared to RMB1.38bn in FY22. Basic earnings per share rose to RMB15.19 in FY23, compared to RMB2.17 in FY22.

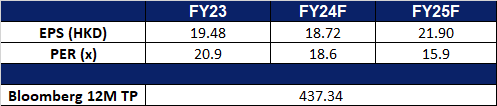

- Market consensus.

(Source: Bloomberg)

Xtep International Holdings Ltd. (1368 HK): Marathon season

- RE-ITERATE BUY Entry – 4.80 Target – 5.20 Stop Loss – 4.60

- Xtep International Holdings Ltd is a China-based company principally engaged in the design, development, manufacturing, sales, marketing, and brand management of sports products, including footwear, apparel, and accessories. The Company operates its businesses through three segments. The Mass Market segment’s signature brand is Xtep. The Athleisure segment’s signature brands are mainly K-Swiss and Palladium. The Professional Sports segment’s signature brands are Saucony and Merrell. The Company distributes its products both in the domestic market and to overseas markets.

- Marathon season. As spring arrives, China gears up for its marathon season, marking a significant resurgence in outdoor events as the nation emerges fully from the COVID-19 pandemic. Over the next two months, numerous marathons are scheduled across the country, including the Chengdu Panda Marathon at the end of March 2024, the Beijing Half Marathon in April 2024, and the Great Wall of China Marathon in May, among others. The Beijing Half Marathon has already garnered immense interest, with a record-breaking 97,988 participants from 42 countries and regions pre-registered for the event. Many marathon enthusiasts in China are expected to invest in new running or training shoes in preparation for these races. As a major player in the sportswear industry, Xtep International stands poised to capitalize on the opportunities presented by the upcoming Marathon Season.

- Strong earnings despite a weak economy. Xtep International has recently announced its earnings, revealing a 10.9% year-on-year increase in revenue and an 11.8% rise in net profit in China. These strong financial results reflect the company’s robust business model and successful rebranding efforts across its brands, including K-Swiss and Palladium. Despite challenging economic conditions characterized by weak consumer spending, Xtep achieved impressive sales figures in China. This stands in stark contrast to other major sportswear brands such as Nike, which recently reported a slower sales growth of approximately 5% in China.

- Expected resurgence of the sports industry in China. Recently, China’s top sports official highlighted ongoing efforts to combat corruption and illegal gambling, aiming to rejuvenate the sports industry. Moreover, Chinese authorities are striving to position China as a comprehensive sports powerhouse by 2035, with plans to host major international competitions like the 2025 Asian Winter Games, 2027 World Athletics Championships, and 2029 World Aquatics Championships. Throughout the past year, China’s sports sector has experienced consistent and robust expansion, marked by diverse mass participation events such as National Fitness Day and grassroots initiatives in ice and snow sports. Furthermore, there has been significant progress in the development of sports infrastructure, with the per capita sports venue area reaching 2.89 square meters in 2023, representing a remarkable 107% increase from 2019.

- FY23 earnings. Total revenue rose 10.9% YoY to RMB14.35bn in FY23, compared to RMB12.93bn in FY22. Net profit increased 11.75% YoY to RMB1.03bn in FY23, compared to RMB921.7mn in FY22. Basic earnings per share rose to RMB40.76 in FY23, compared to RMB36.61 in FY22.

- Market consensus.

(Source: Bloomberg)

Dell Technologies Inc (DELL US): Beyond the algorithm

- RE-ITERATE BUY Entry – 111 Target – 129 Stop Loss – 104

- Dell Technologies Inc. provides computer products. The Company offers laptops, desktops, tablets, workstations, servers, monitors, printers, gateways, software, storage, and networking products. Dell Technologies serves customers worldwide.

- Global PC shipments to rebound in the second half of the year. An IDC report shows that global PC sales remained weak in the first half of 2024, but will grow in the second half, with the main growth markets being China and Japan. The report predicts that PC shipments in China will grow by 6.1% in 2024, and shipments in Japan will grow by 4.7%. The report mentions that AI PCs will stimulate demand from personal and enterprise users. It has been four years since the COVID-19 pandemic began in 2020, and the time for PC replacement has arrived. Therefore, the report predicts that PC shipments will grow by 7.9% next year and the global AI PC market will grow by 35.7% in 2024.

- AI server market size to grow exponentially. According to a market report by Foxconn, the AI server market size will grow from US$30bn in 2023 to US$150bn in 2027. Foxconn also predicts that the AI server market will grow at a CAGR of 42.7% from 2023 to 2027. The current mainstream server market share is about 27% to 29%. Dell accounts for about 35% of the mainstream server market share. Therefore, Dell will also benefit significantly from the wave of artificial intelligence.

- 4Q24 earnings review. Revenue was US$22.32bn, down 10.9% YoY, beating expectations by US$150mn. Non-GAAP earnings per share were US$2.20, beating expectations by US$0.48. The company raised its quarterly dividend by 20.3% to US$0.445.

- Market consensus.

(Source: Bloomberg)

Goldman Sachs Group Inc (GS US): Fundamentals improving

- RE-ITERATE BUY Entry – 410 Target – 450 Stop Loss – 390

- The Goldman Sachs Group, Inc., a bank holding company, is a global investment banking and securities firm specializing in investment banking, trading and principal investments, asset management and securities services. The Company provides services to corporations, financial institutions, governments, and high-net-worth individuals.

- Potential cut in interest rates. On 20 March, the US Federal Reserve maintained its key interest rate but signalled three rate cuts in 2024 which could stimulate increased borrowing and investment activity, potentially benefiting Goldman. The lowered interest rates may encourage companies to issue debt, increasing underwriting opportunities for Goldman Sachs, and it will generate fees for facilitating such transactions. Additionally, the decline in interest rates could spur demand for various financial products and services offered, potentially boosting revenue for its trading desks. However, it’s worth noting that a decline in interest rates may also lead to a reduction in the net interest margin for Goldman Sachs.

- New fund in action. Goldman Sachs Asset Management raised approximately US$700mn for Union Bridge Partners I, a fund that invests alongside hedge funds and private credit firms. The closed-end fund, part of the firm’s External Investing Group, aims to allocate capital into high-conviction ideas from external managers. Co-investments have become popular in the hedge fund industry, offering flexibility amid tough capital-raising conditions. The fund has already deployed 40% of its raised capital across various sectors in North America and Europe.

- 4Q23 earnings review. Revenue rose by 6.9% YoY to US$11.32bn, beating estimates by US$360mn. GAAP EPS was US$5.48, beating estimates by US$1.55. In FY23, it reported net revenue of US$46.25bn and net earnings of US$8.52bn. Diluted EPS was US$22.87 for FY23.

- Market consensus.

(Source: Bloomberg)

Trading Dashboard Update: Take profit on Dyna-Mac (DMHL SP) at S$0.35. Add Yangzijiang Shipbuilding (YZJSGD SP) at S$1.88.