Hot Stocks – 5 April 2021

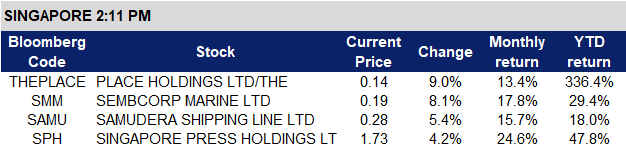

KGI SG Hot Stocks – (2:11PM)

🔥 THE PLACE HOLDINGS +9% on higher than average trading volumes. Seventh most actively traded stock on SGX today, after other trading plays such as OCEANUS +13% and MERCURIAS CAPITAL +20%.

🔥 SEMBCORP MARINE +8% riding high on new order win last week, its first biggest order since demerger from parent company, Sembcorp Industries, last year. Macquarie raised the recommendation on Sembcorp Marine to neutral from underperform. KEPPEL CORP +2% also benefiting from positive spillover.

🔥 SAMUDERA +5% after Lim & Tan initiates coverage with a BUY and target price of S$0.49. The company is benefitting from the recent boom in the container shipping industry. Its net cash accounts for 50% of its market cap.

🔥 SPH +4% still in play following announcement of strategic review. SPH currently trades at 0.7x P/B vs its 5-year average of 1.2x P/B. Analysts consensus 2 BUYS, 1 HOLD, 0 SELL. Consensus BUY TP S$1.74-S$2.09

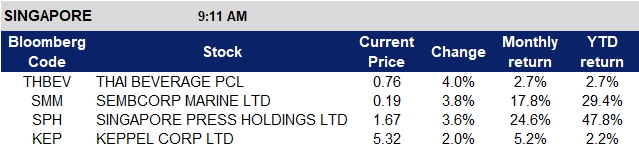

KGI SG Hot Stocks – (9:11AM)

🔥 THAIBEV +4% says SGX has issued its conditional eligibility-to-list letter on April 1 for the proposed spinoff listing of its brewery unit. THAIBEV’s beer business has 3 breweries in Thailand as well as interest in 26 breweries in Vietnam. Its business includes the production, distribution and sales of beer, including Chang and Bia Saigon brands.

🔥 SEMBCORP MARINE +4% still riding high on new order win last week, its first biggest order since demerger from parent company, Sembcorp Industries, last year. Macquarie raised the recommendation on Sembcorp Marine Ltd. to neutral from underperform. KEPPEL CORP +2% also benefiting from positive spillover.

🔥 SPH +4% still in play following the announcement of the strategic review. SPH currently trades at 0.7x P/B vs its 5-year average of 1.2x P/B. Analysts consensus 2 BUYS, 1 HOLD, 0 SELL. Consensus BUY TP S$1.74-S$2.09