20 March 2025: Investment Product Ideas

Vanguard Intermediate Term Corporate Bond ETF (VCIT)

- Focus on High Quality Mid Term Corporate Bonds. The index tracks U S corporate bonds with 5-10 year maturities, primarily in the financial and industrial sectors Holdings are predominantly investment grade (BBB or higher), offering balanced interest rate and credit risk exposure.

- Diversified Portfolio. The ETF holds over 2000 investment grade corporate bonds (BBB or higher), with the top 10 holdings accounting for approximately 2.56%.

- Low Expense Ratio. With a 0.03% expense ratio, this ETF is among the lowest in its category, offering cost effective exposure and helping investors reduce costs.

Fund Name (Ticker) |

|

Description | Vanguard Intermediate-Term Corporate Bond ETF seeks to track the performance of a market-weighted corporate bond index with an intermediate-term dollar-weighted average maturity. The fund invests by sampling the index, meaning that it holds a range of securities that, in the aggregate, approximates the full index in terms of key risk factors and other characteristics. All of the fund’s investments will be selected through the sampling process and at least 80% of the fund’s assets will be invested in bonds included in the index. The fund maintains a dollar-weighted average maturity consistent with that of the index. |

Asset Class | Fixed income |

25-Day Average Volume (as of 18 Mar) | 7,904,785.32 |

Net Assets of Fund (as 28 Feb) | $52.0B |

Yield to maturity (28 Feb) | 5.1% |

Average effective maturity (28 Feb) | 7.3 yrs |

Average duration (28 Feb) | 6.0 yrs |

Expense Ratio (Annual) | 0.03% |

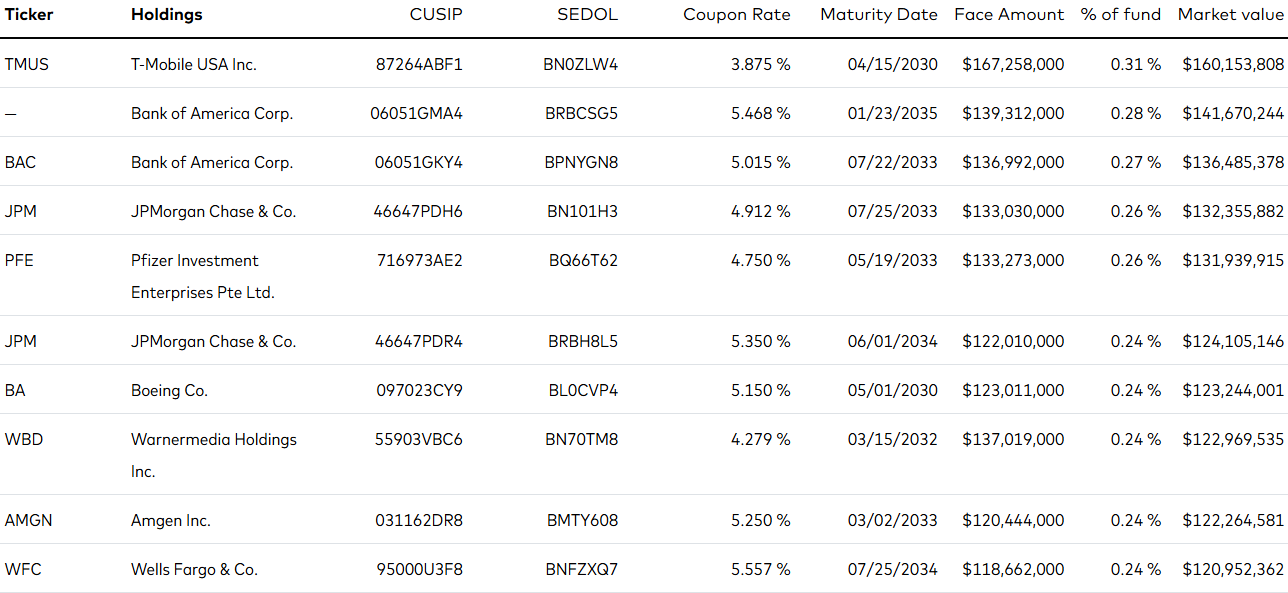

Top Holdings

(as of 28 February 2025)

(Source: Bloomberg)