4 April 2024: Wealth Product Ideas

Capitalizing on a Weaker Swiss Franc

- SNB Implements Rate Cut, Easing Inflation Concerns:

- SNB’s surprise rate cut of 25bps suggests that the central bank is becoming less concerned about high inflation in Switzerland.

- SNB Halts Franc Intervention, Signaling Tolerance for Depreciation:

- SNB’s decision to stop buying Swiss francs to keep the currency strong indicates that they are now comfortable with the prospect of a weaker franc.

- Global Rate Cut Expectations Point to Further CHF Weakness:

- With the European Central Bank and US Federal Reserve also expected to cut rates soon, the SNB is likely to follow suit, which should put further downward pressure on the Swiss franc.

- Moderate Speculative Positioning Suggests Room for Further CHF Decline:

- The current level of bets against the Swiss franc is not extreme, suggesting that there is still room for more investors to join in and bet on a weaker franc, potentially accelerating its decline.

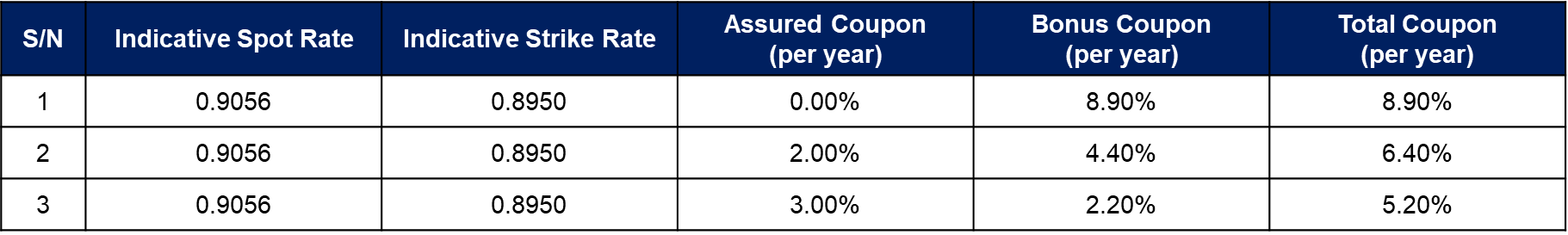

Note: Pricing provided is indicative only. For updated pricing, please contact us directly.

Investment Overview:

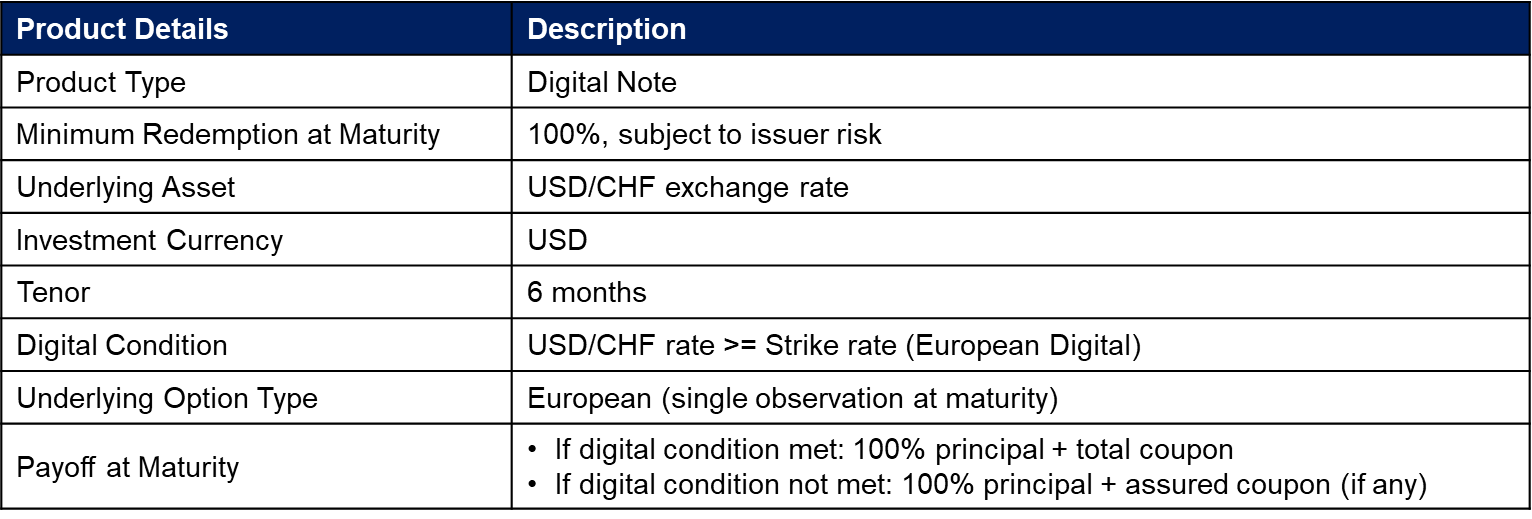

- Potential for Enhanced Returns: At maturity, your payoff is determined by whether the USD/CHF rate is at or above strike.

- Betting on USD Strength: This investment is essentially a bet on the US dollar appreciating against the Swiss franc.

- Limited Downside: Your maximum loss is capped at your initial investment amount, providing downside protection.

Key Risks:

- Exchange Rate Risk: The performance of this investment is directly tied to USD/CHF exchange rate movements. If the USD weakens against the CHF, your return will be limited to the principal (and any assured coupon).

- Issuer Risk: You are exposed to the credit risk of the issuer. If the issuer defaults, you could lose your principal investment.

- Liquidity Risk: This investment may have limited liquidity in the secondary market, making it difficult to sell before maturity.

- Opportunity Cost: Investing in this product may limit your ability to participate in other potentially more profitable trading opportunities.

- Complexity Risk: The structured payout mechanics of this investment can be complex and difficult to fully understand.